The PayPal / Braintree Developer program is the face of technology innovation for the companies. Using an open source technology stack foundation, we are constructing new breeds of payment platforms, API standards, and identity systems to support the next generation of disruptive technology.

Presentation

The Future of Payment Identity

In this session, we explored how new identification techniques around wearables, biometrics, and mobile are vastly changing the payment space.

Workshop

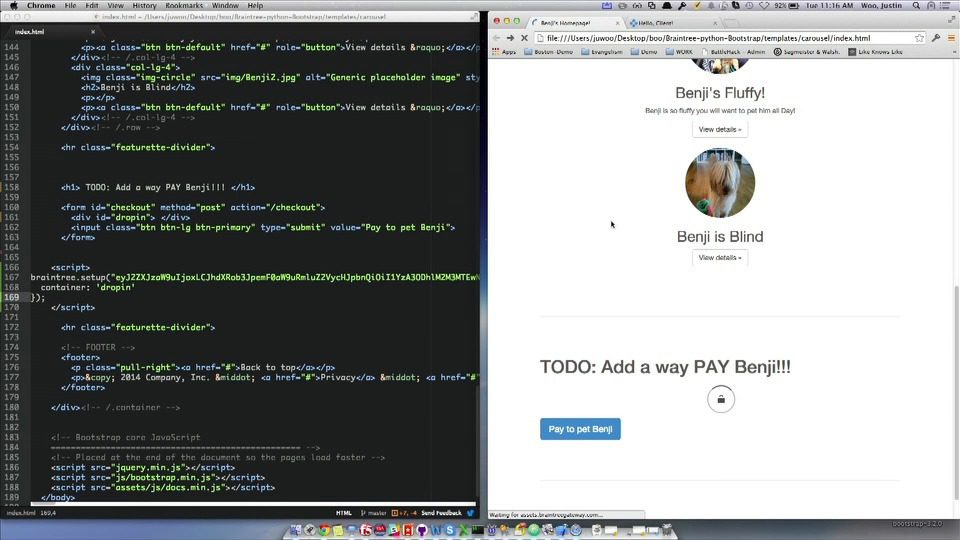

Making Payments Fun

Whoever said payments were complicated/boring? This is a quick introduction into the world of online payments and how to make it fun and enjoyable for your customer. Whether it be on your smartphone or website, we’ve showed you how you can get setup and accept payments quickly.

MasterCard (NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. MasterCard’s products and solutions make everyday commerce activities easier, more secure and more efficient for everyone.

Presentation

Open for Business and Beyond – MasterCard Developer Zone

Discover how MasterCard has become a technology company and is sharing its resources with developers.

Workshops

MasterCard Developer Zone: Under the Hood – Building a Developer Product and Program

Learn how MasterCard, one of the most successful technology companies in the world, is building a global developer platform and program.

MasterCard Developer Zone: Selecting The Right APIs and Driving Innovation

Designing a product using APIs should not be complex or mysterious. In this session, we looked at the technology powering MasterCard Developer Zone and how to use it to create the next Big Thing.

A Big Company in a Startup World: How MasterCard Leads Internal and External Innovation

New products and cutting-edge technology don’t just come from startups. Learn some of the ways MasterCard is supporting innovation and launching products on a global scale.

Plaid powers financial technology applications. Using our API, developers can leverage the data and infrastructure of user bank accounts in a fast and secure manner.

Presentation

Plaid: API for Financial Infrastructure

Learn all about Plaid, the problems we’re solving, and the companies we power.

Personal Capital helps people live better financial lives with technology-enabled advisory services as well as free financial software and educational content. Their award-winning apps enable you to effortlessly view your entire financial life in one place. Personal Capital brings to everyone wealth management that previously only the wealthiest could afford.

Presentation

The Art of Data Aggregation

This presentation is for developers and engineers who build applications on top of data gathered from multiple sources. The objective of our data aggregation platform is to model (and report) a user’s complete financial life.

We share the three key architectural principles that have made this platform possible:

- Owning the aggregated data to improve quality

- Synthesizing data and developing machine learning intelligence to obtain unique insights

- Developing APIs that hide data complexities to drive efficient UI development

Fritz Robbins is the CTO of Personal Capital, where he is responsible for the architecture, implementation, and operation of the company’s software products and services and infrastructure. Previously, he was President of Robbins Technologies, where he was the System Architect for companies including RSA, Wells Fargo and PassMark Security.

Ehsan Lavassani is the lead engineer at Personal Capital. He was the company’s first employee and architected its core systems from ground up. Previously, he was one of the main architects of RSA’s Adaptive Authentication system, which grew to over $100 million in revenue in less than five years.

We are a company based in Spain that has developed financial software since 2012. We have two featured products: an API to extract bank transactions and a clone of Mint, which uses the API.

Presentation

API for Banking

Our API standardizes the way an application can extract information from any bank account. We’re describing how it works, with some examples.

Prudena is a subscription-based online community and web-based toolkit dedicated to assisting value investors with financial analysis. By taking advantage of Prudena’s automated financial statement analysis tools, investors reduce the time it takes to perform high-quality fundamental research.

Presentation

Prudena: Automating Financial Statement Analysis

Charlie Strout founded Prudena when – after graduating from Columbia Business School – he decided performing fundamental equity analysis was too labor intensive. The presentation discusses how he was able to leverage existing APIs to develop Prudena’s analysis tools and publish his own API.

Launched in 2007, OnDeck uses data aggregation and electronic payment technology to evaluate the financial health of small and medium sized businesses to efficiently deliver capital to a market underserved by banks. Its proprietary technology – the OnDeck Score™ – enables small businesses to obtain affordable loans with a fraction of the time and effort that it takes through traditional channels. OnDeck’s credit models look deeper into the health of businesses, focusing on overall business performance, rather than the owner’s personal credit history. As a leading direct lender of small business loans, OnDeck has deployed more than $1 billion in capital nationwide.

Presentation

OnDeck Lending API’s – Frictionless, Extensible, Powerful

The OnDeck Score evaluates thousands of data points – from cash flow to public records to social data – to more accurately and efficiently assess business health and deliver capital in as fast as 24 hours.

Pamela Rice, OnDeck’s SVP of Technology, is discussing how the OnDeck platform provides a critically needed mechanism for financial institutions and other business service providers to efficiently reach the Main Street small business market.

The company has several APIs, which provide powerful, fully integrated lending capabilities to third party partners, thus allowing for instant pre-qualifications, pre-approvals and loan applications. Through a coding and product demo, Pamela demonstrates how both developers and non-developers can interact with OnDeck’s APIs in a UI sandbox and how to utilize our Salesforce app for frictionless plug-and-play integration.

Presenter Bio

Pamela Rice is the Senior Vice President of Technology at OnDeck, bringing extensive experience building innovative, scalable lending solutions. An engineer who built many of the original Bill Me Later credit systems, Pamela’s approach to financial technology leadership combines developing innovative solutions on scalable processes with building high performing teams. Most recently the leader of Global Credit Technology for PayPal, Pamela advanced PayPal’s credit platforms across multi-channel, multi-market products and delivered the first EU PayPal credit product. Pamela is a leader with a proven track record transitioning start-up systems to full-scale enterprises and an enthusiasm for innovation excellence in both human performance and technology systems. She co-founded eBay Women in Technology (eWIT) in Maryland and is a contributing member of Grace Hopper Celebrations of Women in Computing. Pamela holds a bachelor’s degree from the University of Hawaii, a master’s degree in information systems from Johns Hopkins and an Executive MBA from Loyola University.

How they describe themselves: NICE (NASDAQ: NICE) is the worldwide leader of software solutions that deliver strategic insights by capturing and analyzing mass quantities of structured and unstructured data in real time from multiple sources. This includes phone calls, mobile apps, emails, chat, social media, and video. NICE solutions enable organizations to take the Next Best Action to improve customer experience and business results, ensure compliance, and fight financial crime. NICE solutions are used by over 25,000 organizations in more than 150 countries, including over 80 of the Fortune 100 companies.

How they describe their product/innovation: Real-Time Authentication strengthens and streamlines the authentication process by utilizing voice biometrics to authenticate customers in real time during their conversation with an agent.

With Real-Time Authentication, contact centers can:

- Securely authenticate customers in real time with no customer effort

- Expedite time to service and free up more time for revenue generating activities

- Passively enroll the vast majority of their customers seamlessly

- Improve fraud protection on all enrolled accounts

Product distribution strategy: Direct to Business (B2B)

Contacts:

Bus. Dev.: Eran Lion, EVP Marketing & Corporate Development, [email protected]

Press: Erik Snider, Corporate Communications Director, [email protected], 877-245-7448

Sales: Beeri Mart, Regional VP Fraud & Authentication Solutions, [email protected]

How they describe themselves: Patch of Land is a Peer-to-Real-Estate (P2RE) lending marketplace that matches accredited and institutional investors seeking high-yield, short-term, asset-collateralized investments to borrowers seeking more timely and consistent sources of funding for rehabbing properties across America. Patch of Land’s goal is to solve the problem of inefficient, fragmented, and opaque real estate private lending by using technology and data-driven processes to create transparency and to efficiently underwrite projects for borrowers with real estate projects that are routinely bypassed by traditional lenders.

How they describe their product/innovation: We are developing a real-time system that pulls data from multiple sources including major credit reporting agencies. This disparate collection of data will be scientifically conglomerated into proprietary information models and risk analysis summaries. The information along with trained process will allow us to preapprove a wide variety of loan requests and extend automatic terms to existing borrowers for new projects. This information will be used by our underwriters along with a proprietary scoring system for increased efficiency in decision making on lending. Electronic documents can immediately be made available to the borrower for signing and funds wired automatically.

Product distribution strategy: Direct to Consumer (B2C)

Contacts:

Bus. Dev. & Press: AdaPia D’Errico, CMO, [email protected], 310-647-7875

Sales: Jason Fritton, COO & Co-Founder, [email protected], 949-873-3723

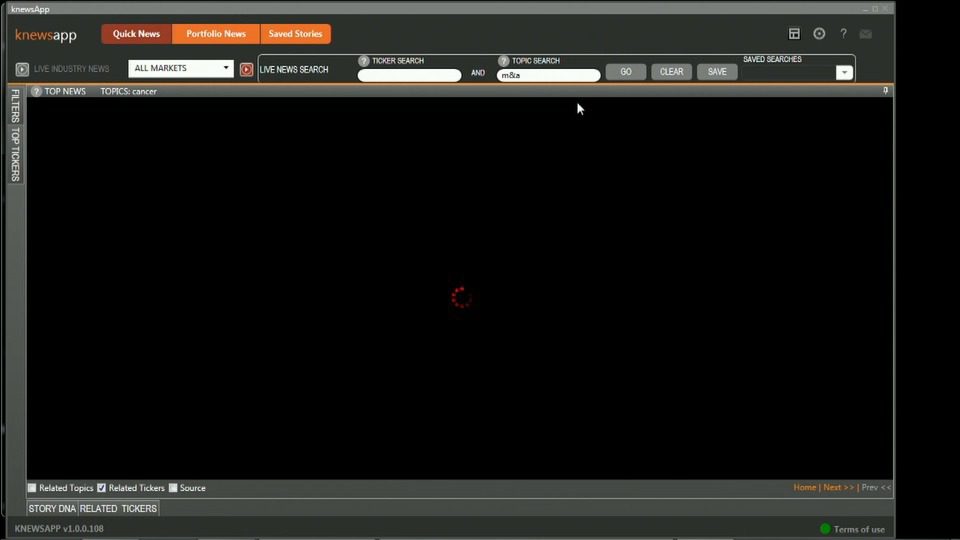

How they describe themselves: Minetta Brook is a big data intelligence augmentation company that has developed and patented a linguistics-based, high-speed, content-discovery technology. This technology, called KRANIUM™, auto discovers key news elements from millions of news stories and tweets in real time. Minetta Brook has also developed proprietary algorithms that allow us to score and rank these news elements based on connections across the entirety of news. Our partnerships with leading content providers gives us access to quality content from 40,000+ news sources. Minetta Brook’s first suite of products is targeted at revolutionizing news discovery in the world of financial trading and investment.

How they describe their product/innovation: Minetta Brook is launching a web application version of KNEWSAPP, a real-time news scoring and discovery application that is currently available only on the Bloomberg Professional™ platform. KNEWSAPP allows trading and investment professionals to take advantage of news related market inefficiencies by surfacing tickers, topics, and stories that are currently developing in the news. This web based product democratizes access to our ground-breaking, real-time, content-discovery technology and to our proprietary scores that lets you surface developing stories from across the entirety of news.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through other fintech companies and platforms

Contacts:

Bus. Dev. & Sales: Ken Cutroneo, Sales Director, [email protected], 917-755-3750

Press: Karthik Vasudevan, Product Manager, [email protected], 425-591-9846

How they describe themselves: P2Binvestor (P2Bi) is a peer-to-business (P2B) crowdlending platform that uses a patent-pending process to provide a better lending option to growing businesses and a new investment vehicle to accredited and institutional investors. P2Bi uses technology to streamline and scale rigorous underwriting operations while providing thorough due diligence to its investor crowd. Businesses can acquire receivables-secured growth capital of up to $5M, and investors can earn net returns of 7-15% APR. Client deals currently range from $150,000 – $2M.

How they describe their product/innovation: P2Bi is demoing a new borrower dashboard and application process that integrate with QuickBooks Online and streamline the borrower’s path from application to funding. The new functionality allows borrowers to automatically sync financials with their application, sync recurring financial data needed for underwriting and ongoing account analysis, and submit invoices for funding. P2Bi is also demoing new underwriting functionality that creates efficiencies for underwriting and account management processes.

Product distribution strategy: Direct to Business (B2B), partners, referrals, digital marketing

Contacts:

Bus. Dev.: G. Krista Morgan, President & Co-Founder, [email protected], 720-326-6939

Press: Erin Bassity, VP Marketing, [email protected], 720-236-5121

Sales: Brad Johnston, Account Manager, [email protected], 646-342-7511

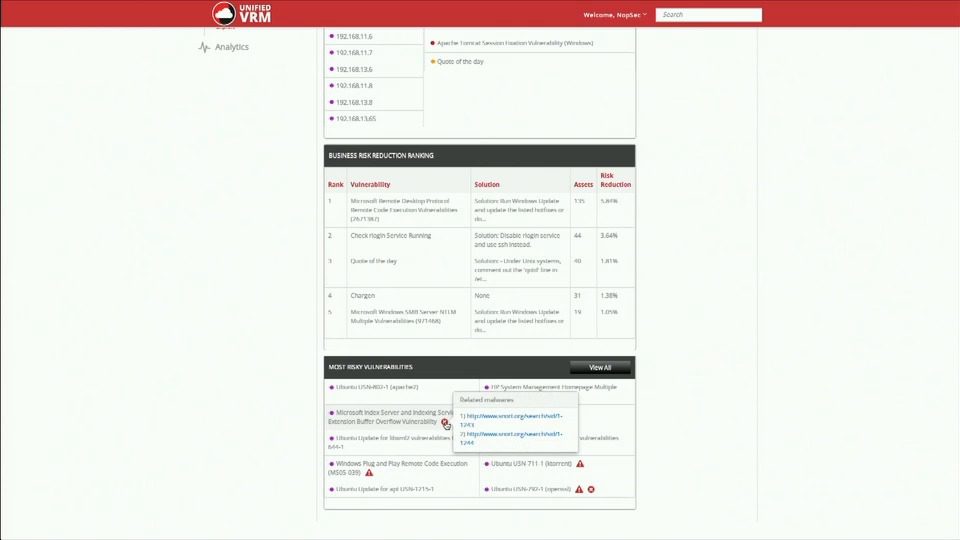

How they describe themselves: NopSec was founded to pursue a vision: Make the digital world a safer place. NopSec is a technology company focused on helping businesses to proactively manage security vulnerability risks and protect their IT environment from security breaches. Having spotted the widespread enterprise issue of information overload, NopSec set out to find better ways to prioritize and manage the often overwhelming amount of data gathered during the process of vulnerability scanning and discovery. We help our customers make proactive vulnerability risk management a business advantage.

How they describe their product/innovation: Cloud-based vulnerability risk management SaaS.

Unified VRM helps businesses holistically manage IT security vulnerabilities, on premises and in the cloud, in a unified, proactive, and flexible way. Unified VRM aggregates the results of vulnerability scanners, proactively prioritizes vulnerabilities based on business risk, and expedites remediation by streamlining the ticketing process and reports. Unified VRM is different from legacy vulnerability scanners in 3 ways:

- Focus on remediation – remediation is easier when you know what to fix

- Automate the process – no more burdensome manual tasks

- Software that just works – eliminate complexity, improve visibility, and glean insights for better decision making

Product distribution strategy: Direct to Business (B2B), licensed

Contacts:

Press: Steven Leonard, CMO, [email protected]

Sales: Suzanne Swanson, VP Sales, [email protected]