On Finovate.com

- Check out this week’s “FinDEVr APIntelligence”

- “Finovate Debuts: ArcBit Introduces its Secure, Easy-to-Use Bitcoin Wallet”

- “FIS Closes SunGuard Acquisition to the Tune of $5.1 Billion”

Around the web

- CSI globalVCard launches partnership program for banks for its electronic payments program.

- SavingAdvice.com highlights how Personal Capital can help you gain control of your finances.

- Credit Sesame features millennial-friendly robo-adviser investment-platforms: Betterment, FutureAdvisor, SigFig, Blooom.

- Quisk selected as a 2015 Red Herring 100 Global Winner.

- TSYS signs payments agreement with Atlanticus to continue support of loan-origination platform, Fortiva.

- Digital Insight unveils Business Banking, an SaaS solution to enable FIs to offer personalized banking experiences to business customers.

- Q2 opens new offices in Lincoln, Nebraska, to accommodate growth, acquisition of Centrix Solutions.

- Xignite Market Data APIs now available on SoundHound’s Houndify sound recognition and search-technology platform.

- Let’s Talk Payments features Trustev, Trulioo, and Trunomi in its look at “RegTech” startups in Europe and the U.S.

- Temenos wins “Best Provider of Front-to-Back Wealth Suite Solutions” at Asian Private Banker’s Technology Awards 2015.

- Avalara partners with open-source billing and payments platform, Kill Bill.

- Silicon Prairie News interviews Daniel Carnes, CSO at Prairie Cloudware, on the future of cybersecurity.

This post will be updated throughout the day as news and developments emerge. You can also follow alumni news headlines on the Finovate Twitter account.

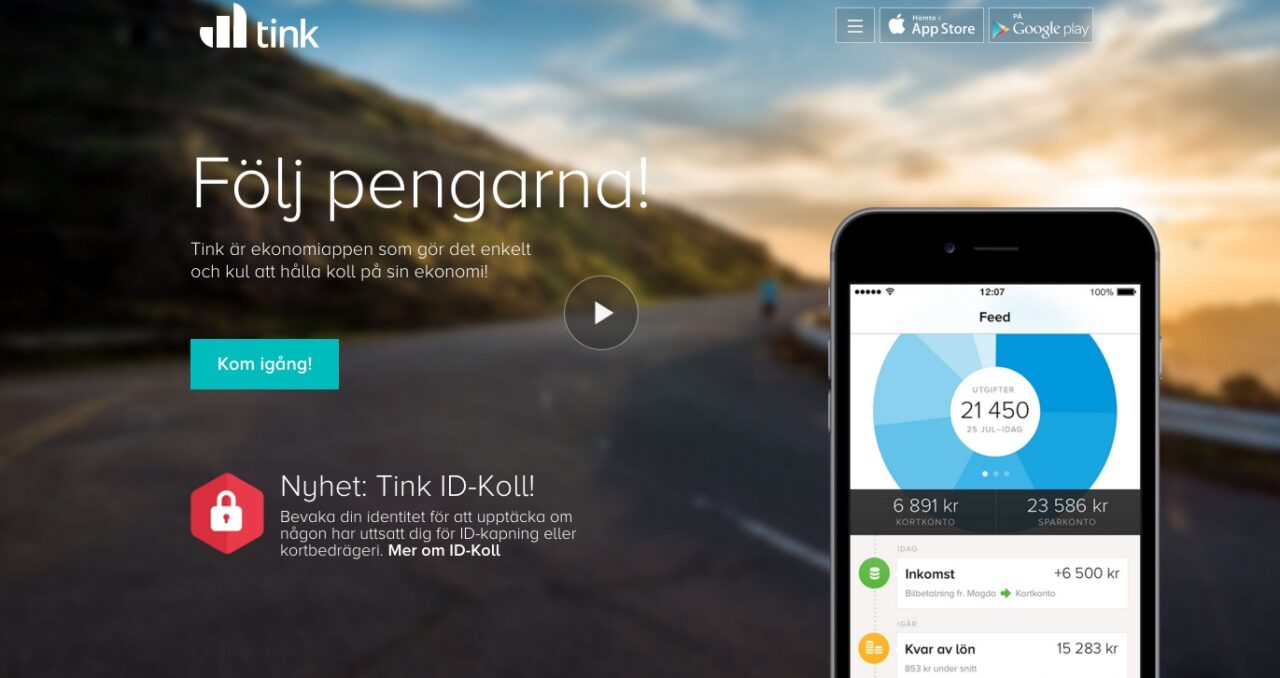

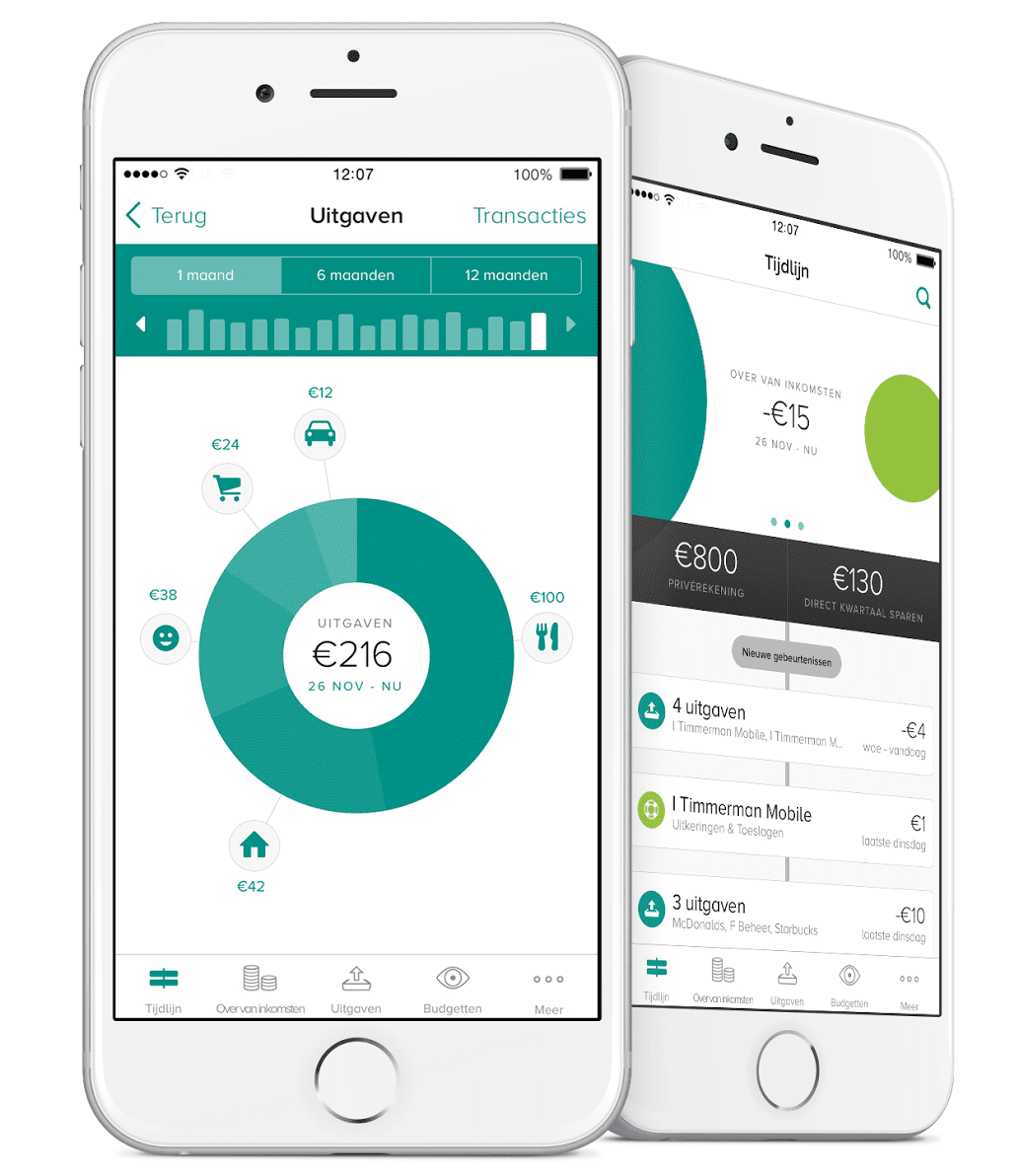

As a part of the partnership, ABN AMRO has worked with Tink to launch Grip, a budgeting and expense-management app that aims to help users control their spending.

As a part of the partnership, ABN AMRO has worked with Tink to launch Grip, a budgeting and expense-management app that aims to help users control their spending.