|

|

|

|

|

|

|

|

|

|

Finovate is part of the Informa Connect Division of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

|

|

|

|

|

|

|

|

|

|

Credorax, a payments company, has selected Temenos T24 Transact, deployed on the cloud, to provide SME, merchant acquiring and cross-border payment services, reports Henry Vilar of Fintech Futures (Finovate’s sister publication).

The firm has created an API-centric technology ecosystem with the Temenos open banking platform running on Microsoft Azure.

Temenos was the first banking software provider to launch a cloud offering running on Azure and since 2011, T24 Transact has been available as a managed service on the Temenos Cloud.

T24 Transact is part of Temenos’ new batch of products announced earlier this month.

Now, Credorax is a fully-fledged European commercial licensed bank via the Malta Financial Services Authority, and offers a suite of services, including fraud detection and local processing.

Steen Jensen, managing director – Europe, Temenos said: “With T24 Transact, Credorax can capitalize on real-time flexible technology today, as well as have a foundation for future growth.”

“We want to provide the scalability necessary to dominate the financial services industry and couple that with versatile and innovative cloud services,” added Moshe Selfin, COO of Credorax.

Credorax’s move into cloud-based banking was motivated by the introduction of PSD2, according to the firm.

Founded in 1993 and headquartered in Geneva, Switzerland, Temenos demonstrated its Connect Mobile Banking solution at FinovateEurope 2015. More than 3,000 companies around the world, including 41 of the top 50 banks, leverage Temenos’ technology to support the transactions of more than 500 million bank customers.

On Finovate.com

Around the web

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

As if disruption in the global banking sector was not already confusing enough, traditional institutions must now deal with the rise of neo-banks banks. This new breed of competition are organizations that are purely digital. They don’t require the licensing, nor do they incur the regulatory burden of traditional banks. They exist without brick and mortar and provide fast, simple, easy to use, highly personalized services that are entirely done via mobile device.

Their rapid growth and success is a result of both a lower cost structure and a regulatory environment aimed at increasing competition and consumer choice. Additionally, they don’t try to be everything to everybody. They excel by offering a limited range of digital products like checking, savings, and a subset of consumer lending products, while deferring things like credit card and mortgage services to more traditional institutions. This results in a lower regulatory burden and reduced overhead which is passed on to the consumer via lower fees.

Their agility and speed is due to the absence of the burden of legacy technology. They are true digital natives — whereas most traditional banks offer a digital front end built on top of outdated and monolithic legacy system-based banking applications.

“These banks don’t carry the weight of legacy technology, so they can leapfrog over traditional infrastructure and disrupt the status quo.”

– Judd Caplain, Head of Global Banking & Capital Markets, KPMG International

Neo-banks target millennials who are more receptive to change. With each passing year the influence of Gen Y changes the shape of the delivery of banking products and services – and that is the long-term bet Neo-banks are making today.

The disruption being driven by this demographic shift has not gone unnoticed by traditional banks. Not only is it forcing banks to accelerate plans to modernize their legacy IT systems and infrastructure, but also to discover new ways of delivering customer value.

The good news is that traditional banks have several advantages over the neo-banks including:

And although traditional banks are starting from a position of competitive advantage, in order to retain and extend that advantage in the digital age, they need to quickly learn how to

No one wakes up in the morning and wonders what the next product offering from their bank is going to be. To that end, traditional banks need to extend and grow the value of the customer relationship beyond increasing products per household and focus on increasing value through improving digitized customer experiences.

To learn how one of the top 15 banks in the world partnered with Nuxeo to extend customer value, join us at Finovate Europe on February 14th at 11:15am for “The ticking time bomb of data: Making sense of legacy data in different systems.” presented by Norman Wren, former Director of Technology and Operations for Santander.

Anti-fraud solution provider Feedzai has collaborated with DataRobot to enable FIs, merchants, and processors to add DataRobot’s machine learning models to the Feedzai platform. The integration, made possible via the OpenML platform Feedzai announced last year, will enable FIs to automate the creation of advanced machine learning models for fraud detection and AML, providing a higher level of defense against financial crime.

“This integration with DataRobot enables us to further open the Feedzai platform to powerful machine learning algorithms into our platform to offer even more of the world’s advanced AI tools to our customers,” Feedzai SVP of Product Saurabh Bajaj said. “This is how we are democratizing AI for our customers.”

The integration also gives data scientists the ability to conduct data cleaning and analysis, feature engineering, and model training and testing, all within the Feedzai platform. Data scientists can also import external models to the platform, as well as take advantage of Feedzai’s other tools, including its automated rules engine, advanced link analysis, Risk Ledger, and Genome to enhance fraud detection further.

“Our partnership with Feedzai gives banks and other financial institutions the flexibility to use the machine learning technology and tools that best fit their needs,” SVP of Business Development for DataRobot Seann Gardiner said. “The combination of Feedzai’s impressive threat detection technology and our world-class automated machine learning capabilities create a best-of-breed solution to fight fraud with unprecedented accuracy.”

With $5 billion in transactions scored daily, Feedzai protects 10 of the largest 25 global banks from fraud. Last month, the company announced a strategic partnership with Citi, which will feature the integration of Feedzai’s anti-fraud technology with Citi’s Treasury and Trade Solutions. Feedzai also unveiled its latest financial crime prevention solution, Risk Ledger, in December. Risk Ledger leverages the millions of transactions processed via its platform to provide a more comprehensive anti-fraud solution.

Founded in 2009 and based in San Francisco, California, Feedzai demonstrated its fraud prevention technology at FinovateEurope 2014. The company has raised $76.1 million in funding, and includes Data Collective DCVC, Sapphire Ventures, Citi Ventures, and Oak HC/FT among its investors.

Revolut, a digital-only bank, has signed an agreement with ClauseMatch to adopt its regulatory technology to streamline management of internal policies, controls and regulatory compliance, following a two-month trial period, reports Henry Vilar of Fintech Futures (Finovate’s sister publication).

The bank has experienced “significant” growth since it was founded three years ago, across 28 markets in Europe, and is preparing to launch in the US, Canada, Australia, New Zealand, Singapore and Japan in the coming months.

Revolut is currently working in multiple jurisdictions with different rules applied to financial services companies. And across these jurisdictions it faces different regulatory challenges.

The company’s CEO and founder Nikolay Storonsky said that one of the main reasons the company was able to scale so fast is due to its approach to compliance.

“Compliance is something that a company cannot get wrong. That’s why it is incredibly important to evaluate the process constantly and innovate where possible. We strongly believe in innovation and technology. We decided to double-down on technology,” Storonsky says.

Revolut reports that it is signing up over 250 businesses and 9,000 customers per day.

Previously, in 2017, ClauseMatch went live with Barclays for policy management and compliance globally.

In other news today (29 January), Revolut unveiled his plan to build a global licensing team that will be responsible for securing banking, trading and credit licenses.

Founded in 2013, Revolut demonstrated its platform at FinovateEurope 2015.

A look at the companies demoing live at FinovateEurope on February 12 through 14, 2019 in London, U.K. Register today and save your spot.

With its latest innovation, DSwiss’ Safes can combine original meta-data that is passed along with documents/requests and data that is extracted with rule-based and machine-learning based algorithms

Features

Why it’s great

User-centric workflows that combine a personal data safe with document requests can provide additional value to both the bank and the client.

Presenters

Presenters

Tobias Christen, CEO

Christen boasts 20 years of experience in software development. Prior to co-founding DSwiss, he was responsible for developing the architecture of a security system for a large international firm.

LinkedIn

Damir Durut, Senior Project Manager

Damir Durut, Senior Project Manager

Durut earned a Bachelor of Science in Business Administration from the Applied University of Zurich. He has 6+ years of experience in IT Project Management, Business Analysis, and Process Management. He is fluent in five languages.

LinkedIn

A look at the companies demoing live at FinovateEurope on February 12 through 14, 2019 in London, U.K. Register today and save your spot.

LOQR’s Unified Identity Management approach provides a customer-centric, mobile first, one-stop-shop, digital identity lifecycle manager, focused on B2B and B2E regulated verticals.

Features

Why it’s great

Use LOQR to turn identity verification into a speedy and cost-effective onboarding process, with the best possible customer experience and easy compliance.

Presenters

Presenters

Ricardo Costa, CEO

Costa has experience in cybersecurity as an international project leader within financial, payment systems digital certification, and electronic identity sectors.

LinkedIn

Pedro Borges, CTO

Borges has taken on multiple roles involved in the software development lifecycle. His experience has ranged from hands-on development to multiple management responsibilities in organizations of different sizes operating in multiple countries.

LinkedIn

A look at the companies demoing live at FinovateEurope on February 12 through 14, 2019 in London, U.K. Register today and save your spot.

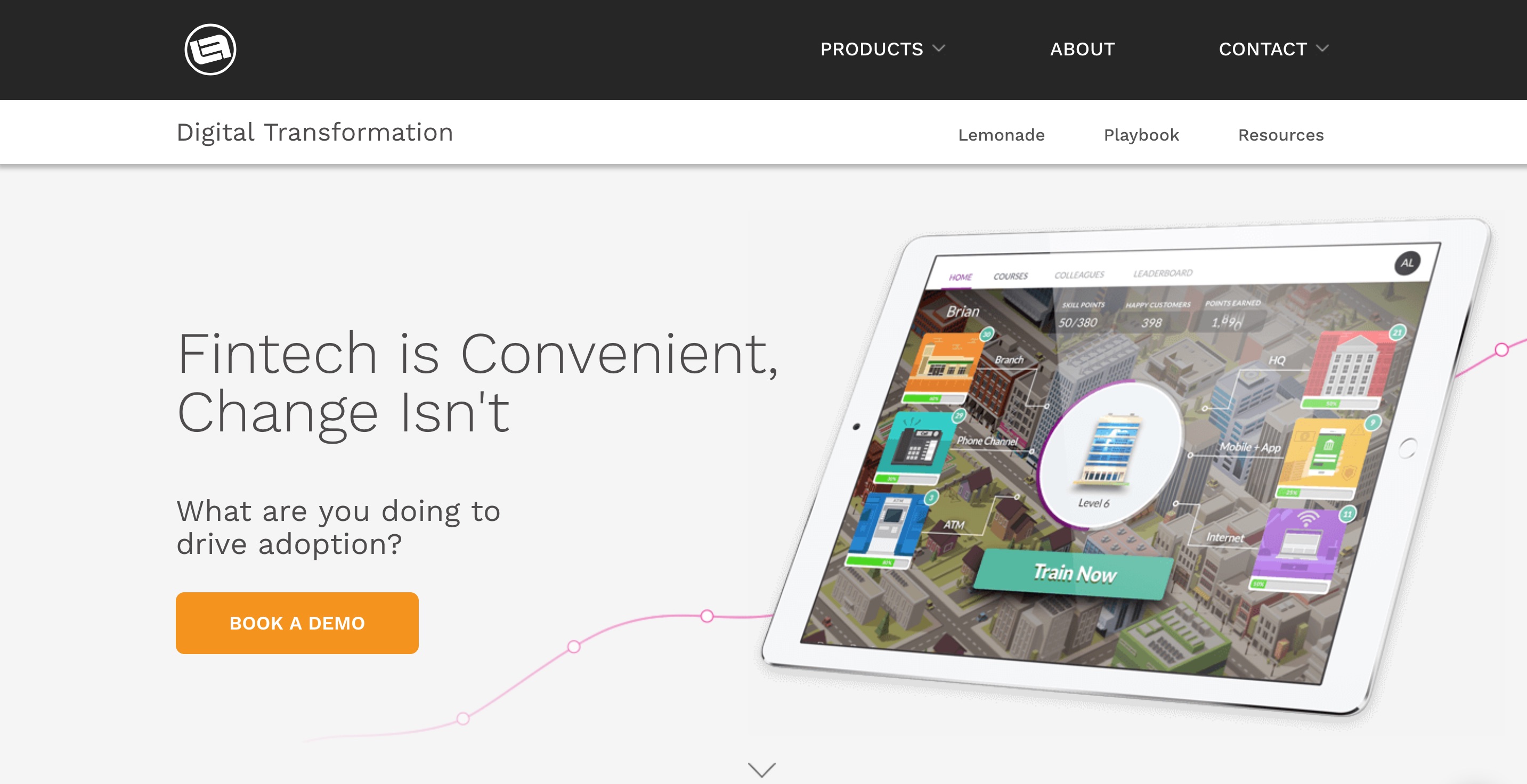

Launchfire’s Lemonade platform is the only all-in-one learning experience platform built specifically for financial institutions.

Features

Why it’s great

The Lemonade learning experience platform creates better staff, faster.

Presenter

Presenter

Romeo Maione, Program Designer and Strategist

As program designer and strategist at Launchfire, Maione has helped design Launchfire’s Learning Experience Platform, Lemonade.

LinkedIn

A look at the companies demoing live at FinovateEurope on February 12 through 14, 2019 in London, U.K. Register today and save your spot.

W.UP transforms the way banks generate digital revenue and interact with clients through AI-powered experiences.

Features

Why it’s great

Using advanced analytics, artificial intelligence and machine learning algorithms, Sales.UP builds customer insights that enable meaningful interactions between banks and their clients.

Presenters

Presenters

Jozef Nyiri, VP of Business Development

Nyiri is a hands-on innovator and growth leader with more than two decades of fintech experience. He is a visionary and speaker on digital transformation of the banking industry.

LinkedIn

Tamás Braun, International Sales and Business Development Director

Tamás Braun, International Sales and Business Development Director

Braun has worked in the retail banking technology industry for the past 15 years. Most recently, he worked at technology vendors such as IND and Misys before joining W.UP.

LinkedIn

Remco Veenenberg, Head of Alliances

Remco Veenenberg, Head of Alliances

Veenenberg has worked in startups focusing on emerging technologies, and established more than 40+ applied AI communities worldwide before evangelizing the use of data and ML for retail banking with W.UP.

LinkedIn

A look at the companies demoing live at FinovateEurope on February 12 through 14, 2019 in London, U.K. Register today and save your spot.

TimeWarp from CREALOGIX is an independent app created for the everyday banker in order to provide them with insights to make better financial decisions at every stage of life.

Features

Why it’s great

The new tool will ultimately help customers simulate every decision they make when it comes to their financial lives and predict the impact of these decisions.

Presenters

Presenters

Jo Howes, Commercial Director

Howes is responsible for sales and marketing activity for CREALOGIX in the U.K. Howes has more than 20 years experience partnering with leading financial institutions to accelerate their digital transformations.

LinkedIn

Eszter Vass, Key Account Manager

Vass has eight years of experience in digitalization in financial services. She is strongly focused on continuously improving the services and experiences offered, as well as enhancing the way people engage with their banks.

LinkedIn

A look at the companies demoing live at FinovateEurope on February 12 through 14, 2019 in London, U.K. Register today and save your spot.

Building on over 10 years of experience creating engaging digital journeys for financial institutions, BlueRush has developed a completely new IndiVideo credit card selector and personalized video experience.

Features

Why it’s great

IndiVideo focuses on accelerating the customer journey through personalized education and visualization. BlueRush has seen conversions lift over 65% with IndiVideo because of its engaging format.

Presenter

Presenter

Ted Mercer, VP of Sales

Mercer has worked in sales and sales management for over 10 years and has a background in financial services as a Chartered Accountant. He helps companies increase customer engagement with IndiVideo.

LinkedIn