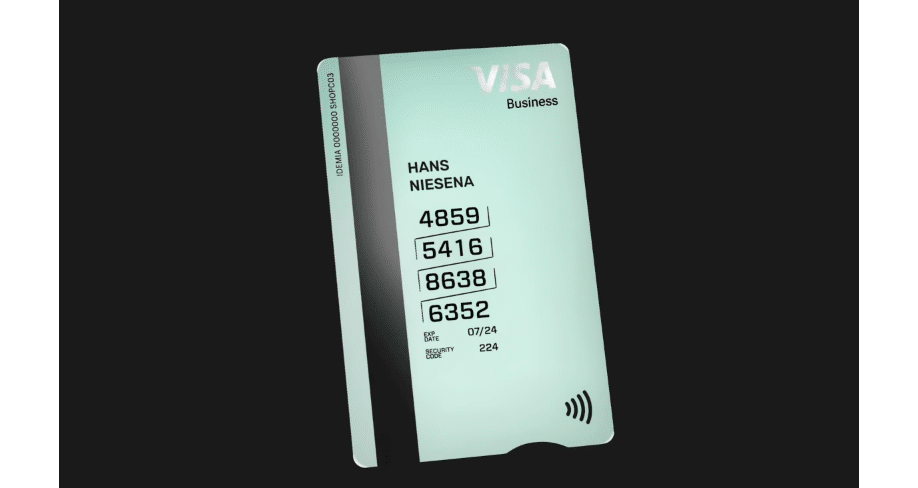

- Shopify is launching a business credit card.

- The launch is among 100+ updates the company is making today as part of its summer release.

- The new Visa-branded credit card is powered by partnerships with Stripe, which is powering the infrastructure behind the card, and Celtic Bank, which serves as the bank partner.

Shopify released 100 updates today. Out of the updates, the most interesting was the launch of a Visa credit card aimed at U.S. businesses. The card is fueled by partnerships with Stripe, which powers the infrastructure, and Celtic Bank, which serves as the issuing bank.

The card does not charge fees or interest– it is a pay-in-full card that offers business owners up to 56 days to pay for their purchases. After that point, Shopify will automatically debit any outstanding balances from the user’s designated account.

The new credit card offers businesses up to 3% cashback on eligible purchases, which include business expenses in the company’s monthly top spend category— marketing, fulfillment, or wholesale. For all other purchases, cardholders receive 1% cashback. Businesses can receive up to $100,000 in cashback, which is earned as a statement credit.

Eligibility for the credit card is based on a business’ sales performance, not an individual’s credit score. This allows the cardholder’s credit limit to increase as their business scales up.

Shopify has been offering businesses access to working capital with its commercial lending platform, Shopify Capital, since 2016. Underwriting for the loans works in the same way that the company’s credit card underwriting works. The credit offers are based on a business’ sales. In fact, the company uses more than 70 data points about a business applicant to underwrite the loan. Since launch, Shopify has distributed more than $4.5 billion in loans to its business users.

Other financial tools that Shopify offers its business users include Shopify Balance, which is a business financial management tool, and Shopify Bill Pay, a tool to help merchants manage and pay vendors.

Canada-based Shopify has been bringing ecommerce websites and tools to retailers since 2004. In the years since, millions of businesses in 175 countries have used the company’s technology to make over $700 billion in sales. Tobias Lütke is CEO.