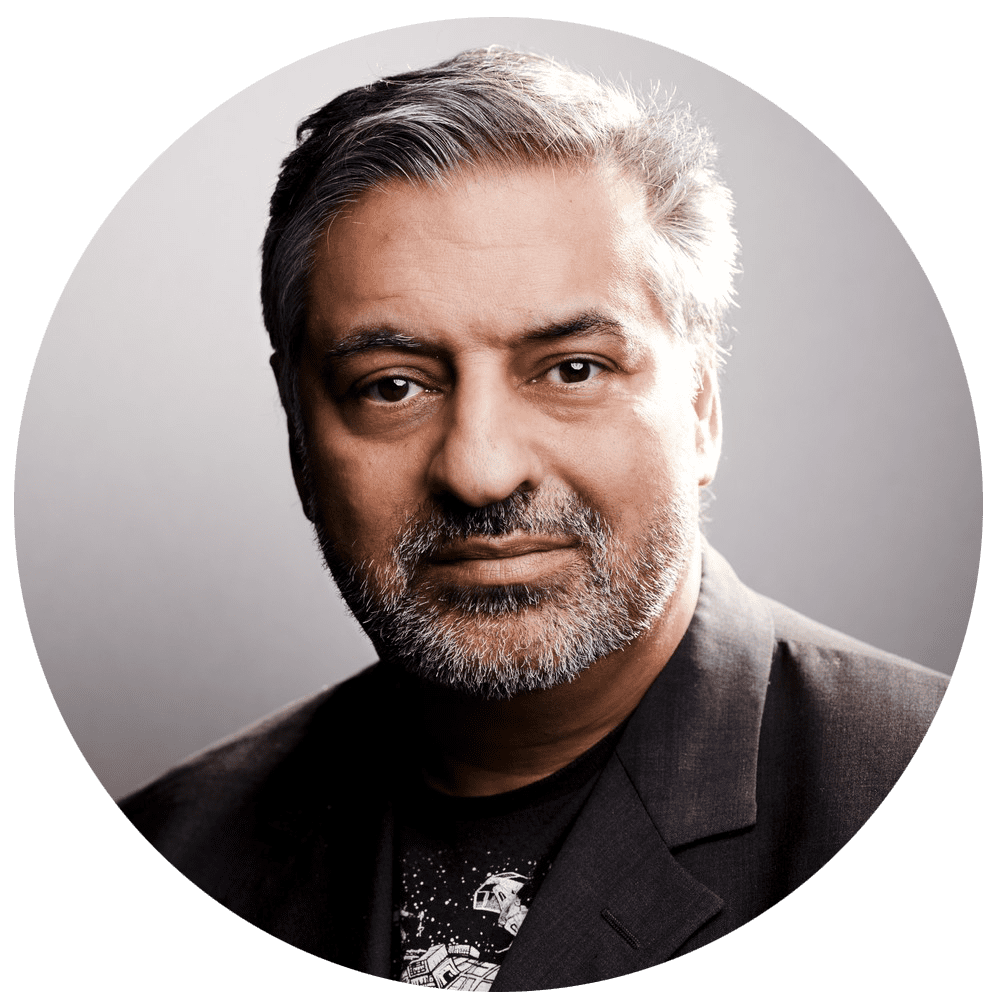

“Banks need to ask themselves whether they are flexible and sensitive enough to adapt to the rapidly changing context.” Harrie Vollaard, Head of FinTech Ventures at Rabobank, has established several partnerships with startups, manages the Fintech investments for the Rabobank, is involved in Fintech accelerator programs around the globe, and created several spinoffs. Speaking at FinovateEurope 2018 about Creating A Digital Investment Experience To Compete In A Zero Interest Rate Environment, we chat to him about his key tips for banks who strive to create a successful digital agenda.

“Banks need to ask themselves whether they are flexible and sensitive enough to adapt to the rapidly changing context.” Harrie Vollaard, Head of FinTech Ventures at Rabobank, has established several partnerships with startups, manages the Fintech investments for the Rabobank, is involved in Fintech accelerator programs around the globe, and created several spinoffs. Speaking at FinovateEurope 2018 about Creating A Digital Investment Experience To Compete In A Zero Interest Rate Environment, we chat to him about his key tips for banks who strive to create a successful digital agenda.

Finovate: What does a bank need to focus on when building a digital agenda?

Vollaard: There are three key areas that banks need address to build their digital agenda:

1. A clear innovation thesis and establishing the areas you want to focus on. Here are four areas that we have defined: financial cruise control, platform banking, emerging technologies as business model enablers, and data for food.

2. Open infrastructure to collaborate. To facilitate in- and out-coming datastreams as well as delivering services to third parties and incorporating external services. I envision a satellite structure of the bank’s core assets surrounded by an ecosystem of third parties and startups where the bank is still the first point of contact.

3. A company-wide digital DNA. This is the key success factor and enabler of innovation. Innovation departments running innovation projects and proof of concepts are essential, but in order to be successful you need scale. Scale can only be accomplished through the business lines and marketing department. The bank needs to look beyond the existing products and that can only be accomplished via a customer-first approach, which means a full adoption of a lean startup methodology and product development processes that facilitate iterative learning. A more Darwinian approach is also preferable; it is not the best executed project but the most adaptable organisation who survives. Banks need to ask themselves whether they are flexible and sensitive enough to adapt to the rapidly changing context.

Finovate: How does the fintech sector offer a growth opportunity for banks?

Vollaard: It offers growth in three key areas:

1. Delivering better, more transparant and cheaper services to our clients (challenger banks, personal finance management, market place lending), streamline business processes (by use of Artificial Intelligence, Blockchain), taking out risk (RegTech). The bottom line it the business model optimization; to improve cost/income ration and to increase customer satisfaction.

2. Adding additional services on top of existing banking infrastructure; services more embedded in the real life/business of the clients. A shift from product oriented to service oriented, related to the real customers needs/pains. E.g. in the value added services on top of payments. Bottom line it is business model extension fulfilling customer/client needs embedded in real life events.

3. Exploring new innovation areas; reinvent the business model of the bank. E.g. transforming your assets in to new service offerings to your clients (e.g. delivering trust services (secure login, authentication, signing services to our clients). In general it means cross industry innovations. Example: We developed an FX platform for ourselves which now can be solved as a B2B solution to other financial institutions. Bottom line it is business model innovation.

Finovate: How has Rabobank collaborated with fintechs to expand products and services for customers?

Vollaard: 90% of the collaboration with fintechs are focused incorporating their services in the service offerings of the bank or in the business processes of the banks.. E.g. Sparkholder with loanstreet; a pre-approved finance tool for SMEs.

9% of Rabobank is an extension of our services, such as Rabo&Co with FinTech Cloud Lending solutions, which is a market place lending solution for SME clients.

1% of the collaboration is related to business model innovation, such as working together with fintech Signicat delivering e-business services iDin (secure login, authentication, signing services to our clients). With our corporate investment arm Rabo Frontier Ventures we are focusing on this category.

Finovate: What are the drivers for change in digital investing?

Vollaard: The most obvious one is the customer and business need. Although this seems like a no-brainer, for the incumbents it means a transformation from a portfolio of financial products (which served the customers of the past) to financial services that fit the customer needs of today.

Another driver is the technologies that offer us opportunities we have never seen before, such as risk models/predictions based on different data sources, optimizing business processes, and new revenue streams.

Finally, there is the regulatory motivation and the harmonization of legislation across Europe to stimulate innovation and lower the thresholds to then expand.

Finovate: How can you compete in a zero interest rate environment?

Vollaard: By making investment more accessible; a mobile only investment app focused on millennials whereby the roundups from transactions are invested in ETFs. The threshold is very low to invest in and a small amount being invested on very regular bases counts up without the customer even noticing. It is completely chat-based, user friendly, design-focused and automated with low cost operation. It is a new and engaged target group.

We know the success that Betterment, Wealthfront, Nutmeg have had serving customers via insightful and user-friendly websites. Inspired by them, we introduced last year Rabo Beheerd Beleggen, which has been accepted with huge success.

Finovate: What will new technologies – like artificial intelligence and blockchain – mean for investment management?

Vollaard: The second wave of technologies impacting the financial industry will offer substantial investment opportunities and reduce costs significantly.

AI can slash down costs by 30% by reducing manual work, and blockchain/smart contracts will eliminate steps in the value chain.

Speaking at

Speaking at ![What’s the Fuss? Amazon Already Offers Full Suite of Banking Services [Updated]](https://finovate.com/wp-content/uploads/2018/03/amazon-banking-product-line.jpg)

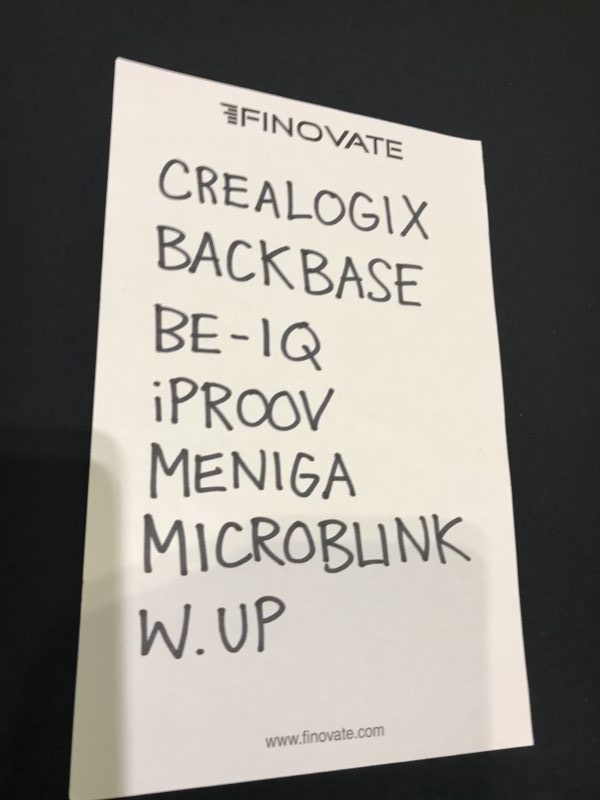

iProov

iProov Microblink

Microblink