Wealthtech innovator Wealthfront unveiled this week its plans to launch a freemium version of its online roboadvisory service. The California-based company will open its Path financial planning tool for free to U.S. users.

Users new to Wealthfront can sync their existing financial accounts with Path, an automated financial planning solution launched in 2017, that offers an interactive experience for users to explore different scenarios that may help them reach their goals. By syncing their own accounts with Path, users can gain a better understanding of their current wealth management habits and create a personalized retirement plan for the future. Wealthfront will allow freemium users to sync not only traditional bank account information but also brokerage account and home value data. As is the case with most freemium services, Wealthfront’s goal with the new offering is to transition clients of the free service to its managed plans.

In an interview with Reuters, Wealthfront Co-founder and Chief Strategy Officer Dan Carroll said, “We don’t believe that financial advice should be for the ultra wealthy and it should be behind the paywall.” The company’s management fees are on the low end of the industry, however. Wealthfront charges a transparent advisory fee of 0.25% and a fund fee that ranges from 0.07% to 0.16%. “We were gratified when we looked at the data, that clients that engage with the engine do save more,” Carroll added.

The freemium service is slated to launch by the end of this year.

Wealthfront stands a little taller now in comparison to competitor Betterment, which is still limited to paid, managed plans. To its benefit, however, Betterment offers optional access to licensed financial experts who provide a human touch to an otherwise strictly algorithmic investing approach. Personal Capital, which offers both a freemium model and access to a team of financial advisors, remains a step above both.

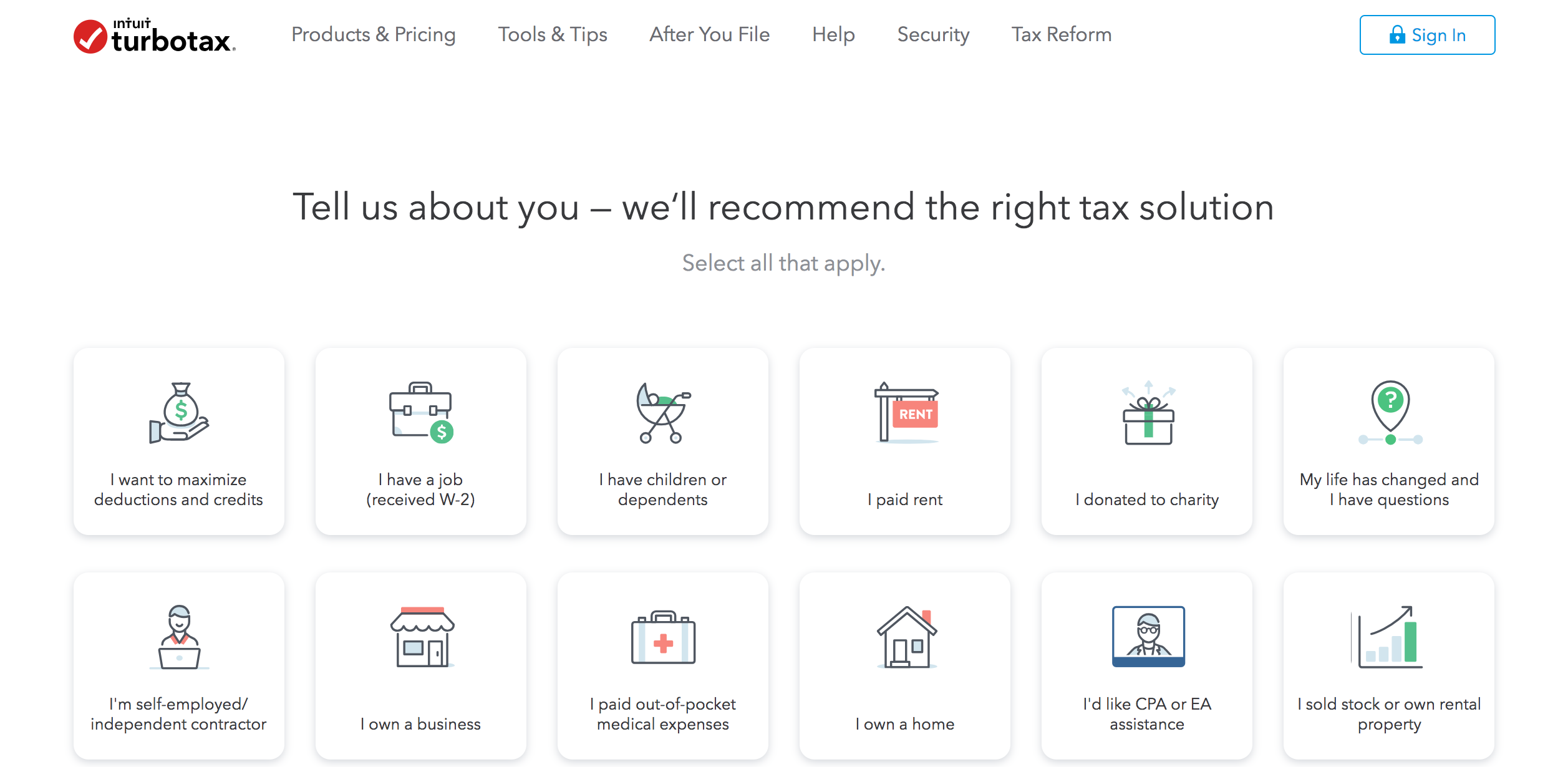

Wealthfront debuted as KaChing at FinovateSpring 2009. The company started 2018 with a capital raise of $75 million and the launch of its home ownership planning tool. Earlier this week, Wealthfront announced it teamed up with Intuit to leverage data from account holders’ TurboTax returns to create a smoother onboarding experience for new clients and offer more personalized services to existing clients, based on their detailed tax return data.