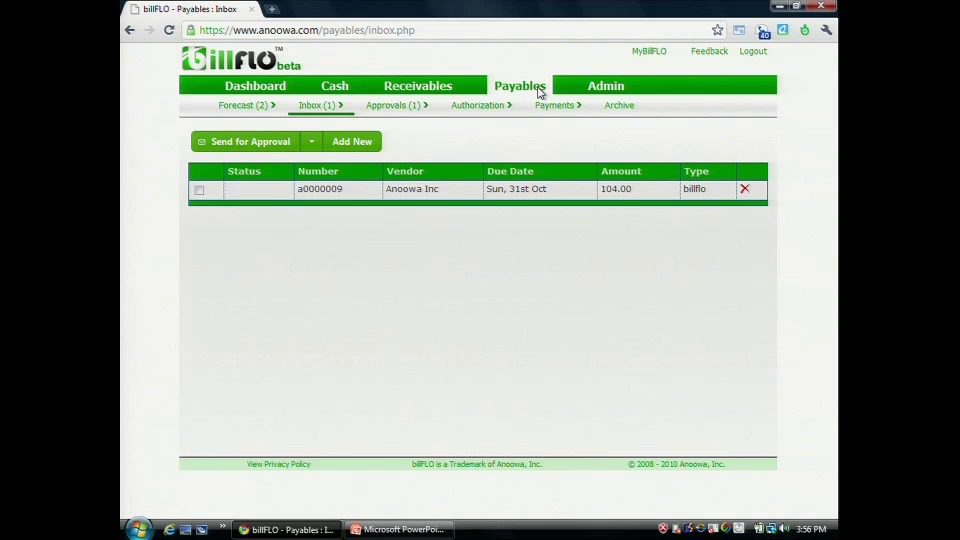

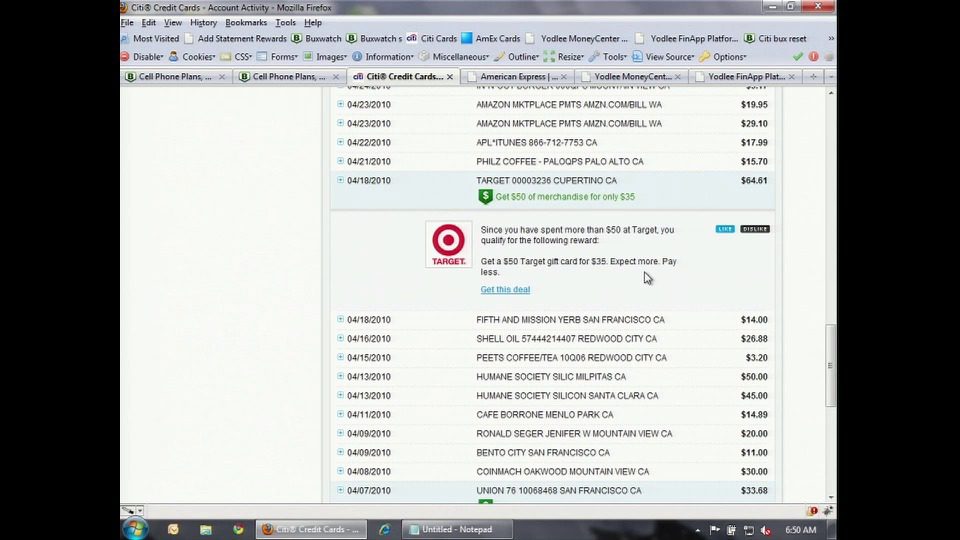

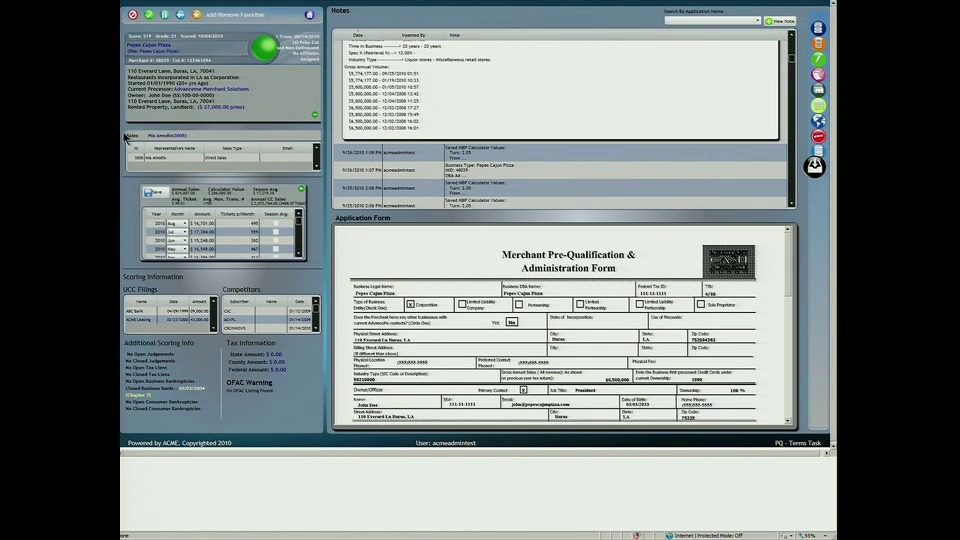

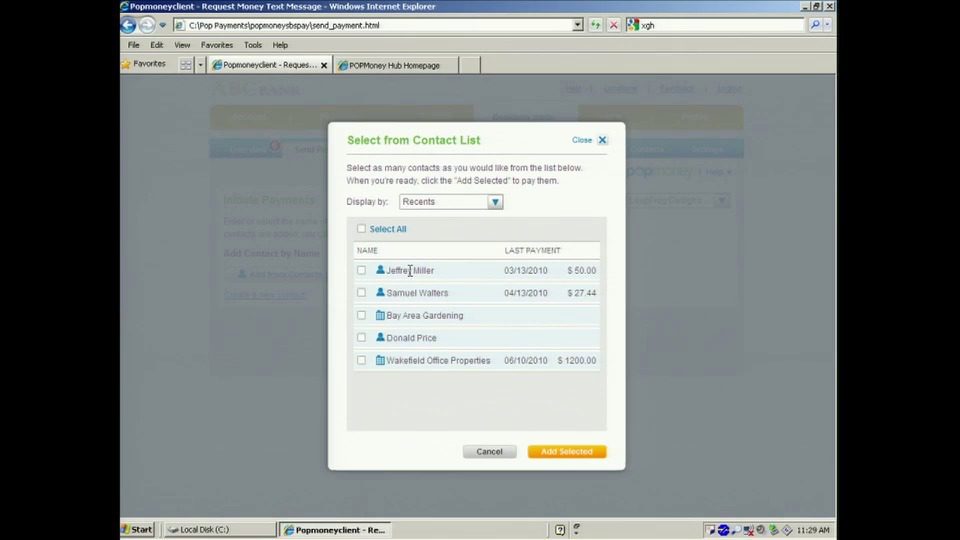

How they describe themselves: BillFLO measures the real-time financial pulse of small businesses to answer the questions that owners most want to know: Exactly how much money do we owe today and to whom? When will we get paid? Are our actions today going to make us money tomorrow? BillFLO streamlines the accounts payable and accounts receivable process by providing a single electronic platform for sending and receiving invoices, tracking expense reports, and integrating with various accounting systems. Combining a simple user interface with sophisticated automation technology, billFLO helps small businesses eliminate the paper from these processes and monitor their expense, income and cash balance in real-time.

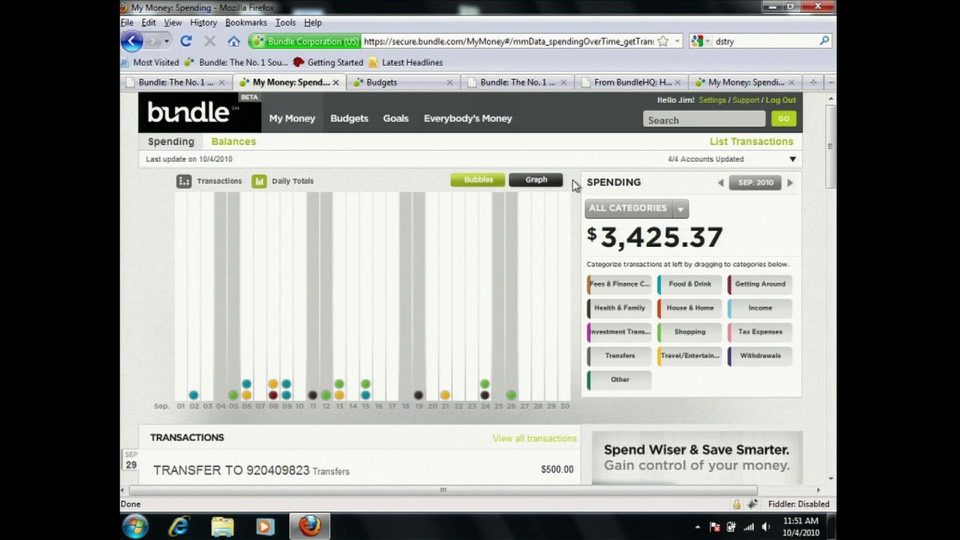

What they think makes them better: Every month, small businesses invest countless hours tracking expense reports, gathering up paper invoices, and pursuing the status of customer payments. Because their accounting systems just provide historical data, businesses must engage in a never-ending paper chase as they attempt to build an accurate picture of their current and projected cash-flow. Using proprietary technologies, billFLO automates the data-gathering process and uses this information to provide a forward-looking, dashboard view of cash flow for small businesses. BillFLO empowers owners to take action before, not after, cash-flow issues arise.

billFLO also increases productivity by integrating with Gmail, smart-phones and popular accounting systems to ensure seamless flow of the expense report, bill and invoice data through image capture, approval and ultimately into the accounting system.

Contacts:

Bus. Dev. & Sales: Ian Sweeney, CEO, [email protected], (510) 339-1690

Press: Debbie Pfeifer, [email protected], (206) 669-3580