Urban FT has reimagined the traditional banking experience by enabling customers not only to track their spending, but also engage with the purchasing experience. Using the Urban FT platform, prepaid card issuers and telco companies are able to offer white-labeled digital banking services.

Company facts:

- Founded: 2012

- HQ: New York City, New York

- Employees: 32

- Registered users: 700,000

Financial tools

Urban FT offers banking features in a non-traditional way, including:

- Prepaid card loading using remote check deposit

- Payment capabilities, such as P2P payment and bill pay

- Transfer methods to move money to and from external accounts

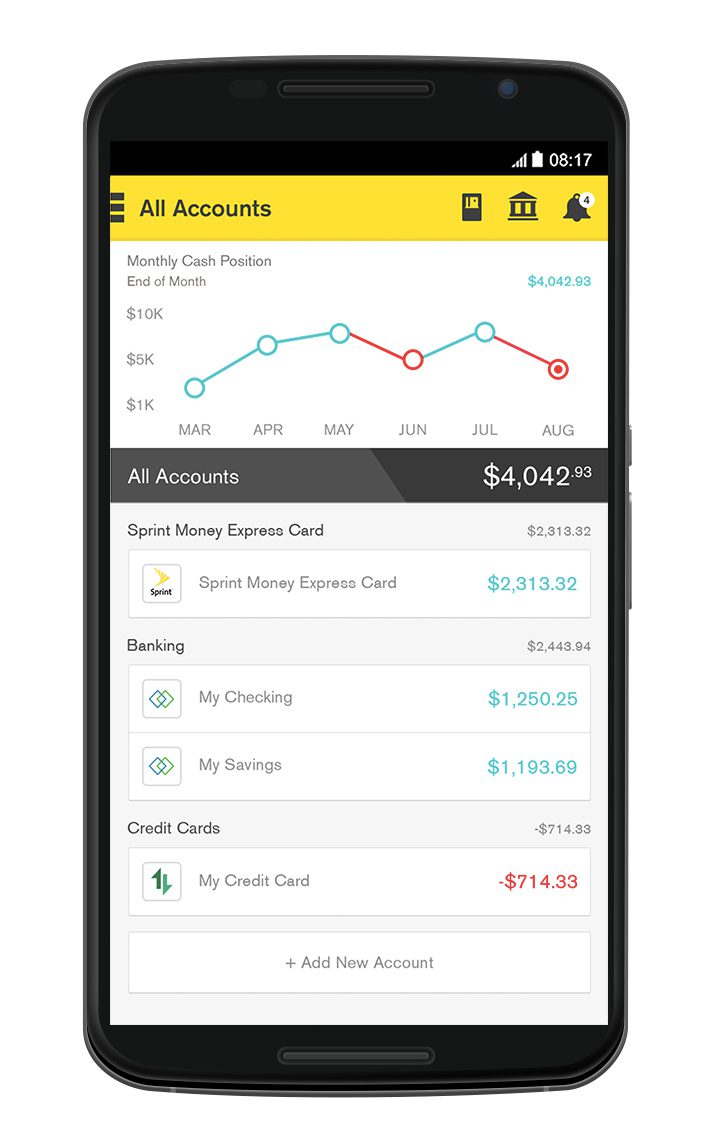

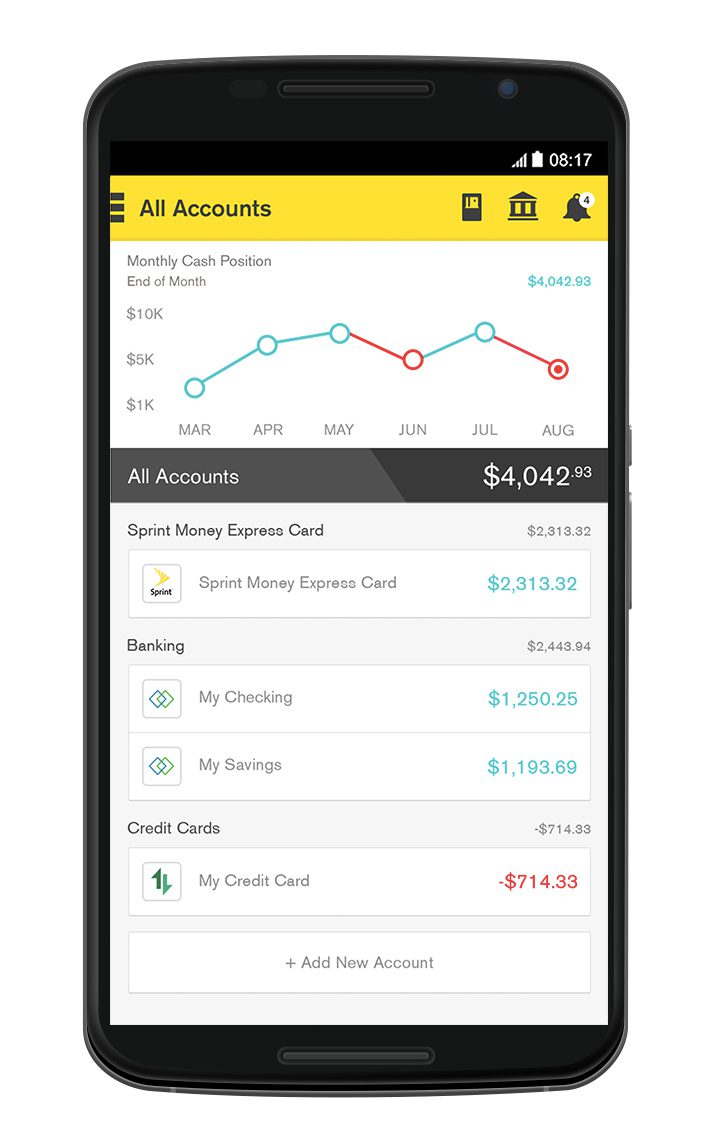

- Aggregated account view

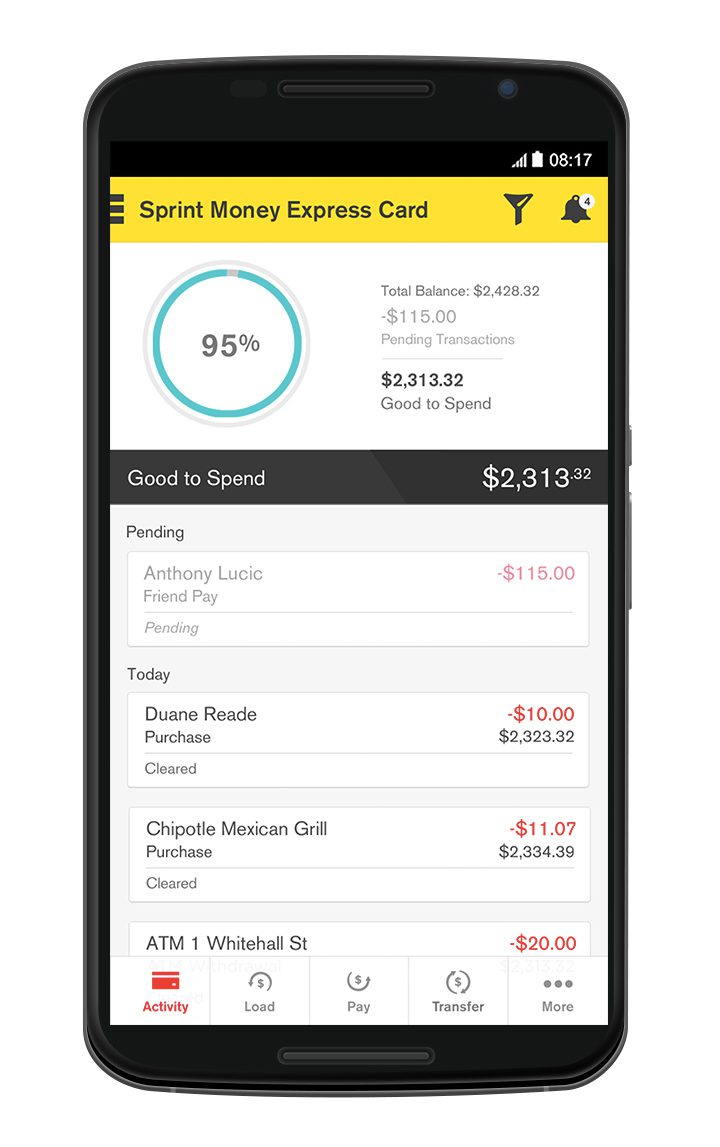

- “Good to spend” remaining balance

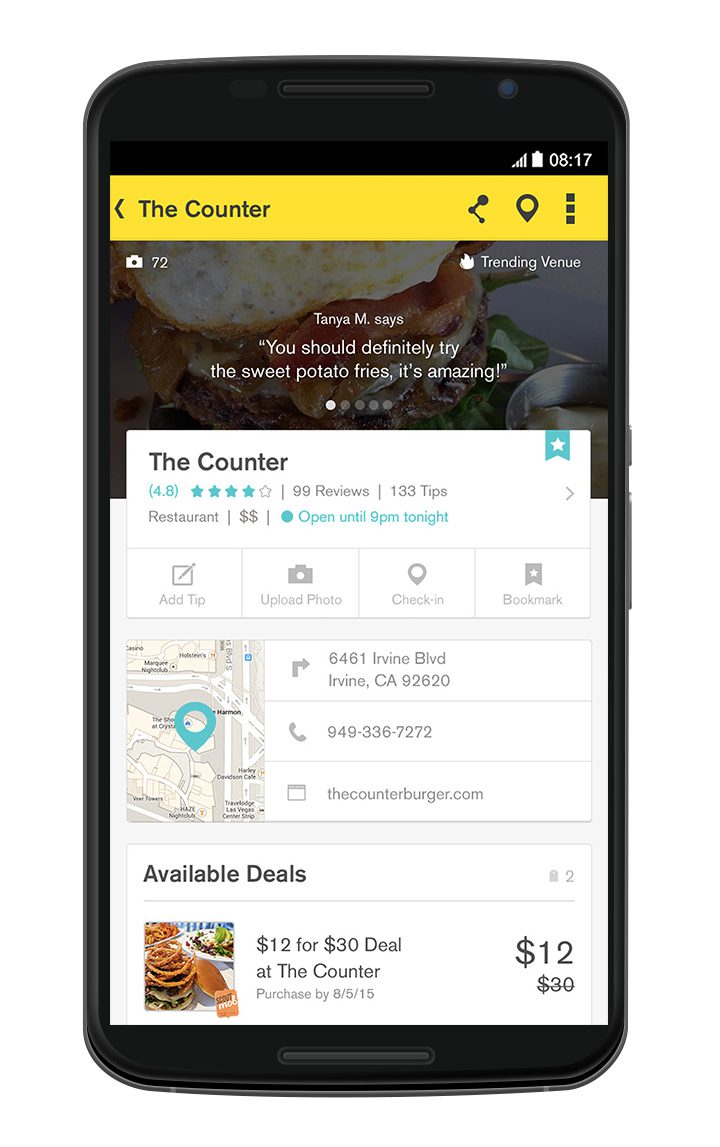

Here’s a view of the user’s aggregated accounts as well as a plot of their monthly cash balance.

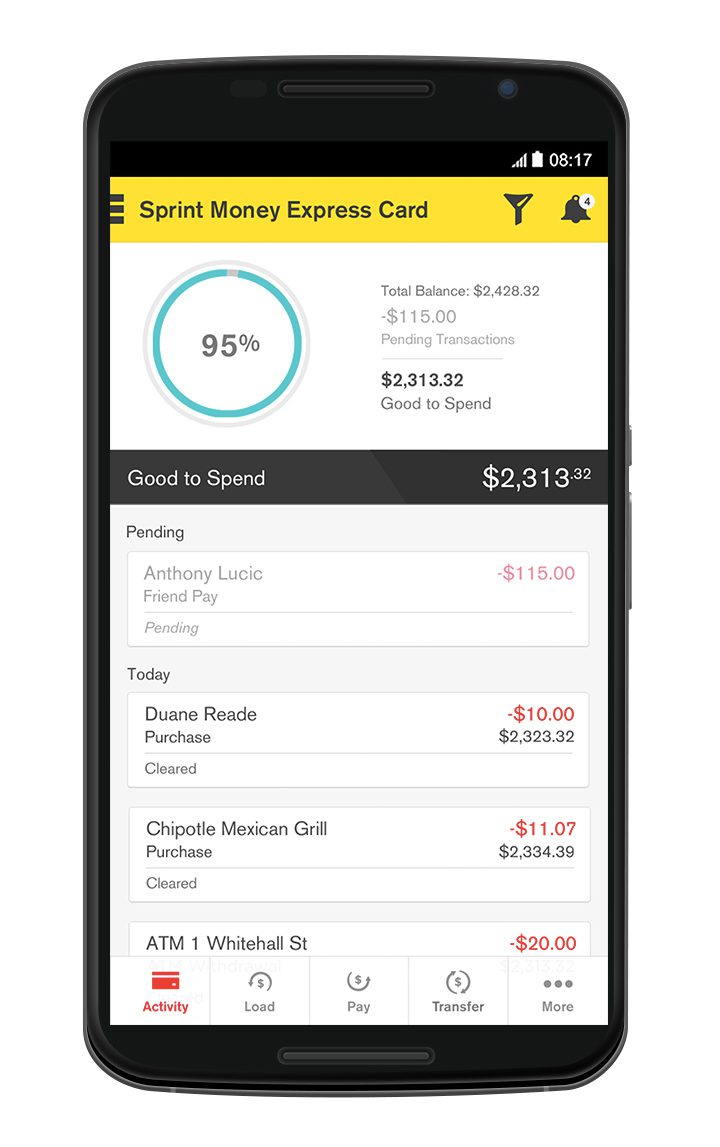

The user sees account activity along with a Good to Spend amount of their remaining balance.

Discovery tools

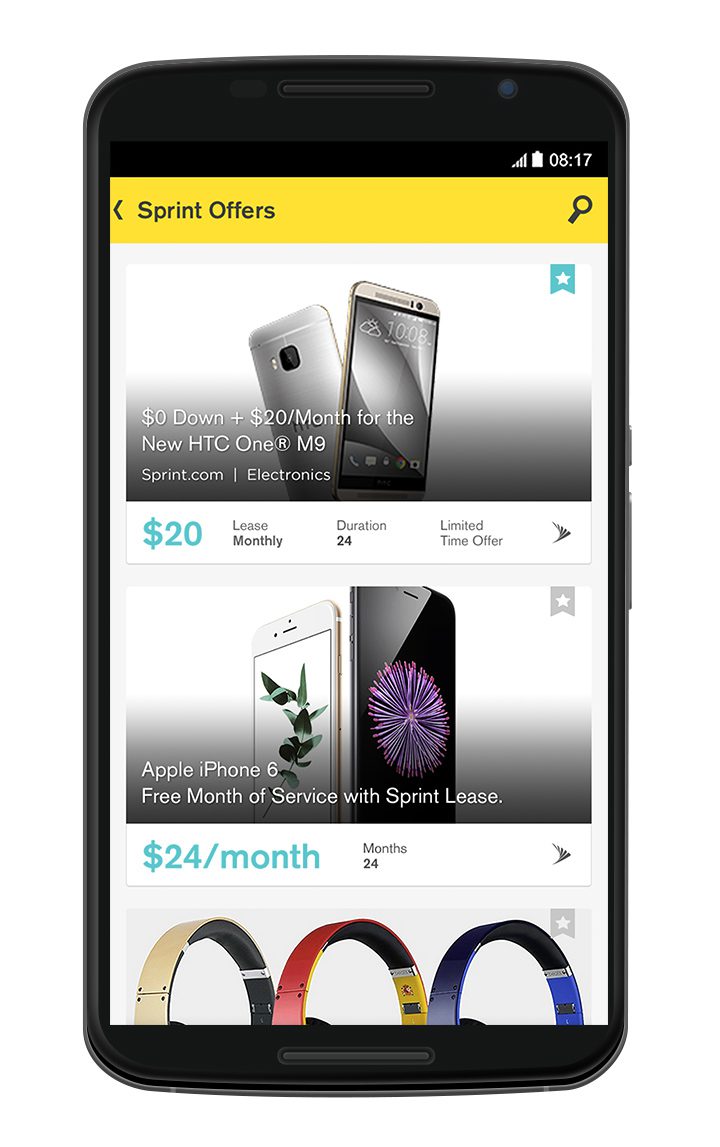

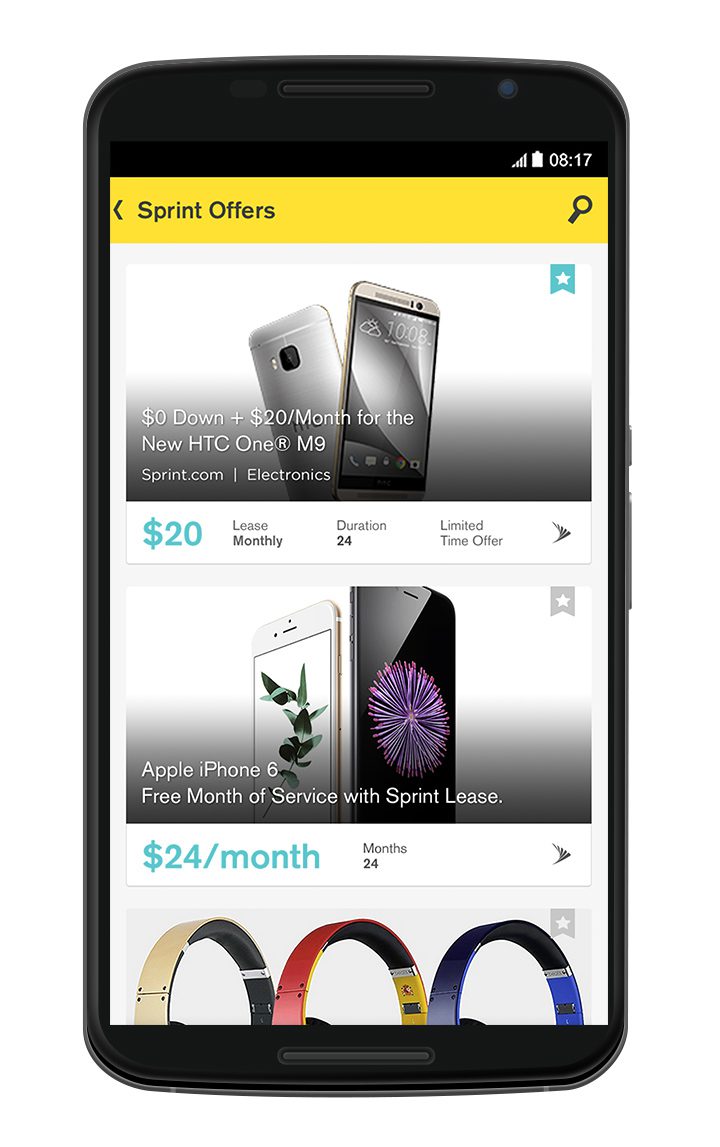

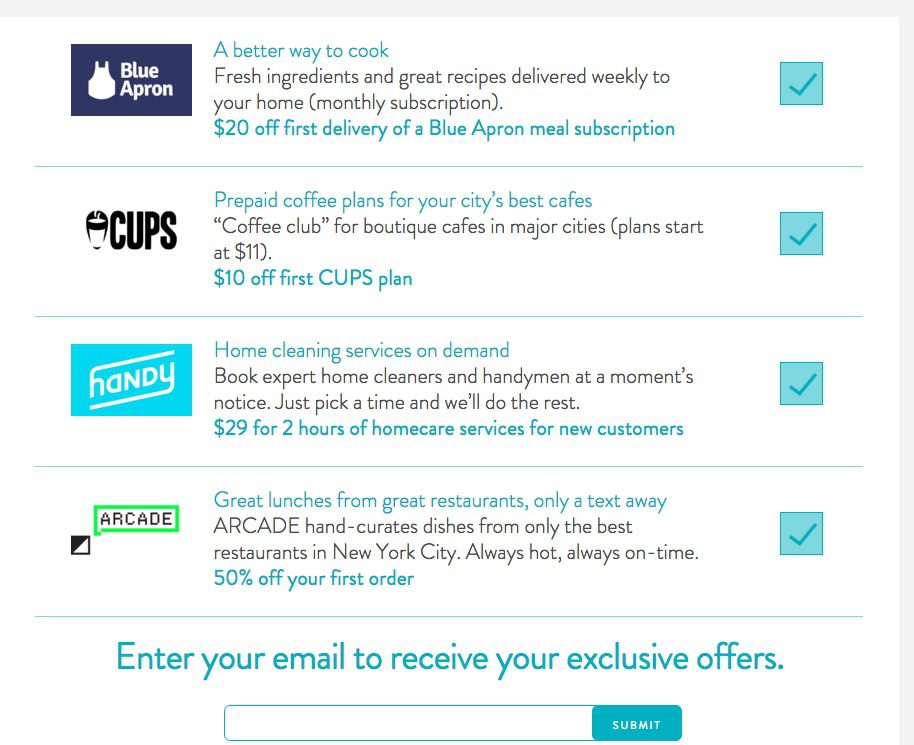

Urban FT offers an engaging experience that extends beyond making purchases and tracking transactions. For example, using a consumer’s purchase data, the platform serves targeted offers within the app, making for a streamlined purchasing experience.

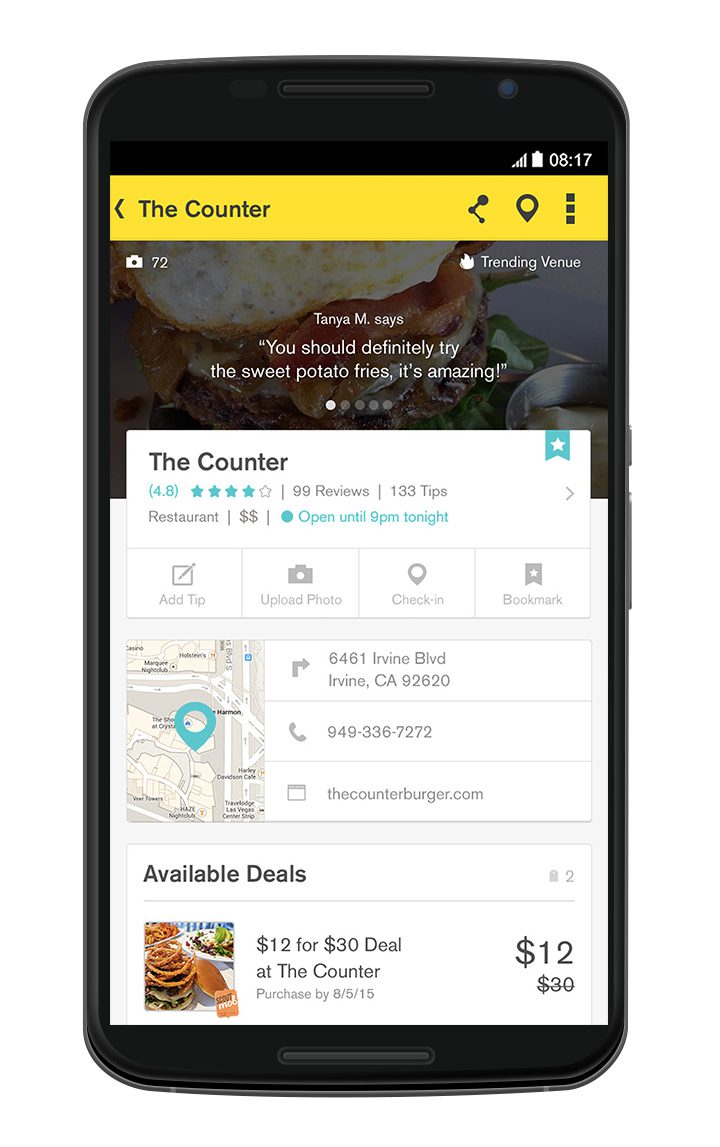

When reviewing account activity, users can click on a transaction to dig into more details about the location of the purchase. Swiping left leads to the app’s Yelp-like functionality that empowers users to leave reviews for restaurants.

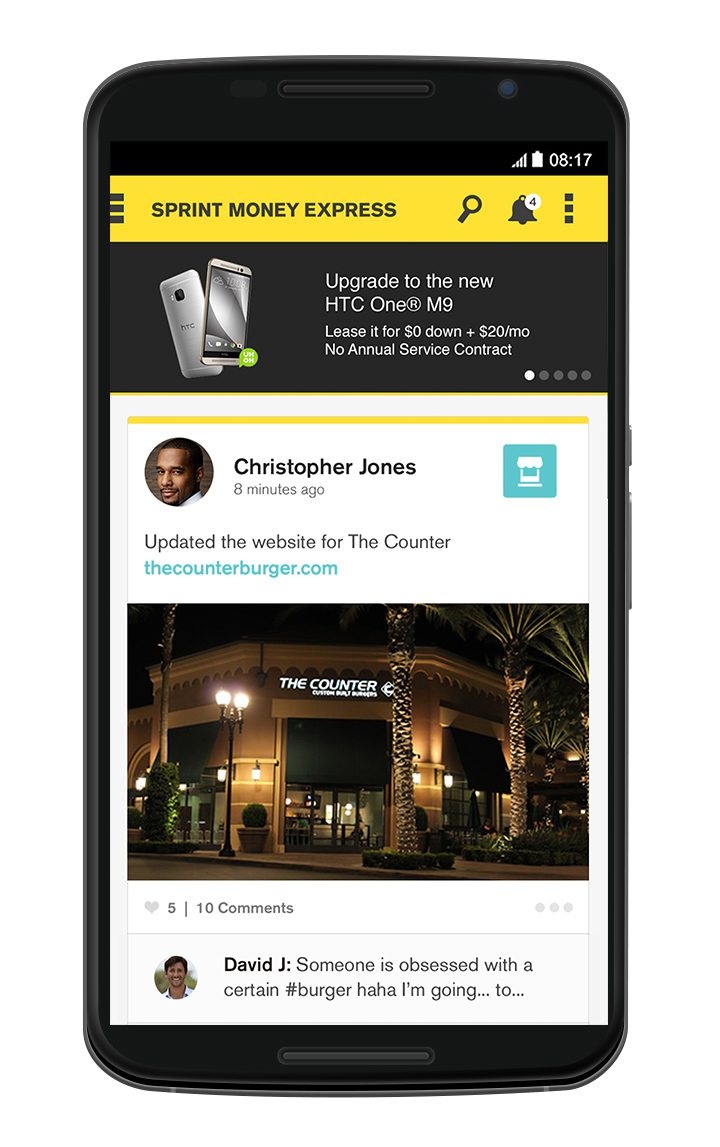

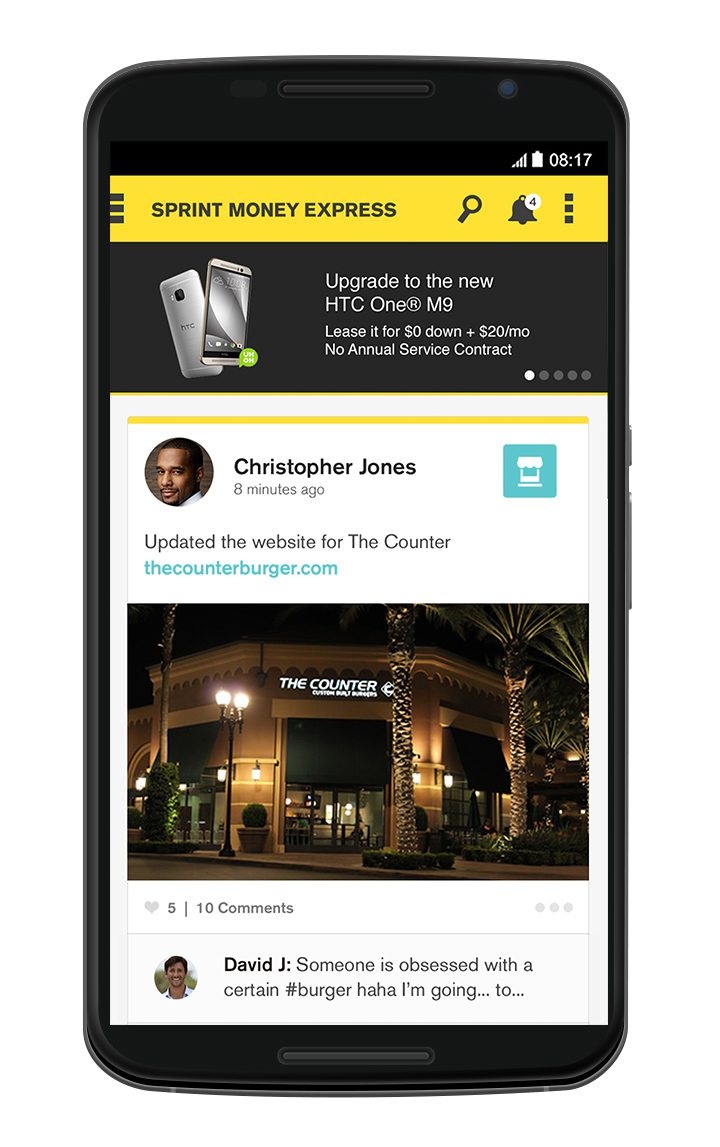

Social feed

Another unique feature is the feed of friends’ non-financial activity. Customers may elect to share experiences, photos and/or financial activity.

By bringing together offers, ratings, and a social feed, Urban FT bridges the gap among venues, spending, and peer activity, all of which encourage regular engagement with the app.

Just prior to Urban FT’s appearance at a FinovateFall, the company acquired digital wallet solutions provider, Wipit (FinovateSpring 2014 demo). Urban FT was eager to leverage Wipit’s relationships with players in the MVNO market: Boost Mobile, Sprint, and Pinsight Media. Urban FT CEO and co-founder Richard Steggall says the acquisition will help the company serve the telco vertical with end-to-end digital banking solutions.

What’s next?

At FinovateFall 2015, Urban FT announced a partnership with Sprint, which will launch its Sprint Money Express mobile wallet in January 2016. The wallet, which uses carrier billing, will offer SKU-level data and a targeted-ad platform.

Urban FT’s COO Kasey Kaplan and Mark Kilpatrick, chief product and brand officer) debuted at FinovateFall 2015:

Soundpays

Soundpays