A look at the companies demoing live at FinovateEurope on February 12 through 14, 2019 in London, U.K. Register today and save your spot.

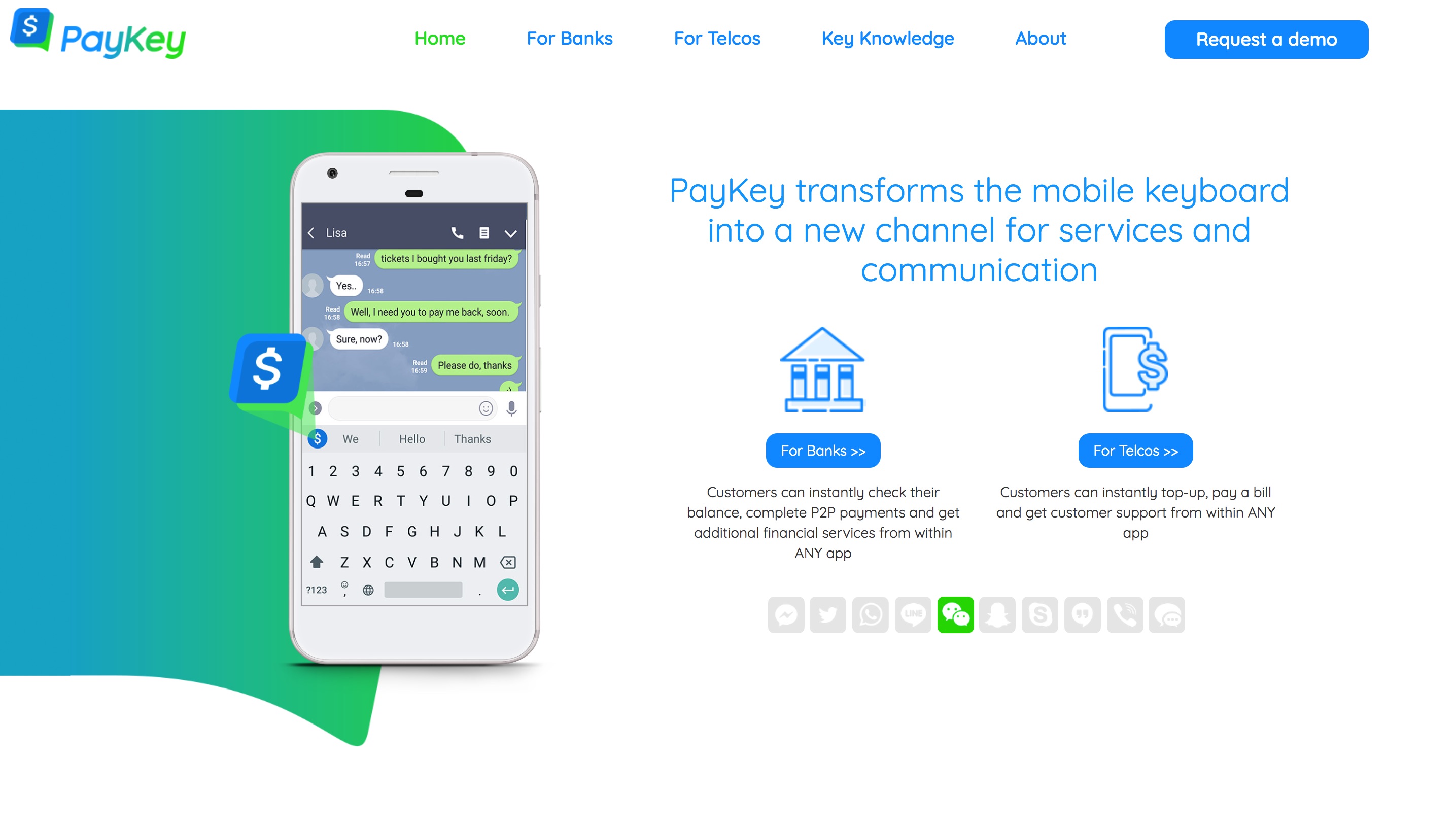

PayKey has developed a unique Social Banking solution that enables users to instantly access key banking services from within ANY app – directly from their keyboard.

Features

- Create a new mobile banking experience, made for the digital age

- Turn the keyboard into an effective services and communication channel

- Increase customer engagement

Why it’s great

Engaging millennials requires tapping into social and messaging apps – where they spend hours. PayKey streamlines banking services into users’ digital life, offering truly contextual banking.

Presenters

Presenters

Guy Talmi, CMO

Talmi leads PayKey’s strategy, marketing, and product management, with 20+ years of experience in global marketing, sales, and business development in telecom, financial services, and digital.

LinkedIn

May Michelson, Director of Business Development, Europe

May Michelson, Director of Business Development, Europe

Starting as a software developer at Intel, Michelson has a strong technical background and experience in technology integration. She is leading PayKey’s strategy in Europe.

LinkedIn

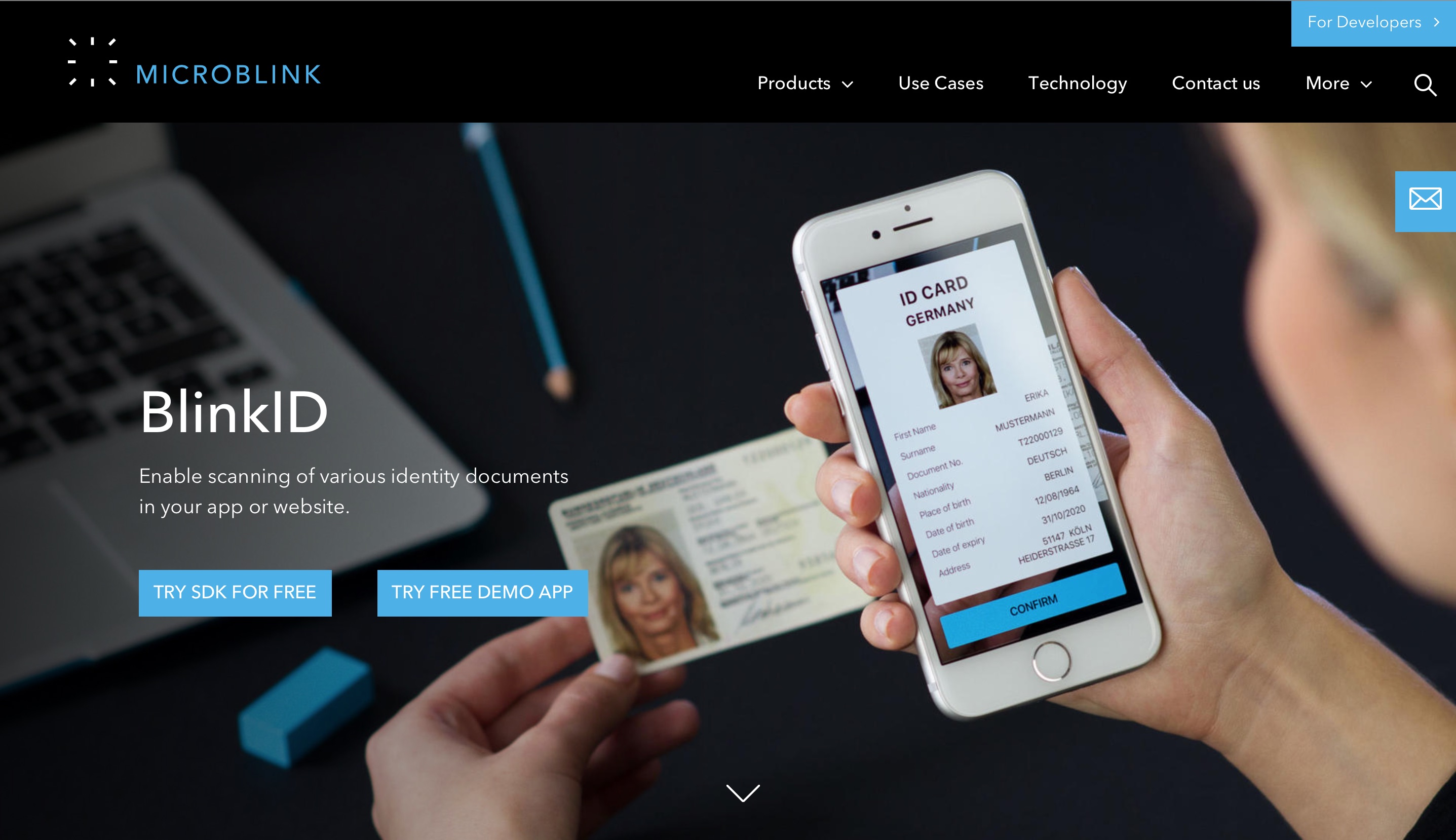

Valery Novikov, Co-Founder, Chief Technology Officer

Valery Novikov, Co-Founder, Chief Technology Officer

Domjan Barić, Project Manager

Domjan Barić, Project Manager

Presenters

Presenters Fridrik Reynisson, Director, Product Development

Fridrik Reynisson, Director, Product Development

Presenters

Presenters Samra Baftiarovic, Product Specialist

Samra Baftiarovic, Product Specialist

Presenters

Presenters Jurica Cerovec, CTO

Jurica Cerovec, CTO

Presenters

Presenters Goran Bosankić, Country Manager

Goran Bosankić, Country Manager

Presenter

Presenter