How they describe themselves: BrightScope™, Inc. is an independent provider of 401k ratings and financial intelligence to plan sponsors, advisors, and participants in all 50 states. Our mission is to increase the retirement security of America’s workforce by bringing transparency and efficiency to the 401k plan market. We maintain a comprehensive database of information on the 401k plan market and add additional value and insight by quantitatively rating each 401k plan across critical metrics.

What they think makes them better: BrightScope has the largest private database of 401k data and analytics in the country. BrightScope is the only 401k analytics firm that is truly independent and does not accept compensation in the form of revenue sharing from mutual fund companies or plan providers. BrightScope is aligned with plan sponsors and seeks to avoid conflicts that will jeopardize its ability to give its clients unbiased advice.

Contacts:

Biz Dev, Sales and Press: Mike Alfred, CEO, [email protected]

How they describe themselves: Canopy Financial provides innovative technology solutions that power the Consumer Directed Healthcare (CDH) programs of some of the world’s largest healthcare and financial institutions.

Ranked #12 on the 2009 Inc. 500 list, Canopy powers millions of HSAs, HRAs and FSAs—enabling millions of consumers to take greater control of their healthcare dollars, providing price transparency for routine medical services, and increasing the speed in which healthcare providers are paid.

What they think makes them better: Canopy’s leading-edge Mobile CDH Application is the first and only offering of its kind in the marketplace. With millions of consumers currently using high deductible health plans (HDHPs) and health-related spending accounts, the Mobile CDH Application for Apple iPhone and iPod Touch allows consumers real-time access to information on which medical procedures are eligible for payment using tax-advantaged CDH spending accounts and the customary cost of those procedures in a local market. The Mobile CDH Application revolutionizes the healthcare industry by making healthcare and its associated costs significantly more transparent.

Contacts:

Sales: Laura Podraza, Director, Sales, [email protected], 312-288-0776

Press: Mark Hall, VP Marketing, [email protected], 609-477-3475

How they describe themselves: CashEdge is the leader in Intelligent Money Movement™ services, enabling financial institutions to provide a single point of access for multiple consumer and small business transfer capabilities including me-to-me transfers, third-party transfers, person-to-person payments and small business payments and invoicing. These transfer routes are supported by industry-leading risk management capabilities that leverage comprehensive, proprietary technology and the insights gathered from managing risk for the world’s largest financial institutions. CashEdge’s services are unmatched in depth, breadth and scalability. The company processed nearly $50 billion in online funds transfers in 2008 for its clients, which include a majority of the nation’s top banks.

What they think makes them better: POPmoney is the first and only person-to-person (P2P) payment solution for banks. POPmoney allows consumers to “Pay Other People” (POP) anywhere, at any time, requiring only a recipient’s email address, cell phone number or bank account information. This revolutionary new service is completely built around a customer’s current banking relationship and is offered directly from within the bank’s online and mobile banking applications. POPmoney enables bank customers to send and receive money directly

from their primary banking accounts – without the need to establish accounts with an independent service or manage balances outside their existing banking relationships.

Contacts:

Biz Dev & Sales: Neil Platt, [email protected]

How they describe themselves: Founded by consumer advocates and credit experts, Credit.com helps people make smarter financial decisions by providing free interactive tools, education, and unbiased comparisons of quality financial products and services. Credit affects many fundamental aspects of our lives. However, an estimated 125 million Americans can’t accurately estimate their credit scores within 50 points – often the difference between getting approved or denied for a loan or apartment. Credit.com’s mission is to change that by providing consumers with valuable tools and information that allow them to effectively manage their credit portfolio with as much attention and care as their investment portfolio.

What they think makes them better: Credit.com’s team of experts built the Credit Report Card to give consumers a completely free, unbiased, and actionable view of their credit reports, and to illustrate how their scores map to the leading credit scoring models used by lenders. It clearly shows consumers how creditors, landlords and others view them according to the five main areas that make up their credit profiles. As part of our mission to increase financial literacy, we syndicate custom versions of our credit and finance tools, widgets, news, and products to select partners who share our vision that an educated consumer is the best customer.

Contacts:

Biz Dev: Rory Holland, CMO, 415-901-1559, [email protected] or Ian Cohen, COO, 415-901-1566, [email protected]

Press: Tony Berlin, Director of Media Relations, 212-317-9179, [email protected]

How they describe themselves: Acculynk is a leading technology provider with a suite of software-only services that secure online transactions. Our flagship product, PaySecure, allows consumers to use PIN debit to pay for online purchases. PIN debit is a preferred payment method at the retail POS but is not available as an Internet payment option. PaySecure brings the safety and convenience of PIN debit online with a simple service that integrates directly into the merchant checkout and requires no consumer enrollment or redirection. Our technologies are backed by a security and encryption framework that is supported by issued and pending patents.

What they think makes them better: Acculynk is the first company in the U.S. to bring PIN debit online with a software-only service. Consumers want more security without sacrificing convenience. PaySecure provides an extra layer of authentication for online transactions using a debit card and PIN consumers already have. PaySecure is also the only alternative payment method that provides value to all payment processing constituents:

- Issuers: reduced fraud, incremental volume, attractive margins, competitive weapon against alternatives

- EFT Networks: new revenue stream, brand extension online

- Online Merchants: instant adoption, lower fees, reduced charge-backs

- Consumers: more security, greater payment choice, simple checkout experience

Contacts:

Bus. Dev.: Tom Wilkerson, VP Bus. Dev., 678-894-7012, [email protected]

Press: Danielle Duclos, Director of Marketing, 678-894-7013, [email protected]

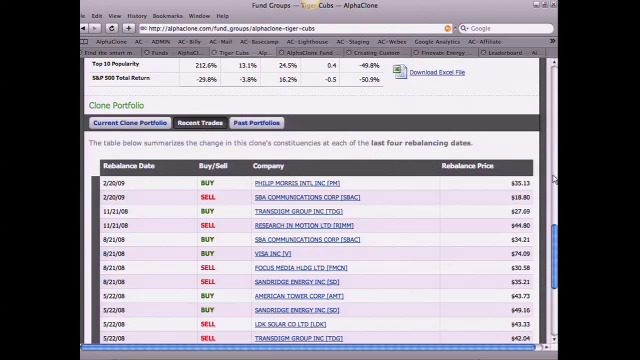

How they describe themselves: AlphaClone is a web-delivered stock research service that lets any investor replicate the performance of the world’s top fund managers. AlphaClone’s technology platform combines public disclosures and private data with proprietary algorithms to instantly create and backtest thousands of “smart money” portfolios. For example, a replicated portfolio of Warren Buffet’s top 10 holdings has outperformed the market by over 8% annually since 2000. AlphaClone’s backtests give investors the confidence to apply the stock ideas they discover because each backtest assumes investment at the time ideas are made public – a process called “cloning”. Our mission is to give investors smarter tools.

What they think makes them better: Intelligent, easy-access, cost effective tools to discover and replicate top investor performance are largely unavailable. AlphaClone is the only service that offers:

- Professional-grade backtests that avoid performance bias

- Automated algorithms that instantly derive and backtest replicated portfolios

- On-demand customization that allows users to instantly create private portfolios

- Painless discovery and tracking of top performing portfolios.

- Proprietary dataset that is expansive, quality tested and hard to replicate.

Contacts:

Bus. Dev., Sales, & Press: Maz Jadallah, Founder & CEO, 415-568-0370, [email protected]

How they describe themselves: Aradiom designs, develops and markets a broad range of secure mobile solutions based on a proprietary platform, QuickFramework™, which allows users to easily build rich mobile applications in just hours with a fully flexible interface design environment, deploy to all Java-enabled handsets, and have full control over already deployed clients by delivering, managing and updating the clients in seconds. Our vision is to provide the best and most secure mobile solutions integrated with appropriate technologies for public and private institutions to meet their increasingly complex business needs.

What they think makes them better: QuickBank, Aradiom’s flexible and feature-rich mobile banking solution, is now fully integrated with SolidPass, Aradiom’s mobile security soft token, allowing multi-factor authentication to be done from one mobile device even for mobile banking transactions. This embedded soft-token solution provides the protection against online and mobile banking fraud threats without sacrificing usability. Users can conduct banking transactions on their mobile devices securely and use the phone to generate OTPs for online banking. More than 450 mobile devices are supported, including iPhones, Windows Mobile phones and BlackBerry devices.

Contacts:

Bus. Dev.: Regina Jun, Director of Business Development, [email protected]

Sales: Michael Larsson, Director of Sales, [email protected]

Press: Michelle Bowling, Director of Marketing, [email protected]

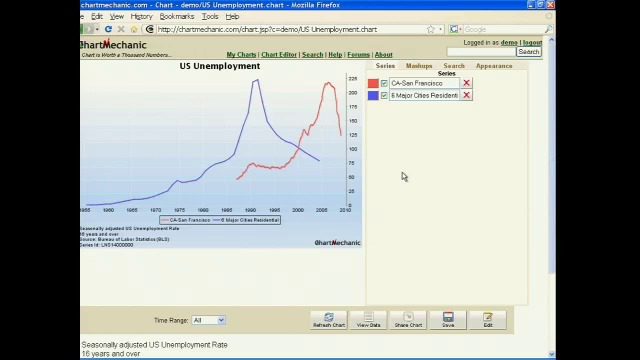

How they describe themselves: ChartMechanic lets users easily combine their own data with a broad library of public domain financial data, from sources like the Federal Reserve, the Bureau of Labor Statistics, or stock/bond prices. ChartMechanic loads data from a variety of sources, such as Microsoft Excel spreadsheets, Google Docs spreadsheets, or even HTML tables on the web. Common financial functions are built in, like adjusting for inflation or year-over-year/month-over-month changes. ChartMechanic lets users compose highly customized charts, and the data is continuously updated, making the charts suitable for financial dashboard and reporting applications.

What they think makes them better: Established financial data vendors offer very high-priced products, requiring special terminals, and often are not easily accessible to their users. ChartMechanic offers an easy-to-use data and charting service, with an intuitive web interface, at a much lower price.

Contacts:

Bus. Dev. & Sales: Jolly Chen, Founder, [email protected], 510-551-7577

Press: Dave Brown, Founder, [email protected], 415-509-2239

How they describe themselves: BillShrink is a free cost-savings tool that saves consumers money on their everyday bills. BillShrink asks users a few quick questions and then searches millions of data points to find and instantly present money-saving alternatives that match actual usage. BillShrink continues to track market changes and can provide an email alert if a better savings opportunity becomes available. Currently BillShrink helps consumers save money on Cell Phone Plans, Credit Cards, and Gas and will be rolling out more bill-saving opportunities.

What they think makes them better: In under a minute, BillShrink conducts an analysis of the consumer’s bill then instantly scans millions of possible product combinations to deliver an unbiased set of savings recommendations. Recommendations are presented in an easy to use interface, so consumers can compare service provider plans – apples-to-apples – against their actual use or needs. Billshrink automatically repeats the analysis on an ongoing basis to ensure their users are always getting the best deal. The personalized recommendations are possible because BillShrink has the largest dataset for each vertical. We monitor over 10 million wireless data points, our credit data deciphers all the points programs down to a dollar amount, and our commute-based gas savings tool factors in the cost of detouring to any station.

Contacts:

Bus. Dev., Sales & Press: Peter Pham, CEO, [email protected]

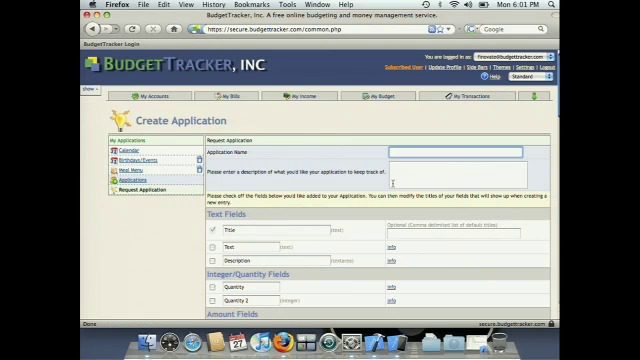

How they describe themselves:

- Money Management – The financial aspect of the site allows users to keep track of their Budget, Bills, Income, Accounts, and Transactions and tie all these together into an easy to read calendar.

- Small Business – This covers the ability to Create and send Invoice/Estimates, Tax Deductions, Expense Reporting capabilities, Income Statements, and Balance Sheets.

- Organization – Along with personal finance, BudgetTracker also gives users organization tools such as Tasks, Shopping Lists, Recipes, and more to track not only their finances but things in their daily life.

- Add-Ons – The add-ons section allows users to create their own applications. They check off the form fields and give names and the application is automatically created for them without having to write any code. In addition, each application is reviewed and if we feel it could be useful to the public, we make it available for everyone but the data remains private.

What they think makes them better: The BudgetTracker product offers the widest range of services for both end-users and small businesses alike. For small businesses, we stand out by offering the ability to track Invoices, Time Sheets, Expense Reports, Employee Accounts, Tax Deduction capabilities, Income Statements, and Balance Sheets. All of these services are tied in with a complete Money Management tool that allows regular users to manage their personal finances from any Internet connection. We’ve also come up with a way to allow users to create their own applications allowing them to track anything they can think of. While other companies specialize in only a few of these fields, BudgetTracker offers a complete package.

Contacts:

Bus. Dev., Sales and Press: Kyle Kirman, 425-444-2332, [email protected]

How they describe themselves: CalendarBudget is a unique online personal finance organizer combined with a powerful planning tool. Easily embedded into and branded for an existing web site, CalendarBudget presents your financial data in an easy to use calendar interface. Your account balance is shown at the top of every day in the past, present and future. Your bills and spending are shown in the context of all other transactions. With CalendarBudget, planning for future purchases and avoiding surprises such as overdraft and bounced checks is easy. Category budgets, along with charts, reports and reminders make planning your future easy and even enjoyable.

What they think makes them better: CalendarBudget stands out for two reasons: the interface and planning your future. First, CalendarBudget’s main view is a calendar. Everyone already knows how to use a calendar. There’s no strange proprietary interface to learn how to use, so you are immediately comfortable and productive with the tool. Second, because we are a calendar, you can move forward into the future and see what your account balance is going to be like, according to your spending habits and plan. Where other tools simply analyze historical data, CalendarBudget helps you plan your future spending so you can live within your means.

Contacts:

Bus. Dev.: Robin Poulin, 905-434-4927, [email protected]

Sales: Gavin Bourne, 717-659-4851, [email protected]

Press: Kristen Keller, 609-644-4896, [email protected]

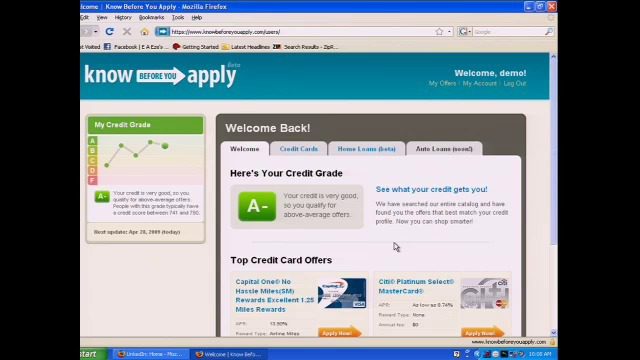

How they describe themselves: Centrro, with its KnowBeforeYouApply service, helps consumers find financial products (such as credit cards, mortgages and other personal finance services) that match their credit risk profile. This is a $4 billion annual online financial services advertising market with 154 million online, credit-active consumers. KnowBeforeYouApply targets this market with a free service for consumers to know which loan products they would qualify for before ever applying. Also, we track consumers’ credit grades over time, and make relevant and timely recommendations that benefit their unique situation. KnowBeforeYouApply saves consumers time and money, and significantly improves lender approval rates and lowers rejection costs.

What they think makes them better: KnowBeforeYouApply can tell a consumer what they would be approved for before they ever apply. This can substantially increase the lead match rate from less than 15% to 80%. Unlike competitors, we access consumer credit reports and scores in real-time (without affecting their FICO grades), and use a proprietary credit accessing and matching engine to perform sophisticated pairings using lender-supplied guidelines. Unlike lead generation firms, our consumers completely control who they are ultimately paired with. KnowBeforeYouApply also tracks a consumer’s credit grade for free over time while comparable services charge the consumer more than $100 per year.

Contacts:

Bus. Dev.: Matt Murray, [email protected], 408-499-3076

Press: Ike Eze, [email protected], 510-384-7900

Sales: Tuyen N. Vo, [email protected], 510-269-4199