How they describe themselves: Consumers are clamoring for better budgeting solutions. Just look at the 59% of prepaid cards used by banked consumers “to help them budget and control spending” – the number one reason they use prepaid cards.

OnBudget strongly monetizes the budgeting process, creating a uniquely profitable prepaid product for OnBudget and banking partners who license the OnBudget platform. Completely fee-free to users, OnBudget works as a companion to their bank accounts. Setup is effortless, spending is tracked in real time, instant transfers ensure a seamless experience, and the extremely simple and deeply insightful UI encourages habit-forming, long-term use. Plus, OnBudget helps partnering financial institutions recover critical, lost post-Durbin revenues.

How they describe their product/innovation: OnBudget combines a free, simple-to-use app with a free (& totally fee-free) household Budget Card that links to a user’s checking or savings account. Users effortlessly set up and manage budgets, track spending and view spending trends in real time by category. The OnBudget solution eliminates tedious data entry, inaccurate categorization and transaction reporting delays associated with other budgeting and personal financial management solutions. The OnBudget platform analyzes transactions, identifies trends and interacts with users in real time, becoming an instant virtual “envelope budgeting system” that helps banked consumers manage daily living expenses. It’s uncomplicated, intuitive, real time, habit-forming and, best of all, totally free.

Product Distribution Strategy: Direct to Consumer (B2C), through financial institutions, licensed

Contacts:

Bus. Dev.: Jim Collas, CEO & President, [email protected]

Press: Sunny Zobel, PR, [email protected]

Sales: Mike Corrales, VP Marketing, [email protected]

How they describe themselves: Ondot brings together executives from mobile, security, and payment card industries that share a vision of transforming how consumers interact with their financial institutions. Ondot is the creator of Mobile Card Services, a solution that enables financial institutions and their card processors to deliver a new category of proactive control and interactive services to consumers.

How they describe their product/innovation: Ondot empowers cardholders to remotely control their existing credit and debit cards from a smartphone app. Cardholders can lock or unlock their cards, set usage controls by location, merchants, transaction types, and spend limits, and receive and respond instantly to alerts and offers. Ondot’s customers have reduced fraud costs by 60%, increased card revenue by 50%, and gained market share in high-growth consumer segments.

Product Distribution Strategy: Through financial institutions, through other fintech companies and platforms

Contacts:

Bus. Dev. & Sales: [email protected]

Press: [email protected]

How they describe themselves: Some finance professionals (e.g., traders) can make decisions alone. Many other advisory professionals need to convince their clients of the merits of a trade or deal. They are selling an idea and these ideas are physically represented by pitchbooks. Pellucid Analytics is revolutionizing both senior and junior advisory professional workflows. Junior advisory professionals are freed from spreadsheet, data, and chart wrangling. Senior advisory professionals have immediate visual access to a broad and deep chart gallery to support ideation, hypothesis testing, and narrative construction.

How they describe their product/innovation: Pellucid fixes pitchbook creation. It is a tablet and browser-based product tailored to the needs of advisory professionals that compresses the time required to perform a broad range of pitchbook-related activities from days to seconds. Rather than collecting data, running analytics, designing charts, and formatting slides, Pellucid users leverage a large gallery of print-ready charts populated with current data and formatted to firm-specific branding standards. Assembling such charts into a pitchbook is a simple drag-and-drop exercise. As a result, users can focus on applying judgment to information and crafting a compelling message directly relevant to their clients.

Product Distribution Strategy: Direct to Business (B2B), licensed

Contacts:

Bus. Dev., Press & Sales: Brett Crockett, COO, [email protected], 720-336-5150

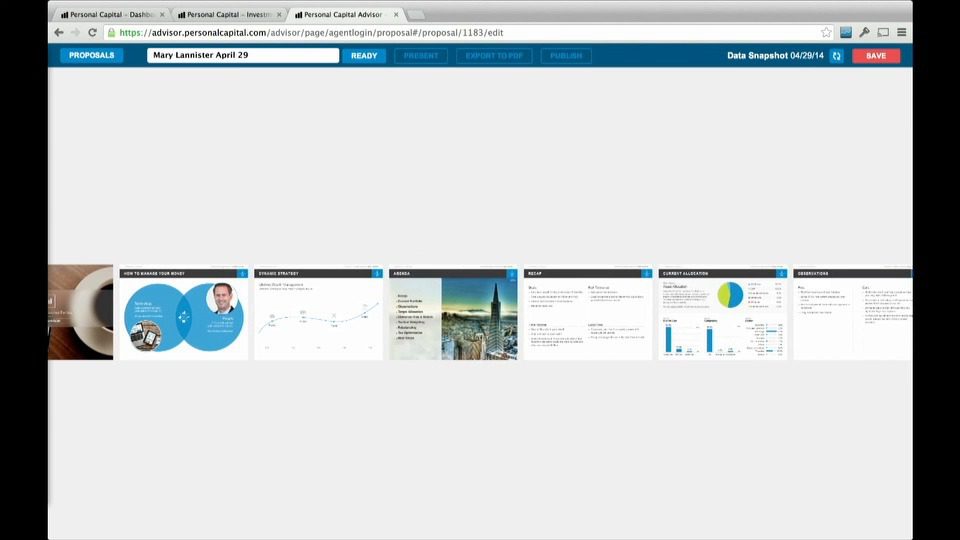

How they describe themselves: Personal Capital’s mission is to help people live better financial lives. We’ve built powerful web and mobile aggregation software that enables our users to view all of their accounts in one place. In addition, we combine high tech and high touch to deliver financial planning and investment portfolio management services. Our investment clients work one-on-one with an individual Personal Capital advisor to develop personalized strategies to meet their financial goals. We’re democratizing access to great advice and disrupting the $10T wealth management market in the process.

How they describe their product/innovation: Traditional financial advisors have to manually collect, process, calculate, and report back on a prospect’s financial situation to generate a strategy for presentation. Personal Capital combines its award winning account aggregation and customer-facing user interface with a back office that allows our financial advisors to generate 90% of a proposal with one click, saving hundreds of advisor hours per month and allowing us to make our service both more personal and scalable. Once the proposal is created, the advisor can present and drive the discussion through our own remote sharing capability, viewable on any device.

Product Distribution Strategy: Direct to Consumer (B2C)

Contacts:

Bus. Dev. & Press: Catha Mullen, Bus. Dev. Manager, [email protected],

415-547-8318

Sales: Jeff Davis, Director of Advisory Sales, [email protected], 415-800-6004

How they describe themselves: Pixeliris is a company with services in the area of technology marketing. The company started 15 years ago proposing audio software and has been expanding ever since with services and research in the area of digital development.

Pixeliris Labs is Pixeliris’ R&D laboratory that has been working over the past five years on different high-tech technologies including contactless communication protocols between smart devices. This research has resulted in several patents in the area of sonic and ultrasonic communication between smart devices.

How they describe their product/innovation: CopSonic is the first universal contactless mobile payment system powered by our unique technology. It is based on sonic communication transiting through the devices’ speakers and microphones. Therefore, our technology is compatible with 100% of existing phones and smartphones, unlike NFC technologies. Several patents have been filed with regard to the security of the transaction.

Our technology allows peer-to-peer transactions between feature phones and smartphones but also enables online passwordless authentication turning the devices into security dongles.

We developed an SDK that allows third-party companies to integrate the modules and, therefore, create a business model based on transaction fees or licenses.

Product Distribution Strategy: Direct to Business (B2B), through other fintech companies and platforms, licensed

Contacts:

Bus. Dev. & Press: Brian Roeten, Senior Project Manager, [email protected]

Sales: Christian Ruiz, Marketing Director, [email protected]

How they describe themselves: International banking group PrivatBank serves over 20 million corporate and individual сustomers in Ukraine, Latvia, Portugal, Italy, Cyprus, and Georgia. PrivatBank is the leader of the Ukrainian banking sector and one of the largest issuers and acquirers of payment cards in Eastern Europe. It is one of the most innovative banks in the world.

How they describe their product/innovation: Topless Android ATM is an ATM without an unnecessary TOP. It is equipped with an Android phone with an NFC chip, Raspberry Pi, cash dispenser, and safe. The ATM has minimum electronics and no keypad or buttons and is controlled by customers’ smartphones.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions

How they describe themselves: Matchi is a privately funded company, headquartered in Hong Kong and has a global banking client base that includes UBS, Bank of Queensland (Australia), Sberbank Labs Russia, American Express, OCBC Bank Singapore, Bank Respublika Azerbaijan, Standard Chartered (Global HQ) and Standard Chartered Bank Singapore.

How they describe their product/innovation: Matchi is an Innovation Matchmaking platform for banks and innovators to establish collaborative relationships that deliver increased return on investment for innovators and banks alike. Matchi is here to open persuasive channels of communication so that both sides can benefit from the relationship.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B)

Contacts:

Press & Sales: Philippa Newnes, Director, [email protected], +61 401 915 153

How they describe themselves: Meniga offers white-label mobile and web-based Personal Finance Management (PFM) and next generation online banking solutions to retail banks. To achieve true mass appeal and reach even people who usually avoid facing their finances, Meniga uses social curiosity, humor, and gaming concepts to engage users to think about their money.

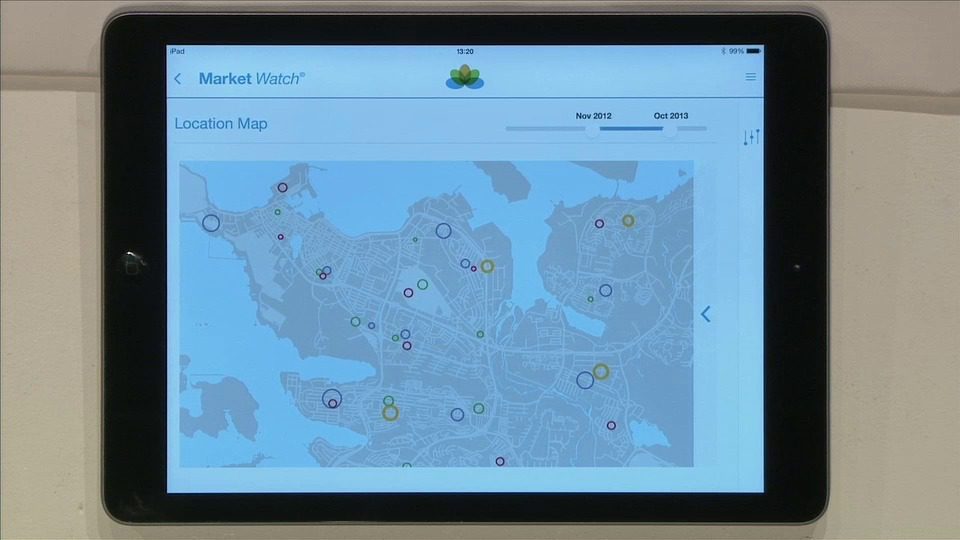

How they describe their product/innovation: The MarketWatch offers Financial Institutions a unique way to analyze financial data that lives within their systems. Complementary to Meniga‘s PFM Solution, the MarketWatch enriches the transactional data and is a real-time, transaction-based analytics platform for industry-specific market intelligence and reporting. The superior market intelligence provided by the MarketWatch can be offered by banks to retailers for competitive analysis or to improve tactical decision making thereby creating a new revenue stream.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions

Contacts:

Bus. Dev. & Press: Georg Ludviksson, CEO, [email protected], +46 767822146

Sales: Duena Blomstrom, VP Sales, [email protected], +46 708620578

How they describe themselves: Misys Digital Channels (formerly IND Group) is a digital banking, PFM and payments technology software vendor for financial institutions. Focusing on customer experience, our goal is to evolve e-banking technology to web 2.0, turning it into a sales and customer engagement platform. Our unique innovations and multichannel products support banks’ in-development needs caused by the economic slowdown.

How they describe their product/innovation: To adapt to younger generations’ requirements, Misys delivers a best-in-class banking app with an innovative drive. With Misys BankFusion Digital: Mobile Banking, all services are only a few taps away – anytime, anywhere. Mobile banking has never been so comfortable and easy, yet secure. The application offers more than just transactional banking: based on customers’ life situations banks are able to deliver personal, targeted offers, turn data into relevant, visualized information, and provide a user experience like never before, turning mobile banking into their primary engagement and sales channel.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed

Contacts:

Bus. Dev. & Sales: József Nyíri, Director of Innovation, Misys Labs, [email protected]

Press: Viktor Bálint, Head of Marketing, Digital Channels, [email protected]

How they describe themselves: We operate a mobile payment service that offers universal access while being totally independent from credit cards and telcos.

On the front-end, we offer an application for smartphones and a voice service for dumbphones. No special equipment is required from customers or from merchants. Integration in cash registers and vending machines is quick and easy.

For the back-end:

- In OECD countries, we connect directly with bank accounts towards real-time transactions, thereby slashing costs and risks and improving the user experience.

- In unbanked or underbanked countries, we aim to build and operate a national e-cash infrastructure on behalf of the central bank, instead of fighting with local money transfer services.

How they describe their product/innovation: The new Mobino app delivers superior convenience for customers with a seamless integration of many payment scenarios:

- Peer-to-peer money transfer

- Payment for goods and services in shops

- POS and cash register integration

- Quicker and safer e-commerce payments

- Fluid payment flow for mobile commerce

- Cheap and efficient international remittances

- Registration and KYC process for unbanked

- Cash-in/out operations at agents and ATMs

We are looking for distribution partners and investors to expand our reach in Europe and worldwide.

How they describe themselves: Money on Toast is part of CPN Investment Management, a discretionary fund manager and advisory service that has been operating throughout the UK since 1986. Money on Toast was founded by Charlie Nicholls, a young entrepreneur who spotted an opportunity to provide advice to the millions of clients who had been abandoned by other financial institutions as a result of RDR.

Money on Toast aims to revolutionise the financial services industry, providing an innovative way for consumers to receive FCA regulated financial advice online on a wide range of financial services products such as ISAs, pensions and protection policies.

How they describe their product/innovation: Money on Toast delivers independent and whole of the market FCA-regulated financial advice online via an algorithm-powered adviser, Doughbot. Clients can obtain advice on investments, pre and at-retirement planning, protection and inheritance tax.

How it works: The online system guides the customer through a series of questions, assessing a number of different factors just as a human adviser would. Doughbot then produces a comprehensive electronic suitability report detailing what has been recommended, which is emailed to the client. Clients can then click through and buy these products directly online. All interactions are electronically tracked, providing a complete compliance trail.

Product Distribution Strategy: Direct to Consumer (B2C), through financial institutions

Contacts:

Bus. Dev.: Kay Ovenden, Business Development Director, [email protected],

01243 819101

Press: Catharine Dodd, Project Manager, [email protected], 01243 819101

Sales: Charlie Nicholls, Founder & Managing Partner, [email protected], 01243 819101

How they describe themselves: We are MyOrder. We empower and delight our customers by delivering confidence and convenience to their shopping experience.

How they describe their product/innovation: The smartest way to spend, connect, shop, browse and have fun.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B), international distribution strategy through partners (FIƒ??s, other FinTech companies, etc.)

Contacts:

Bus. Dev.: Gertjan Rösken, CTO, [email protected]

Press & Sales: Thomas Brinkman, CSO, [email protected]