- Finastra is selling its Treasury and Capital Markets (TCM) division to an affiliate of private equity firm Apax Partners.

- TCM will become a standalone company under Apax ownership and will receive investment to accelerate product innovation, enhance cloud capabilities, and improve the customer experience.

- The deal is expected to close in the first half of 2026.

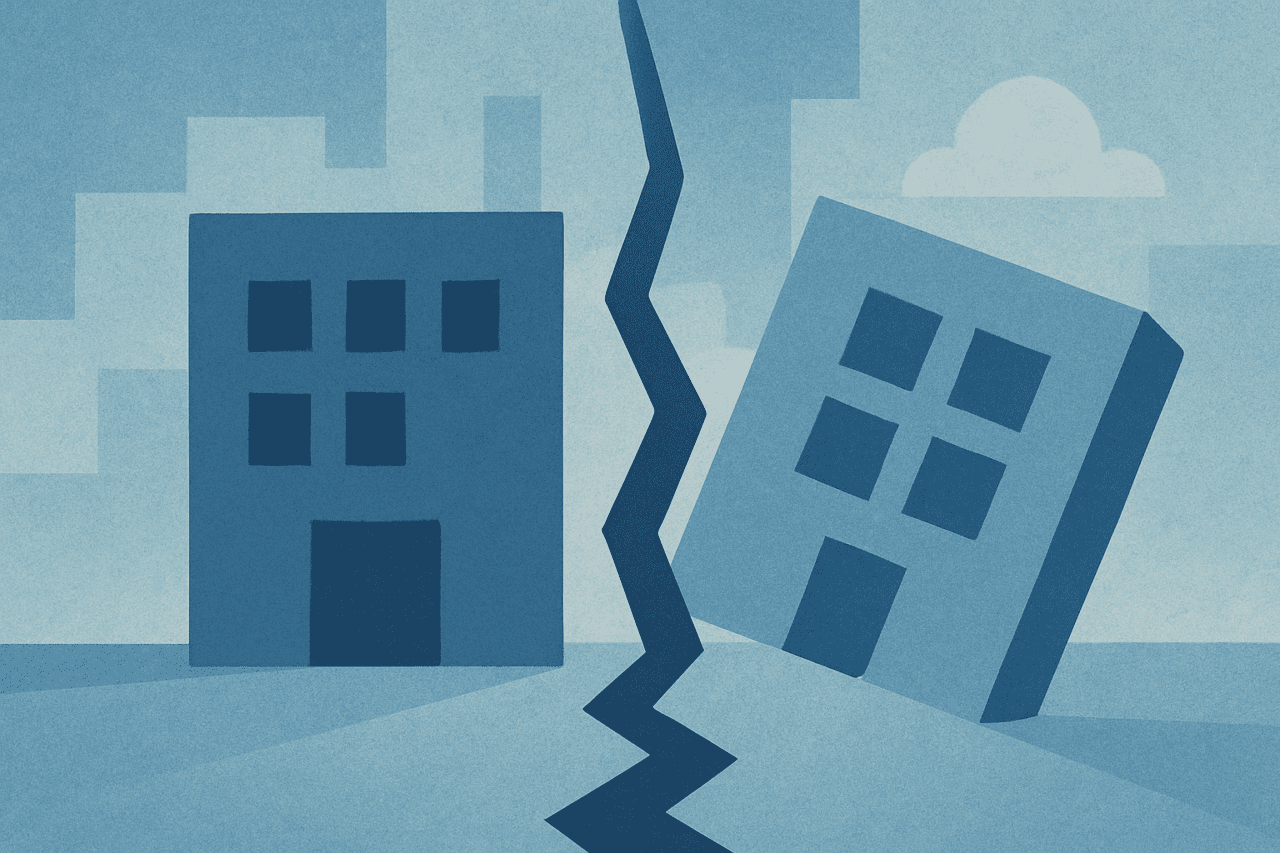

UK-based financial services software provider Finastra announced that it is selling its Treasury and Capital Markets (TCM) business unit to an affiliate of private equity firm Apax Partners. Once the transaction closes in the first half of 2026, Apax will rebrand TCM and operate it as a standalone business.

The deal gives Finastra room to double down on its core banking software, while TCM gains the backing to modernize and grow under independent ownership.

Finastra’s TCM facilitates risk management, regulatory compliance, and capital markets operations with its suite of software products, which include Kondor, Summit, and Opics. The business unit has more than 340 financial institution clients.

Under the ownership of Apax, TCM will be able to invest further in new product development, marketing, and technology infrastructure. Additionally, Apax will help TCM sharpen its strategic and operational focus, enhance its customer experience, and accelerate its cloud technology offering.

“We’re excited to partner with the TCM team as the business begins a new chapter as an independent organization,” said Apax Partner Gabriele Cipparrone. “With the backing of the Apax Funds, we expect TCM to benefit from accelerated innovation and enhanced operations, delivering even greater value to its clients.”

In addition to TCM, Apax has invested in other companies in the application software industry. Some of the firm’s more notable investments include Paycor HCM, Zellis Group, ECi Software, OCS / Finwave, Azentio, EcoOnline, and IBS Software.

Finastra anticipates that selling TCM will streamline its product portfolio and free up cash to reinvest in the business.

“This sale marks an important milestone for Finastra that will help further launch our next phase of growth with a focused suite of mission-critical financial services software,” said Finastra CEO Chris Walters. “It will provide capital to accelerate our strategy and reinvest in our core business, while providing our award-winning TCM platform with the backing of an experienced, long-term technology investor to support its continued success moving forward.”

With customers in 135 countries, Finastra serves 8,100 financial institutions with its software applications across lending, payments, and retail banking. The company was founded in 2017 as a combination of Misys and D+H. Earlier this year, Finastra appointed Chris Walters as CEO.