Here’s a test that tells you when you’ve built a successful mobile app:

Here’s a test that tells you when you’ve built a successful mobile app:

- Place your laptop next to your iPhone/Android

- Choose a task

- Reach for the device that’s easiest to use for that task

If you don’t reach for the mobile phone first, you still have work to do on the user experience.

I’ve always chosen the laptop for banking, even though I’ve ported more than a dozen other routine tasks to the iPhone (note 1). The hassle of logging in with those tiny iPhone keys pushes me to the laptop. But as of Tuesday, USAA’s latest iPhone app, version 2.2, has changed the equation, and there’s no looking back.

Mobile vs. online banking

The key to making mobile a profitable channel is to make the user experience BETTER than online. And USAA is the only U.S. financial institution doing that today.

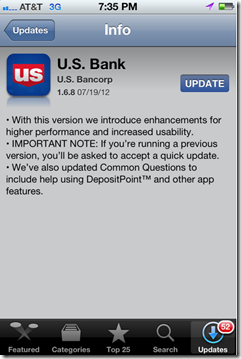

USAA’s biggest mobile “wow” is mobile check deposits (see Deposit@Mobile screenshot below) introduced six months ago for the iPhone. While it may not seem novel to those in the industry familiar with scanner-based remote deposits, the average consumer considers an iPhone check deposit to be almost magical. Other than a few small credit unions, no other major banking competitor offers it, so USAA continues to own mobile magic.

But with Bank of America rumored to be readying a launch mobile deposits, which will no doubt be featured in Apple TV ads, (see latest one here), USAA needs to keep innovating.

But with Bank of America rumored to be readying a launch mobile deposits, which will no doubt be featured in Apple TV ads, (see latest one here), USAA needs to keep innovating.

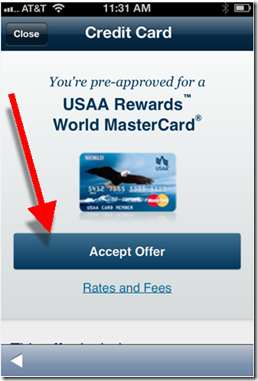

And this week, USAA delivered with a single-PIN login with authentication powered by VeriSign VIP service. The optional 4-digit sign-on process is available now on the iPhone and will be available in April for Android and “shortly thereafter” for Blackberry (note 2).

In a time when it’s more tedious and less secure to log in online, USAA takes us back in time to a simpler day, when you could log in with just a few digits.

And by using techniques that authenticate the mobile phone during login, the bank says that mobile access is more secure than online.

Think about that for a moment. Mobile is MORE SECURE than online. With tens of millions of customers deathly afraid of logging in via their virus-laden PCs, imagine what that could do for mobile adoption.

It will take time to educate the market. Currently, most consumers believe the mobile channel is far less secure. But if they can be convinced the opposite is true, many will kiss online banking goodbye forever.

Notes:

1. According to yesterday’s release, USAA has 1.3 million mobile users, 17% of its 7.4 million customer base.

2. Previously, USAA users were required to sign on with username, password and PIN. The simple sign-on process is optional for those not trusting the simpler process.

3. For more info on financial services opportunities on the iPhone, see our March 2009 Online Banking Report.