Innovations in automobile financing that leverage mobile technology to empower buyers. Omnichannel solutions that enable customer onboarding in less than a minute. Intelligent personal assistants that hear and respond in natural, conversational language.

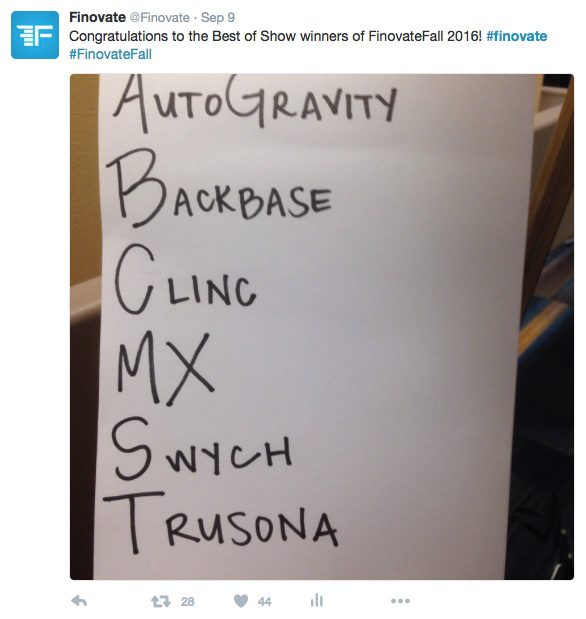

The Best of Show winners of FinovateFall 2016 are a compelling tribute to the diversity of our industry. From new strategies that help financial institutions leverage their data to provide better services, to platforms that transform the gift card from a present-of-last-resort to the perfect gift, to a multifaceted identity-solution capable of securing everything from your email account to SWIFT wires, it is an exciting time to be a part of this dynamic fusion of finance and technology.

And while we give due credit to those demos that drew the most enthusiastic praise from our record-breaking FinovateFall audience, know that our Best of Show winners represent the tip of the spear, the vanguard of a movement whose innovations will shape the way we save, spend, invest, and engage the financial world for years to come.

Here are our Best of Show award winners for FinovateFall 2016 (in alphabetic order):

AutoGravity for its app that harnesses the power of the smartphone to enable users to take control of the automobile buying and financing experience.

AutoGravity for its app that harnesses the power of the smartphone to enable users to take control of the automobile buying and financing experience.

Backbase for its omnichannel banking platform that leverages optical character recognition and facial recognition to deliver 60-second onboarding.

Backbase for its omnichannel banking platform that leverages optical character recognition and facial recognition to deliver 60-second onboarding.

Clinc for its personal assistant for mobile banking, “Finie,” that uses advanced artificial intelligence and deep learning to communicate with users in natural, conversational language.

Clinc for its personal assistant for mobile banking, “Finie,” that uses advanced artificial intelligence and deep learning to communicate with users in natural, conversational language.

MX for its innovative technology that enables FIs to acquire new data, as well as better and more effortlessly understand and analyze the data they already have.

MX for its innovative technology that enables FIs to acquire new data, as well as better and more effortlessly understand and analyze the data they already have.

Swych for its mobile gifting platform that makes it easy for users to buy, send, upload, redeem, and exchange gift cards instantly and conveniently from their mobile devices.

Swych for its mobile gifting platform that makes it easy for users to buy, send, upload, redeem, and exchange gift cards instantly and conveniently from their mobile devices.

Trusona for its insured cloud identity suite with offerings that run the gamut from securing everyday logins to protecting the world’s most sensitive assets.

Trusona for its insured cloud identity suite with offerings that run the gamut from securing everyday logins to protecting the world’s most sensitive assets.

We had a great time at FinovateFall 2016 and hope you enjoyed our two-day conference, as well. A thousand thanks to our sponsors, our partners, our presenters, and, last but not least, the 1,600+ attendees who made this year’s FinovateFall our biggest event yet. We’ll see you again next year!

Notes on methodology:

1. Only audience members NOT associated with demoing companies were eligible to vote. Finovate employees did not vote.

2. Attendees were encouraged to note their favorites during each day. At the end of the last demo, they chose their three favorites.

3. The exact written instructions given to attendees: “Please rate (the companies) on the basis of demo quality and potential impact of the innovation demoed.”

4. The six companies appearing on the highest percentage of submitted ballots were named “Best of Show.”

5. Go here for a list of previous Best of Show winners through 2014. Best of Show winners from our 2015 and 2016 conferences are below:

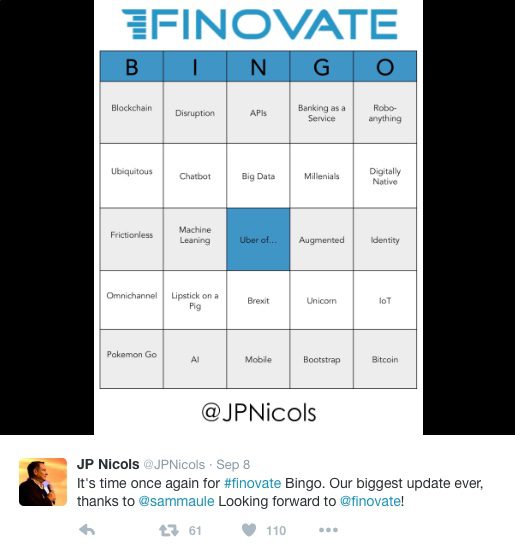

Our Twitter followers are not above issuing a challenge or two, either. How does this technology help banks and credit unions serve their customers better? Why does this solution secure my personal information or my business data better than another? What does this innovation truly do to foster financial inclusion and support the underbanked?

Our Twitter followers are not above issuing a challenge or two, either. How does this technology help banks and credit unions serve their customers better? Why does this solution secure my personal information or my business data better than another? What does this innovation truly do to foster financial inclusion and support the underbanked?

years as a portfolio manager. Before that, Berglund was a financial analyst and later an associate at Goldman Sachs in the firm’s investment banking division. A veteran of the Swedish Army, where he earned the rank of 2nd lieutenant, Berglund holds an MS in economics and business administration from the Stockholm School of Economics.

years as a portfolio manager. Before that, Berglund was a financial analyst and later an associate at Goldman Sachs in the firm’s investment banking division. A veteran of the Swedish Army, where he earned the rank of 2nd lieutenant, Berglund holds an MS in economics and business administration from the Stockholm School of Economics.

Be a part of it—with Bizzabo!

Be a part of it—with Bizzabo! Le tweet c’est chic

Le tweet c’est chic