Don’t panic! I’m not necessarily saying that “savingstech” is yet another “thingtech” that you’ll be required to know before the next Fintech Cocktail Club social. Think of savings tech simply as shorthand for companies that are developing and deploying technologies that enable us save more of what we earn. Sure, the average fintech fan probably feels they know all there is to know when it comes to PFM. But the technologies that help ferry our hard-earned money into a safer place than the nearest cash register are more diverse than you might imagine.

Just check out our multi-part series on savings tech. From crowdfunding and Generation Z targeting to passive investing and goals-based PFM, fintech has left few technologies untested in the pursuit of better, more efficient and effective savings strategies for all of us.

And so the only question that remains is: Where is savings tech going and what will it look like when it gets there? We reached out to our Finovate alumni community and put the question to them. This is what they told us.

Om Kundu, CEO and Chairman InSpirAVE (FF16)

InSpirAVE’s Internet of Savings® platform leverages the power of social networks to encourage smart financial decision-making and amplify savings.

Finovate: What is the most challenging aspect about building a savings solution?

Om Kundu: A part of it is structural forces. Think about the arc in the evolution of the internet over the past decade and a half. It has been strikingly asymmetrical in how it has put our spending muscle on steroids while our longer-term savings muscle has atrophied on a relative basis … especially when it comes to goals that really matter.

If there is a singular obsession in ‘reducing friction’ that stands out in the juggernaut of e-commerce – as much as in-store technologies – it is the preoccupation of an ever-accelerating tech-stack to fuel “Push-Button-Get-Stuff” as the defining essence of commerce in much of our lives.

What is missing in that future? Technology that is equally ingenuous and accountable in furthering human agency to make decisions that are thoughtful, rather than impulsive. We think of them as purchase decisions, but they really are financial decisions that can only be made properly to the extent you and your loved ones have the tools to discern whether buying that shiny object really matters … and whether you have the savings to pay for it.

Pictured: InSpirAve CEO and Chairman Om Kundu demonstrating The Internet of Savings® at FinovateFall 2016.

Finovate: Let’s look to the future. What kind of savings technology will we see over the next three to five years, for example?

Kundu: It’s really about goals and creating sustainable, achievable pathways to getting you there in ways that are not only affordable, but are equally memorable in terms of the shared experiences that are created for you and your loved ones in that path-to-purchase. As the definition of liquidity – historically confined to monetary equity socked away in your bank account and credit line – becomes more inclusive of social equity across increasingly networked social platforms and distributed ledgers, your overall well-wishing community will play an equally important role as the historical stores of savings (banks) and spending (merchants) have.

And that’s a big part of the fabric woven into InSpirAVE’s design as well, empowering our users with the digital tools to cultivate their own well-wishing community which, in turn, eggs the user on … in articulation, accelerated progress, and ultimately fulfillment of whatever goal they set their mind to.

Bill Dwight, CEO and Founder, FamZoo (FS13)

FamZoo is an online and mobile platform that helps parents teach their children responsible personal financial habits through a private, secure”Virtual Family Bank.”

Finovate: Do you see a bright future of savings-enabled technologies?

Bill Dwight: I think savings enabling tech will explode in popularity. As a consumer, having to diligently exercise willpower to amass savings is a pretty horrible experience. If, on the other hand, a piece of smart automation can amass savings for me painlessly “behind my back”, the experience is nothing short of delightful. One day, you sign in and say, “whoa, I have $1000 in my emergency fund or $500 in my travel fund – awesome!” That’s what companies like Digit (digit.co/) are doing for individuals, and that’s what we (famzoo.com) do for kids earning an allowance or working odd jobs for their parents. It’s such a delightful and positive financial experience from the norm that its expansion and evolution is inevitable.

Pictured: FamZoo CEO and Founder Bill Dwight demonstrating FamZoo’s Prepaid Card Family Pack at FinovateSpring 2013.

Finovate: Which direction do you think savings tech will – or should – go in the years to come?

Dwight: Automation algorithms will naturally grow more sophisticated and effective as they leverage more and more knowledge about the saver’s unique situation and financial habits. They’ll also be able to allocate funds across a broader array of target accounts in an integrated, optimal way. For example, if the algorithms know you have young kids, more automated savings might be redirected toward 529 accounts to help pay for future college expenses. Or, your teen with that first summer job might have more automated savings funneled toward an early Roth IRA where it can grow tax free for decades. Or, perhaps the everyday “behind your back” savings will automatically redirect to knock out your most expensive consumer debt first before adjusting back to satisfying your longer term savings goals.

Moven Enterprise is an engagement platform that transforms customer financial data into digital experiences and actionable insights.

Finovate: What is most challenging when it comes to building savings solutions?

Greg Midtbo: The challenge is to take a different approach. Industries primarily approach this from a product perspective, as savings-as-a-product, and how to find tools to enable that product. The hunch is to take it from a customer’s perspective, to help the customer understand the trade-offs between the little decisions they make day to day, and how that impacts their medium- and long-term financial well-being.

In other words, how to help people make better decisions that may give them simple ways to give transparency to that trade-off and to take action. This may mean how to (1) control their spending or manage their spending and then (2) how to manage what they do with the amount of money they make that they don’t spend – which is savings or investing or other durations of storing assets. I think that’s the challenge: to break out of the product and cross-sell-into-a-product metaphor and approach it from a holistic customer perspective.

Banks tend to communicate to people around savings around rate and term. And since we’re in a very low interest rate environment, there’s not a lot of motivation there. So the motivation we think is around their overall financial health and helping them understand that trade-off.

Pictured: Moven Chief Revenue Officer Greg Midtbo demonstrating Moven Enterprise at FinovateEurope 2017.

Finovate: And in terms of future, looking out over the next three to five years?

Midtbo: I think we’ll move beyond just insight into the current state and start to make smart recommendations. How do you get to those goals that you set – whether its that carbon fiber bike or savings for education and retirement? What actions can you take to get there? We think artificial intelligence algorithms that know everything about you and can start to bring financial advice are next … I’m thinking back to the e*Trade commercials – not just some guy your Dad introduced you to or a twice-a-year sit down with a financial advisor – but a solution that is everyday giving you a little bit of financial coaching based on you. Not based on people like you or a segment (of the population), but based on you, what your next smart financial move is.

So that and (removing) the friction from taking those actions are key. Put the product/channel construct in the background and, in the foreground, a more seamless and advice-driven customer experience.

Dr. Yassin Hankir, CEO and Founder, savedroid (FS16)

With its lifestyle savings rules called “smooves,” savedroid is an algorithm-based mobile app that transforms everyday activities into automated savings.

Pictured: Savedroid CEO and Founder Dr. Yassin Hankir demonstrating his company’s savings solution at FinovateSpring 2016.

Finovate: What is the future of SavingsTech? What can we expect from this space over the next three to five years?

Yassin Hankir: I strongly believe Artificial Intelligence (AI) will be the key driver of innovation in savings technology going forward. Smart and autonomous savings tools enabling users to achieve their personal saving goals through automatically optimizing their individual savings and spending are on the rise.

This will create the next level of personal financial everyday assistance suitable for typical mass market users. (This will) contribute to fintech overcoming its niche market status and expanding to a significantly broader target audience.

One of the most popular savings strategies ever devised, cash envelope budgeting, is re-invented and digitized in the new savings solution from ProActive Budget.

Finovate: What are some of the most challenging issues in savings tech right now?

Ryan Clark: 57% of the U.S. is financially “unhealthy,” living paycheck-to-paycheck. For these people saving money isn’t even on their radar. They’re just trying to pay the bills each month. The key is to help them control their discretionary spend. Fix this and suddenly there’s some money to save.

Pictured: CEO and founder Ryan Clark demonstrating ProActive at FinovateFall 2016.

Do you see a bright future for savings-enabled technologies?

Clark: People like automation, but too much causes people to check out of their finances causing even worse problems. The ideal system will help them analyze their finances and then determine where they can cut back to be able to save. This must be involved and customized since money is very emotional. But these tools are coming and it will help people save and grow their wealth like never before.

Which direction do you think savings technology will – or should – go in the years to come?

Clark: It has to be holistic while keeping things simple. Spending controls will dominate the space since savings is a byproduct of spending decisions. The convergence of budgeting and banking will continue and accelerate making both controlling spending inside a planned budget and automated savings easier.

For more on our savings technology, check out our six-part series on key players and the enabling technologies.

Designed by Freepik

Above: Sean Patterson, Worldcore’s Marketing & PR Director, debuting authentication technology at FinovateEurope 2017 in London

Above: Sean Patterson, Worldcore’s Marketing & PR Director, debuting authentication technology at FinovateEurope 2017 in London We followed up with Worldcore’s CEO, Alex Nasonov (pictured), for an interview after FinovateEurope.

We followed up with Worldcore’s CEO, Alex Nasonov (pictured), for an interview after FinovateEurope.

Kunal Anand, CTO & Co-Founder of Prevoty, presenting on using runtime visibility to align application security with DevOps

Kunal Anand, CTO & Co-Founder of Prevoty, presenting on using runtime visibility to align application security with DevOps Ken Maier takes home the award for the most engaging Twitter user

Ken Maier takes home the award for the most engaging Twitter user

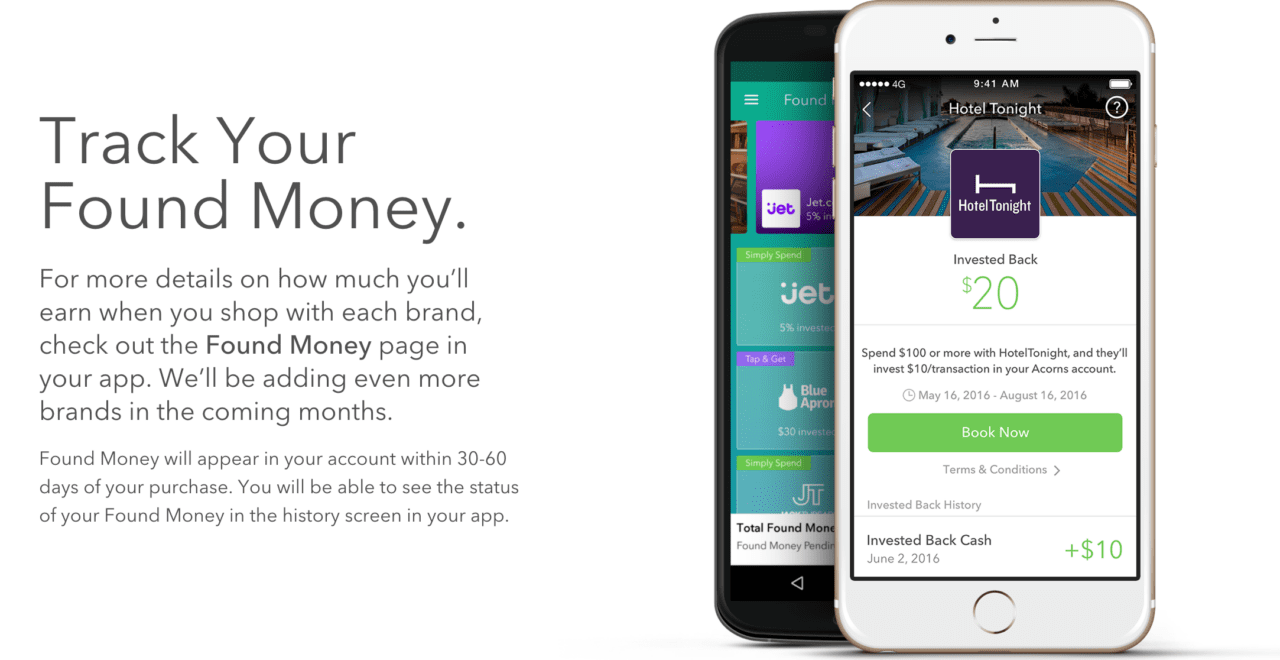

Prosper’s Auto Invest feature helps users take a “set it and forget it” approach to saving

Prosper’s Auto Invest feature helps users take a “set it and forget it” approach to saving