There are many countries whose fintech innovations are often overlooked. And Canada, America’s legendarily kinder, gentler neighbor to the north, is among them.

This week’s edition of Finovate Global takes a look at recent fintech headlines emanating from the Great White North this week. The news ranges from big new fundings to new product launches to deal-making in Canada’s banking industry.

Clik2pay, a payment service provider based in Toronto, Ontario, has teamed up with lending process automation expert Inovatec. The partnership will enables Inovatec’s clients to use Clik2pay’s direct-from-account payment platform to request payments from customers. The functionality leverages Interac’s e-Transfer money transfer solution to ensure safe and secure fund movement.

“Clik2pay is always looking for ways to make the payments process simpler,” Clik2pay Chief Commercial Officer David Robinson said. “Allowing borrowers to make payment directly from their bank account in real-time through an email or text makes paying incredibly easy for the customer and allows for more efficient collections and payment reconciliation by lenders.”

The collaboration will give lenders the ability to use email to collect payments directly from customer bank accounts – and have those payments reconciled automatically on Inovatec’s platform. The process supports agent-assisted collections, as well, enabling lenders to textc customers payment links and secure real-time notification of successful payments “before the borrower hangs up the phone” the company noted in a statement.

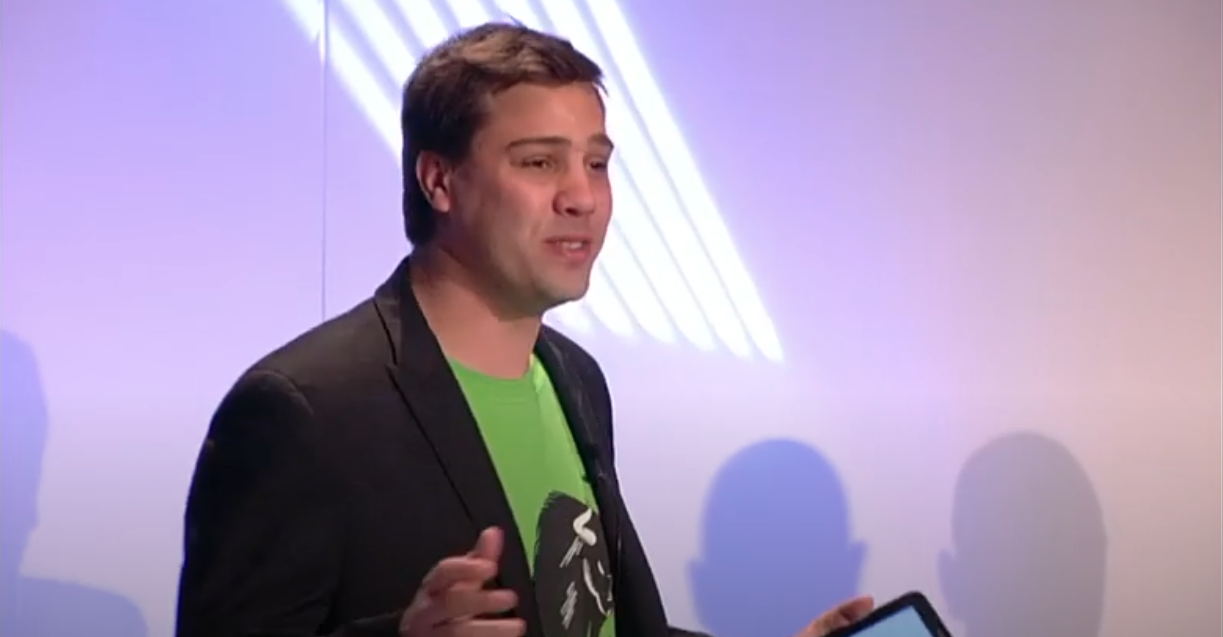

Clik2pay is the first Canadian company to provide real-time, direct-from-account payments for businesses at almost all FIs in the country. Founded in 2019, Clik2pay relaunched its Clik2pay mobile app for small businesses last month. The new app features an enhanced user experience, including improved, simplified onboarding. Mike Bradley is founder and CEO.

Canadian banks have made fintech headlines this week, as well. Bank of Montreal (BMO), for example, announced the launch of its new credit card installment offering. Currently available to BMO’s Canadian retail credit card customers via their online banking platform, the new plan – called PaySmart – enables customers to convert eligible credit card purchases of more than $100 into smaller monthly payments.

Customers will be able to choose between three, six, or 12 equal monthly payments. No interest is charged and BMO will access a monthly fee of up to 0.9%. Because purchases are within the customer’s existing credit limits, no additional credit check or approval is required.

BMO’s latest offering is part of a suite of solutions designed to help its customers better manage cash flow and finances. These solutions include the bank’s Pre-Authorized Payments Manager, Same Day Grace feature, and BMO CashTrack.

In other Canadian banking news, Royal Bank of Canada announced that it has purchased U.K.-based HSBC’s Canadian business for $10 billion (£8.4 billion; C$13.5 billion). The move comes as HSBC seeks to bolster its business in Asia – especially China. The company has more than 130 branches and 780,000 customers as part of HSBC Canada. And while HSBC has also expressed plans to abandon its retail banking operations in the U.S. and France, it is the company’s Canadian division that has turned a profit -whereas both its businesses in the U.S. and France have not.

The acquisition is the biggest by RBC under the tenure of CEO Dave McKay, who has also tried to calm concerns about potential layoffs by noting that RBC is considered one of the best workplaces in the country. McKay also pointed to the fact that RBC has nearly 6,000 open positions and referred to the acquisition as a “talent acquisition opportunity” for RBC. HSBC Canada has $134 billion in assets and 4,200 full-time employees.

“HSBC Canada offers the opportunity to add a complementary business and client base in the market we know best and where we can deliver strong returns and client value given our financial strength and award-winning service,” McKay said in a statement.

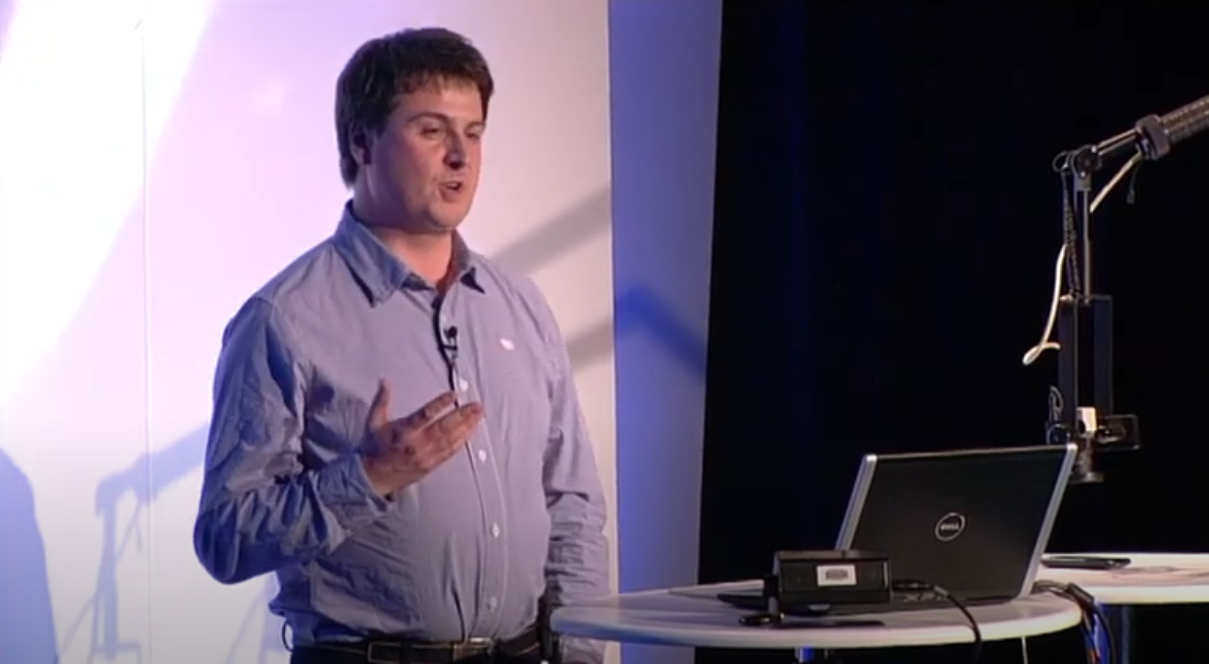

Earlier this week we shared news that Toronto-based FinovateFall 2019 alum Buckzy Payments had secured $14.5 million in Series A funding. The company offers real-time, cross border payments services, as well as banking-as-a-service capabilities, via its embedded finance platform. The company has more than 140 bank, neobank, and fintech customers since going live with its platform in 2020. This week’s funding takes Buckzy’s total equity capital to more than $23 million. The round was led by Mistral Venture Partners and Uncorrelated Ventures.

“This round of financing is a validation of Buckzy’s vision to create an intelligent and automated international payment system,” Buckzy CEO Abdul Naushad said. “We’re on a mission to build the plumbing for real-time money movement globally, the same way high-speed internet fundamentally shifted the communications industry.”

Here is our look at fintech innovation around the world.

Latin America and the Caribbean

- Brazil’s Nubank announced that it will offer savings accounts and debit cards in Mexico via its digital banking arm, Nu México.

- Chilean based alternative credit scoring fintech Destácame raised $10 million in funding.

- Brazilian fund Latitud released its The LatAmTech Report 2022 this week highlighting trends for B2C fintech in Latin America.

Asia-Pacific

- Finastra launched a new Center of Excellence (COE) at MRANTI Technology Park in Kuala Lumpur, Malaysia.

- Cambodia’s ABA Bank leveraged technology from Compass Plus Technologies to introduce instant card issuance kiosks.

- Financial crime compliance company Napier announced its entry to the Japanese market via its financial crime risk management platform, Napier Continuum.

Sub-Saharan Africa

- ThetaRay and Ghanian mobile financial services company Zeepay partnered to help fight financial crime in remittance transactions.

- TechCrunch profiled South African payments company Revio.

- Kenyan payment service provider Cellulant launched its expansion to South Africa..

Central and Eastern Europe

- Hamburg Commercial Bank announced that it has implemented and is now live on the nCino Bank Operating System.

- ING Germany partnered with Viafintech to launch new cash service offering.

- Estonia-based payment tracking company Transferlink announced a partnership with open banking platform Nordigen.

Middle East and Northern Africa

- UAE-based expense management platform Qashio secured $10 million in seed funding.

- Jingle Pay, a financial super app based in the UAE, announced a strategic agreement with Mastercard.

- Israel-based workplace intelligence platform Shield raised $20 million in Series B funding.

Central and Southern Asia

- KreditBee, a fintech platform based in India, raised $80 million in Series D funding.

- Mumbai-based youth banking startup Galgal Money secured $1 million in funding.

- M bank in Mongolia is the latest customer – and first Mongolian client – of Singapore-based B2B SaaS fintech finbots.ai