This post is part of our live coverage of FinovateSpring 2015.

CUneXus showed off cplXpress:

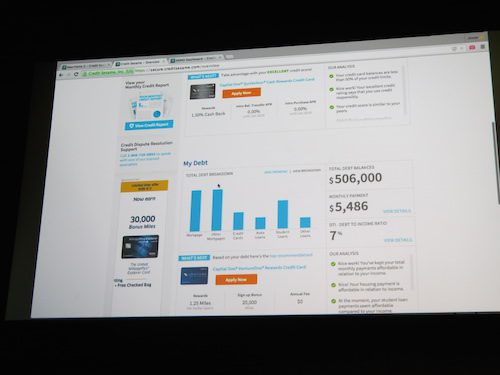

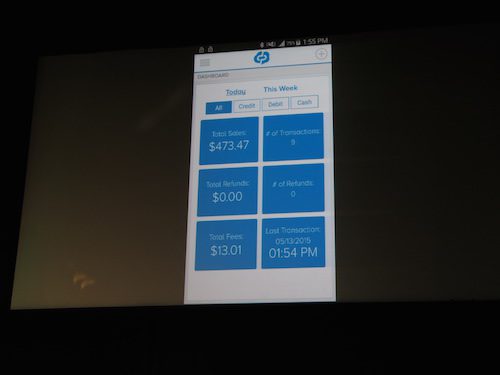

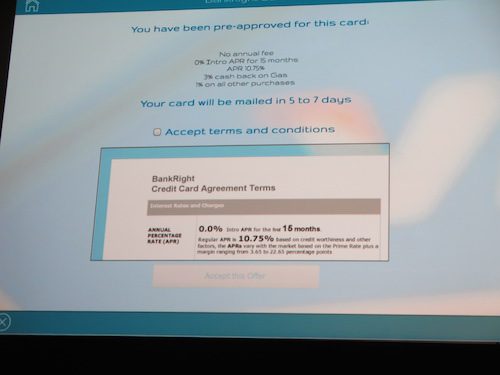

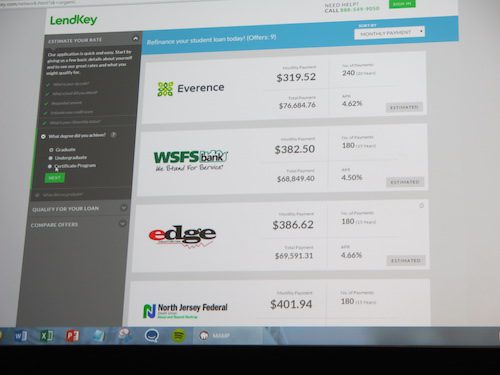

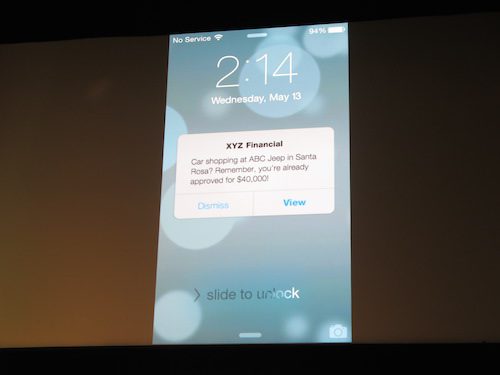

Our cplXpress platform allows lending institutions to empower their customers with perpetual loan approval across multiple product lines. This unique and timely solution grants consumers ongoing insight into their personal buying power, and immediate access to preapproved loan offers at every touchpoint. No loan application necessary. Our advanced risk assessment and pricing engine generates a highly personalized and targeted menu of offers based on each individual’s unique financial profile, then communicates these offers within the institution’s online banking, mobile banking, branch, call center, direct mail, and email channels. We are demoing a selection of new online and mobile interfaces, as well as unveiling our latest mobile document delivery, e-signature, and point-of-sale lending capabilities.

Presenters: CUneXus’s Dave Buerger, co-founder and CEO, and Darin Chong, co-founder and COO

Product Launch: December 2013

Metrics: Founded by a dynamic group of seasoned ex-bankers, CUneXus is privately funded with headquarters 45 minutes north of San Francisco in beautiful Sonoma County. The company’s cplXpress lending automation platform was launched in 2014 and has generated over $100 million in consumer loans in its first nine months of service, a metric projected to grow exponentially in 2015. CUneXus was recently recognized as one of just ten companies to watch on KPMG’s global report of “The Best Fintech Innovators of 2014” and has been selected to participate in Silicon Valley’s renowned Plug & Play Fintech accelerator program for 2015.

Product distribution strategy: Direct to Business (B2B), licensed, white-label

HQ: Santa Rosa, California

Founded: October 2011

Website: cunexus.com

Twitter: @cunexus