This post is part of our live coverage of FinovateFall 2013.

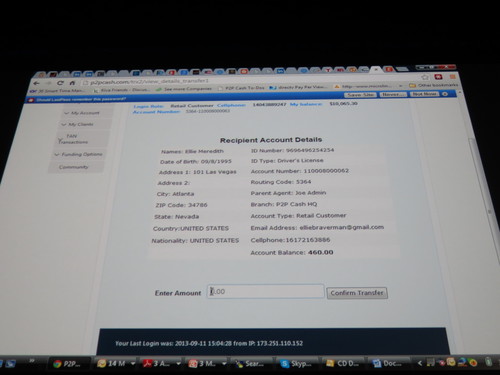

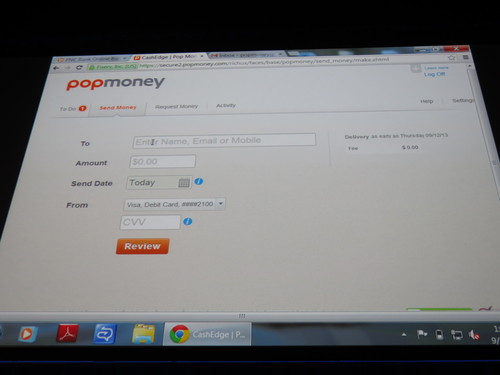

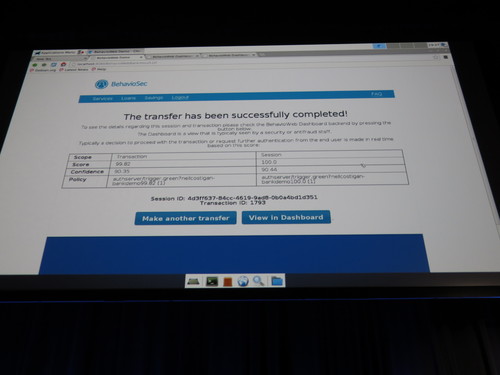

Next, P2P Cash stepped up to demo its remittance platform:

“P2P Cash’s low cost money transfer system enables online consumers to send money to any cellphone worldwide at zero cost. Using international banking standards (SWIFT), P2P Cash developed a highly scalable, low cost mobile financial services solution to send cash to any cellphone globally. The technology enables any retailer to offer money transfer and other financial services to their customers, generating new revenue for the retailer.”

Product Launch: February 2013

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions, & licensed

HQ: Roswell, GA

Founded: February 2008

Website: p2pcash.com