Of all the trends accelerated by the global pandemic, enhancing customer engagement may be both the most critical and the most enduring as we transition toward a post-COVID world. In the latest edition of his Finovate Podcast, host Greg Palmer talks with Crayon Data founder and CEO Suresh Shankar about his takeaways from 2020 and what he expects from fintechs and their customers in 2021.

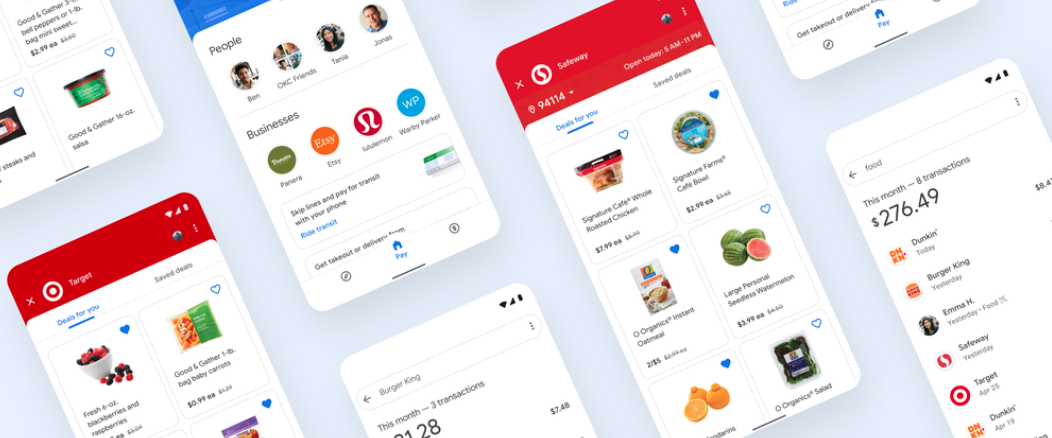

Shankar founded Crayon Data, a big data/AI startup, in 2012. The Singapore-based company helps businesses succeed by leveraging enterprise data to create digital-first customer experiences. Crayon’s flagship platform, maya.ai, enables businesses to boost revenues, reach inactive customers, and cut down on time and effort on low-ROI marketing campaigns – all by delivering highly relevant, highly personalized digital experiences to customers without compromising privacy. Crayon Data made its Finovate debut at FinovateEurope last year.

The Finovate Podcast is also a great source for 30,000 ft high observations on both the fintech landscape as well as the broader terrain of technological innovation. Greg Palmer’s recent conversation with futurist Nancy Giordano delves into what she calls the “Productivity Revolution” and its implications for fintech and financial services.

“There was a way we approached building the industrial era of the 20th century and prior that now no longer holds up and we have to have a really different way of thinking as we move into the future. ‘Leadering’ (the title of her new book) is the contrast to ‘leadership’. It’s a verb that’s dynamic and inclusive and caring and allows us to build the future that we really want to build … It sounds lofty, but it’s actually pretty practical.”

A guest lecturer at Singularity University, a ten-year TEDx curator, founder of Play Big Inc. consultancy, and one of the premier female futurists in the world, Giordano consistently underscores the role of the individual in times of rapid change and disruption. Her new book, Leadering: The Ways Visionary Leaders Play Bigger, connects the rise of innovative technologies with changing societal expectations to give individuals insight into what it takes to create human-centered solutions and long-term value.

For more from the Finovate podcast, check out our podcast archives.