How they describe themselves: Dwolla is the first and only online, mobile, and social peer-to-peer payment platform. The new cashed-based Dwolla network, which allows users to circumvent costly traditional credit card networks, leverages social communities (Facebook and Twitter) and location-based cell phone payments to disrupt the current payment industry. Dwolla also offers a tiered banking services product, called FiSync, which provides financial institutions customized synchronization of users accounts with Dwolla’s technology. When fully integrated, members of partnering institutions have seamless and instantaneous access to their account’s funds to pay for goods and services via their cell phone in real-world environments, just like cash. Dwolla transactions only cost 25 cents, regardless of how high the amount is.

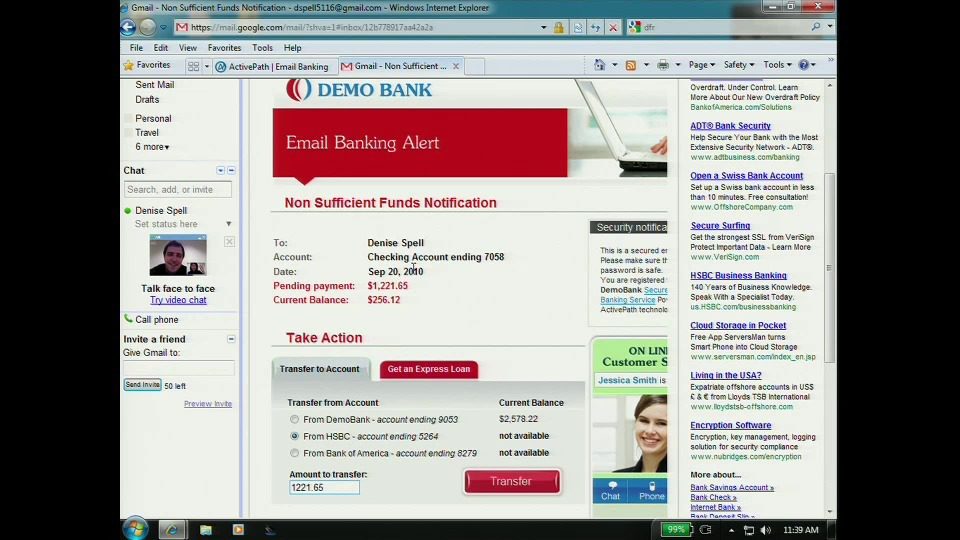

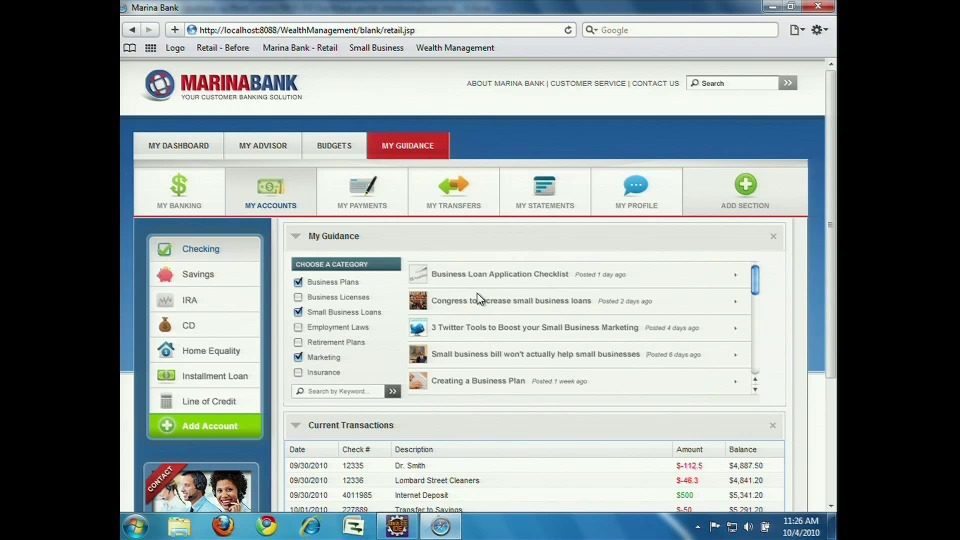

How they describe their product/innovation: Dwolla will be discussing FiSync, a new banking product for financial institutions that empowers account holders with Dwolla technologies, one of which will remove ACH wait times and allow for instant cash-based mobile payments. It’ll also be unveiling its revolutionary new data aggregator, the FiSync Dashboard. The new technology will yield unimaginable insight into consumer behavior never before available to financial institutions.

Contacts:

Bus. Dev., Sales: Charise Flynn, COO, [email protected], 515-280-1000

Press: Jordan Lampe, Communications Director, [email protected], 515-250-4616