SoftBank Backs Latin America

Last week, the international fintech buzz was all about the booming investment in African startups. As you can see in our sub-Saharan Africa section below, that buzz continues as analysts wonder how African fintechs can best leverage their good financial fortunes of late.

But this week, it’s all about Latin America as fintechs from Mexico to Argentina lock in triple digit investments. What’s especially interesting is that two of the week’s biggest beneficiaries – Konfio and Uala – have the same participating benefactor in SoftBank.

The investment in Argentina’s Uala was the first time the Japanese-based firm had funded a company from Argentina, but not SoftBank’s first funding in the region. The firm invested $1 billion in Colombian delivery app Rappi in April of this year. SoftBank has a deeper history investing in Mexican startups, having funded payments startup Clip and used car buying platform Kavak. SoftBank is also especially active in Brazil; the firm led a $140 million round for the country’s e-commerce solution provider VTEX in November.

FinovateEurope Goes to Berlin!

It’s not too early to start thinking and planning for 2020 – especially with our first conference right around the corner in February.

After six years of basing our annual European fintech conference in London, Finovate is crossing the channel and setting up our stage in Berlin, Germany next year. Our new FinovateEurope location will also feature a new event format designed to ensure attendees maximize their time at the conference. Take a look at our developing agenda to see what we have in store February 11th through the 13th.

Here’s our weekly look at fintech around the world.

Asia-Pacific

- Singapore’s FinAccel, maker of Kredivo, raises $90 million in round led by Asia Growth Fund and Square Peg.

- Maybank Group, the fourth largest bank by assets in Southeast Asia, goes livewith Avaloq’s banking suite.

- South Korea announces plans to launch opening banking system before year’s end.

- Vymo brings AI-powered sales coaching to insurance giant Sompo.

Sub-Saharan Africa

- Can Africa’s fintech startups learn from the experience of M-Pesa? TechCrunch considers the opportunities now available thanks to recent positive funding trends.

- A partnership between Smartstream and Union Systems will help African FIs digitize their post-trade environments.

- QuartzAfrica takes a look at the “niche ecosystems” that are developing amid Africa’s rapidly expanding fintech industry.

Central and Eastern Europe

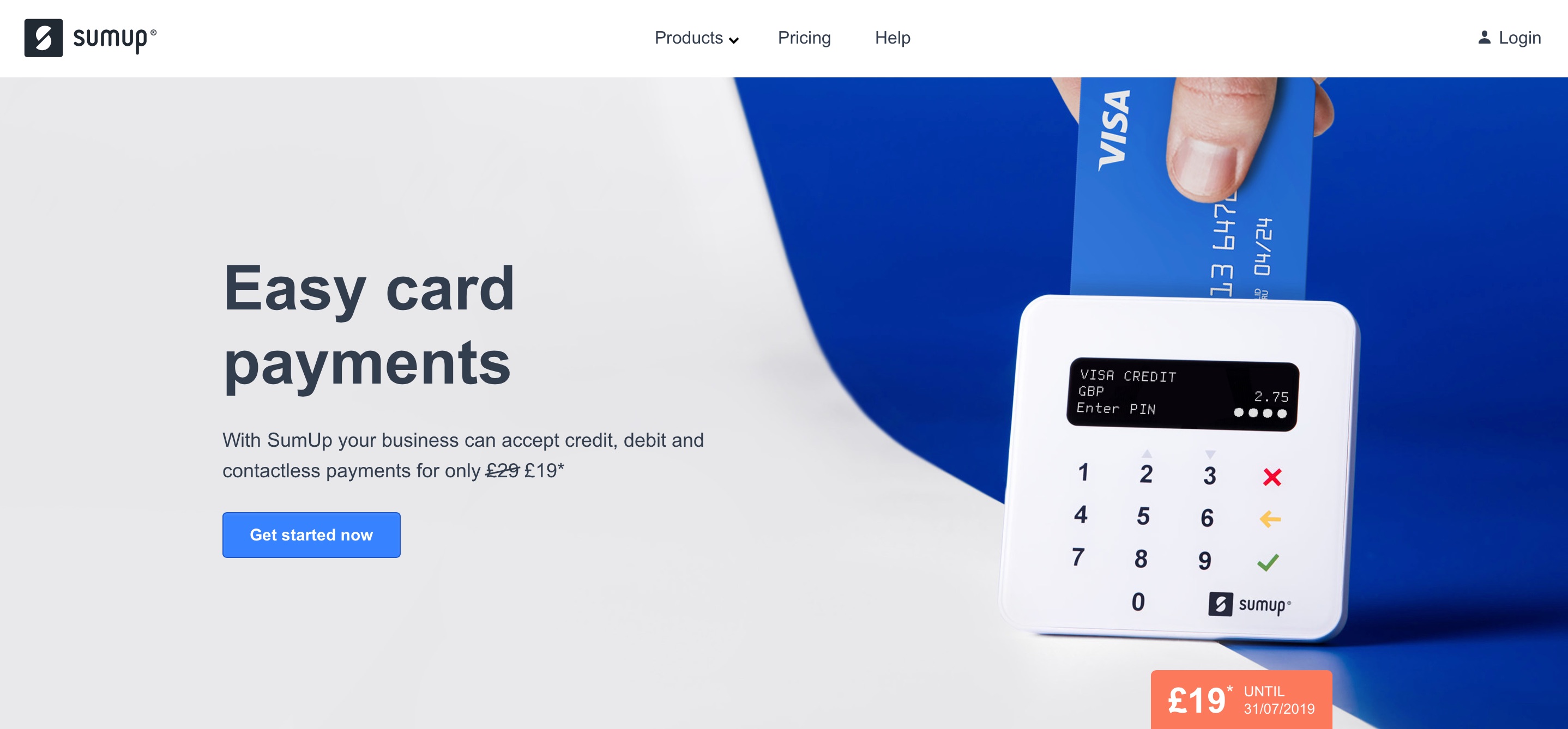

- Berlin, Germany-based SME digital banking platform Penta teams up with SumUp.

- First Investment Bank (Fibank) goes live with the first, PSD2-compliant, open banking platform in Bulgaria.

- Tinkoff GDRs will be included in MOEX Russia indices next month.

Middle East and Northern Africa

- Sudan’s Nile Bank is the latest FI to choose Oracle’s Flexcube core banking solution.

- Temenos teams up with Egyptian National Post Organization.

- Dubai Financial Services Authority inks fintech pact with Luxembourg’s Commission de Surveillance du Secteur Financier.

Central and Southern Asia

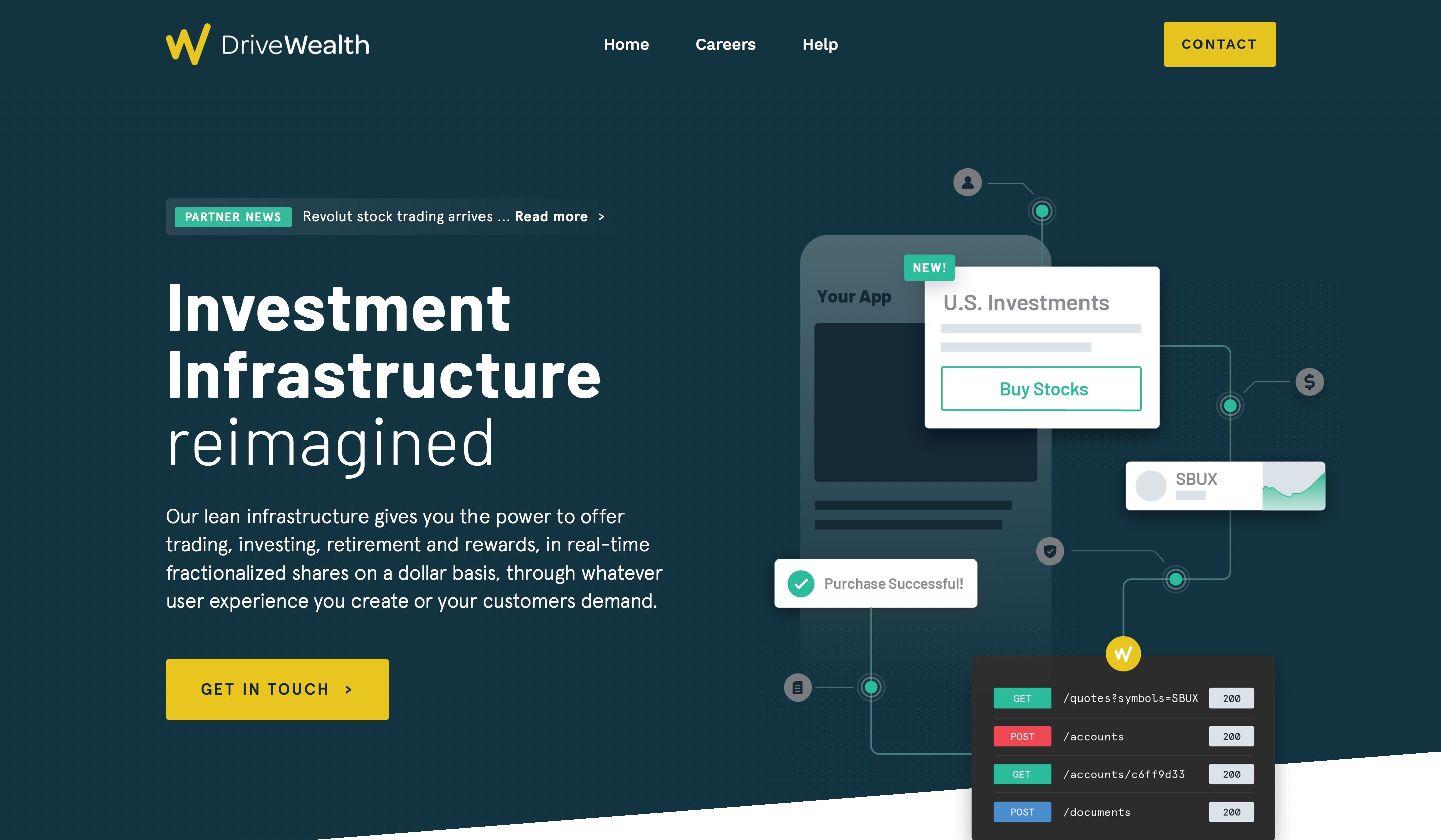

- DriveWealth helps Indian investors access U.S. stocks via new partnership.

- Indian banking technology provider TCS Financial Solutions migrates three credit unions to a cloud-version of its TCS Bancs system.

- Paysend introduces worldwide money transfers to Uzbekistan.

- Sri Lanka’s central bank examines the possibility of applying blockchain technology to streamline KYC processes for FIs.

Latin America and the Caribbean

- Uala, a money management app from Argentina, raises $150 million in Series C round led by Tencent and SoftBank.

- Mexican SME credit assessment specialist Konfio closes $100 million investment from SoftBank.

- MercadoLibre picks up $125 million loan from Goldman Sachs.

As Finovate goes increasingly global, so does our coverage of financial technology. Finovate Global is our weekly look at fintech innovation in developing economies in Asia, Africa, the Middle East, Latin America, and Central and Eastern Europe.