Peer-to-peer small business financing platform Bitbond has entered into a partnership with 1741 Fund Management to launch an alternative investment fund.

The new investment opportunity is made possible through an open-ended investment fund from 1741 Fund Management. Through the partnership, any institutional investor will have access to a diversified portfolio of small business loans that are originated through Bitbond’s small business lending platform. The new product is set up as an Alternative Investment Fund under the E.U.’s Alternative Investment Fund Managers Directive.

Germany-based Bitbond offers small businesses across the globe fast access to working capital. Its platform connects small business owners with individual and institutional investors and leverages the blockchain to send cross-border payments quickly and inexpensively. Because Bitbond requires less manual involvement than traditional underwriting methods, it also has the advantage of scalability.

Since it was launched in 2013, the Bitbond platform has facilitated more than 2,300 loans worth $7.4 million (€6 million), most of which is used as short-term working capital for online retailers. Bitbond, which holds its own BaFin regulatory license, boasts more than 130,000 users from 120 countries.

At FinovateFall 2016, Bitbond launched an automated SME scoring engine. The tool offers a universal, automated scoring method that provides borrowers instant funding after their application is accepted. Last spring, the company brought in $5.4 million in debt financing and an undisclosed amount of equity funding, taking Bitbond’s total equity funds to more than $2.4 million. Radko Albrecht is founder and CEO.

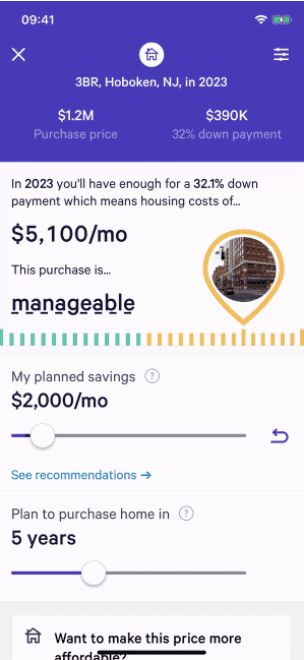

The Path home planning tool aims to help buyers understand what they can afford today and what it may take for them to be able to afford a larger home in the future. Also importantly, the tool shows users how this purchase may impact future goals, such as retiring early or paying for a child’s college tuition. Path extends beyond traditional affordability calculators to show a cost estimate that considers the user’s financial standing and other financial goals.

The Path home planning tool aims to help buyers understand what they can afford today and what it may take for them to be able to afford a larger home in the future. Also importantly, the tool shows users how this purchase may impact future goals, such as retiring early or paying for a child’s college tuition. Path extends beyond traditional affordability calculators to show a cost estimate that considers the user’s financial standing and other financial goals.