Opentech has leveraged Mastercard Send APIs to offer a new solution, OpenPay Send, that will give financial institutions across Europe powerful money transfer capabilities.

“Opentech’s mission is to be the enabler of digital payments for banks, leveraging state-of-the-art infrastructures to build highly reliable and flexible solutions, ready to be deployed to the end user,” Opentech CEO Stefano Andreani said. “The partnership with Mastercard and the integration with their worldwide network is a perfect fit to our strategy, bringing a great value and convenience to our customers.” Andreani called OpenPay Send “an important addition to our offering.”

OpenPay Send will also enable firms to offer a broad range of services – from remittance and micropayments to insurance claim distribution and real-time P2P payments. Available via a single integration, the solution helps institutions transfer money to more than 100 corridors – including as many as three billion bank accounts – as well as mobile wallets, payment cards, and cash-out locations worldwide.

The new technology gives banks and other FIs the flexibility to tailor its offering, specifying which countries and sending channels to be activated, and at what costs. OpenPay Send also features a customizable UI for both mobile and web, as well as an administrative portal. Opentech will demo OpenPay Send later this month at FinovateEurope in Berlin, Germany.

Mastercard’s Arne Pache, VP of Digital Payments and Labs, praised the collaboration as an example of how the Mastercard Send platform improves the process of global money transfer. “(We) designed the Mastercard Send platform envisioning a better, faster, and smarter way to send money all over the world in multiple ways by leveraging our expertise and the existing relationships with our customers.” Pache added that the partnership with Opentech and launch of OpenPay Send “brings this vision to life.”

Opentech demonstrated its white-label mobile app, OpenPay for Business, at FinovateEurope 2018. The company is headquartered in both Italy and Switzerland.

Here is our weekly roundup of the latest news from our Finovate alumni:

- BBVA’s Holvi to expand to the U.K.

- Cloud 9 partners with Green Key Technologies to enable more efficient and secure extraction of voice trading data.

- Blackhawk Network sets up development center in India, reveals plans to hire 200.

- Lighter Capital promotes Joe Silver to Chief Financial Officer.

- SparkPost announces new features for its Receipt Validation tool.

- Pensions administrator TKP teams up with Ohpen.

- Credit Agricole nabs majority stake in Linxo.

- ID R&D’s new release of IDVoice v.2.11 includes key performance enhancements.

- Tink launches in France.

- Revolut offers free airport lounge access to users if their flight is delayed by more than one hour.

- Billtrust’s Business Payments Network is now integrated with Corporate Spending Innovations to enable their customers to automate supplier payment delivery.

- Voleo taps Glen Wilson as its interim CEO. Company founder Thomas Beattie will remain as Voleo CCO.

- Xignite now available in Amazon Web Services (AWS).

- Jack Henry launches core-agnostic banking platform.

- DefenseStorm reports zero attrition and 50% customer growth in 2019.

- FIS partners with alternative SMB funding company LiberisFinance.

- Pacific Service Credit Union selects Digital Onboarding to enhance member onboarding.

- Quid merges with social media analytics company NetBase.

- ndgit and Konsentus partner for PSD2 compliance. This week, ndgit also released version 2 of its API platform.

- Arxan Technologies recorded 30% subscription growth in 2019.

- Upgrade Pack raises $5 million in seed round.

Alummi Features and Profiles

Here’s How Far We’ve Come with Voice AI in Customer Service – When it comes to customer service, even in-person interactions can be unpleasant. And doing business over the phone is usually markedly worse, especially if there is a bot involved. There is one fintech fighting that stereotype, however.

Currencycloud Raises $80 Million in New Funding – B2B cross border payments innovator Currencycloud has locked in $80 million in new funding.

Citi Unveils Digital Investment Platform Powered by Jemstep – Launched by Citi last week and powered by Jemstep, Citi Wealth Builder is the latest addition to the world of digital investing platforms.

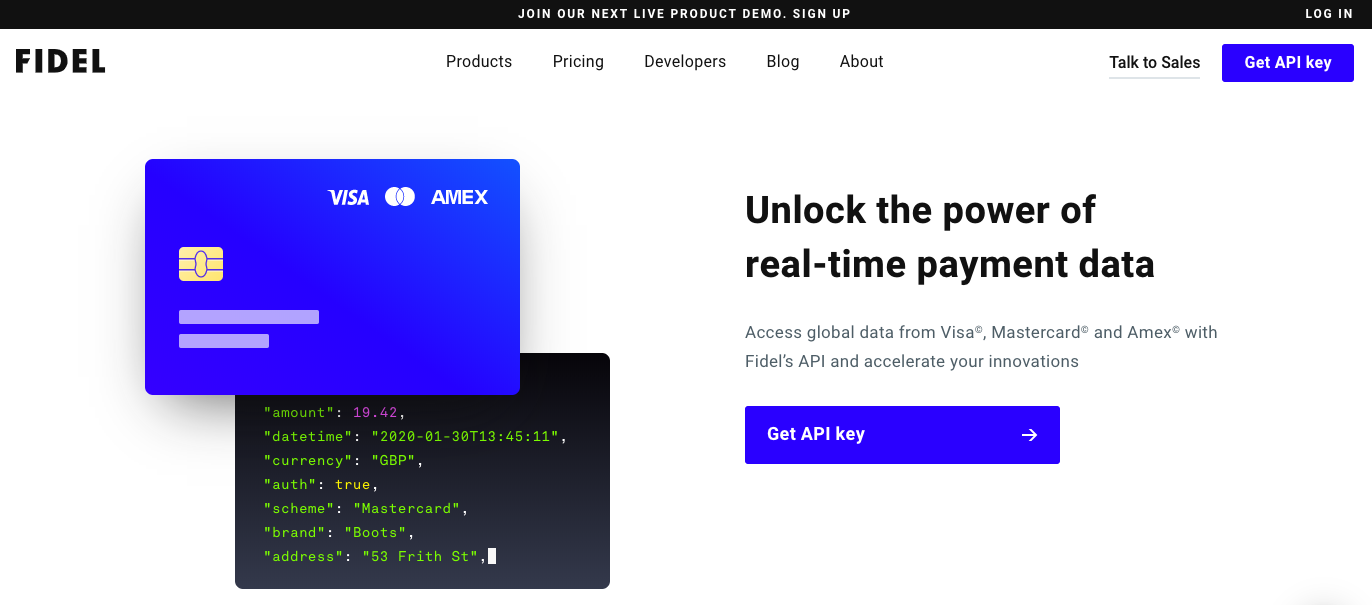

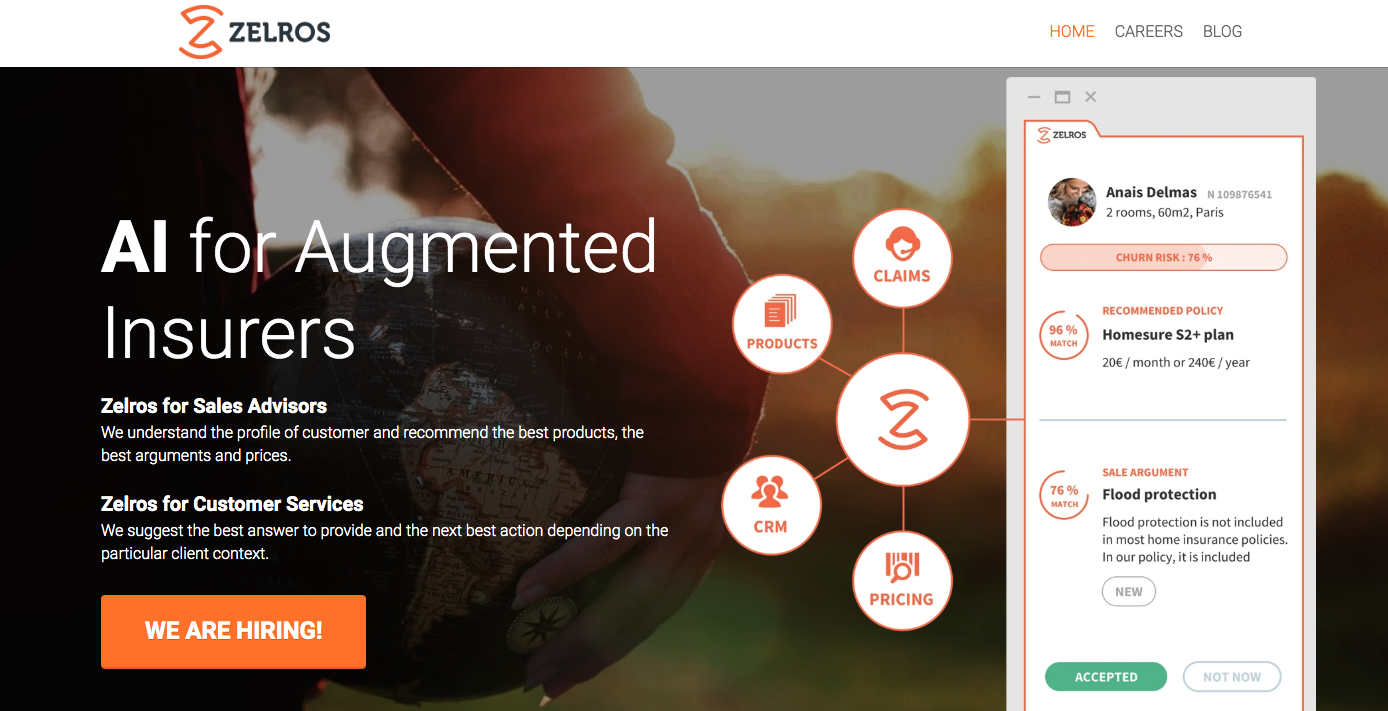

Our latest FinovateEurope Sneak Peeks are up. Meet LeapXpert, Crowdz, Diligend, ITSCREDIT, Crayon Data, Chatvisor, Neonomics, Covr Security, Fidel, and Zelros.

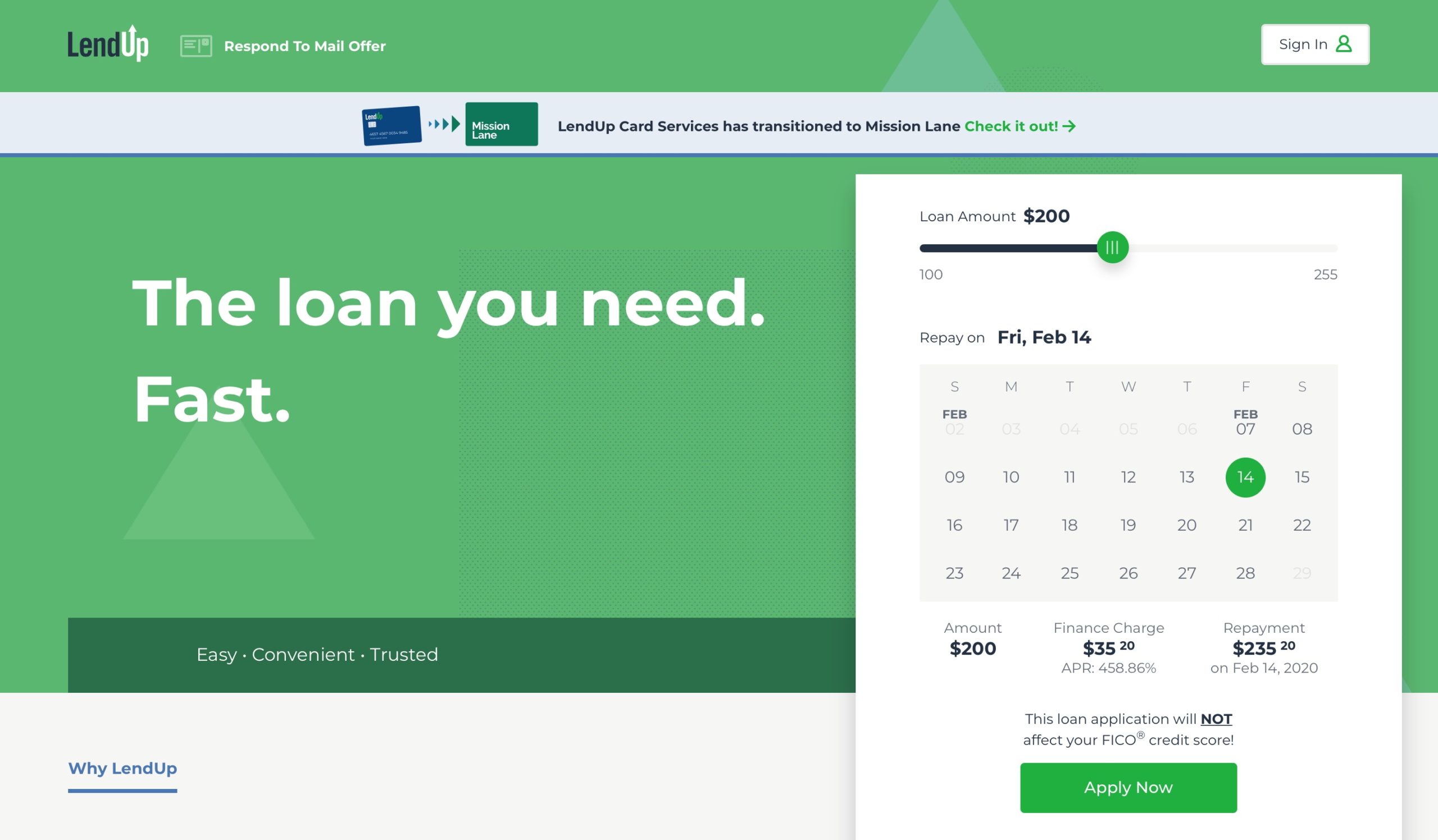

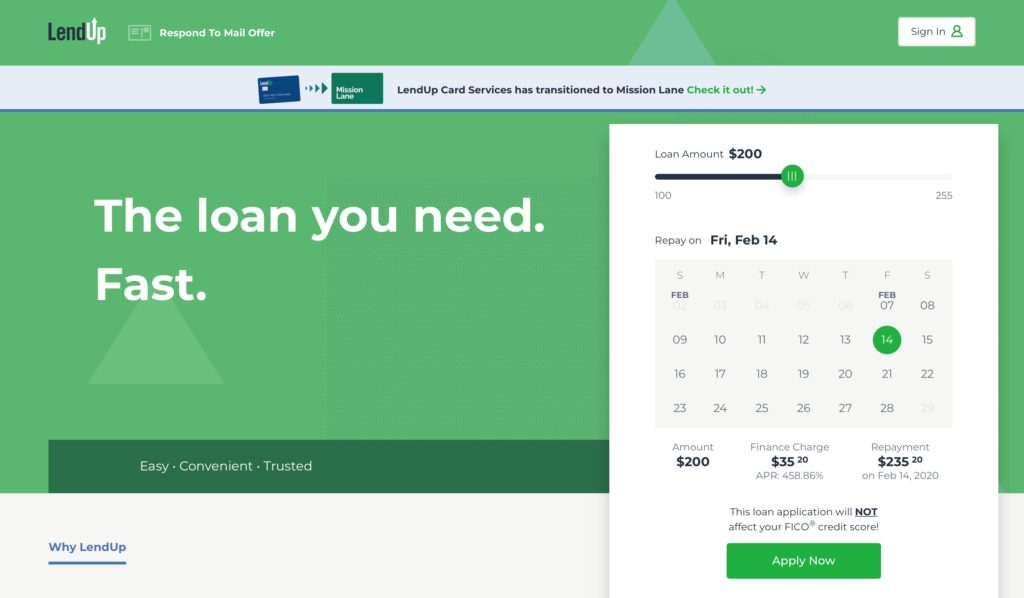

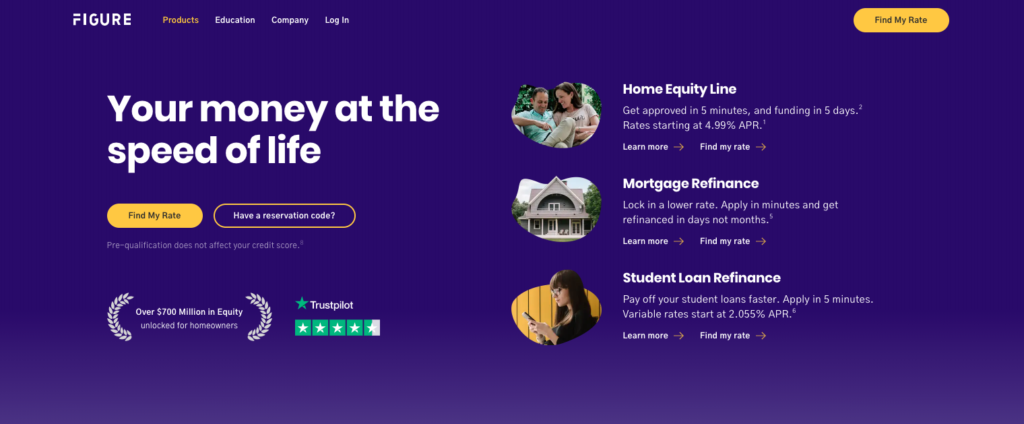

LendUp Tops $2 Billion in Consumer Loans Mark – Since its launch in 2011, socially responsible lender LendUp has surpassed $2 billion in consumer financing via its digital lending platform.

FICO Suite 10 Brings New Precision and Flexibility to Credit Scoring Decisions – The new technology from FICO leverages trended credit bureau data to boost its predictive power, enabling lenders to make more precise decisions on credit risk.

Splitit Taps Stripe to Facilitate Merchant Onboarding for Payment Installments – The agreement makes Stripe the payment facilitator for all new merchants who onboard with Splitit.

Also on Finovate.com

PSD2 Turns Two: Where Do We Go From Here? – Break out the PSD2 birthday cake! On January 13 the Second Payment Services Directive (PSD2)– what we now generally think of as open banking– turned two years old.

Digital Dollars and E-Euros: The Case for National Digital Currencies – In recent weeks and months, we’ve heard news of a growing number of central banks investigating the pros and cons of digitizing their money supply.

Stop Looking at Your Customer Base as a Faceless Mass – f you ask Balázs Vinnai, president of W.UP, one size does not fit all when it comes to banking. In fact, his company’s entire premise is built around creating a personalized user experience.

Follow the Money: FinovateEurope’s VC All Stars Talk Fintech Investment in Europe – This year at FinovateEurope, we’ve added a panel called Investor All Stars. It’s stacked with investors who will offer up their take on the top topics for venture capital funding in fintech.