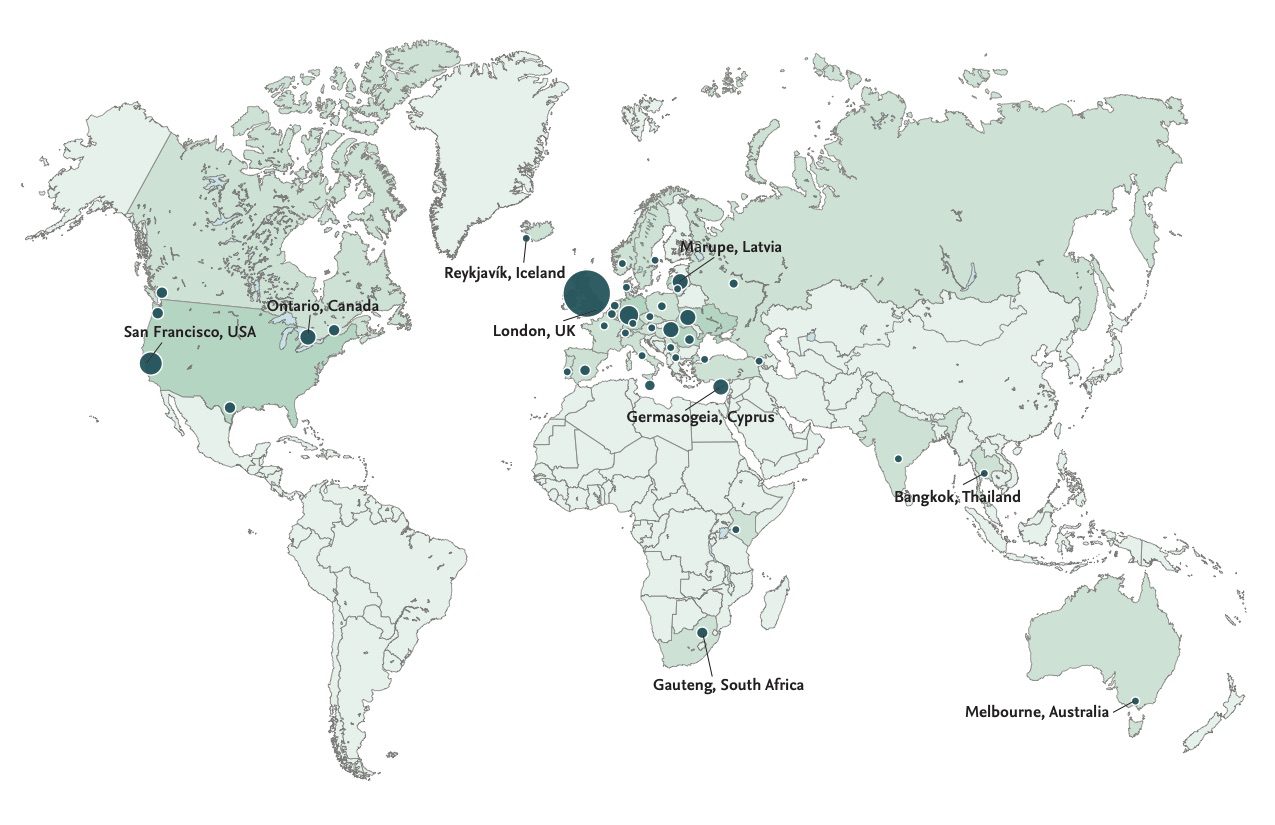

We’re nearing the end of the work week and shifting our focus to FinDEVr London, which starts on Monday, 12 June. This is the first FinDEVr outside of the U.S. and marks our most international FinDEVr event to date. The presenter map (above) highlights the geographic diversity of this year’s presenting companies.

Don’t forget to register before the event– tickets are still available, but act soon! Here are a few, quick reminders to help you get ready:

Where

Next week’s show will be held at Tobacco Dock in London (Tobacco Quay, Wapping Ln, St Katharine’s & Wapping, London E1W 2SF)

When

The first presentation takes place at 9:30 AM on 12 June and registration opens at 8:30 AM so feel free to come early, take advantage of the free breakfast, and save your seat. Check out the full agenda on our website.

Who

The agenda is loaded with fintech companies working on relevant issues for the global finance industry. View the presenter list on our website, check out previews of the companies’ presentations, and read interviews from company representatives on our blog.

Attendees traveling to FinDEVr London will be coming in from all over the world. Check out the presenter map to see the locales:

FinDEVr London 2017 is sponsored by TestDevLab.

FinDEVr London 2017 is partnered with Aite Group, Banking Technology, BayPay Forum, BiometricUpdate.com, Brave New Coin, Breaking Banks, Byte Academy, The Canadian Trade Commissioner Service, Celent, Cointelegraph, Colloquy, Cooper Press, Distributed, Economic Journal, Empire Startups, Femtech Leaders, Finmaps, Fintech Finance, Global Data, Harrington Starr, Holland Fintech, Level39, London Tech Week, Mapa Research, Mercator Advisory Group, The Paypers, Plug and Play, SecuritySolutionsWatch.com, SME Finance Forum, Startupbootcamp, Swiss Finance + Technology Association, and Women Who Code.

Fidor Solutions

Fidor Solutions

At

At