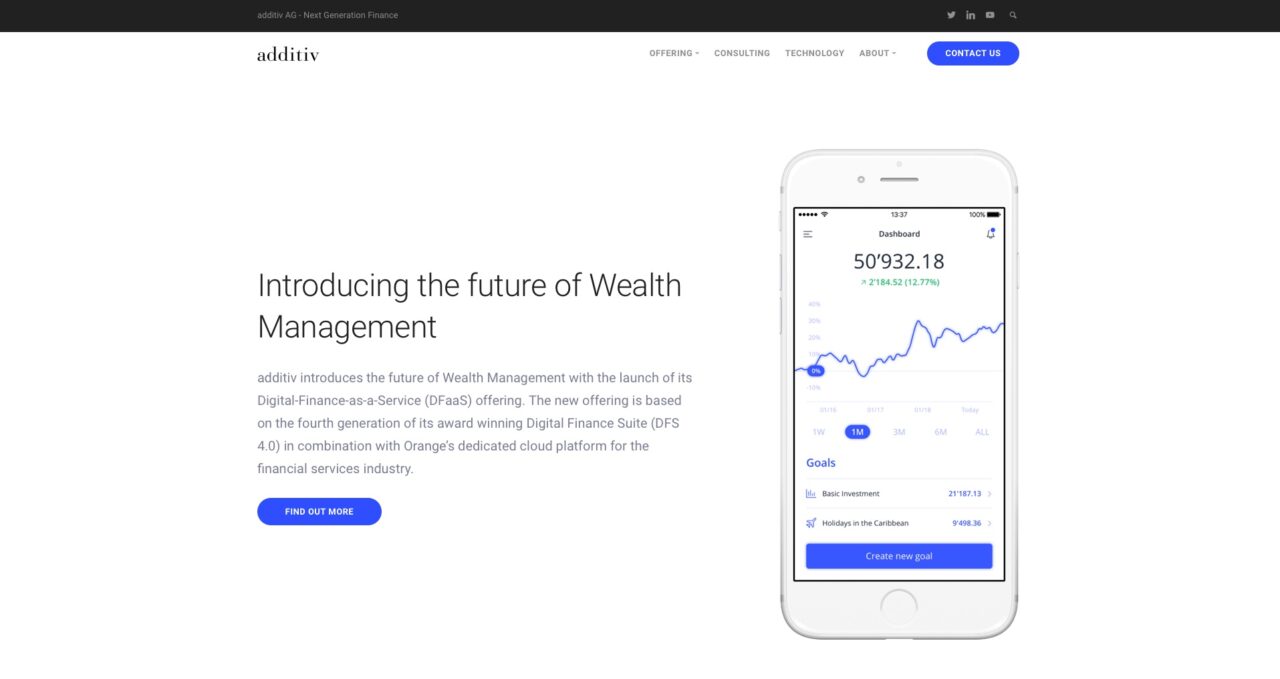

European robo advisor additiv its leveraging is relationship with Orange Business Services to make its cloud-based digital wealth management technology available to banks and other FIs. Offered as a SaaS solution, additiv’s wealth management as-a-service technology features out-of-the-box solutions including robo advisory, portfolio management, and client and advisory dashboards.

“By partnering with Orange Business Services we can provide financial institutions with a fast and highly-secure way of tapping into this new market opportunity, while improving the end-client experience and reducing operating costs,” explained additiv CEO and founder, Michael Stemmle.

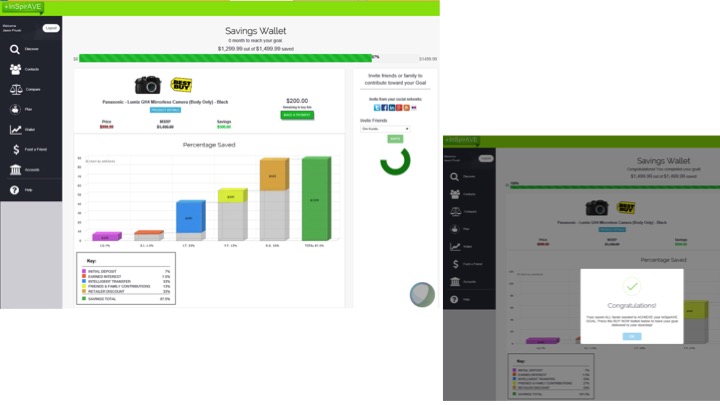

Michael Stemmle, CEO and founder of additiv, demonstrating the company’s cloud-based robo advisor at FinovateAsia 2017.

Stemmle added that the joint platform will give FIs access to the company’s Digital Financial Suite, as well as its global ecosystem of partners who offer a range of additional services including client administration, execution and custody services with access to 35,000 FIs across eight asset classes.”

The new solution will be introduced in Europe, the Middle East, Africa, and the Asia Pacific on dedicated Orange cloud platforms. Orange Business Services is the B2B division of the Orange Group, the first mobile operator to make contactless cash payments available in Europe. The company launched its Orange Money solution in 2008, linking a mobile account with an Orange mobile number to support the cash needs of customers in the Middle East and Africa. Last year, the Orange Group launched Orange Bank in France.

“Our highly-secure cloud platform is providing additiv with a smart and efficient way for financial institutions to plug in a game-changing range of products and map the entire data journey to provide valuable customer insight,” CEO of Orange Business Services, Helmut Reisinger said. “It will make digital wealth management easier and more convenient, which will undoubtedly broaden the appeal of wealth management.”

Headquartered in Zurich, Switzerland, and founded in 1998, additiv demonstrated its configurable, cloud-based robo advisor at FinovateAsia 2017. A provider of digital financial and wealth management solutions to banks, insurers, wealth, and asset managers in Europe and the Asia-Pacific region, additiv has more than 15 existing deployments of its technology.

Additiv has raised $21 million (CHF 21 million) in funding courtesy of an investment from Switzerland’s BZ Bank last spring.