This week’s edition of Finovate Global takes a look at the wave of funding that fintechs in France have received in recent weeks. The $108 million secured by hardware crypto wallet maker Ledger appropriately leads the pack. But there have been a handful of investments in a variety of French fintechs that are also noteworthy.

First up, though, it’s Ledger’s massive fundraising. The Paris, France-based crypto wallet designer and manufacturer announced that it raised $108 million in funding this week. The investment is part of the company’s Series C round and, as such, does not change Ledger’s $1.4 billion valuation. The funding does add to the $385 million the company raised in 2021.

Ledger’s latest investors are a lengthy list of new and existing backers. True Global Ventures, Digital Finance Group, and VaynerFund are among the new investors. Existing investors 10T, Cité Gestion Private Bank, Cap Horn, Morgan Creek, Cathay Innovation, Korelya Capital, and Molten Ventures are among Ledger’s existing investors who also participated.

“Today, Ledger announced our funding round. These funds will accelerate our mission to bring a new generation of secure consumer devices to hundreds of millions exploring critical digital assets and blockchain-enabled technology,” Ledger chairman and CEO Pascal Gauthier wrote in a blog post at the Ledger website.

Ledger demonstrated its crypto hardware technology at FinovateEurope back in 2016. The company currently offers three hardware wallets, Ledger Nano X and Ledger Nano S Plus, and Ledger Stax. The latter model, the company’s latest, was only recently announced and is scheduled to begin shipping to customers within the next few months.

The investment in Ledger is a reminder that France remains among the more crypto-friendly countries in Europe, if not the western world. U.S. based Circle, the company behind both USDC and Euro Coin, recently announced that it had chosen France for its European headquarters. This is just one reflection of the country’s openness to the cryptocurrency industry.

News that Burger King fast food restaurants in Paris will begin accepting cryptocurrency for payment may be another. The company has partnered with Instpower, who will deploy its power bank rental machines in Burger King’s Paris locations. The power bank rental machines are connected to a pair of cryptocurrency payment services – Alchemy Pay and Binance Pay. Now Burger King consumers will be able to get their Whoppers, charge their mobile devices, and pay in crypto all in the same place. The move is a boon for Instpower as it seeks to expand the popularity of power banks in Europe. The collaboration is also a clear win for crypto, which benefits from both the publicity and the convenient new use case for crypto holders.

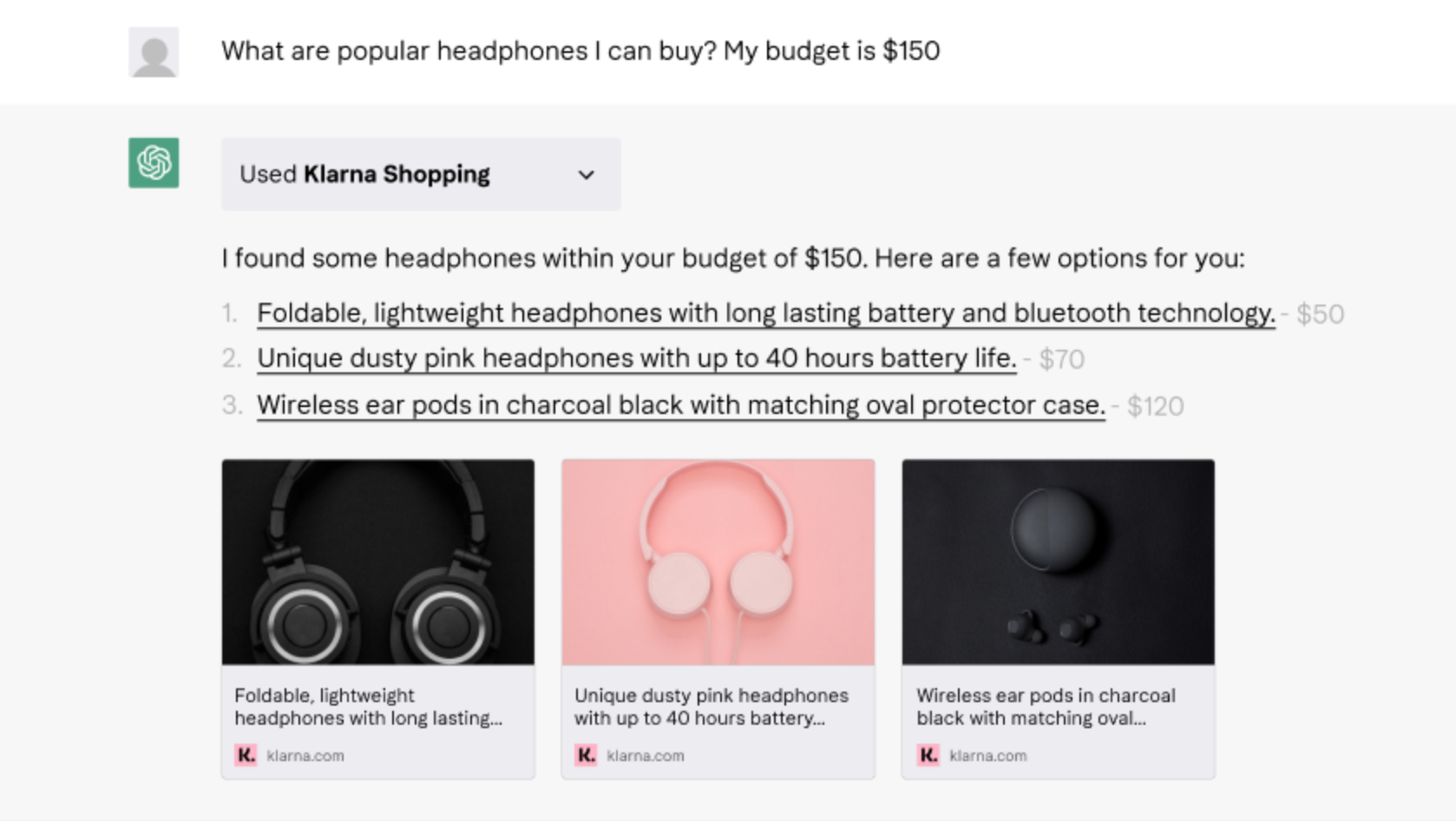

Ledger is not the only French fintech scoring investor dollars this month. N2F, a French startup that offers business financial management software, raised $26 million (€24 million) in a round led by PSG Equity. A French fintech called Elyn that offers try-before-you-buy services raised $2.7 million (€2.5 million) in pre-seed funding in a round led by Headline and Sequoia Arc. On the financing front, B2B lender Aria secured a $53.3 million (€50 million) debt facility courtesy of M&G Investments. The funding added to the $21.7 million (€20 million) debt facility the company announced last year.

Here is our look at fintech innovation around the world.

Latin America and the Caribbean

- IBS Intelligence profiled three Peru-based payments companies: Chaty, Izipay, and Yape.

- Caribbean and Latin America-based real-time payments specialist Financial Urban Exchange agreed to be acquired by Zenus Bank.

- The International Monetary Fund published a report this week titled “The Rise and Impact of Fintech in Latin America.”

Asia-Pacific

- Thai insurtech startup Roojai secured $42 million in Series B funding.

- Advance, a Philippines-based fintech dedicated to providing easier access to financial services, raised $16 million in pre-Series A funding.

- Vietnam-based fintech unicorn Momo is the only Vietnamese company to make The Asian Banker’s Global Platforms Ranking 2023.

Sub-Saharan Africa

- Nigerian fintech Zone partnered with ThetaRay to monitor its blockchain payments network.

- Pan-African neobank Payday raised $3 million in seed funding.

- IPB, a division of Deutsche Bank that caters to private, wealth, and commercial customers, expanded its wealth management services to South Africa.

Central and Eastern Europe

- Poland’s Secfense joined the Cybersecurity program of Google’s Startups Growth Academy. Secfense demoed its passwordless authentication technology at FinovateEurope 2022.

- Austria-based Finmatics secured $6.5 million (€6 million) in Series A funding for its technology that brings the power of AI to accounting and tax planning.

- Swiss fintech Klarpay AG announced achieving profitability in its first year of operations.

Middle East and Northern Africa

- Egypt’s Camel Ventures launched a new $16.2 million (EGP 500 million) venture capital investment vehicle, Camel Ventures for Investment I (CVI) to help fund support the country’s fintech ecosystem.

- Investing services group IQ-EQ announced an expansion of its operations into the UAE.

- Paymentology partnered with Wio Bank PJSC, bringing its customer-centric card payment services to the UAE.

Central and Southern Asia

- Pakistan-based HugoBank introduced its new CEO Atyab Tahir.

- HDFC Bank, the largest private sector bank in India, partnered with Backbase.

- Uzbekistan-based fintech Alif Moliya Uzbekistan won the Best Innovative Products award at the 3rd CIS Islamic Banking and Finance Forum.