Customer-focused banking tools provider W.UP revealed its latest development today. The Hungary-based company is launching Money Stories.

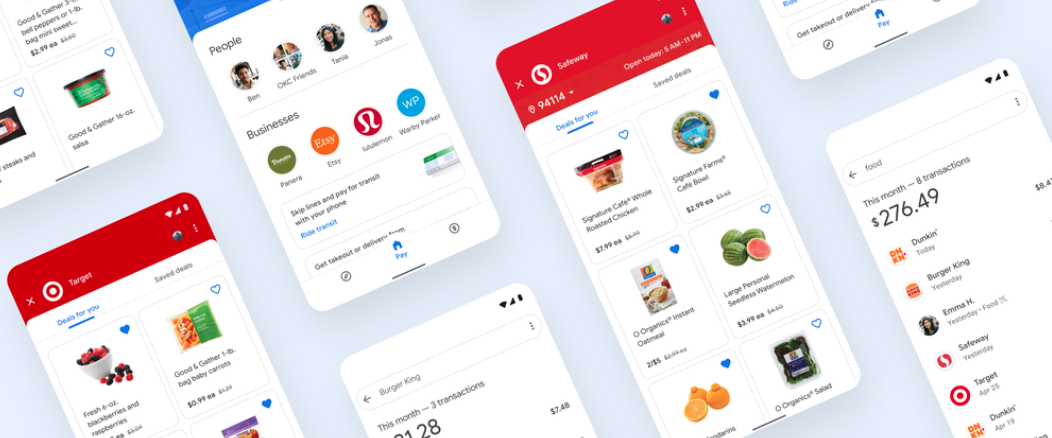

The new embeddable tool enables banks to offer their customers bite-sized snapshots of their financial lives. These easily consumable bits of content combine data analytics with digital storytelling to make it even easier for banks to help users to understand their financial standing in a fast-paced way.

The new tool takes the concept from millennial-friendly mobile apps such as Snapchat, Instagram, Facebook, and Twitter. Each of these social media platforms are notorious for enabling users to quickly publish and view life updates and ideas, share new songs, and even exchange gossip. The micro-content requires little attention from viewers, who are easily distracted and prone to multi-tasking.

Similarly, Money Stories leverages transactional and behavioral analytics to show users daily highlights, weekly and monthly forecasts, and yearly summaries. Overall, these updates take the form of unusually large transactions, double charges, sharp balance drops, recurring transitions, top spending categories, changes in spending or credit card usage, and more. In addition to showing users their historical data, Money Stories can also help users plan for the future by showing options to pay off credit card debt, avoid overdrafts, and more.

All of the graphics appear on a single screen for seven-to-ten seconds, so the user does not need to scroll or set aside much time in their day to understand the analyses.

W.UP is keeping the integration easy for banks. “When all is said and done, the only decision for banks to make remains what product and service offers to slide into the story stream to boost targeting accuracy, conversion, and customer satisfaction levels,” said W.UP Head of Product Gellért Vinnai.

Founded in 2014, W.UP takes PFM to a personalized level by leveraging AI and real-time data. These product offerings have obviously struck a chord in the banking crowd; the company has won Best of Show awards at FinovateEurope 2018, 2019, and most recently for its demo in 2020.

Photo by Karolina Grabowska from Pexels