Here is the second and final look at the companies that will demo at FinovateAsia on November 6 in Singapore. Each company provided a short summary of the innovation they will debut on stage. In case you missed it, check out Sneak Peek Part 1.

Don’t miss the opportunity to experience the hottest innovations in financial technology at the very first FinovateAsia. Get your FinovateAsia ticket here.

___________________________________________________

ayondo shows the newest and third generation of their web application which will be the next

generation of social trading. Simply follow the best traders automatically with your brokerage account.

Innovation type: Banking, investing, PFM

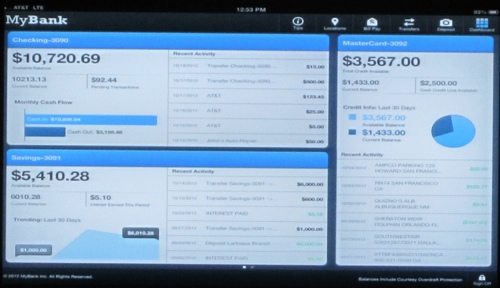

Backbase delivers Bank 2.0 Portal software that provides a new user experience layer on top of underlying infrastructure and IT systems. It gives financials the opportunity to create interactions that link customers to relevant information and applications to fit their needs and preferences. With its modern, widget-based architecture, Backbase Bank 2.0 Portal provides the flexibility and speed to create modern portals that truly empower the customer.

Innovation type: Marketing, mobile, online

BankBazaar.com will demo its 7-minute Credit eApproval

process highlighting the platform’s real-time integration with underwriting engines, loan origination systems, net-banking systems, and online payroll management tools. Combined with a full service CRM system powering credit and sales work flow management, the platform delivers 7-minute eApproval via online, mobile, and tablet interfaces.

Innovation type: Lending, mobile, online

Clari5 iRM brings extreme real-time intelligence to Relationship Managers (RMs) on the move. Typical RM mobile apps are screen extensions of CRM and are not connected in real-time to the underlying core systems. Consequently RMs are the last ones to know when a significant moment of truth event happens.

Clari5 iRM is a next generation product that interprets customers’ structured/unstructured events in real-time and provides an inference instantly empowering RMs to provide more personalized services. Clari5 iRM also leverages the full power of the device by using its real-time push, GPS, voice recognition, video, and screen sharing capabilities.

Innovation type: Marketing, mobile, sales

Can publicly available information gleaned from Facebook, Twitter, LinkedIn and other online sources

help financial institutions predict financial risk?

DemystData helps financial institutions tap into the explosive growth of online, social, and internal data to make better customer decisions. Our latest innovation navigates some of the world’s newest data sources to provide our clients with a deep, holistic view of the modern day consumer, and then uses this information to assess consumer risk and behaviour.

Innovation type: Identity, lending, marketing

Need an onboarding tool that increases customer engagement? Figlo offers a complete solution to gain insight in financial matters on a consumer level. Financial planning is now accessible to everyone on any device anywhere.

Innovation type: Marketing, online, PFM

See how financial institutions can save millions by implementing BankFiling, a new innovation from Luminous that delivers short ROI yet requires limited investment. A whole new approach to commercial and business banking. A must see for all financial institutions!

Innovation type: Banking, lending, small business

Pandai.cn delivers next generation peer-to-peer 2.0 lending services in China by answering what the future of peer-to-peer lending should be. It should be safe, transparent, inclusive and easy-to-understand.

You’ll see how easy it is to invest in creditworthy borrowers that have passed our robust credit risk management system.

Innovation type: Investing, lending, PFM

Can you tag your financial position, identify the cross vertical exposure by currency, industry, issuer, region real-time; on-demand? The last 30 years have seen amazing advances in technology that have transformed the world. In the world of financial technology, all of this power has been applied to develop more complex instruments – derivatives, swaps, CDO’s CDS’s – faster and faster trading platforms – “flash trading” and co-location, and risk analytics and trading models.

But, the ability to track and account for this explosion of trading vehicles and volumes is right where it was 30 years ago. Not anymore, come see the future of transparency.&n

bsp;

Innovation type: Back office, insurance, investing

PocketSmith is the comprehensive personal finance app with cashflow forecasting.

We think that the best way to organize and control your money is to relate it to events in your life by using a calendar. This way, financial planning becomes a part of your daily routine rather than a chore.

As you plan, PocketSmith’s calendar shows you the progress of your money over time, so you will better understand how your financial decisions affect your future.

Innovation type: Mobile, online, PFM

Want to know the secret to getting 60% of your customers to say yes to eBilling? All it takes is 7 minutes to see why email delivery of bills and statements is what gets customers to turn off paper forever.

Join Striata as we demonstrate our powerful interactive bill which is encrypted, has integrated eConsent, shared password security, instant dispute capability, and mobile one click pay.

With registration-free push email billing, you can drive traffic to your portal, cut your costs and deliver bills and statements right into your customers’ hands. Convenient, secure, mobile ready.

Innovation type: Communications, payments

In the last 4 years, Tagit Mobility Platform Mobeix has been adopted by several leading enterprises. But, we believe mobility should be for all– large, medium and small enterprises.

With this vision, we started our journey to build the Mobeix Open Platform through which enterprises can build, launch and manage apps on their own. Using the Tagit Open Platform, merchants and enterprises will be able to develop and deploy apps for their customers and employees in no time. We will demonstrate how easy it is for anyone to register and start building apps.

Innovation type: Banking, mobile, security

TradeHero empowers ordinary people to make money from the financial markets. Traders are able to place real-time virtual trades against stock exchanges and TradeHero generates performance rankings of the trader community.

Members of the TradeHero community can follow the top-ranked traders for a fee. Traders can build a following around themselves and monetize off their trade-feeds while those following get relevant, pertinent and timely financial trading tips and feeds.

Innovation type: Investing, mobile, payments

The world is increasingly adopting smartphones and social media. Leading FIs are beginning to leverage these seismic shifts in communications for competitive advantage, reducing costs and generating new revenue streams. Smartphones change user expectations about online banking services, functionality, and interactivity. They also present new risk vectors that cannot be ignored.

Zighra’s patent pending mobile technology provides unique interactivity, building closer customer relationships by increasing security, trust, and satisfaction while significantly reducing fraud and associated costs.

Innovation type: Communications, mobile, security