How they describe themselves: Pixeliris is a company with services in the area of technology marketing. The company started 15 years ago proposing audio software and has been increasing ever since with services and research in the area of digital development.

Pixeliris Labs is Pixeliris’ R&D laboratory that has been working over the past 5 years on different high-tech technologies, including contactless communication protocols between smart devices. This research has resulted in several patents in the area of sonic and ultrasonic communication between smart devices.

How they describe their product/innovation: CopSonic is the first universal contactless mobile payment system powered by our unique technology. It is based on sonic communication transiting through the devices’ speakers and microphones. Therefore, our technology is compatible with 100% of existing phones and smartphones, unlike NFC technologies. Several patents have been filed with regard to the security of the transaction.

Our technology allows peer-to-peer transactions between feature phones and smartphones but also enables online passwordless authentication turning the devices into security dongles.

We developed an SDK that allows third-party companies to integrate the modules and, therefore, create a business model based on transaction fees or licenses.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, licensed

Contacts:

Bus. Dev. & Press: Brian Roeten, Senior Project Manager, [email protected]

Sales: Christian Ruiz, Marketing Director, [email protected]

How they describe themselves: Plutus Software was incorporated in Singapore in February 2012. We saw a great opportunity to create a web and mobile ecosystem specifically to cater to the needs of the large and ever growing consumer finance sector in Asia. Our goal is to develop apps and platform products that are geared towards fulfilling this objective.

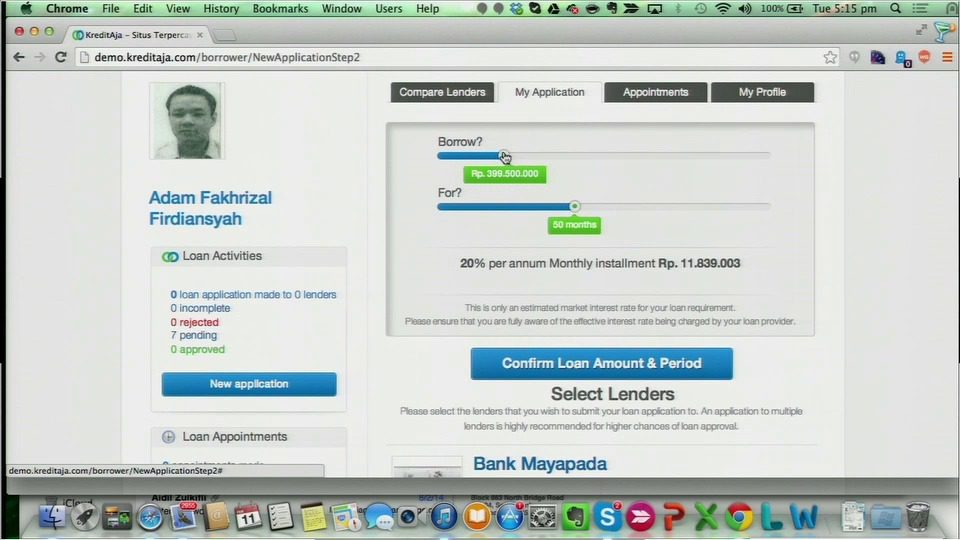

For our first major overseas market, Indonesia, our flagship product, LoanGarage.com, is known as KreditAja.com, and it was launched in May 2013. It aims to empower Indonesian consumers by acting as a ‘one stop shop’ where they can choose from a curated selection of various financial products with the best rates available at any given time and from the most reliable and reputable lenders in the market.

How they describe their product/innovation: In addition to the comparison functionality for the various financial products, KreditAja.com features predictive analytics to aid both borrowers and lenders. For borrowers, this potentially enables creditworthy individuals to gain access to financing that they normally would not be able to obtain based on traditional credit scoring methods. At the same time, this analytics capability enables lenders on our platform to more accurately assess the risk of borrowers so as to better price the products that they are disbursing. Our proprietary credit scoring system aims to produce a more holistic assessment of a borrower’s creditworthiness via incorporating multiple data sources, including social media.

Product Distribution Strategy: Direct to Business (B2B), licensed

Contacts:

Bus. Dev., Press & Sales: Aidil Zulkifli, CEO & Founder, [email protected], +65 9320 0041 Shaiful Bahri, VP Operations & Strategy, [email protected], +65 9062 8572

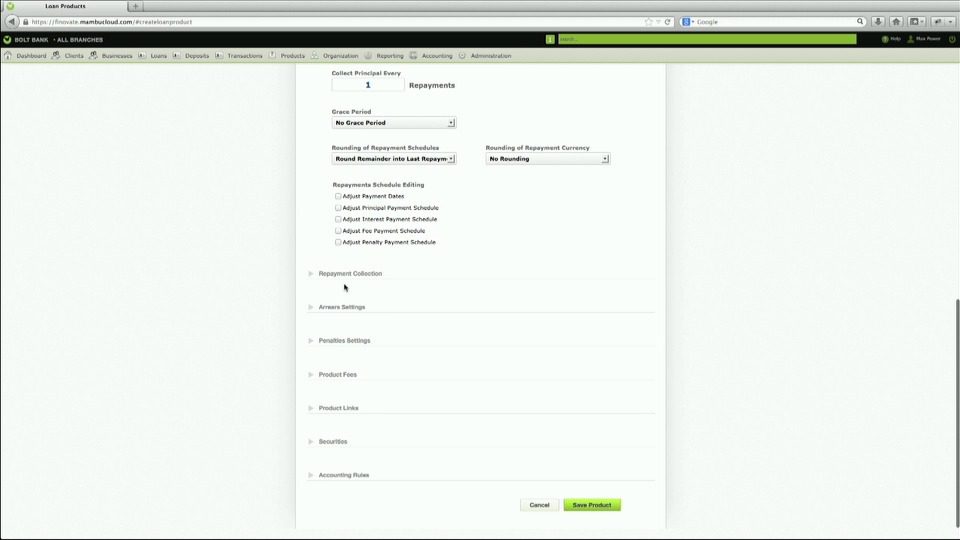

How they describe themselves: Mambu enables any financial institution to deliver state-of-the-art banking through a native cloud-based software as a service solution. Agile, flexible and open, Mambu eliminates the complexities typically associated with core banking software, at a fraction of the cost. Mambu’s end-to-end approach makes it simple and cost-effective to provide essential banking services like loans and deposits.

How they describe their product/innovation: Mambu is a native cloud SaaS banking application. Built entirely for the web with a ‘cloud-first’ approach, our product runs the end-to-end operations that a bank needs, from loan and deposit product creation and servicing, to client relationship management and reporting. It does this entirely online and with a business and delivery model that allows any financial institution of any size to rapidly access state-of-the-art banking technology in the cloud, at a fraction of the cost and time of a traditional core banking solution.

Product Distribution Strategy: Direct to Business (B2B)

Contacts:

Bus. Dev. & Sales: David Hamilton, President, [email protected]

Press: Ruth Brown, Head of PR & Communications, [email protected]

How they describe themselves: Matchi offers unprecedented collaboration opportunities for banks globally and provides the perfect forum for vendors and innovators to ‘match-make’ their innovation to a financial institution anywhere in the world.

Matchi founders saw a need for a central place where innovators and vendors from all parts of the world could match-make their innovation to banks that can use these innovations.

Banking executives can locate relevant innovations based on a keyword search to assist in reducing costs, boosting growth, and generating new revenue streams.

Matchi.Biz is headquartered in Hong Kong, with offices in the UK, South Africa, and Australia.

How they describe their product/innovation: A global community innovation platform for the financial services industry that offers market ready banking innovations from across the globe and collaboration opportunities that have the potential to save the banks millions of dollars in development costs.

Product Distribution Strategy: Direct to Consumer (B2C) & Direct to Business (B2B)

Contacts:

Bus. Dev., Press & Sales: Philippa Newnes, Director, [email protected], +61 401 915 153

How they describe themselves: Privately held company with key expertise and focus in the unique challenges of high-growth emerging markets. Serving customers such as banks, mobile operators, merchant acquirers, and payment service providers. Focusing purely on the mobility space in the fintech sector – solutions not doing any transaction processing. Mistral’s white-label products simply connect to existing transaction systems to make them mobile.

How they describe their product/innovation: Money Mobility Suite™ from Mistral Mobile eliminates the technological barriers to providing mobile financial services. Money Mobility Suite™ is a mobile front-end solution that works on any phone, on any network and anywhere – allowing you to reach and serve more customers, with faster time-to-market, and higher cost-efficiency than alternative solutions, driving your revenues and lowering your operating costs dramatically.

Product Distribution Strategy: Direct to Business (B2B) and through other fintech companies and platform providers

Contacts:

Bus. Dev. & Press: Peter Ollikainen, SVP Product Marketing, [email protected], +358 50 4872668

Sales: Ludwig Schulze, CEO, [email protected], +1-917-514-5027

How they describe themselves: Mobexo offers a fully customizable system of pre-payment, payment, and post-payment services. The Mobexo mobile payment system allows two parties to transfer funds instantaneously and securely without the need of additional devices. Unlike credit cards or cash, Mobexo allows merchants to accept funds from customers without requiring them to give out their personal banking information. Our integrated services for merchants include directives for getting customers, business performance analytics, and functionalities for the management of promotions and customer loyalty programs.

How they describe their product/innovation: Mobexo seamlessly connects businesses and their customers. The Mobexo mobile payment application allows business owners to create customized and targeted promotional campaigns via the Merchant Portal to reach their customers when they want to and how they want to. Personal Mobexo users then have the ability to apply these offers when they pay using the application. Every time a user checks out using Mobexo, it will notify them when they have offers to apply to their payments. In this way, Mobexo is a tool that enlivens the connection between consumers and businesses.

Product Distribution Strategy: Direct to Consumer (B2C) & Direct to Business (B2B)

Contacts:

Bus. Dev.: Lawrence Chung, Head of Strategy, [email protected]

Press: Coco Chan, EA to CEO, [email protected]

Sales: John Wong, Sales Manager, [email protected]

How they describe themselves: We operate a mobile payment service that offers universal access while being totally independent from credit cards and telcos.

On the front-end, we offer an application for smartphones and a voice service for dumbphones. No special equipment is required from customers or from merchants. Integration in cash registers and vending machines is quick and easy.

For the back-end:

- In OECD countries, we connect directly with bank accounts towards real-time transactions, thereby slashing costs and risks and improving the user experience

- In unbanked or underbanked countries, we aim to build and operate a national e-cash infrastructure on behalf of the central bank, instead of fighting with local money transfer services

How they describe their product/innovation: We are introducing the international version of the Mobino application, available in 5 languages and 50 currencies.

Various scenarios will be outlined:

- Peer-to-peer money transfer

- Payment for goods and services in shops

- POS and cash register integration

- Quicker and safer e-commerce payments

- Fluid payment flow for mobile commerce

- Cheap and efficient international remittances

- Registration and KYC process for unbanked

- Cash-in and cash-out operations at agents

We are looking for distribution partners and investors in the Asia Pacific region in order to prepare service launch.

How they describe themselves: Founded in 2005, Payoneer is an industry-leading provider of global mass payout services that accelerates growth for customers by improving the way they make payouts to more than 200 countries worldwide. Payoneer’s complete solution provides a simple, secure, compliant and cost-effective way for companies of all sizes to offer cost-saving payout options, including prepaid debit cards, deposits to local banks worldwide, international wire transfers, mobile payments, local e-wallets, and local-currency paper checks. Payoneer has served thousands of companies and more than one million payees around the world. For more information: www.payoneer.com.

How they describe their product/innovation: The Payoneer commercial account offers businesses and individuals worldwide the ability to receive funds from a global network of corporate companies. Account holders have a variety of tools to access their funds, including low cost withdrawals to bank accounts worldwide, a Prepaid Debit MasterCard card that enables instant spending and ATM access, and options to transfer funds to local eWallets in select countries. The account can be managed from the Payoneer website or from a mobile application. Registration for the account is available via Payoneer’s website or directly from the website of companies that form the Payoneer commercial funds transfer network.

Contacts:

Bus. Dev.: Oded Zehavi, CRO, [email protected]

Press: Ronit Druker, VP Marketing, [email protected]

How they describe themselves: Pixeliris is a company with services in the area of technology marketing. The company started 15 years ago proposing audio software and has been increasing ever since with services and research in the area of digital development.

Pixeliris Labs is Pixeliris’ R&D laboratory that has been working over the past 5 years on different high-tech technologies, including contactless communication between smart devices. This research has resulted in several patents in the area of sonic and ultrasonic communication between smart devices.

How they describe their product/innovation: CopSonic is the first universal contactless mobile payment system powered by our unique technology. It is based on sonic communication transiting through the devices’ speakers and microphones. Therefore, our technology is compatible with 100% of existing phones and smartphones, unlike NFC technologies. Several patents have been filed with regard to the security of the transaction.

Our technology also allows the use of phones and smartphones for online passwordless authentication. It turns mobile devices into security dongles.

We have developed an SDK with our technology that allows third-party companies to integrate the modules and, therefore, create a business model based on transaction fees or licenses.

Product Distribution Strategy: Direct to Business (B2B), through other fintech companies and platforms, and licensed

Contacts:

Bus. Dev.: Brian Roeten, Senior Project Manager, [email protected]

Press & Sales: Christian Ruiz, Marketing Director, [email protected]

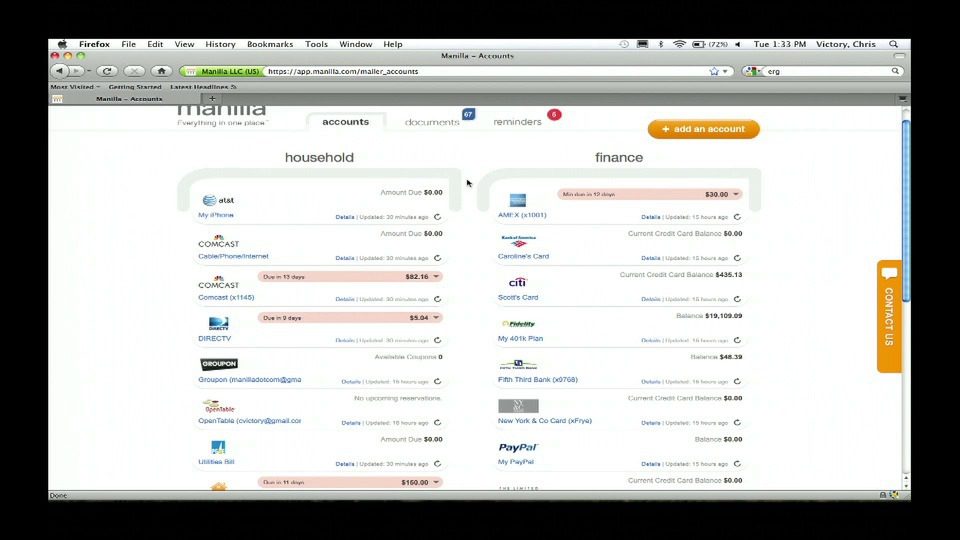

How they describe themselves: Manilla organizes and simplifies people’s lives by providing one secure access point to all household accounts and services. The free service helps consumers manage their household accounts, including financial accounts, utilities, subscriptions, daily deals, and travel rewards programs, all through Manilla.com or Manilla’s free iOs and Android mobile apps. Under a single password, Manilla gives customers an automated, organized view of all of their account information, text, and email reminders to pay bills, renew expiring subscriptions, and manage soon-to-expire daily deals, all with unlimited storage and seamless document retrieval. Manilla is a part of the Hearst Corporation.

How they describe their product/innovation: Manilla launched a distribution deal within AOL reaching 24M users. Manilla is now seamlessly integrated into AOL Mail as the new AOL Bill Manager tool powered by Manilla. Manilla’s new email import feature will scan a user’s AOL inbox and suggest providers that the user has an account with and load them automatically into Manilla. The AOL Bill Manager Powered By Manilla will provide partners with increased engagement, additional marketing opportunities, enhanced data insights and more.

Product Distribution Strategy: Direct to Consumer (B2C) & Direct to Business (B2B)

Contacts:

Bus. Dev. & Sales: Chris Victory, VP Sales & Bus. Dev., [email protected], o: 212-969-7520

Press: Rachel Shaffer, Allison + Partners, [email protected], o: 646-428-0626

How they describe themselves: Market IQ is the leading provider of Market Sentiment, Fundamental Insights, and Investment Signals to help Portfolio Managers, Analysts, and Investment Firms with Company Research, Portfolio Analytics and Optimization, and Early Market Signals (derived from big data and machine learning techniques for analyzing unstructured and structured data sources).

How they describe their product/innovation: Market IQ Terminal:

- Real-time Sentiment and Actionable Fundamental Insights based on Market IQ’s patented algorithms to provide deeper insights into a company’s strengths and weaknesses.

- Better discoverability with Market IQ Search and Natural Language Processing algorithms (applied to over 40 sources of unstructured data), allowing managers to ingest relevant insights from more sources at a glance – making ‘big data’ actionable.

- Developed in collaboration with top investment management firms and market participants, Market IQ is modeled after broad portfolio management principles. The intuitive and customizable workflow is designed to allow subscribers to tailor Market IQ to their investment process.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, & licensed

Contacts:

Bus. Dev., Press, & Sales: David Middleton, [email protected], 1-800-604-0647

How they describe themselves: MasterCard (NYSE: MA) is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. MasterCard’s products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone.

How they describe their product/innovation: The Dual Value Health Card combines the MasterCard payment network with InComm’s closed-loop payment system. The Dual Value Health Card can be swiped at the point of sale (POS) and routed to an open-loop or closed-loop processor, allowing the cardholder to offer payment on eligible items while simultaneously receiving targeted incentives, all in real time and right at the POS.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions, & licensed

Contacts:

Bus. Dev.: Ernest Rolfson, [email protected]

Press: Laurie Fee, [email protected]