This is a sponsored article by LiveBank by Ailleron

In this digital age, the banking sector is not just undergoing change; it is at the cusp of a revolutionary transformation that is poised to redefine the very fabric of financial services. This transformative wave is powered by the synergistic relationship between human intelligence and artificial intelligence (AI). Far from merely mechanizing existing processes, this collaboration aims to completely reimagine how banking services are delivered, making them more intuitive, efficient, and customer-centric.

Transforming Human-to-Human Interaction through Technology

At the heart of this transformation is the role of Generative AI. This advanced form of AI is transforming modern banking by enhancing the human element rather than replacing it, particularly in complex sales processes. For example, while simpler banking products have become largely automated and can be easily accessed online by customers independently, more intricate products – like those involving mortgages or business financing – still benefit significantly from human insight. However, AI tools in banking is not replacing the need for human interaction; instead, it enhances the advisory services provided by banking professionals, making these interactions more productive and customer-friendly.

Entirely Digital Mortgage Application Process

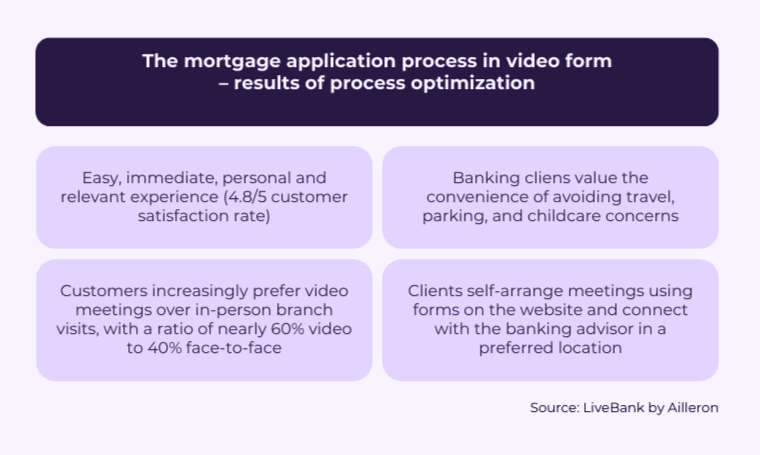

A vivid demonstration of this innovative approach was showcased by LiveBank in collaboration with ING Bank on the London stage. They illustrated how digitization could reinvent the mortgage process, which has traditionally relied heavily on face-to-face interactions and extensive paperwork. By integrating AI with digital technologies, LiveBank has transformed this process to better align with contemporary customer expectations, which include a seamless digital experience, personalized service, and simplified procedures that significantly cut down on processing times.

As a leader of Retail Banking in ING emphasized during a joint speech, “Customers seek the convenience of applying for a mortgage online, uploading required documents electronically, and monitoring their application’s progress in real-time. They also prioritize transparency, clear communication, competitive interest rates, and personalized guidance throughout the mortgage journey. Ultimately, they desire a smoother and more efficient experience compared to traditional paper-based methods.”

With 45% of consumers favoring digital channels for banking product purchases, LiveBank aligns perfectly with the modern client’s preferences. It streamlines banking operations and enhances customer service by offering real-time human-to-human assistance through the customer’s first-choice communication channel.

The entire presentation and more insights are available here.

How to Redefine an Online Mortgage Experience?

ING Bank has been expanding its remote customer service capabilities, particularly for clients interested in mortgage offerings. The journey began with the option to submit applications via phone through the Contract Center, which was later extended to include customers using the services of specialists in ING’s branches.

Recognizing the evolving landscape of customer expectations, ING took the initiative to introduce video call options, marking a significant advancement in providing clients with a seamless remote banking experience. This decision entailed evaluating both customer needs and advisor perspectives.

Success Story of ING Bank & LiveBank by Ailleron

To ensure alignment with customer expectations, ING conducted comprehensive research, actively seeking feedback and insights. Valuable suggestions emerged from this process, including the need for video meetings with specialists in local branches, especially in emergency situations.

In response to these insights, ING embarked on a journey to integrate customer expectations with the capabilities offered by video support tools. This strategic alignment not only enhances the remote banking experience but also underscores ING’s commitment to innovation and customer-centricity.

This transformation is crucial in today’s banking landscape, where customer expectations are increasingly geared towards digital solutions. The transition involves not only adopting new technologies but also rethinking the customer journey to make it as frictionless as possible. By reducing the need for in-person meetings and streamlining documentation, banks can address significant pain points, making the process quicker and more pleasant for customers while also optimizing operational efficiency.

The successful digital transformation of complex banking products like mortgages requires thorough organizational preparation. It entails understanding and integrating the needs and expectations of all stakeholders involved – both customers and bank employees. This preparation is critical to ensure that the new digital channels are not just new tools but are part of a holistic strategy to improve both customer and employee experiences.

Bank Branches and Their Role in Building Customer Relations

The recent pandemic has accelerated the shift away from traditional branch-based banking towards more dynamic, digital models. This shift has prompted banks to rethink the role of physical branches. Despite their reduced footfall, branches continue to play a critical role, particularly in fostering stronger customer relationships. Recognizing this, LiveBank has innovated a new approach where loan specialists are made available to clients through convenient video calls, allowing for digital collaboration throughout the loan application process. This approach not only maintains the personal touch that is often crucial in banking but also enhances convenience and efficiency.

Furthermore, LiveBank’s method allows clients to choose how they wish to engage with the bank, emphasizing the flexibility and client autonomy that modern customers desire. This model has proved successful, leading to a majority of remote interactions with over 400 branch mortgage specialists (60% of new meetings were on video) while maintaining high levels of customer satisfaction 4.9/5 – a testament to the effectiveness of integrating personalization with digital efficiency.

How to Increase Sales in Banking Using AI & GenAI Capabilities?

The expansive capabilities of Generative AI were further highlighted at FinovateEurope in London, where banking experts showcased how AI could elevate the credit process. AI assists bank advisors by managing vast amounts of data and providing insights, thereby enhancing their ability to offer tailored advice. Additionally, the use of advanced AI-driven avatars can pre-qualify customer needs, ensuring that when a client is handed over to a human advisor, the groundwork is already laid for productive interaction.

This blend of human empathy and machine precision is crucial. It leverages the strengths of both to optimize banking operations and tailor services to individual needs, thereby not only elevating the efficiency and effectiveness of banking services but also enriching the customer experience with a personal touch that technology alone cannot provide.

Human Empathy Meets Machine Precision to Optimize Banking Operations

LiveBank exemplifies this future, standing at the forefront of the transformative journey in banking. Its platform is meticulously designed to integrate the capabilities of humans and machines seamlessly, ensuring that every customer interaction is a blend of efficiency, personalization, and security. The key to their success lies in finding the optimal balance between human and artificial intelligence, using the unique attributes of both to deliver high-quality service in real time.

In conclusion, as the banking sector moves forward, the integration of human and machine intelligence holds incredible potential. Innovations like those pioneered by LiveBank are not just enhancing operational efficiencies; they are fundamentally enriching how customers experience banking. This is a visionary journey, one that promises to transform the landscape of financial services and set new standards for the banking industry worldwide.

Mateusz Grys, LiveBank by Ailleron speaker said, “Generative AI is a major trend reshaping our industry, but the human aspect remains critical, especially in sales and advisory roles. It’s crucial for dealing with complex banking products that customers may encounter only once in their lifetime. By integrating AI, we enhance these interactions, but the empathy and understanding of human advisors are irreplaceable when navigating such significant financial decisions.”

.png)