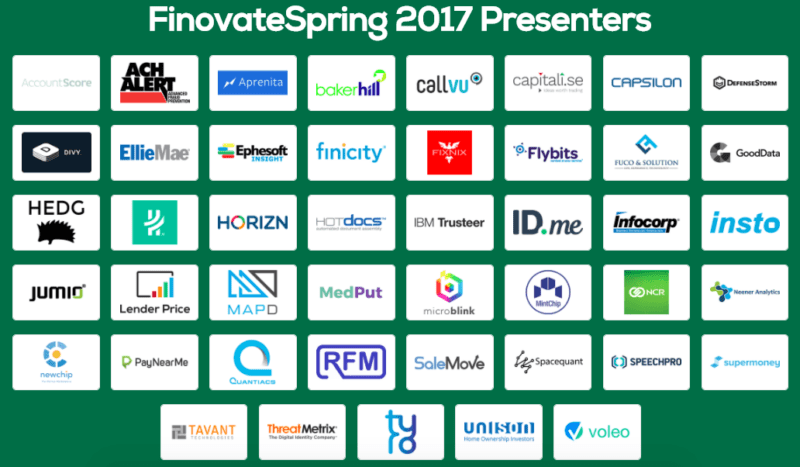

FinDEVr Previews highlight companies presenting new developer tools, platforms, and integrations at FinDEVr New York 2017, March 21 & 22. Tickets are on sale now. Visit our registration page and save your spot today.

Modelshop is an analytics automation platform for financial services. The company allows analysts to rapidly create custom analytics decision engines to drive lending, portfolio risk management, fraud mitigation, or any custom decision need. At FinDEVr, Modelshop will demonstrate creating a credit risk decision engine from scratch using marketplace data.

Why it’s a must-see:

Modelshop transforms how IT and business can collaborate to deploy new intelligent decision services. The company’s powerful ontology modeling engine, variable language (Groovy), and seamless integration with R and Python are backed by a user experience and REST APIs that are instantly available to enterprise applications, consumer apps, and spreadsheets.

Check out more previews of upcoming FinDEVr New York 2017 presentations and don’t forget to register before it’s too late.

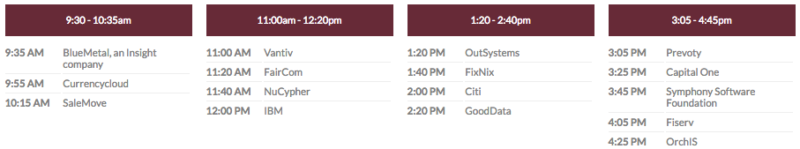

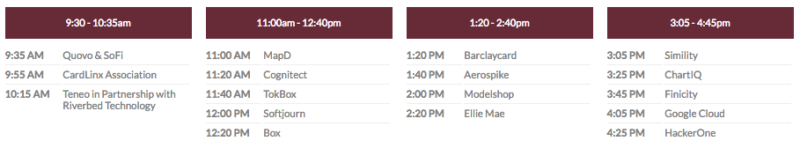

The event kicks off at 9:30AM on both March 21 & 22 (breakfast is available the hour before). 15-minute TED-style presentations with short Q&A sessions run throughout the day, and the longer networking happy hour gives attendees the chance to dive deeper into the content seen on stage.

The event kicks off at 9:30AM on both March 21 & 22 (breakfast is available the hour before). 15-minute TED-style presentations with short Q&A sessions run throughout the day, and the longer networking happy hour gives attendees the chance to dive deeper into the content seen on stage.