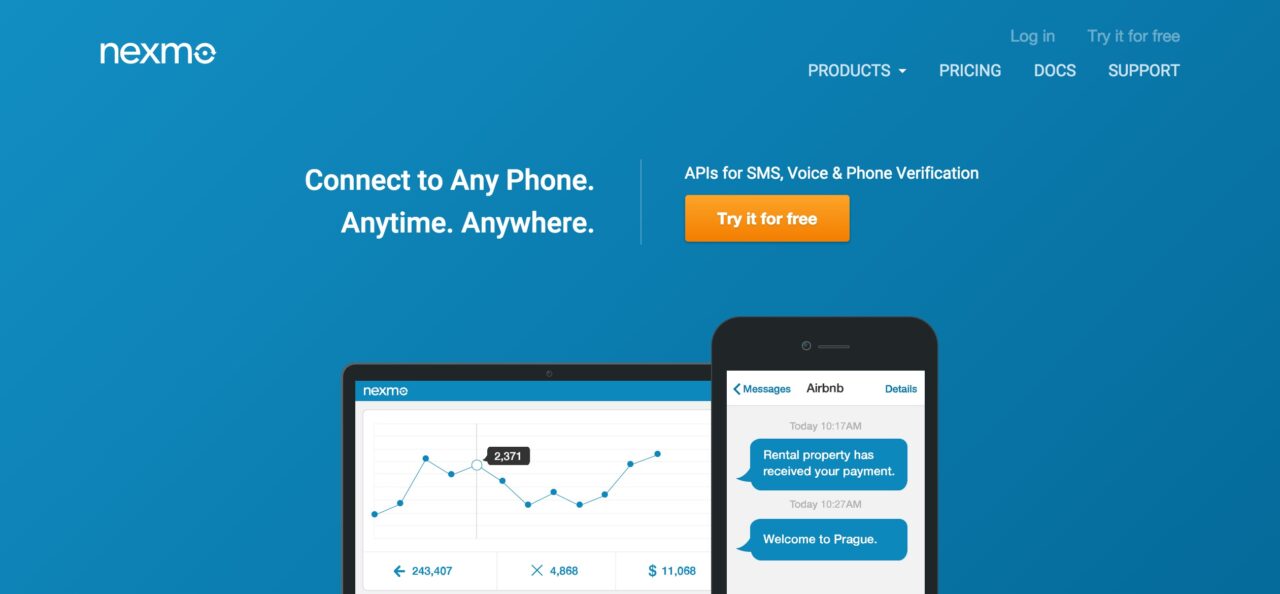

Nexmo is a global cloud communications platform company providing communication APIs and SDKs for voice, text, messaging, phone verification, and chat-app connectivity.

At FinDEVr San Francisco 2015, Nexmo showed how its APIs and SDKs help companies such as Expedia, Zipcar, and Viber increase security, decrease fraud, and protect user identity—without compromising the user experience. To dig a bit deeper, we recently spoke with the San Francisco-based company’s CEO, Tony Jamous.

To dig a bit deeper, we recently spoke with the San Francisco-based company’s CEO, Tony Jamous. Prior to founding Nexmo in 2010, Jamous worked at Paymo, which was acquired by BOKU in 2009.

In his interview, Jamous spoke with us about the inspiration for Nexmo, the company’s competitive advantages, and its challenges.

Finovate: What was the impetus behind creating Nexmo?

Jamous: Nexmo was created to reduce the barriers to entry for developers to innovate with communication technologies and enable scalable and global high-quality communication infrastructure. Imagine how hard it would have been for Airbnb, one of our global customers, to individually connect to more than 200 carrier networks using arcane telecommunications protocols.

Early on, we were obsessed with building networks and investing in cloud technologies to sustain quality of network as our customers scaled their businesses. Nexmo uniquely connects our customers’ traffic as closely to carriers as is physically possible to reduce message and call latency. We also measure quality feedback for every transaction and adapt how each message or voice call is being routed in real time to continually improve overall quality.

Finovate: Your solutions are used in a number of industries. What is unique about the communications and fraud problems in the financial services sector?

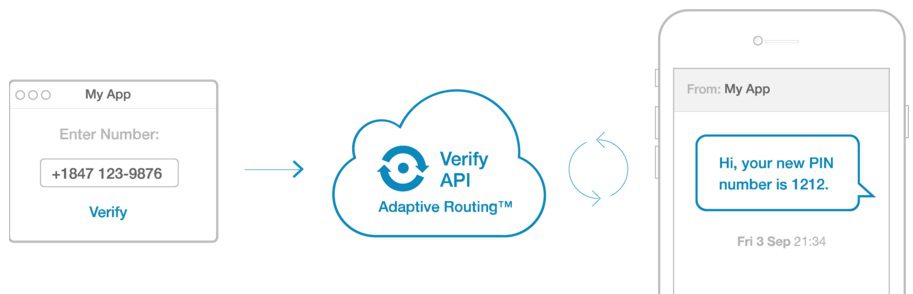

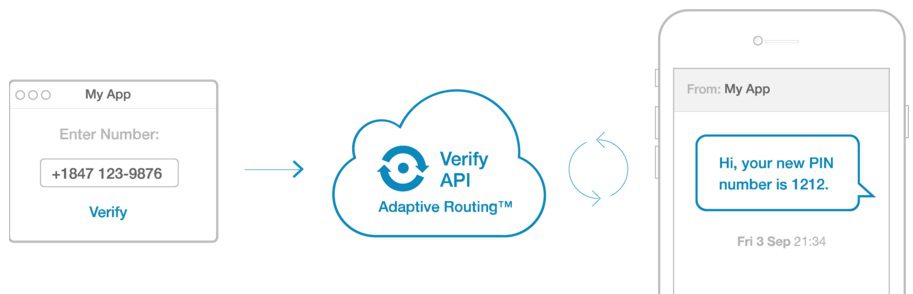

Jamous: The phone number has emerged in recent years as a user-friendly way to identify and authenticate real people. Our APIs, especially Verify (pictured below) and Number Insight, are designed to enable financial services players to easily embed two (or more) factor authentication, and gather data on the phone number during the transaction. These tools enable financial service providers to reduce fraud without the need to gain expertise in teleco rules and regulations.

Finovate: What is the most creative solution you’ve seen a financial services company build using a Nexmo API?

Jamous: Bitcoin platforms have been driving innovation in fraud prevention at a faster rate than any other segment within the fintech space, and Nexmo works with many of the leading bitcoin companies.

To secure your bitcoins from theft, enabling phone-number two-factor authentication with the Nexmo Verify SDK or API is strongly recommended. This involves sending a one-time password (OTP) to a user over a separate communication channel (SMS or voice) rather than the IP channel (internet) used by the bitcoin exchange or wallet. Aside from sending payments, phone-number verification can also be required for registration, login, resetting passwords and authenticating changes made to your [specific] bitcoin exchange or wallet account. Bitcoin theft might be irreversible, but you can prevent it with an extra layer of protection using Nexmo’s Verify API or Verify SDK.

Finovate: What are the biggest challenges for Nexmo?

Jamous: Nexmo has reached a phase in which we need to both scale the business and improve operational efficiency, all while keeping a priority on customer-facing teams and tools. We have a long journey ahead, which will be both challenging and exciting for the team.

Nexmo will demo what’s new with its Verify SDK at FinovateEurope on 9/10 February in London. Tickets are selling fast; register today to secure your seat.

PFM and banking-software company

PFM and banking-software company

Presenters

Presenters Mathew Cagney, General Manager, Sales

Mathew Cagney, General Manager, Sales

Presenters

Presenters Sebastian Hasenack, Head of Product Management

Sebastian Hasenack, Head of Product Management

Presenter

Presenter

Presenters

Presenters Koen Christiaens, Chief Product Officer

Koen Christiaens, Chief Product Officer

Pola Wiza, student

Pola Wiza, student