As social media analytics company Neener Analytics says on its website, “we may not be superheroes… but we’re pretty darn close.” As proof, the company is backed by an advisory board, whose members have Ph.Ds in fields such as game theory, behavioral economics, and decision science.

Furthermore, the company itself has received its share of accolades. CIO Review Magazine named Neener Analytics among Top 20 Most Promising Data Analytics Companies 2017, CIO.com honored the company in Top 20 Fintechs to Watch in 2017, MergerMarket U.K. listed it as a Top 4 U.S. Fintech To Follow in 2017, and Neener Analytics won Best of Show at FinovateSpring 2017 last month in San Jose.

In the company’s award-winning demo, Neener Analytics CEO Jeff LoCastro showed off what the company is doing to earn such accolades. “We’re here to unveil today at Finovate social media decisioning analytics that actually works,” LoCastro said. He went on to explain that Neener Analytics goes further than just “measuring likes and friends,” what he described as the “you-are-who-your-friends-are” approach that is unfounded because “we’re not who our friends are.”

Instead, Neener Analytics looks at each user’s individual social media presence and leverages social biometrics to determine their risk. LoCastro pointed out during his demo that the question is not can the user pay the bank back, but rather will they pay them back. It is this perspective that distinguishes Neener Analytics from others that use social media data for underwriting.

Company facts

- Headquartered in San Jose, CA

- Typically reduces lender defaults by 25% to 33%

- Can accurately predict or project a consumer’s FICO score range almost 80% of the time

Above: Neener Analytics’ Jeff LoCastro (CEO & Founder) and Marc Tomlinson (CTO & Co-Founder) demo at FinovateSpring 2017

We spoke with Jeff LoCastro after his demo at FinovateSpring this year. The following is the written interview.

We spoke with Jeff LoCastro after his demo at FinovateSpring this year. The following is the written interview.

Finovate: What problem does Neener Analytics solve?

Jeff LoCastro: Well, current credit and financial risk assessment systems using historical, transactional, and relational data simply don’t provide individually actionable projective insight.

Think of us as the Biometrics of Personality. We’ve developed a regulatory compliant social media analytics technology for lenders, insurance companies, and other risk-centric businesses. This technology enables them to better decision and understand specific individual risk outcomes of thin-file, no-file and credit challenged consumers using our patent-pending personality and behavior analytics technology. We decision individual human characteristics, not transactions, history, or relationships.

We’ve also redefined the idea of the social login. No longer is it simply a way to prepopulate applications or registrations. That’s old stuff. We’ve turned it into a portable financial persona.

Finovate: Who are your primary customers?

LoCastro: Lenders, insurance companies, or any consumer-facing business trying to understand the risk of the engagement. Our sweet spot right now are those really trying to understand the thin-file, no-file, and credit challenged consumers out there… about 56% of American consumers. And internationally, it can be as high as 90%.

Finovate: How does Neener Analytics solve the problem better?

LoCastro: Again, think of us as the biometrics of personality. What if you could sit each customer down with a psychologist and ask them, “are you REALLY going to pay us back?” or “Why should we trust you?” And have everything that customer says predict, with almost 80% accuracy, whether they will default on their loan, transact or revolve, predict/project a risk-correlated FICO score, or tell you if they are likely telling the truth. With one click and a 20-minute implementation, we’ve automated that psychologist.

Finovate: Tell us about your favorite implementation of your solution.

LoCastro: Sure. We recently completed a comprehensive, nine-month long validation for a U.S.-based high-volume consumer products lender doing about 30,000+ applications per month. Their market leans generally toward thin-file and no file individuals, but does also include those we would classify as simply “credit challenged.” They wanted to see 1) if we could improve on their current underwriting models to better predict default, 2) How many turn-downs we would predict default or succeed compared to their current approaches. We also used this validation as an opportunity (although not a use case for them) to predict collection reinstatement and charge-off.

We reduced their defaults by 33% and demonstrated a revenue increase of 22%. In our collections validation, we demonstrated that we could predict (post default) who would likely be reinstatable with a 79% accuracy.

Finovate: What in your background gave you the confidence to tackle this challenge?

LoCastro: I was a part of the initial executive team of the inventor of the online social network, Classmates.com, and was extracting insights from social media long before it became a thing. I can’t for certain say that I invented it, but I sure did pioneer the cost-per-action model. It worked for us (and our customers) because I could prove insight, and that insight created clicks. While the rest of the market was bragging about “investor” revenue, we were out there actually making money and being, at the time, one of the fastest growing web properties in the world.

Finovate: What are some upcoming initiatives from Neener Analytics that we can look forward to over the next few months?

LoCastro: There’s a couple that we are not quite ready to announce, but we are grinding out 16-hour days developing new ways to deliver insight. We are, in particular, honing our ability to predict ‘veracity,’ that is, whether they are likely telling the truth or not. Our initial testing has been out-of-this-world promising.

Finovate: Where do you see Neener Analytics a year or two from now?

LoCastro: Let me answer this way: I see the future of social media itself being almost “avatars of self.” Now this is me saying this, not Facebook or whatever. People are pouring themselves into their media and it seems to me to be the next logical step. And with the coming of functional AI, I can see social media being defined as a “conversation” with that user, their AI avatar of sorts, instead of being defined as a page or “profile”. We are definitely poised for that. But that’s perhaps longer than two years.

So the next couple years, I see us with double-digit in-roads into the four major lending verticals and having cracked the insurance markets. Ambitious, yes. Do-able, absolutely. With the right partners and strategic relationships… very doable. I’ve made sure we think big and that’s never going to change.

Check out the live demo from Neener Analytics at FinovateSpring 2017 with Jeff LoCastro (CEO & Founder) and Marc Tomlinson (CTO & Co-Founder):

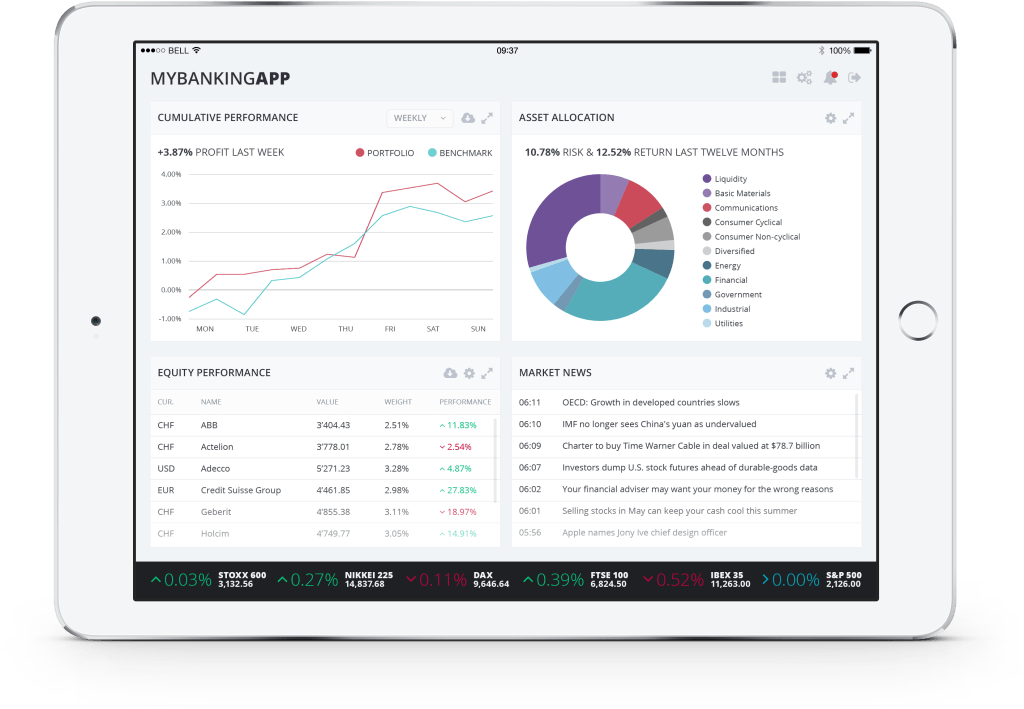

Founded in 1998, additiv offers a digital financial suite, robo advisor and advisor services, as well as digital mortgage tools. At FinovateEurope 2016, the company’s CEO and founder, Michael Stemmle, along with Adriano Lucatelli and Marc Sauter from Descartes Finance,

Founded in 1998, additiv offers a digital financial suite, robo advisor and advisor services, as well as digital mortgage tools. At FinovateEurope 2016, the company’s CEO and founder, Michael Stemmle, along with Adriano Lucatelli and Marc Sauter from Descartes Finance,