A look at the companies demoing live at FinovateAsia on October 14 through 15, 2019 in Singapore. Register today and save your spot.

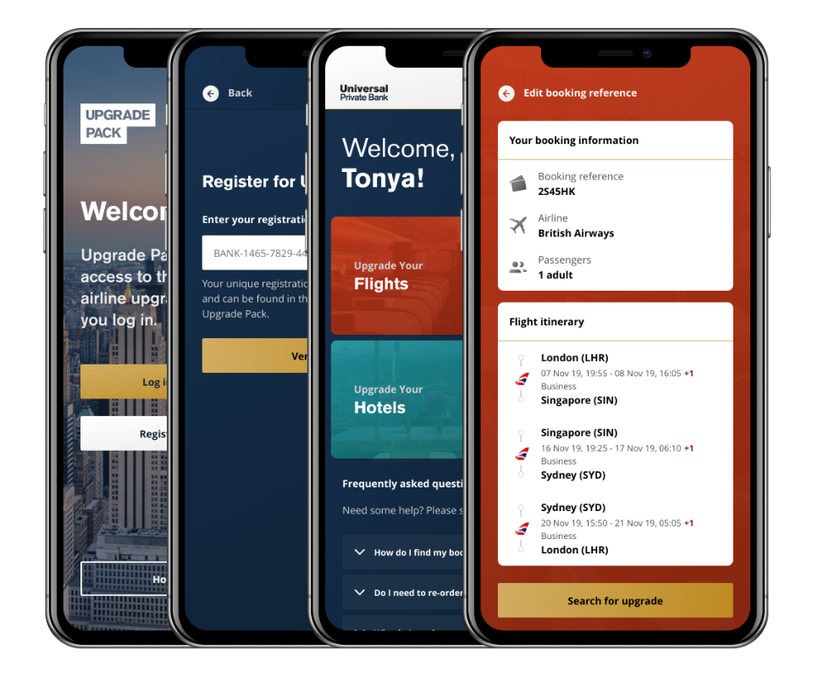

Upgrade Pack is a market-first platform for exclusive travel upgrades. The company helps financial institutions reward their most valued customers while also driving incremental card revenue.

Features

- Brand differentiation by providing customers with exclusive upgrade offers in real time

- Highly scalable platform technology, no complex integration

- Purchase data aids future customer segmentation

Why it’s great

Upgrade Pack helps you optimize the latest platform technology to deliver product innovation that will retain and attract the most high value customers.

Presenters

Urchana Moudgil, Co-Founder and Group COO

Moudgil has held senior finance roles in leading consultancy firms. Her experience in financial management and operations has helped Upgrade Pack raise £3 million and scale internationally in just a year.

LinkedIn

Tobias Berger, COO-Asia Pacific

A digital leader with 20 years of experience, Berger has built and led digital innovations within APAC for brands including Expedia and Google, with a recent focus on platforms and commercial strategy.

LinkedIn