Secure information sharing specialist identitii has joined forces with robotic process automation specialist Blue Prism. Together, the two will design technology to help FIs securely digitize and automate corporate payment and trade transaction processes – including a detailed audit trail – in an effort to better detect fraud.

identitii will integrate its verification engine, Integrity, and its permission data sharing capabilities into Blue Prism’s Digital Workforce, which is used by businesses to automate complex work processes. This will help businesses better organize and verify the data required in typically manual, time-consuming processes like cross-border corporate transactions, as well as provide for needed AML review and financial crimes sanctions checking.

“By combining our core strengths, we will enable our customers to achieve enhanced transparency and a complete audit trail of the provenance of information from Blue Prism’s digital workforce,” identitii CEO and co-founder Nick Armstrong said. “This will allow users to share information more securely, reduce the risk of information being tampered with and allow for detailed reporting.”

Blue Prism’s Digital Workforce enables businesses to automate tasks such as collection and management of documentation across multiple legacy systems. Businesses using the platform can leverage AI, machine learning, intelligent automation, and sentiment analysis to improve processes, share information more securely, and provide clearer, more detailed reporting for compliance purposes.

“Security, auditability and compliance can’t be an afterthought when thinking of automation,” David Moss, CTO and co-founder of Blue Prism said. “Working with identitii bolsters our ecosystem of security partners while providing our joint customers with the Digital Workforce they need to complete their digital transformation programs, which helps ensure that every transaction is safe and accounted for.”

Founded in 2014, identitii demonstrated its identitii Serra solution at FinovateFall 2017. identitii Serra is a permissioned, append-only, federated database designed for the financial industry. Using distributed ledger technology and relational and graph databases, identitii Serra enables FIs to exchange information in a way that is both secure and auditable.

identitii raised an undisclosed amount from The Lind Partners in January 2017. The company supports offices in Sydney, Australia, and in Singapore.

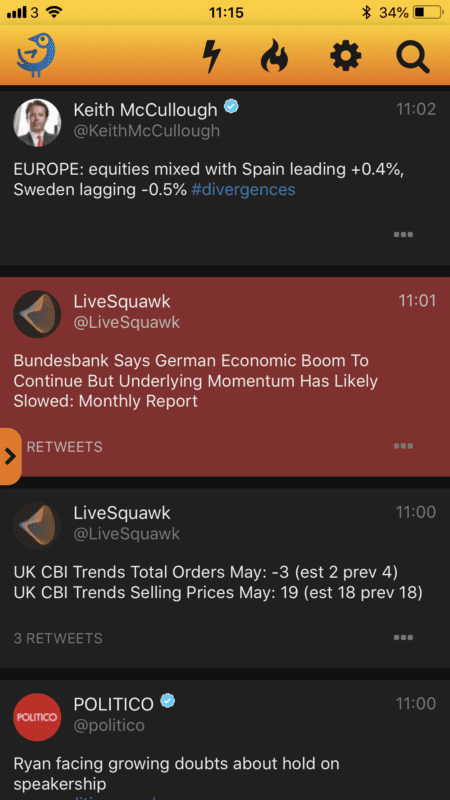

Market EarlyBird offers a read-only, anonymized Twitter service designed for financial markets professionals that enables them to spot trading opportunities and quickly identify potentially market-moving news before it makes the headlines. The platform helps satisfy compliance requirements by recording, logging, and timestamping Tweets as they appear – as well as including them in MiFiD II Transaction Reconstruction where appropriate. And by blocking users from tweeting and direct messaging, the platform satisfies one of the principal challenges for financial professionals using Twitter.

Market EarlyBird offers a read-only, anonymized Twitter service designed for financial markets professionals that enables them to spot trading opportunities and quickly identify potentially market-moving news before it makes the headlines. The platform helps satisfy compliance requirements by recording, logging, and timestamping Tweets as they appear – as well as including them in MiFiD II Transaction Reconstruction where appropriate. And by blocking users from tweeting and direct messaging, the platform satisfies one of the principal challenges for financial professionals using Twitter.

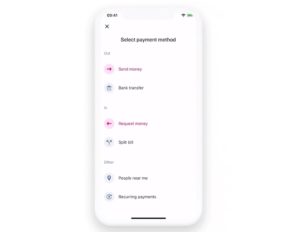

To use the new feature, users with the latest version of the Revolut app select the People Near Me option from the Payments tab. Enable Near Me and choose your location sharing preferences. When the list of Revolut users appears, make your selection, choose “send” or “receive” and confirm the amount. Note that the person or persons on the other end of the transfer will need to have their Near Me screen open and select their location sharing preferences, as well.

To use the new feature, users with the latest version of the Revolut app select the People Near Me option from the Payments tab. Enable Near Me and choose your location sharing preferences. When the list of Revolut users appears, make your selection, choose “send” or “receive” and confirm the amount. Note that the person or persons on the other end of the transfer will need to have their Near Me screen open and select their location sharing preferences, as well.