Is it any surprise that data is at the center of our Theme Cloud for FinDEVr London 2017?

Think about it. Everything is about data. Security is about safeguarding our data. APIs are about accessing and sharing data. Behavior analytics helps us undercover and utilize new forms of data – the unique timbre of a voice, patterns of strokes on a touchpad – that we previously didn’t even consider as data. Fraud prevention, KYC, digital identity … all of these themes are both top of mind for fintech professionals and critical applications of, you guessed it, data.

During one of the many insightful presentations from our developers conference in the States earlier this year, Sandeep Sood, VP of Software Engineering for Capital One, underscored how central data is to the trajectory of technological change, including in fintech. After pointing out that the mathematic underpinning for recent breakthroughs like facial recognition has been available since the late 1880s, Sood asked, “then why has it taken so long for us to have facial recognition technology?”

“The mathematics were never the limiting factor when it came to this sort of technology and our ability to do artificial intelligence and machine learning,” Sood explained. “Nor was it the computing power. The major breakthrough in the last 10 years was actually access to data.” Sood quoted Google Research Director, Peter Norvig who said, “We don’t have better algorithms. We just have more data.”

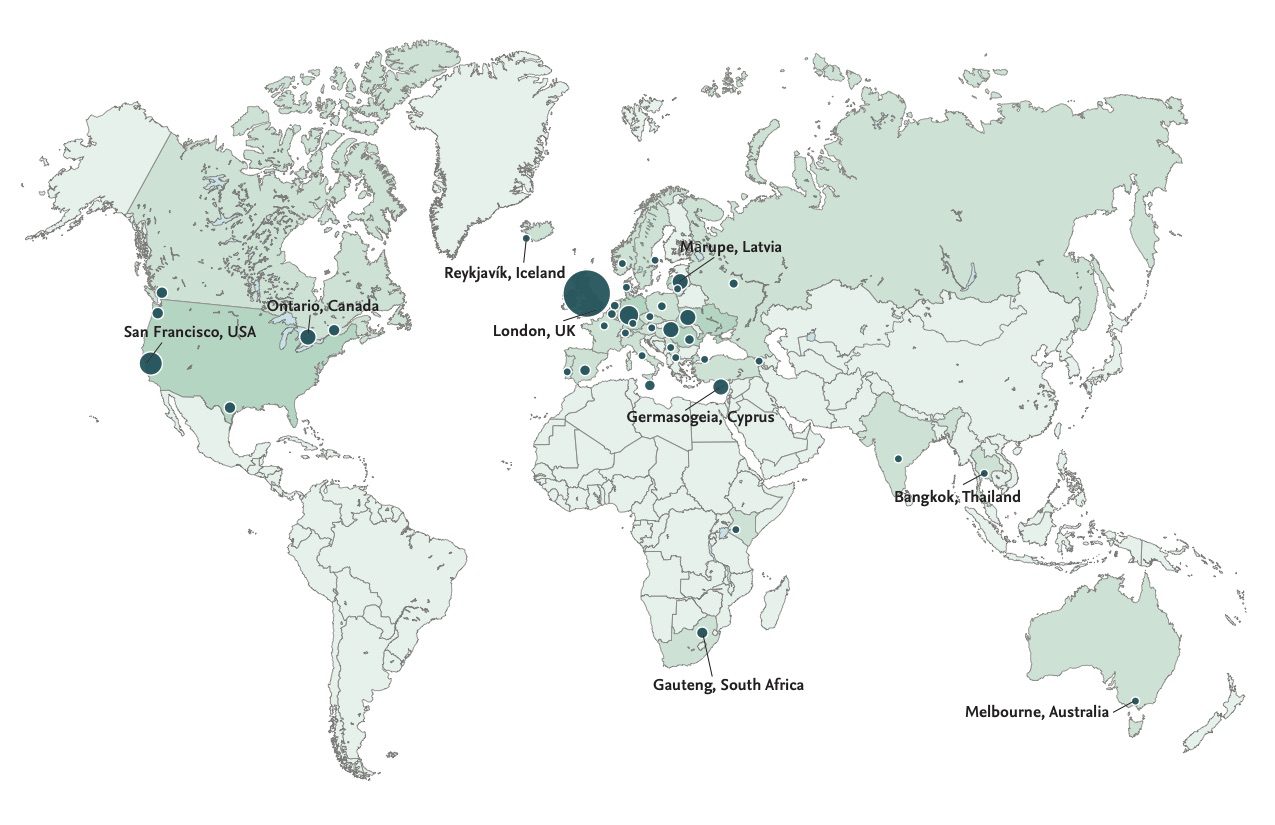

FinDEVR London starts tomorrow. Launched in Silicon Valley in the fall of 2014, our developers conference has brought together hundreds of professionals who specialize in tackling some of fintech’s trickiest challenges from the inside out. And as our Title Cloud for this week’s event shows, these professionals include everyone from Chief Technology Officers and IT Heads to software engineers, developers, and architects. These are the individuals whose names are often not well known, but whose talent and hard work is what enables us to manage our finances on our smartphones, safeguard our online identities against cybercriminals, and so much more.

Our two-day event runs all day Monday and Tuesday. Both days will feature 15-minute presentations from a wide variety of fintech professionals – all with explicitly technical backgrounds. FinDEVr London will also provide plenty of opportunities for attendees to mix, mingle, and meet up with our presenters, our sponsors, and their fellow attendees. For our first U.K. developers conference, we’ve added a handful of new features designed to help you maximize your time at FinDEVr London. These include lunchtime roundtable discussions led by our presenters, and a special panel on the open banking era hosted by the Finovate research team.

Tickets to this week’s conference are still available. So be sure to stop by our registration page and save your spot today. In the meanwhile, to help you get ready for the conference, here are a few things to know to help you make the most of your FinDEVr London experience.

Time & Date

- FinDEVr London takes place on Monday, 12 June, and Tuesday, 13 June. Registration opens at 8:30am and the first presentation begins at 9:3oam on both days.

Location

- FinDEVr London will be held at London’s Tobacco Dock at Tobacco Quay, Wapping Lane, St Katharine’s & Wapping, London E1W 2SF.

Agenda

- Get a preview of what’s coming over the two days of FinDEVr London. Presentations and presenters, roundtables, our panel, networking … check out our agenda to see what’s happening when.

Learn about the companies that will be presenting at FinDEVr London 2017 in our FinDEVr Previews series, while our FinDEVr Interviews give you a change to find out more about the teams behind the technologies. And if you like what you read, we hope we’ll see you bright and early Monday morning at the Tobacco Dock for FinDEVr’s U.K. debut.

FinDEVr London 2017 is sponsored by TestDevLab.

FinDEVr London 2017 is partnered with Aite Group, Banking Technology, BayPay Forum, BiometricUpdate.com, Brave New Coin, Breaking Banks, Byte Academy, The Canadian Trade Commissioner Service, Celent, Cointelegraph, Colloquy, Cooper Press, Distributed, Economic Journal, Empire Startups, Femtech Leaders, Finmaps, Fintech Finance, Global Data, Harrington Starr, Holland Fintech, Level39, London Tech Week, Mapa Research, Mercator Advisory Group, The Paypers, Plug and Play, SecuritySolutionsWatch.com, SME Finance Forum, Startupbootcamp, Swiss Finance + Technology Association, and Women Who Code.