Alumni Alley is the latest addition to our upcoming FinovateEurope conference in March. This new feature is exclusively for FinovateEurope alums, and will give these companies a unique opportunity to share their latest innovations in a special showcase at the event. Learn more about FinovateEurope’s Alumni Alley and see if it’s a fit for you!

This week we continue our commemoration of FinovateEurope’s earliest alums with a look at SaaS accounting platform innovator Xero, digital communications provider Striata, and digital identity pioneer miiCard – now DirectID.

Your Cloud Accounting Platform Hero, Xero

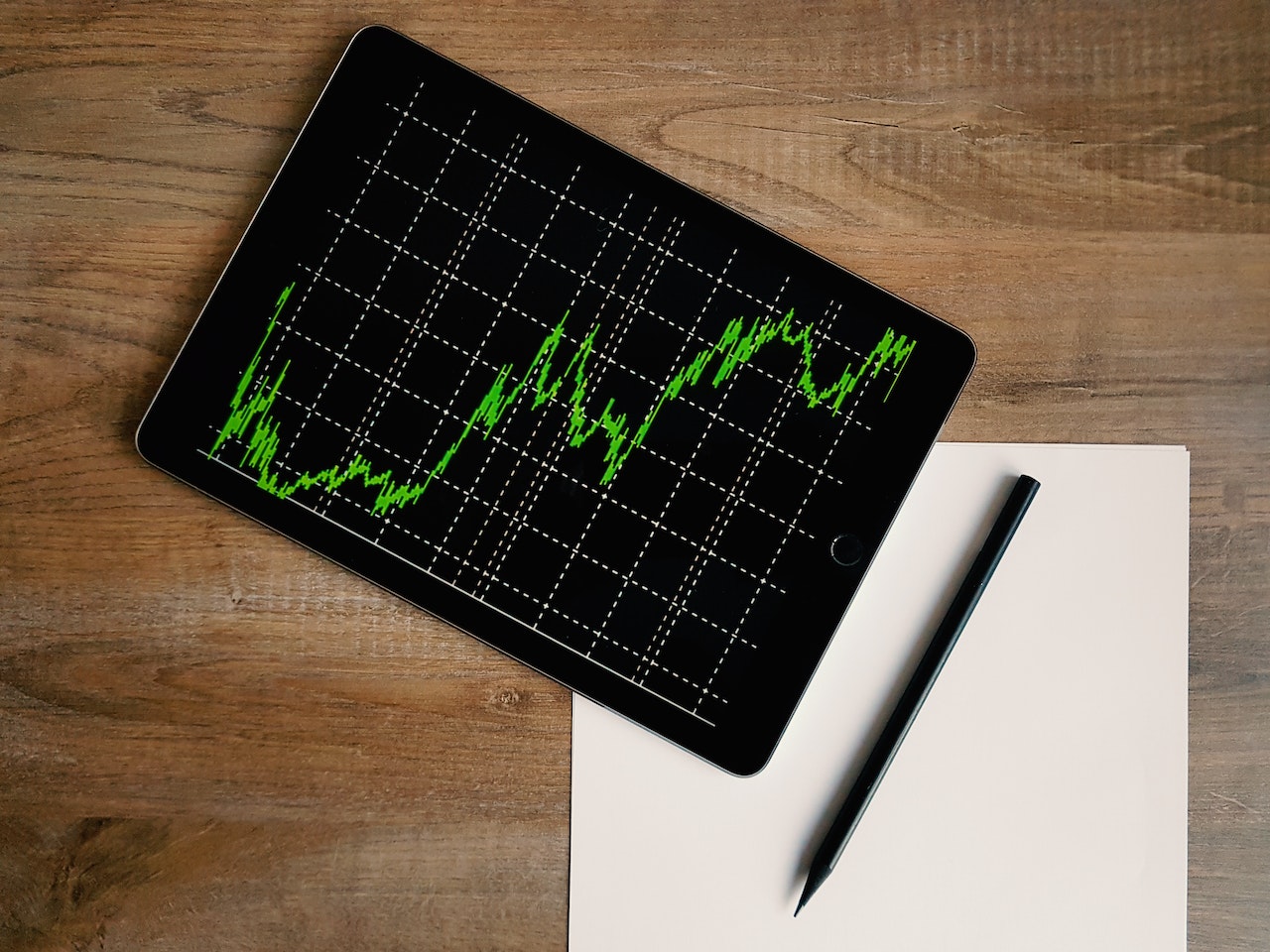

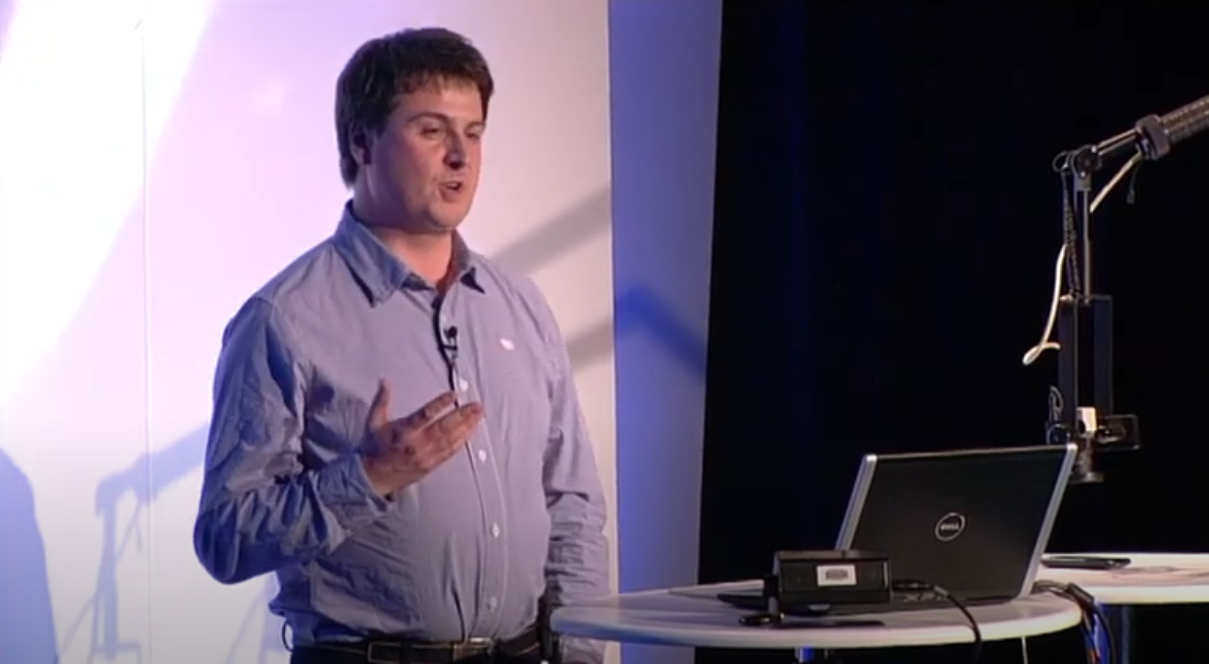

Believe it or not, there was once a debate about whether or not accounting technology truly qualified as fintech. Helping make the case were companies like Xero, a Wellington, New Zealand-based startup, founded in 2006, that was bringing its SaaS accounting solution to small businesses and their accountants around the world. When the company made its Finovate debut at FinovateEurope in 2011, the five-year old firm had raised $35 million and had 27,000 customers in 50 countries. Today, Xero is a cloud-based accounting powerhouse with more than $680 million in equity capital raised, and more than 3.5 million subscribers to its technology around the world.

Founded by Rod Drury, who was CEO of Xero until 2018, Xero offers small businesses the tools they need to manage many critical financial operations including accepting payments, billpay, inventory and project tracking, expense claim and invoice management, and more. A partnership with fellow Finovate alum Gusto enables Xero users to calculate pay and deductions, as well as make payroll payments to employees.

Earlier this month, Xero announced that Sukhinder Singh Cassidy had been appointed as the company’s new CEO. Cassidy will take the reins from Steve Vamos, who has served in the position for almost five years. Xero Chair David Thodey praised his new CEO as a “purpose-driven and human-centered leader who is passionate about supporting our customers and is committed to growing and nurturing Xero’s unique and vibrant culture.”

Striata Becomes Tilte: Beyond the Business of eDoc Delivery

The business of edocument delivery has changed significantly over the decade-plus since FinovateEurope 2011. But New York-based customer communications specialist Striata, which made its Finovate debut at our European event that year, has continued to innovate in this space, transforming complex customer communications systems and leveraging multi-factor authentication and encryption key management to ensure both security and compliance.

This helps explain why the company caught the eye of customer communications management (CCM) software and services company Doxim who, in 2020, acquired Striata for an undisclosed sum. The acquisition integrated Striata’s technology into Doxim’s CCM Platform, helping move the solution closer to Doxim’s goal of offering an “integrated SaaS CCM platform” that supports the entire omni-channel customer communications lifecycle.

“For over 20 years, Striata has been innovating in the CCM space by delivering digital-first solutions across multiple industries, channels, and devices,” Striata CEO Michael Wright said when the acquisition was announced. “As the world evolves into a digital community, a platform approach to scalable and secure yet personalized communications will be critical.”

In October, Striata underwent another transition as the firm’s South Africa team, under the leadership of Wright, launched Tilte.cx. The new venture is an IT services and consulting company that helps businesses enhance customer engagement via solutions ranging from digital communications and chat commerce to customer journey orchestration and data analysis.

Innovations in Digital Identity: from miiCard to DirectID

The FinovateEurope 2011 demo from Edinburgh-based miiCard (now DirectID) helped introduce many fintech observers to the challenges – and opportunities – in the field of trusted online identity.

Founded in 2010, miiCard appeared on the FinovateEurope stage with an identity-as-a-service solution that enabled users to prove that they “were who they said they were” online in minutes. The verification was as authentic as a physical passport or photo ID, establishing identity to level of assurance 3+, as well as meeting both KYC and AML compliance requirements.

Founded by James Varga, who continues to serve as the company’s CEO, miiCard rebranded to The ID Co. in 2016. The move reflected the growth of the company’s B2B DirectID service, which, launched in 2014, provided an “all-in-one” embedded, integrated verification solution that was especially valuable for financial institutions processing high value transactions online.

“Our mission is to create a layer of trust online, a digital world where you can trust that people really are who they say they are,” Varga said when the rebrand was announced. “Our new company name represents who we are, and better reflects our mission to help solve one of the greatest challenges of our time.”

Four years later and the impact of DirectID on the company’s business was so profound that another rebrand was launched, this time naming the company after what had clearly been demonstrated to be the firm’s most accomplished solution. “The market has changed so much, and data has become such an important part of our offering, that this change in focus was required,” Varga explained in a blog post.

Since the latest rebrand, DirectID has forged partnerships with a wide range of companies including authentication company Trust Stamp and credit hire organization AX. More recently, DirectID teamed up with U.K. payments company ShieldPay and secured $3 million in new funding.