So how did you spend the days leading up to FinovateFall 2015?

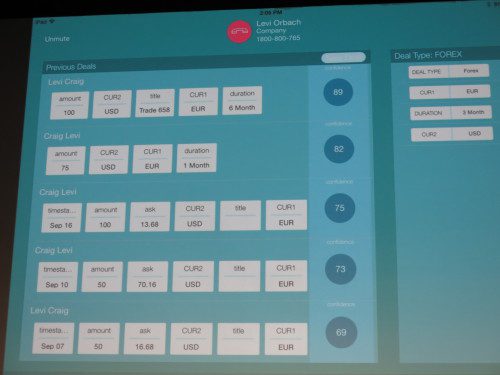

Finovate newcomer and mobile trading platform developer, Trading Ticket, celebrated its first appearance at Finovate with a $4 million seed investment from Citi Ventures and Valar Ventures.

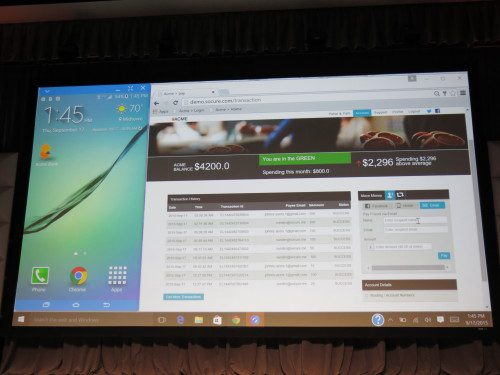

Ramneek Gupta, managing director and co-head of investing at Citi Ventures, praised Trading Ticket’s ability to “integrate mobile trading seamlessly into online publishing platforms.” Trading Ticket’s TradeIt platform makes trading easier and more secure, enabling traders and investors to trade from partner websites and apps with whatever broker they choose. The technology is expected to go live soon on mobile apps including Stock Trader, Rubicoin, and Investr. Major financial websites like Benzinga, MarketWatch, and The Street.com will also soon feature TradeIt.

As part of the investment, Andrew McCormack (Valar founding partner) and Blake Darcy (DLJdirect founding CEO) will join the Trading Ticket board. Gupta will serve as a board observer.

Trading Ticket distinguishes itself from other mobile trading solutions in three ways, according to company co-founder and CEO Nathan Richardson. “Speed to trade for users, order volume for brokers, and a direct monetization opportunity for publishers who don’t want the conflict of becoming a broker-dealer.” Publishers and web-app developers can integrate TradeIt into their own solutions through the TradeIt API, widgets, a short URL for use with social media like Twitter, as well as an iOS SDK, and ad units. Exchange-traded fund (ETF) providers say the platform helps them “close the sales cycle” with retail investors in particular by making it easier for visitors to buy highlighted fund offerings.

The technology won Trading Ticket “Most Innovative Trading Solution” at Citibank’s Global Mobile Challenge this spring.

Founded in September 2014 and headquartered in New York, Trading Ticket made its Finovate debut at FinovateFall 2015. Video of the company’s live demonstration will be available later this week.