Finovate has curated an additional summit day that will take place the day after FinovateFall on September 27. The exclusive summit day kicks off at 8am and will focus on two of the technologies that are driving fintech innovation forward in the 21st century: Artificial Intelligence and Blockchain Technology. Be sure to register if you’re interested in taking part in these conversations.

Here we’ll preview the Artificial Intelligence track.

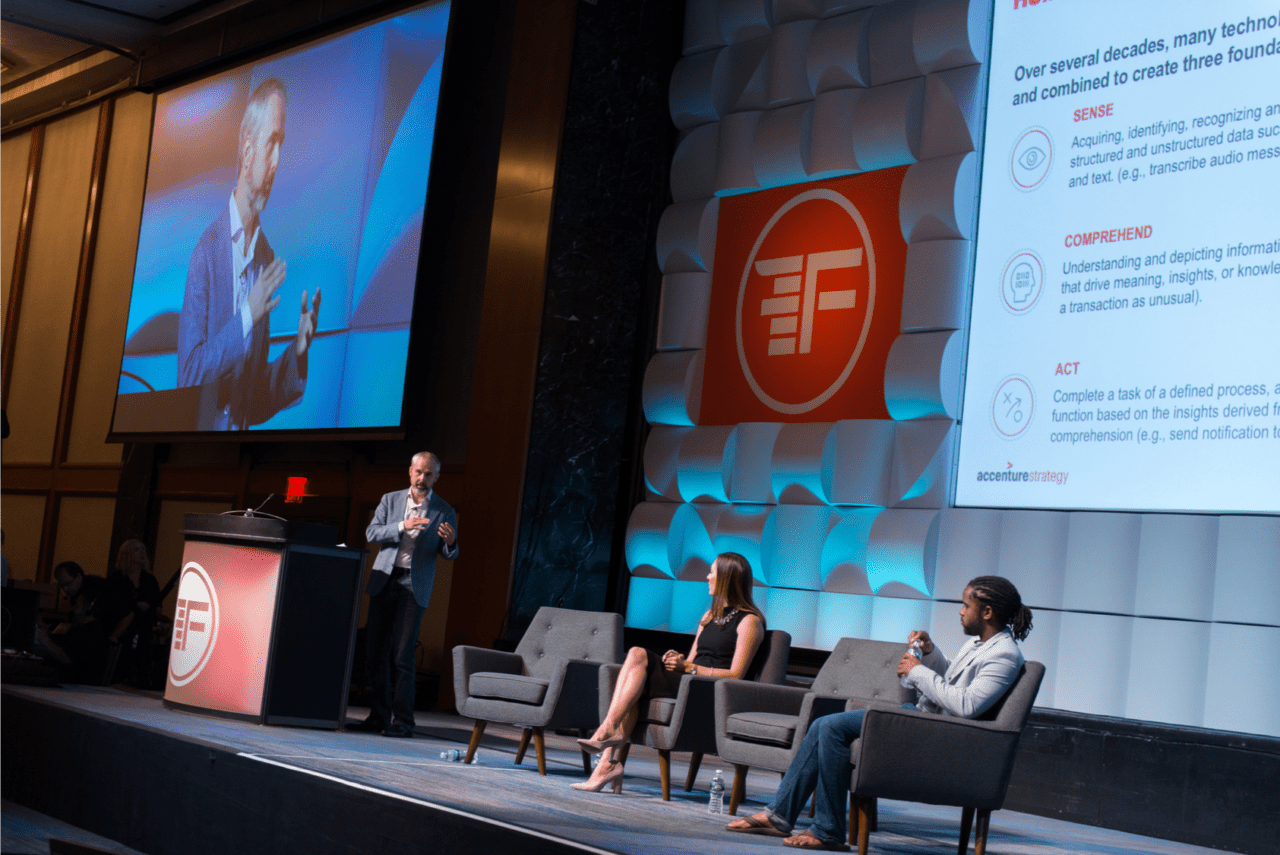

A is for Artificial Intelligence

Our Artificial Intelligence Fintech Summit will begin with Wells Fargo & Company’s Brad Stewart who is SVP for the bank’s Artificial Intelligence Enterprise Solutions group. Analysts believe that artificial intelligence (AI) will play a major role in financial services and commerce, driving greater personalization, efficiency, and security. Wells Fargo CEO and President Tim Sloan highlighted the potential for AI to transform banking by comparing it with events from his own 30-year experience in the industry:

I remember starting out as a retail banker when the first ATM was delivered to our branch! The ATM was revolutionary because it provided customers with a different way to do business with us. But innovation in financial services isn’t about delivering the latest technology. It’s about providing customers with better information in the moment, so they can make better decisions.

With Tata Consultancy Services estimating that people will manage 85% of business relationships without human interaction by 2020, AI will help shape the future of fintech. In his keynote address, Driving Organizational Transformation with AI, Stewart will look at the impact of artificial intelligence in financial services, providing a context for the expectations we should have when it comes to dealing with this new and evolving technology. Similar themes will be addressed by Optimove CEO and Founder Pini Yakuel during his midday discussion on How Science Builds Relationships.

Our AI track will also feature case studies that help us understand how banks are putting AI to work. Chief Analytics Officer for Commonwealth Bank of Australia Emil Matsakh will lead a discussion titled Mastering Adoption of Advanced Analytics and AI, that will look at the challenges of integrating AI in the enterprise. Jake Tyler, founder and CEO of Finn.AI, and Sumit Sarkar, head of Customer Experience & Strategy for Personal Banking at BMO will talk about the launch of BMO’s conversational AI solution, BMO Bolt, and share key metrics and early results.

A third opportunity to hear about AI in action comes in our real applications showcase. This conversation will feature data scientists and technical architects Hari Ramamurthy of Kuflink, Agnes Tourin of New York University, Jeffrey Yau of AllianceBerstein, Julia Romero of Haven Life, and ShanShan Li of Mass Mutual, who will share their experiences with and insights into AI’s business applications.

We’ll also get to hear a few fightin’ words where AI is concerned. A series of debates scheduled throughout the day will provide some lively and spirited conversation about some of the more controversial aspects of artificial intelligence. Sears Merritt, VP & Chief Data Scientist for MassMutual, and Katie Meyers, SVP & Chief Data Scientist for Farmers Insurance, will debate the latest data management strategies for successful AI.

Neeraj Arora, Global Head of Decision Science and Data Automation, Personal Insurance, AIG will moderate a debate how fintechs and corporates can build a productive partnership in AI. Participating in this conversation will be Veronica Osinksi, Founding Managing Partner, Trifecta Capital; Max Chee, Head of Aquiline Technology Growth, Aquiline Capital Partners; and Dan Dall’Asta, Partner, Route 66 Ventures.

Ellen Carney, Principal at Forrester Research, will sit down with Head of Artificial Intelligence and Machine Learning at HCSC, Imir Arifi, to discuss how to build a “foundation for success” when it comes to introducing robotics into financial services and AI.

This track will also feature a roundtable on how to use AI to add value to the customer experience. This session features Beyond the Arc’s Steven Ramirez, Swiss Re Management Corporation’s Jerry Gupta, Wells Fargo’s Ryan Miller, USAA’s Darrius Jones, Celent’s Daniel Latimore, and Ally Financial’s Aravind Rajasekaran.

Already registered for the main 3-day FinovateFall event but would like to add on the summit for the discounted rate? Please reach out to customer services at [email protected] or +1 (888) 670-8200 to activate the discount.