How they describe themselves: Minetta Brook is a big data intelligence augmentation company that has developed and patented a linguistics-based, high-speed, content-discovery technology. This technology, called KRANIUM™, auto discovers key news elements from millions of news stories and tweets in real time. Minetta Brook has also developed proprietary algorithms that allow us to score and rank these news elements based on connections across the entirety of news. Our partnerships with leading content providers gives us access to quality content from 40,000+ news sources. Minetta Brook’s first suite of products is targeted at revolutionizing news discovery in the world of financial trading and investment.

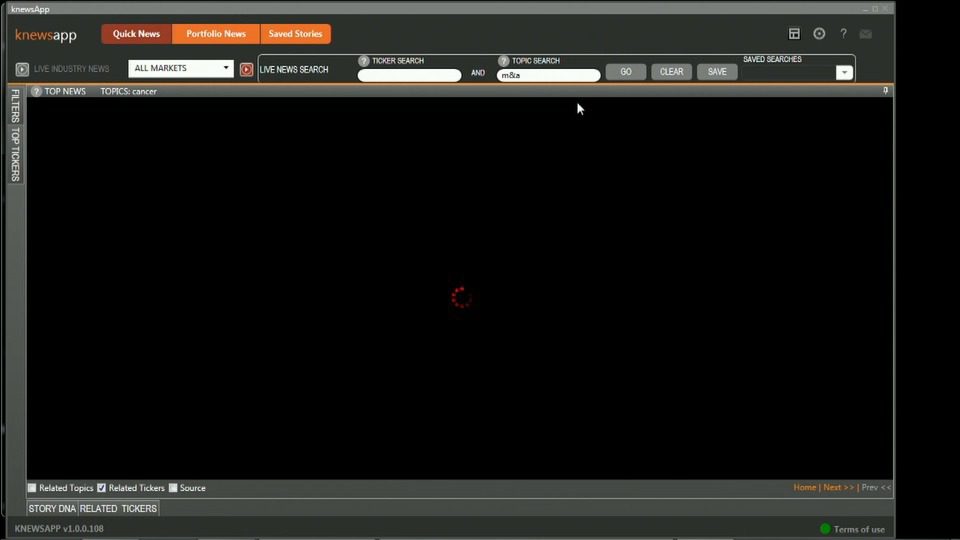

How they describe their product/innovation: Minetta Brook is launching a web application version of KNEWSAPP, a real-time news scoring and discovery application that is currently available only on the Bloomberg Professional™ platform. KNEWSAPP allows trading and investment professionals to take advantage of news related market inefficiencies by surfacing tickers, topics, and stories that are currently developing in the news. This web based product democratizes access to our ground-breaking, real-time, content-discovery technology and to our proprietary scores that lets you surface developing stories from across the entirety of news.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through other fintech companies and platforms

Contacts:

Bus. Dev. & Sales: Ken Cutroneo, Sales Director, [email protected], 917-755-3750

Press: Karthik Vasudevan, Product Manager, [email protected], 425-591-9846