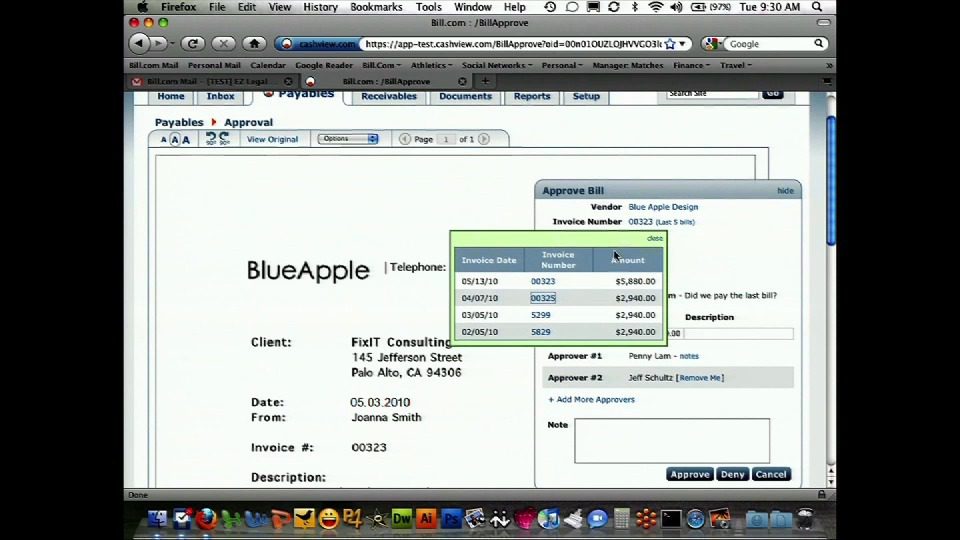

How they describe themselves: Bill.com is the first SaaS financial management service

designed specifically for small and medium sized businesses and their financial advisors to help them manage their cash flow more efficiently and effectively. By eliminating manual, paper-based processes Bill.com is saving businesses over 50% of the time and cost of managing financials.

Bill.com streamlines payables and receivables and provides access to financial documents anytime, anywhere. It includes a simple way to digitize incoming bills and send electronic invoices, synchronize payables and receivables with accounting packages, automate multi-user approval workflow with role-based controls, and pay or get paid via check or ePayment.

What they think makes them better: B2B bill payment represents over $14B in annual

payments, yet unlike consumer banking where over 70% of payments are now done online, over 70% of B2B payments are still done by printing, signing, and mailing checks. Until now, solutions were either too accounting-focused (requiring manual, paper-based processes to supplement the software) or payment-focused (requiring duplicate processes and data entry).

Bill.com is unique in its ability to bridge the gap between accounting and banking worlds with a streamlined, simple, low-cost process that matches how small and medium sized businesses actually work.

Contacts:

Bus. Dev.: Christy Ross, VP Business Development, [email protected]

Sales: Roger Horwitz, Director of Sales, [email protected]

Press: Jeff Schultz, VP Marketing, [email protected]

How they describe themselves: Blippy is a social network where people share and discuss the things they buy. Blippy makes it easy to share purchases by allowing users to automatically sync their credit cards and e-commerce accounts with Blippy. Privacy controls ensure that users only share the purchases they want to share.

What they think makes them better: Blippy creates community and meaning around everyday purchases. The idea for Blippy came from the realization that every time we pay for something, there’s a potentially interesting conversation to be had. Blippy makes it easy to create conversation around a new movie you saw, songs you downloaded, restaurants you’re trying, ingredients you’re picking up for a great recipe, and other everyday purchases. With the API that we’re announcing at Finovate, we look forward to working with developers to uncover even more meaning from these purchases for the Blippy community.

Contacts:

Press, Bus. Dev. & Sales: Philip Kaplan, [email protected]

How they describe themselves: Bobber Interactive provides financial institutions a powerful, cost-efficient growth engine for new accounts and core deposits with the first social, viral money management platform designed for today’s youth. American teens represent $200 billion of discretionary income each year and reflect significant lifetime value, with 60% maintaining their banking relationship after college. Additionally, 81% of today’s youth play online games and 72% have profiles on social networks like Facebook. Bobber uses proven, “addictive” social game mechanics (progression, persistence, network participation and sharing) to motivate smart money management among this valuable demographic, while generating increased deposits, long-term savings and viral user growth.

What they think makes them better: The majority of teens today say managing their money is one of their top priorities (Schwab “Teens & Money” study), but existing options lack relevance, accessibility and excitement. With Bobber, teens benefit from a practical, tool-based framework for expanding their income sources, accelerating progress on their most important goals and enjoying an engaging experience they can share with friends and family. Parents benefit from a safe, convenient way to motivate their teens to build responsible habits around money. Partner financial institutions benefit from an innovative, cost-efficient driver of account generation and deposits growth, without disruption to existing IT platforms.

Contacts:

Bus. Dev.: Eric Eastman, Founder & CEO, 415-652-7513, [email protected]

Sales & Press: Scott Dodson, COO, 206-818-1066, [email protected]

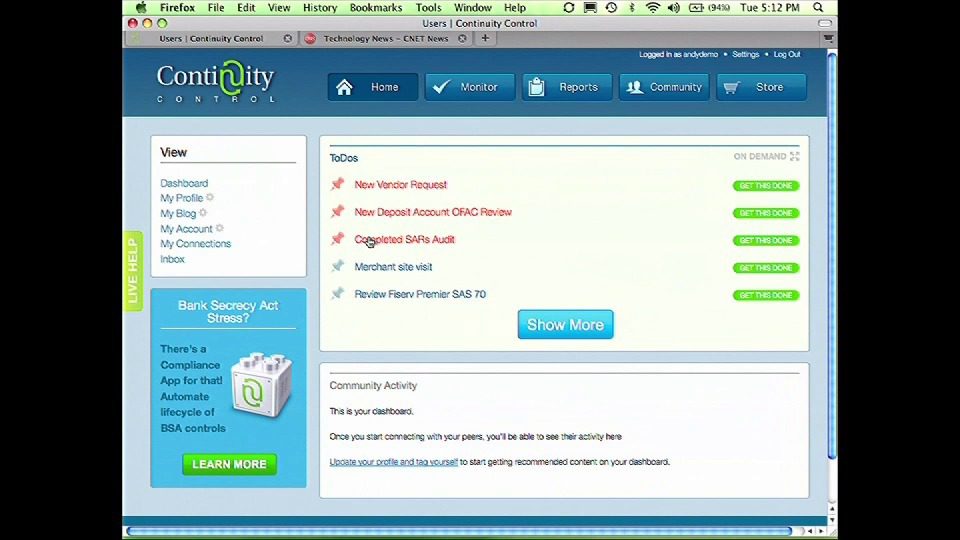

How they describe themselves: Continuity Control (Control) organizes and facilitates the work of compliance within a financial institution. This is key to addressing the issue of ever-increasing governmental oversight, rising costs associated with compliance, the amount of work and resources required and the overall burden to the organization, which Continuity refers to as the Compliance Tax.

Control features applications (APPs) that all work together and provide policies, tasks and assignments that ensure that annual oversight, periodic reviews and routine operation tasks get to the proper individuals with a financial institution at the right time. Think of Control as a pre-programmed Universal Remote that organizes everything into one place.

What they think makes them better: Continuity Control was founded in late 2008 by financial service and compliance industry veterans who were seeking to simplify the process of governance, compliance and risk management for banks and credit unions throughout the United States. The company has pioneered the use of collaboration and social networking among bank, credit union and financial industry executives to create cost effective solutions that streamline, organize and manage policies, procedures and audit programs. Using a Software as a Service (SaaS) model, Continuity Control has developed an on-demand, Web-based software foundation for financial institution controls that automates the regulatory process for community banks and credit unions, while at the same time offering more visibility, cost saving and operational efficiency.

Contacts:

Bus. Dev.: Peter Halenar, SVP, Alliances & Business Development, [email protected]

Sales: Andy Greenwalt, Founder & CEO, [email protected]

Press: Marvin (Mickey) Goldwasser, SVP Marketing, [email protected]

How they describe themselves: Controlabill is the only true set and forget payment service in the world. It uniquely addresses customers’ need for budgeting, discipline, organization and convenience.

Market research predicts Controlabill take up rates of up to 65% appealing to household, investor and small business segments. It leverages existing payment, billing and banking systems, minimizing cost, operational complexity and risk. Controlabill is an authority management service between customers, billers and banks, and it aggregates and manages “authorities” ensuring on-time payments. Controlabill is compatible with payment systems around the world, and has multiple paths to market through banks, billers and new media companies.

What they think makes them better: Controlabill changes how authorities are managed between customers, billers and banks. With Controlabill’s easy-to-use widget, customers capture and manage all their payment relationships with billers and banks in one place. Previously customers had to set up authorities with each biller individually – often still using paper and stamps. Controlabill improves usability of the direct payment system. Billers pull payments electronically on-time without customer involvement. Direct payment is the most cost efficient payment system for billers and banks. Without Controlabill, customers push payments, manually by checks and online bill payment services. Even with technology: onerous, manual, repetitive and time consuming.

Contacts:

Bus. Dev., Sales, & Press: Stephen Coulter, Founder, +61-40-333-8888, [email protected]

How they describe themselves: Cortera is an online source for commercial credit information and financial intelligence on over 20 million businesses of every size. The company has a 15-year track record of providing comprehensive data and innovative tools to credit and finance professionals at the most affordable prices in the industry. In 2009, Cortera created the first online community enabling everyone – from both small businesses to large organizations – to monitor, rate and exchange comments on the payment performance of virtually any business in real time.

What they think makes them better: In 2009, Cortera launched a community-based alternative to business credit reporting, combining credit data with social reviews and ratings. Building on this foundation, Cortera is now introducing hyper-local, industry or project based networks – groups with shared suppliers and trading partners – where people can share payment experiences. Cortera Circles brings the tried-and-true concept of local or industry-based credit groups to the web and to businesses historically excluded from network-based financial transparency. This introduces a focused wealth of information not available through current social networking groups or message boards, while delivering dynamic, real-time information not available through today’s credit bureaus.

Contacts:

Sales: Jeff Braunstein, VP of Sales, 561-226-9032, [email protected]

Press: Alex Coté, VP of Marketing, 857-403-1370, [email protected],

Patrick Rafter, Valuecasters, 617-901-2697, [email protected]

How they describe themselves: DebtGoal is like “Weight Watchers for debt,” a subscription service that helps consumers get out of debt faster by simply paying smarter. DebtGoal provides its members with a personalized SmartPay™ Plan to get out of debt quickly as possible. DebtGoal does this by helping members allocate interest payments more efficiently and stay on track with their plan. DebtGoal members are paying off over $1 billion in debt, and a typical member can get out of debt 16 years sooner and save $35,000 in interest.

What they think makes them better: Stress from debt affects almost half of American

households, yet remarkably there hasn’t been a healthy, consumer-friendly solution to that problem. Our research has found that for most Americans, getting out of debt isn’t about an inability to pay, but rather an inability to organize. So, we employed principles of behavioral psychology to build an online application that lets consumers organize their debt accounts and optimize their interest payments – letting them avoid debt settlement, debt consolidation, and credit counseling.

Executives: Scott Crawford, CEO (former head of Product R&D and Subscription Product

Marketing at HSBC); Igor Vaks, COO (former CIO of FreeCreditReport.com), Chris Kelly, Business Development and Marketing

Board Members: Ed Ojdana (Founder of FreeCreditReport.com), Dave Whorton (Managing

Director of Tugboat Ventures)

Contacts:

Bus. Dev. and Partnerships: Chris Kelly, [email protected]

Press: Katherine Madariaga, [email protected]

How they describe themselves: There is no One-Size-Fits-All solution for enterprise financial services applications. Different customers have diverse financial needs. Yet today, most financial services organizations are unable to translate valuable customer data into personalized user experiences. The Backbase Next-Generation Portal for Financial Services provides highly-personalized online experiences to delight customers and achieve eBusiness goals. Organizations can target branding, content, applications, and financial tools to customers based upon

How they describe themselves: BancVue is the leading provider of innovative products, marketing, and consulting solutions to community financial institutions nationwide. Kasasa is a national brand of superior products that gives community financial institutions the marketing scale they need to compete with the megabanks.

Kasasa is designed to unite community financial institutions around a powerful brand of products that give consumers something they actually want combined with the personal service of the finest neighborhood institutions. Kasasa also delivers marketing presence and scale by aggregating the marketing dollars from participating community financial institutions, and creating comprehensive, integrated, and entirely localized marketing plans for each institution.

What they think makes them better: Kasasa is the first national brand of deposit accounts for community financial institutions, delivering a powerful and unified message to consumers. Through intensive consumer research, BancVue learned that consumers believed they could only get good products and indifferent service from megabanks or good service and average products from community financial institutions. Kasasa gives consumers a reason to believe they can get both superior products and personal service. By aggregating marketing dollars and creating an integrated marketing campaign, Kasasa offers marketing support that exceeds the typical megabank’s high-budget program and truly empowers community financial institutions to compete with a national brand.

Contacts:

Biz Dev: Gabriel Krajicek, 512-418-9590, [email protected]

Sales: Jim Quinn, EVP Chief Sales Officer, 512-349-4123, [email protected]

Press: Dan Mahoney, CSG PR, 970-405-8060, [email protected]

How they describe themselves: Billeo streamlines the online transaction process by giving consumers complete control over when and how they manage, organize, pay bills and shop online. Billeo offers a one-step password log-on and one-click completion of online shopping checkout and bill payment forms. Payments and credits are instantaneous, and electronic receipts are automatically captured, categorized, saved and filed. Billeo users have shopped at over 11,000 ecommerce sites and paid bills at more than 9,200 company websites across 26 categories, including utility, wireless, insurance, cable and credit card companies.

What they think makes them better: Today, consumers have to take considerable effort to find online shopping discounts via search, bank and financial institution hosted offer malls, coupon sites or merchant e-mails. Now, Billeo’s Offer Assistant presents consumers with the latest retailer and financial institution offers within their Google, Yahoo! and Bing search results. This gives financial institutions, card issuers and online retailers the ability to market directly to the consumer in real-time, influencing both the purchase and the payment type used. In turn, Billeo gives consumers the latest available offers and discounts just when you need them and assists them from search to purchase. No other service provides this. The toolbar is free and is available at billeo.com.

Contacts:

Biz Dev & Sales: Robin O’Connell, [email protected]

Press: Julie Karbo, Partner, K/F Communications, [email protected]

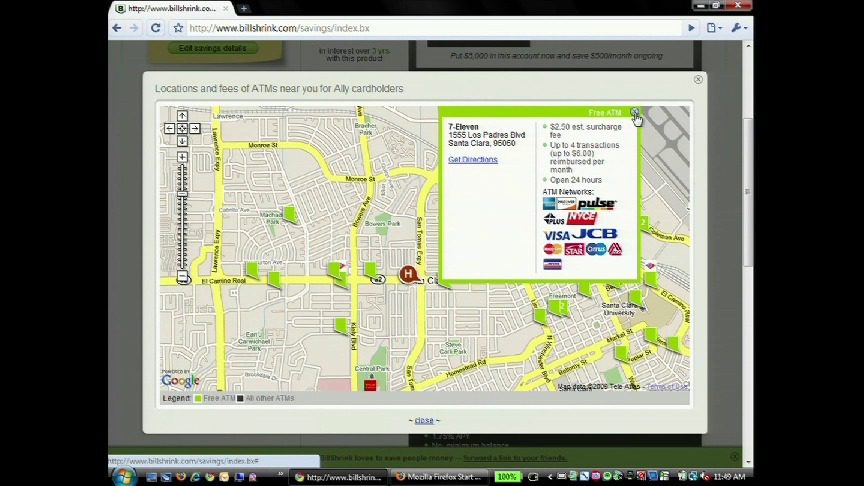

How they describe themselves: BillShrink is the free online money-saving service designed to help people lower their bills. In an era when eight in 10 Americans overpay for expenses like credit cards and wireless bills, BillShrink empowers and inspires people to become savvy shoppers by simplifying all the complex pricing structures to show what true cost of ownership means.

As one of the most sophisticated decision engines, BillShrink analyzes customers’ spending behavior and usage to reveal savings recommendations tailored to their unique needs. The company is on track to find $1 billion in savings for Americans by the end of 2009.

What they think makes them better: We believe transparency is the future of marketing. BillShrink is building an ongoing relationship with people by empowering them with personalized analysis to help them save real money. We put people’s interests first and present unbiased recommendations that are best for the user and not those that may result in lead generation for us. Sending alerts and notifications when our system finds a better deal for a user is an important part of the service.

Contacts:

Biz Dev & Sales: Peter Pham, CEO, [email protected]

Press: Taryn Langer, Group SJR, [email protected], 646-495-9721

How they describe themselves: Bling Nation provides tap and go payments at the physical point of purchase. The company enables consumers to pay merchants by tapping their mobile phone at the point of sale instead of using a credit card or cash. Financial institutions sponsor the service in their respective markets. Bling Nation offers lower costs, increased efficiency, better marketing and rewards services and improved security compared to credit cards, debit cards, checks and cash.

What they think makes them better: Bling Nation was founded in 2007 by the team that created the largest microfinance institution in Brazil and the largest alternative payment network in Brazil. Bling Nation enables consumers to use any mobile phone to pay for purchases at the point of sale. In addition to consumer convenience and instant access to coupon redemptions, merchants reduce their acceptance and banks increase income.

Contacts:

Biz Dev: Dan Rogers, CFO, [email protected]

Sales: Shannon Goldman, Head of Sales, [email protected]

Press: Joy Harper, Account Agent and Elizabeth Salter McMillan, Account Supervisor, [email protected]