Since the day I started writing about financial services 21 years ago (yikes), people have asked me if I’m running out of things to write about. Most people can’t imagine how you’d write four paragraphs on banking innovations, let alone 40,000. But running low on ideas is the least of my concerns. The underlying topic, money, is massive and ever-changing with new technology, regulations, and consumer tastes.

Since the day I started writing about financial services 21 years ago (yikes), people have asked me if I’m running out of things to write about. Most people can’t imagine how you’d write four paragraphs on banking innovations, let alone 40,000. But running low on ideas is the least of my concerns. The underlying topic, money, is massive and ever-changing with new technology, regulations, and consumer tastes.

Money impacts us every single day. And for most people, it’s an almost 24/7 pursuit, and defines what they do all day, where they live, who their friends are, how they spend their leisure time, how happy they are (up to $75k annually in the USA anyway), and even how long they live. So if you are in the business of managing money, be it storing it, spending it, maximizing it, or protecting it, you have a vital role.

It’s not a perfect metaphor, but you could call money the operating system (OS) of living. That’s probably overly tech/hipster, but then again that’s what we do for a living. And if money is the OS, then payments, insurance, wealth management, and so on, are all apps running across it. Which kind of makes sense in a Friday afternoon way of thinking.

What does that mean for running your financial services business? YOU ARE SO FREAKING IMPORTANT IN YOUR CUSTOMERS’ LIVES! That’s a blessing and a curse. They can’t live without you, which is great for revenues, but you also can’t afford big mistakes. That means service, security, trust, user experience all have a higher bar than the average tech or service company. And that’s expensive.

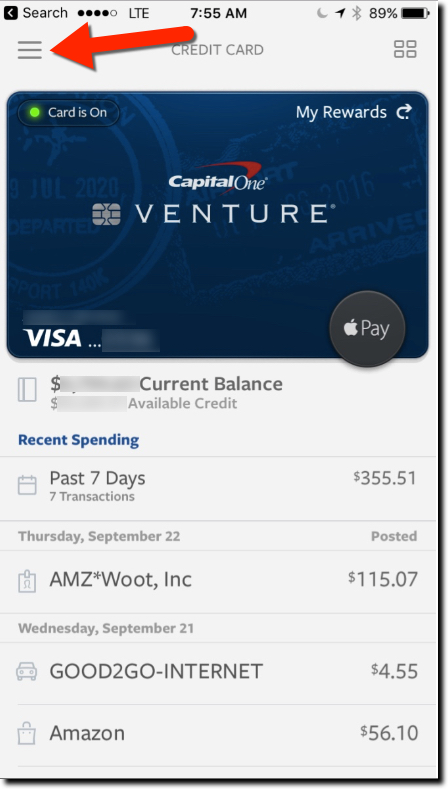

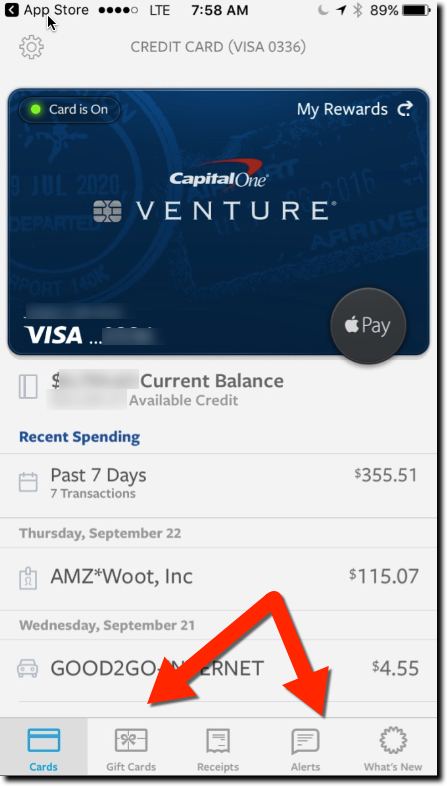

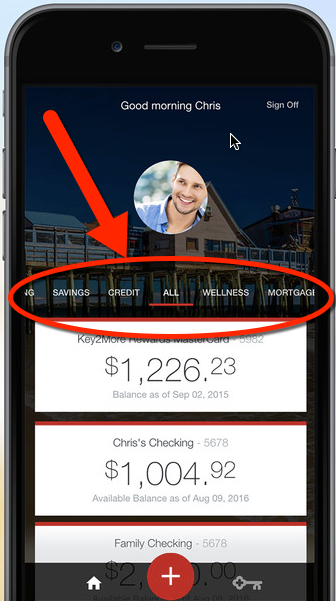

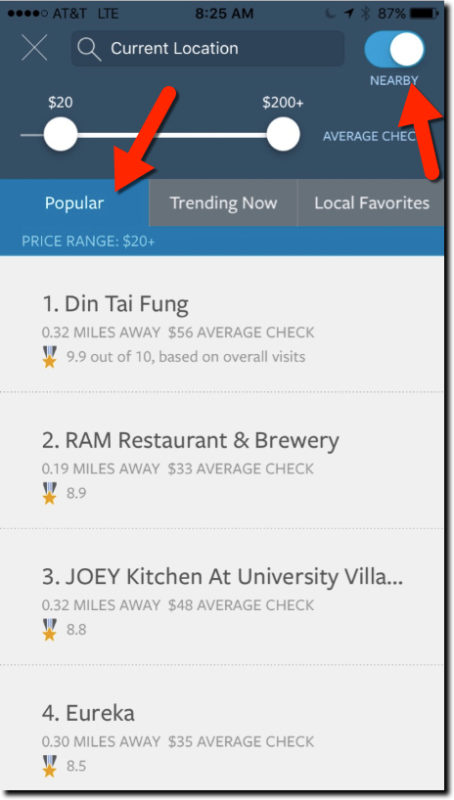

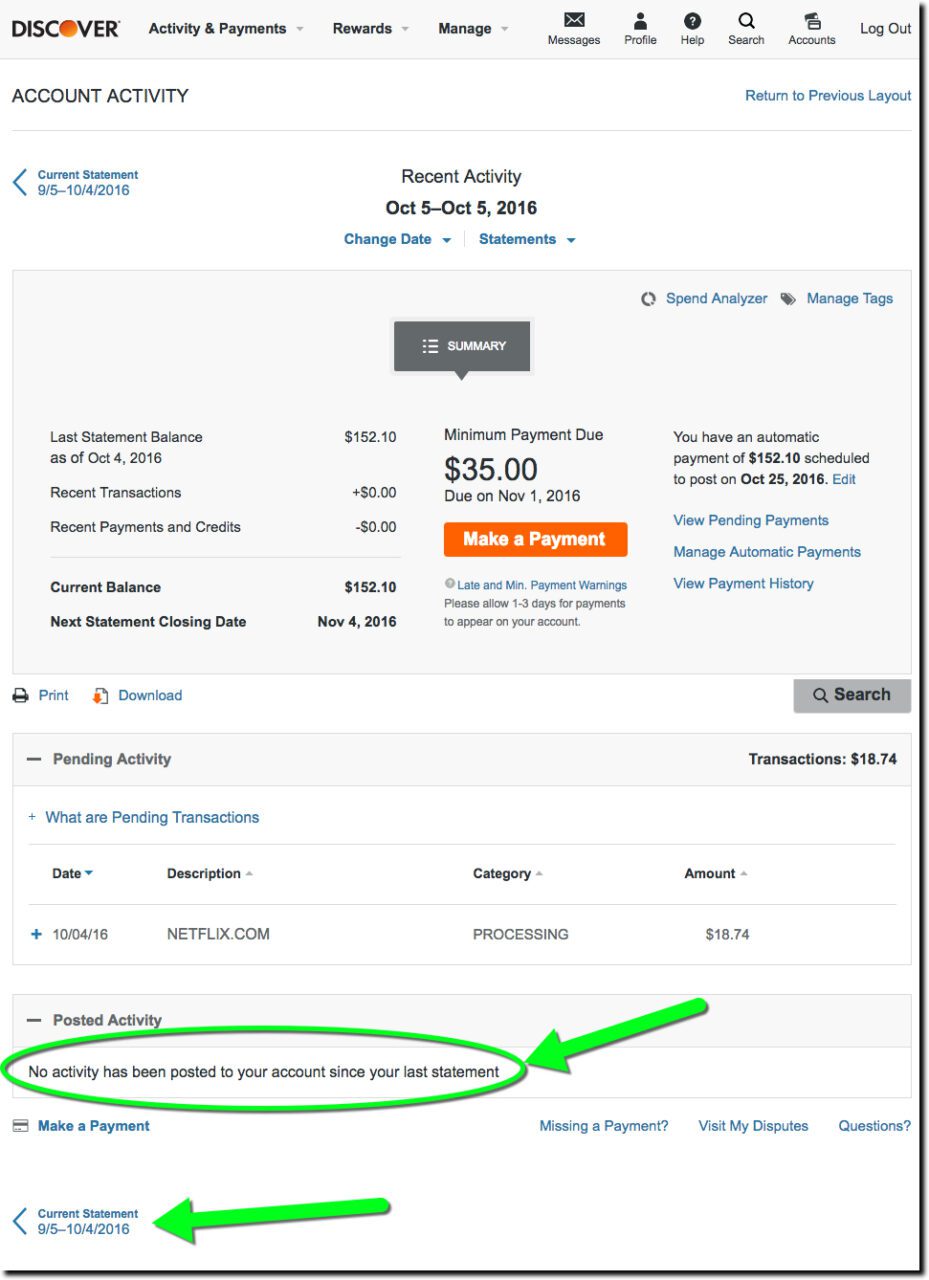

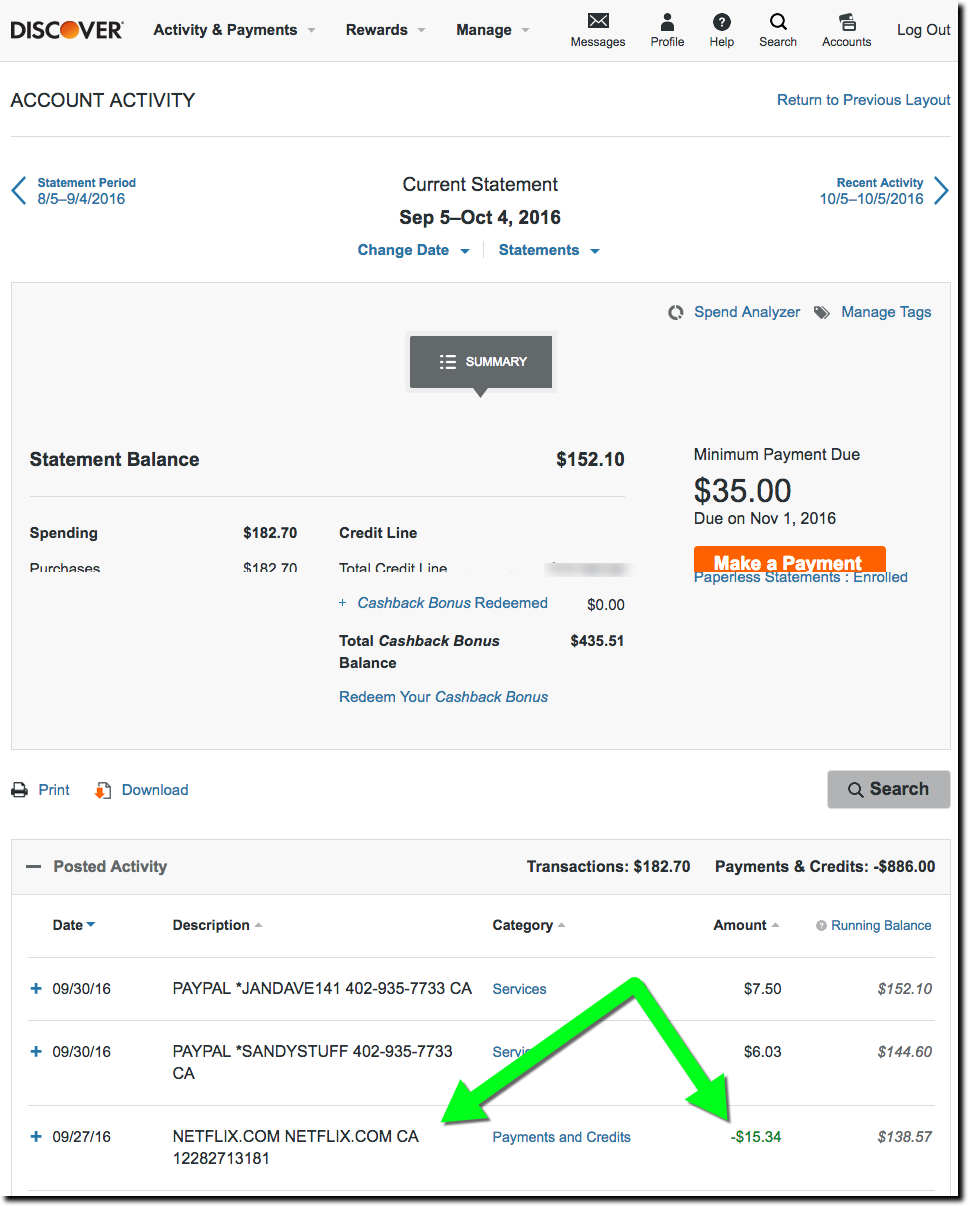

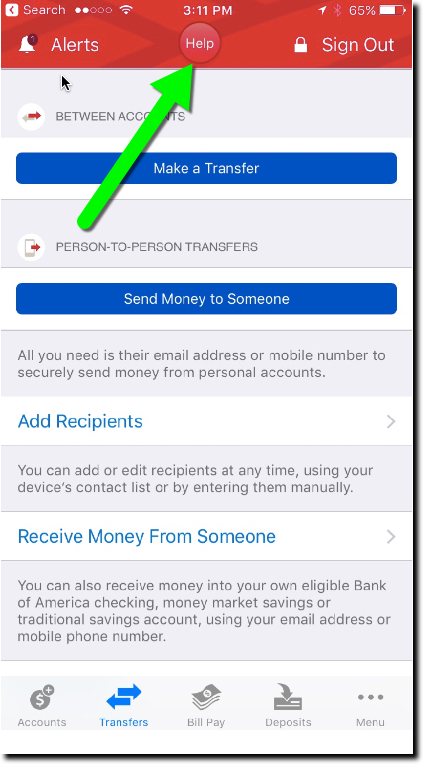

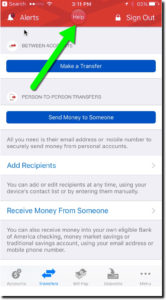

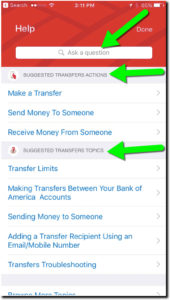

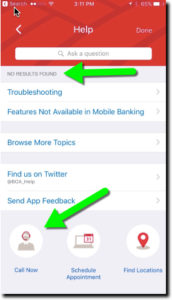

But thank goodness for mobile. It’s a miracle device in so many ways. But aside from chatting and photo sharing, its biggest impact could be on financial matters. Mobile is a free, 24/7 connection to money. That could be disconcerting, especially for the majority of consumers with money worries. So it’s the job of the bank, credit union, PFM provider, to use that connection to ease anxiety, rather than exacerbate it.

But that’s no easy task, given that money is the one of the biggest sources of anxiety in the country, accounting for three of the top-10 worries according to a 2015 study conducted by Chapman University (Hi Charlie). Unlike many posts, I don’t claim to have an answer here. But there are strides being made by pioneers who harness spending data to let customers know how much “free cash” they have at the moment (e.g., Simple’s Safe to Spend) or where they stand on their monthly budget (e.g., Moven and Capital One’s new Inform app) as well as chatbots that have your back (e.g., Bank of America’s chatbot Erica demo’d this week).

It’s a great time to be a bank/financial technologist. Enjoy making a difference!!

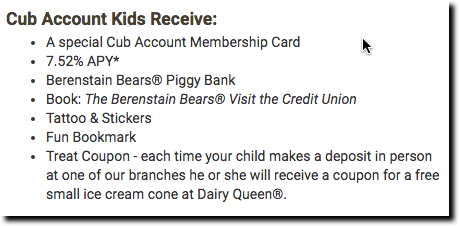

The book is in use at a number of credit unions, but none more prominently than

The book is in use at a number of credit unions, but none more prominently than

I am not a

I am not a