GreenAddress is a leader in securing bitcoins and providing instant clearing confirmations. It supports desktop, mobile and web apps and offers a very featureful and secure wallet as well as APIs to enable third party developers.

Presentation

GreenAddress: Instant and Secure Bitcoin

The presentation is introducing bitcoin’s multisignature features. These features allow users to radically improve the security of bitcoin wallets, as well as create new services like instant confirmation allowing for faster arbitration between exchanges.

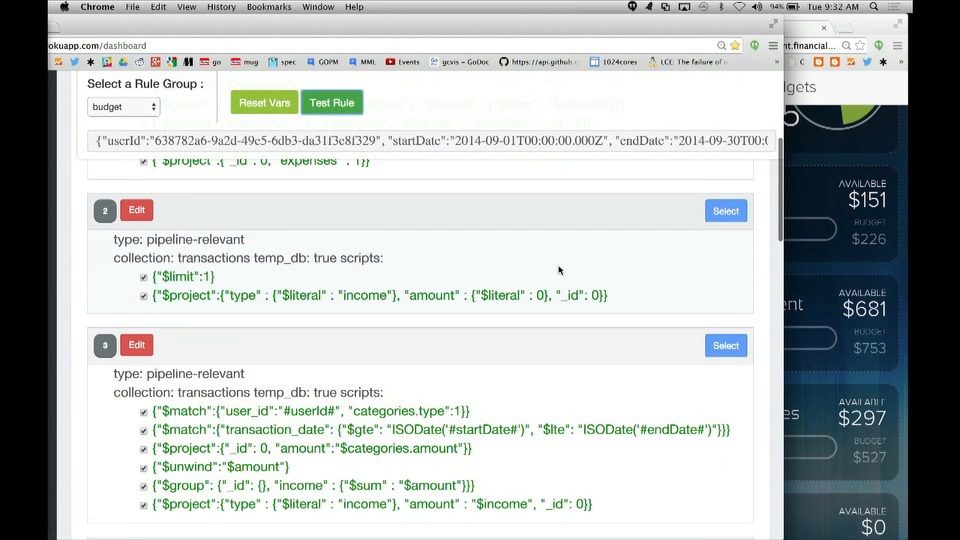

Financial Apps provides a suite of developer tools and API access for financial account and transactional data. Our solutions help to quickly build the next generation FinApp. The Financial Apps Relevancy Engine helps make data actionable, providing a comprehensive solution for Fintech development.

Presentation

Driving the Data to Action

Detailed financial data is the “Big Data” we all want to work with. In this presentation, Financial Apps shows how its Platform and Relevancy Engine enables developers to access, consume and integrate consumer financial data within their solutions.

Workshop

Get Relevant: Driving Data to Action

The Financial Apps Platform simplifies the way developers build, manage, and scale their applications’ transaction driven components. In this workshop, we demystify the process of transforming financial data into relevant solutions that can directly consumed by your applications. Learn how to:

- Connect to financial data using Financial Apps’ easy to use RESTful based JSON API and developer libraries

- Construct complex data aggregations in minutes using Boolean logic with the FA Relevancy Engine Interface

- Executed and deliver new datasets at run time speed and make schema changes without system interruptions

- Create queries and rules that analyze your data and deliver actionable results and alerts

Contacts:

Bob Sullivan, President: [email protected], 954-325-2102

Bill Kennedy, Chief Scientist: [email protected], 305-527-3353

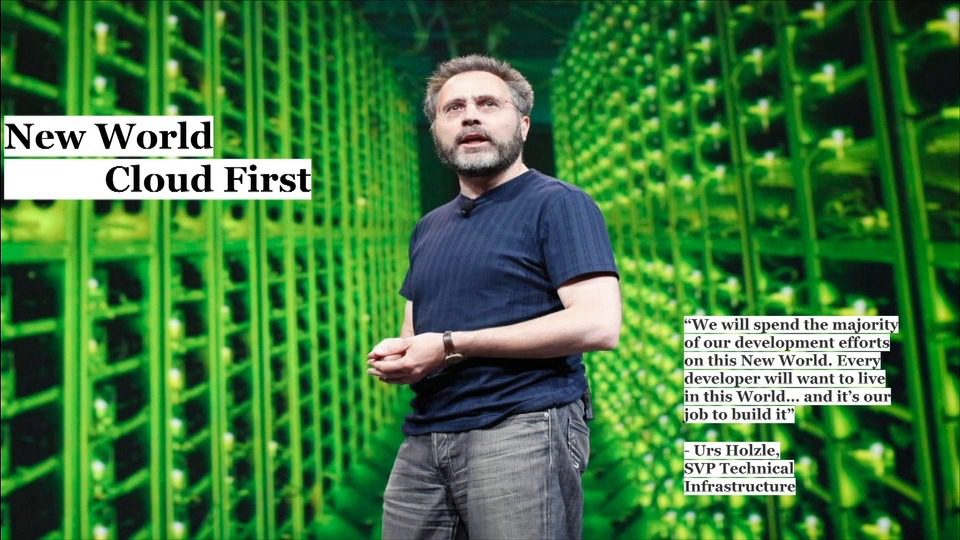

Google Cloud Platform enables developers to build, test and deploy applications on Google’s highly scalable and reliable infrastructure. This suite of services allows developers to choose from computing, storage and application services for web, mobile and backend solutions.

Presentation

Big Data on Google

Google has been the most innovative Big Data company in the World, having paved the way for highly distributed parallelized workflows. Technologies like Hadoop, Flume, Dremel, and HBase were made possible by Google’s research and development efforts. Now Google is outsourcing its own Big Data secret.

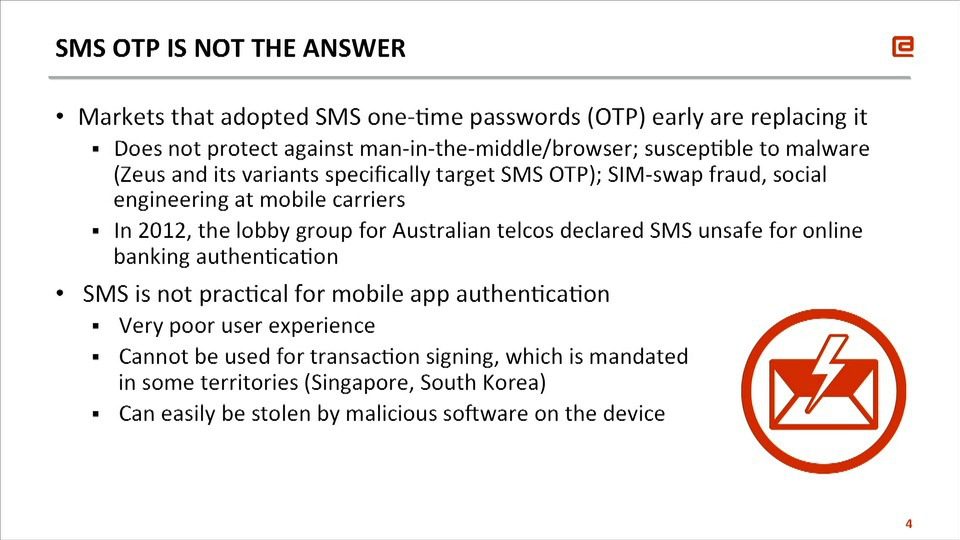

An innovator in transaction authentication and mobile app security. Our one-of-a-kind approach harnesses the power of electronic certificate technology with the convenience of mobile phones providing financial institutions and their customers with full protection from online and mobile banking fraud.

Presentation

Securing Mobile Applications Through Transport Layer Diversity

Mobile security is becoming increasingly important as more functionality is shifting to these devices. But how do we ensure the integrity of the phone and the server we’re connecting to? This is a common problem and has been addressed by recommending out-of-band authentication schemes.

Eshta develops and operates Eshtapay as a financial platform that can act as an online payment system, e-wallet, escrow system, and self-service payment terminal back-end. Eshtapay (due to its very flexible architecture) is a Swiss-Army knife for the online banked and unbanked alike.

Presentation

Eshtapay: The Financial Swiss-Army Knife

Eshtapay is directly operated in Ukraine and Egypt and also used online from Dubai to France to power self-service payment kiosks, service vending machines, service marketplaces, and ATMs. With less than 6 months time to market for deployment, Eshtapay exhibits remarkable versatility and efficiency.

Workshop

Eshtapay: 80M People Market Case Study

Eshta CEO Catalin Braescu is offering a detailed break down of the customization and deployment of Eshtapay for the 80-million-person Egyptian market. Expect a colorful presentation, Indiana Jones situations, breakneck deadlines, and a Hollywood happy ending!

Forte Payment Systems empowers developers to build secure and innovative electronic payment solutions for all platforms whether online, at a physical POS or on the road. Able to provide the modern, robust and powerful options that large companies demand, along with the ease of use, simplicity and affordability for the smallest of operations, Forte redefines the notion of flexibility and scalability.

Presentation

Professional Payments Made Easy: Developer to Developer

Enable payments into your application with Forte’s full range of enterprise-class services. Our modern and professional RESTful APIs have been implemented to simplify integrations, yet keep power and flexibility for developers to build massively scalable and distributed payment-enabled solutions.

Workshop

Forte Payment APIs – Deep Dive

This hands-on workshop is focused on integration using Forte.js, Forte Checkout and Forte’s REST-based APIs. We also discussed our SDKs, which make integration using today’s most popular development languages and mobile OS a snap.

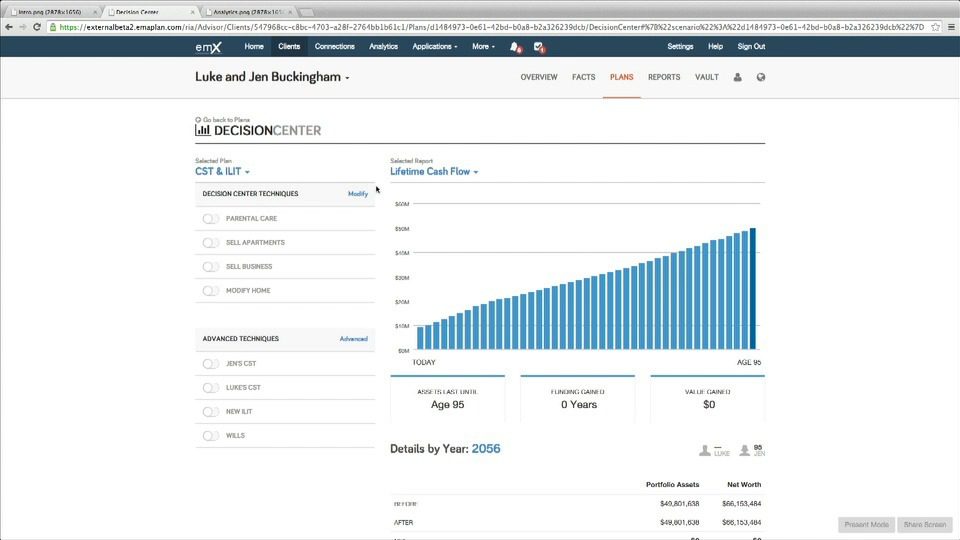

How they describe themselves: eMoney Advisor, based in Conshohocken, PA, is the leading wealth-planning system for financial advisors. A technology envisioned and created by advisors for advisors, eMoney’s award-winning “software” is bigger than the term suggests — it’s a way of doing business. Tailored to transform an advisor’s ability to deliver expertise, eMoney is the silent partner in the practice of more than 20,000 of the industry’s top financial professionals, helping them leverage technology to gain new assets, strengthen client relationships, and compete on a whole new level. Driven to lead through innovation, eMoney is committed to positioning its advisors for greater success.

How they describe their product/innovation: Smarter, faster, friendly, and easier to use, EMX is the next generation of the eMoney Advisor experience. While we’ve always led the pack in financial planning, we’ve stepped up our game, creating a platform for an unparalleled interactive experience for advisors and their clients, improving efficiency with new integrations and better connections. And with robust analytics and a more intuitive interface, EMX empowers our advisors to maximize the potential of their book of business. Learning from over 14 years of experience and feedback from more than 20,000 advisors, with EMX, we’ve built the ultimate wealth-management solution that will redefine success in an advisor’s business.

Product distribution strategy: Direct to Business (B2B), through financial institutions, licensed

Contacts:

Bus. Dev.: Kyle, Wharton, Bus. Dev. Director, [email protected]

Press: Kelly Waltrich, Communications Director, [email protected]

Sales: Drew DiMarino, SVP Sales, [email protected]

How they describe themselves: At HedgeCoVest, we believe the next generation of alternative investments has arrived. HedgeCoVest has created an online marketplace for today’s investors who are searching for smarter, more transparent, and secure options to allocate to hedge funds. Through our technology, we are able to offer clients the benefits of traditional hedge fund investments, without many of the risks associated with commingled investments. Our solution is designed to put our clients in control of their assets and investments and lower minimum investment requirements with simple flat fees.

How they describe their product/innovation: HedgeCoVest is an investment tool allowing you to mirror hedge fund investments in your own brokerage account. Using HedgeCoVest, you can research hedge funds, their risk/return profile, management team and more. Then, when you find a fund to mirror, you can allocate with the click of a button. Our proprietary trading technology, the Replicazor, sees hedge fund portfolios and duplicates them in your account in real time. Anytime your chosen fund makes a trade, the Replicazor will make a corresponding trade for you within milliseconds. No guesswork, no investing based on outdated reports. One-to-one tracking of real hedge funds.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed

Contacts:

Bus. Dev. & Sales: Alex Smith-Ryland, 561-835-8690

Press: David Schroeder, 561-835-8690

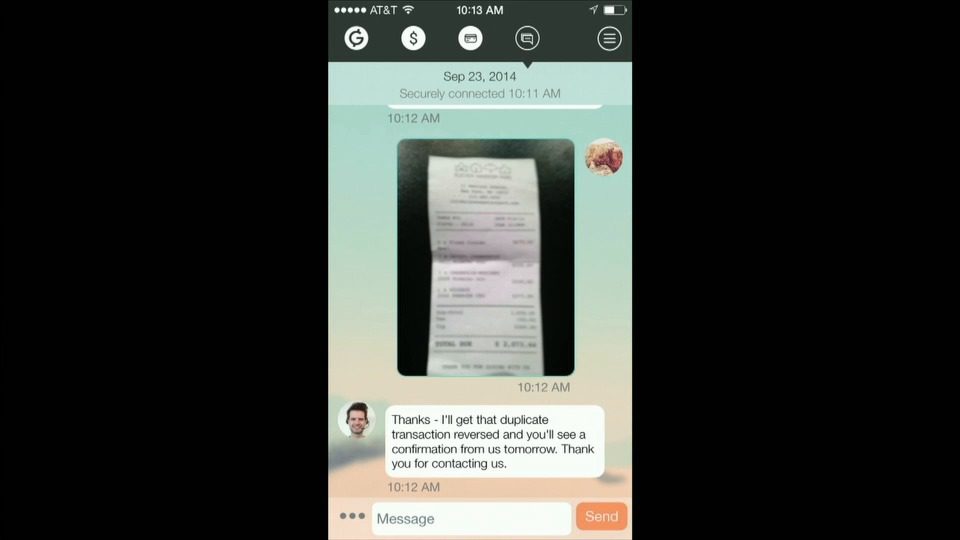

How they describe themselves: Fiserv (NASDAQ: FISV) is a leading global provider of information management and electronic commerce systems for the financial services industry, providing integrated technology and services that create value and results for our clients. Fiserv drives innovations that transform experiences for more than 14,500 clients worldwide.

How they describe their product/innovation: Fiserv is demonstrating what next generation customer-to-bank interactions will look like, particularly in a mobile-first world. The ‘App of the Future’ innovation based on the Mobiliti™ platform assembles three distinct consumer interaction methods – Live Chat, Secure Mailbox & Messaging, and Click-to-Call – and makes them contextual (i.e. providing context information to the representative of the bank as part of the interaction). All inside the mobile banking application.

This innovation has a number of benefits to consumers and financial institutions, including: increased efficiencies of interactions, more secure than various existing authentication methods, and portrays the banks’ brand as helpful, modern, and compelling.

Product distribution strategy: Direct to Business (B2B), through financial institutions

Contacts:

Bus. Dev.: Kelly Rodriguez, VP Strategy & Bus. Dev., [email protected], 678-375-1095

Press: Ann Cave, PR Director, [email protected]

Sales: Joe Christenson, VP Sales Mobile Solutions, [email protected], 210-378-0893

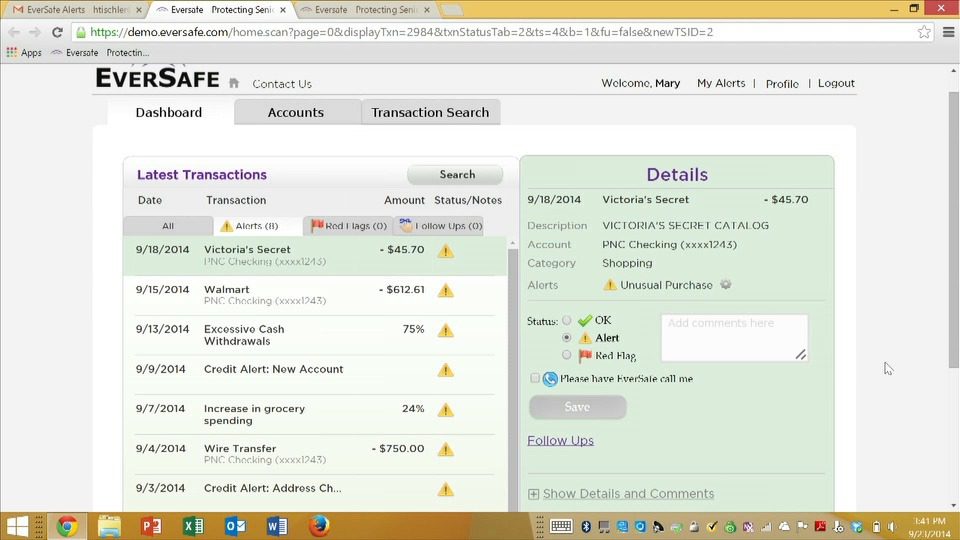

How they describe themselves: The financial abuse of older Americans is a growing epidemic costing seniors billions of dollars annually. EverSafe is the first technology-based solution to address this challenging problem. Founded by financial services and credit management industry veteran Howard Tischler — whose mother was a victim of elder financial abuse — EverSafe scans financial accounts, credit cards, and credit report activity daily, alerting members of suspicious activity. A proactive financial defense network, EverSafe protects seniors against financial abuse.

How they describe their product/innovation: EverSafe applies technology to combat elder financial exploitation. The service reviews the senior’s financial transactions and credit report activity daily and if suspicious activity is detected, an alert is sent immediately. EverSafe’s sophisticated software employs a set of rules developed specifically for seniors to comb every transaction looking for abnormalities, including unexpected patterns in spending, deposits, and withdrawals. If suspicious activity is confirmed, the resolution process begins. EverSafe tracks the remediation plan and sends follow ups to help curtail further financial exposure.

Product distribution strategy: Direct to Consumer (B2C), through financial institutions

Contacts:

Bus. Dev. & Sales: Howard L. Tischler, Founder & CEO, [email protected],

410-343-9674

Press: Christopher Grover, VP Marketing, [email protected], 301-482-0277

How they describe themselves: Founded in 2006, Geezeo is a leading Personal Financial Management (PFM) solutions provider for financial institutions. We help banks and credit unions engage their base, leverage data, reach new market segments, and increase wallet share though our PFM solution and integrated Engagement Banking Marketing Platform. Our API takes this a step further, and allows best-in-class service providers to leverage the features and benefits of PFM via just about any channel. We’re excited to take what we learned from the consumer PFM market and apply our knowledge in a way that FIs can better support the needs of small and mid-size businesses.

How they describe their product/innovation: Small and middle market businesses represent critical markets for FIs. TruBusiness is a white label business financial management tool that helps FIs better engage the market. At the same time, the tool offers robust online financial management to business banking clients, offering business customers and FIs predictive insight and capability beyond the expected.

Product distribution strategy: Like all Geezeo products, we expect our business financial management solution will be offered to financial institutions directly and via channel partners through other fintech companies with a keen interest in the small to mid-size business banking market.

Contacts:

Bus. Dev.: Pete Glyman, President, 866-876-3654

Press: Bryan Clagett, CMO, 757-243-3453

Sales: Steve Nigri, VP, 866-876-3654

How they describe themselves: EyeLock, a leader in iris authentication, provides the highest level of security with EyeLock ID. The company’s proprietary, embeddable technology enables convenient, secure authentication of individuals across physical and logical environments. EyeLock’s software has been integrated across consumer and enterprise platforms, eliminating the need for PINs and passwords. No two irises are alike, and outside DNA, iris is the most accurate human identifier. Corporations across the Fortune 500 recognize the level of security EyeLock provides due to its FAR, ease of use, and scalability. As a sponsor member of the FIDO Alliance, EyeLock is dedicated to providing digital privacy security.

How they describe their product/innovation: Never type a password again— myris is a USB powered Iris Identity Authenticator that grants you access to your digital world.

myris uses patented technology to convert your individual iris characteristics to a code unique only to you, then matches your encrypted code to grant access to your PCs, e-commerce sites, applications, and data – all in less than 1 second.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through other fintech companies and platforms

Contacts:

Bus. Dev.: Anthony Antolino, CMO & Bus. Dev., [email protected]

Press: Jeanne Templeton, Weber Shandwick, [email protected]

Sales: Darlene Crumbaugh, VP Financial Services, [email protected]