- FICO and LigaData have partnered on a decision-as-a-service tool.

- The two will make the new capabilities available to telecommunications firms in Africa, the Middle East, and Asia.

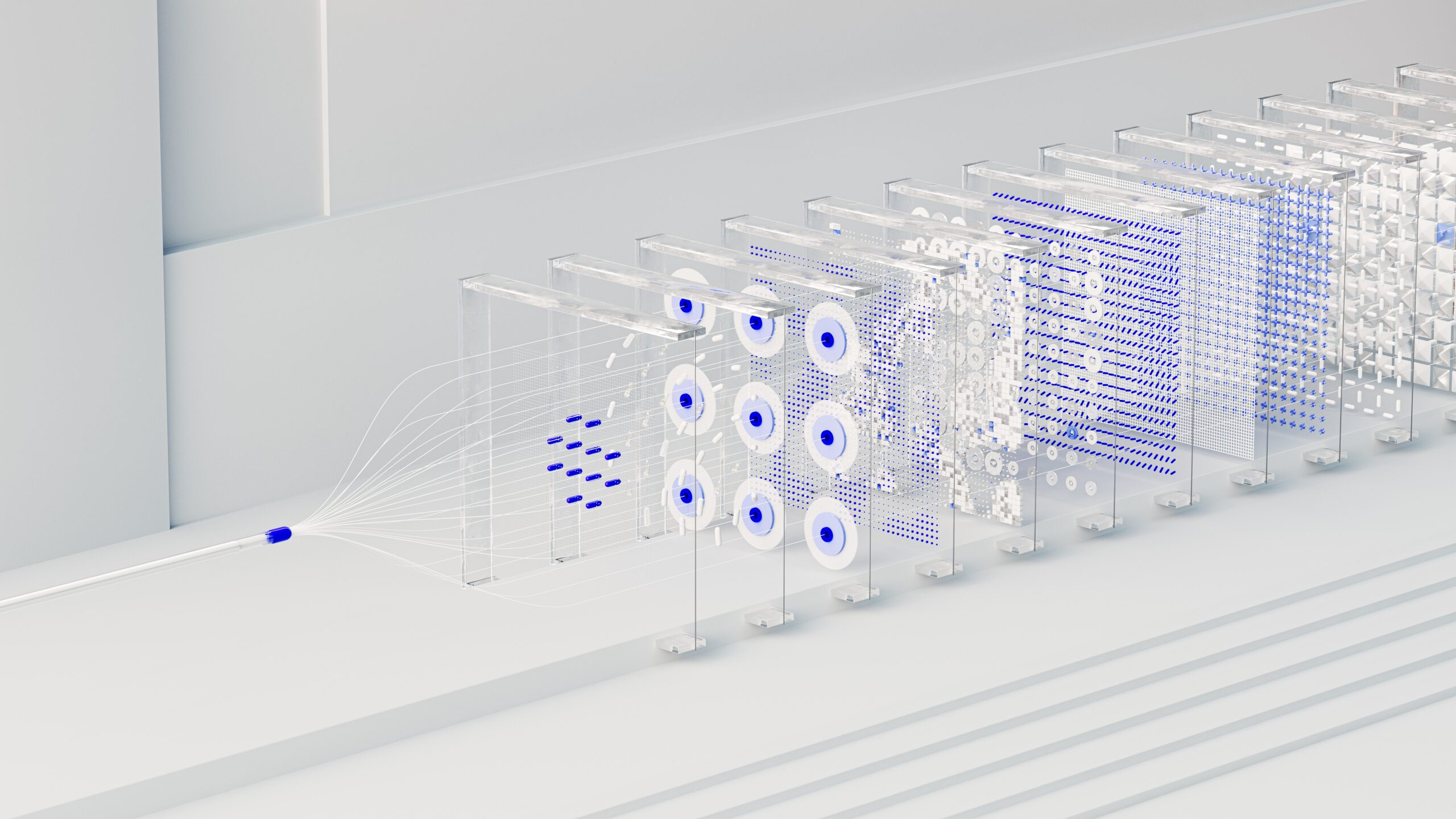

- The decision-as-a-service solutions suite includes mobile lending, price optimization, collections optimization, subscriber segmentation, and fraud detection for communications service providers.

Data and analytics firm FICO and big data analytics company LigaData have come together in a move to bring decision-as-a-service capabilities to telecommunications firms in Africa, the Middle East, and Asia.

The two California-based companies will offer solutions that leverage data to help telcos increase revenues, decrease costs, and expand their offerings. Tools included in the decision-as-a-service solutions suite are mobile lending, price optimization, collections optimization, subscriber segmentation, and fraud detection for communications service providers.

“Together we plan to also help communications service providers grant loans in emerging markets, making it easier for consumers while increasing the digitization of the economy,” said FICO Vice President of Global Partners & Alliances Alexandre Graff.

FICO and LigaData envision that the tool will help telcos add new revenue streams and ultimately expand financial inclusion in emerging markets. “Our partnership with FICO will give communications service providers new tools to expand and compete in a data-driven marketplace,” explained LigaData CEO Bassel Ojjeh. “In addition, we will be bringing to market new solutions that can help communications service providers serve the large number of unbanked and underbanked communities in Africa, the Middle East, and Asia.”

LigaData’s name follows the naming convention of major soccer teams such as Bundesliga, La Liga, and Liga MX and is a reference to the company’s league of data experts. LigaData offers two main products, Data Fabric, which helps telcos leverage data better understand their customers by breaking down silos, and Flare, which serves as a decisioning engine that breaks down the data to provide operational and subscriber insights. These solutions are used by over 30 mobile network operators, supporting over 350 million subscribers around the world.

Founded in 1956 and headquartered in California, FICO offers decisioning tools used by more than 650 clients, including nine of the top 10 U.S. banks and eight of the top 10 EMEA banks. The company was recently named Best Technology Provider for Data Analytics at the 2022 Credit Awards, and was identified as a leader in The Forrester Wave: AI Decisioning Platforms, Q2 2023 report.