I’ve written plenty about the importance of the iPhone App Store, both here and in Online Banking Report (note 1). But there’s one subtle side benefit I hadn’t thought too much about previously.

I’ve written plenty about the importance of the iPhone App Store, both here and in Online Banking Report (note 1). But there’s one subtle side benefit I hadn’t thought too much about previously.

Every time a new version of a native app is released, users must take action to download it if they want the new features. While this process used to be a nightmare in the desktop software days where users had to use floppy disks, CDs or large downloads to reinstall the software, it’s an absolute breeze on the iPhone and usually takes less than a minute from start to finish. And there’s no restarting the iPhone or choosing installation options. It’s just a one-click process plus the input of your iTunes password if you weren’t already logged in.

So why is this process a benefit? Because each time a new release is available a little icon shows on top of the App Store icon (see screenshot 1 below). Users then press the App Store icon, choose update, and they see a list of applications with updates available (screenshot 2). At that point users choose to update them all or look at them individually.

We believe most users are interested enough in their financial apps to take a look at the update, at least until the novelty of the mobile app wears off some years in the future. This provides financial institutions a free marketing opportunity to not only explain the new features of the app, but also deliver other marketing messages. You are much more likely to make an impression with your customers during the update process, compared to sending out a random marketing email.

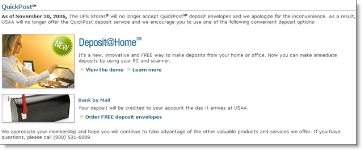

In the three bank examples below, only USAA (screenshot 3) uses the opportunity to further cement its relationship with mobile customers, touting its new remote deposit capabilities along with several other enhancements. Wells Fargo (screenshot 4) takes a matter-of-fact, “we’re fixing bugs” approach that is OK, but still misses the chance to communicate with users. But Chase (screenshot 5) completely annoys users with two sentences of marketing speak that says nothing about the update.

Lessons for financial & mobile marketers: Whenever you release an update for your mobile app (note 2), take the opportunity to communicate with your customers as follows:

- Clearly explain the benefits of the changes to the app

- Highlight one or two related benefits of the app

- Mention any related news or promotions

- Strike a good balance between disseminating technical info and marketing new benefits

Screenshots

1. Main iPhone screen shows 2. The Updates page shows the 4 apps

that 4 app updates are that have new versions available.

available (right side halfway down).

3. USAA’s latest update explains the specific changes made and provides several new benefits to using the app.

4 & 5. On the other hand, the Wells Fargo and Chase update messages are sparse. The Wells Fargo update appears to be a minor bug fix, so we’ll cut them some slack for the terse message. However, Chase, with a minor update (2.0.1 update) to its major 2.0 release (released Aug 25), says absolutely nothing in 24 words of marketing-speak:

We’re listening — You asked for a fully native iPhone banking application. This Chase iPhone app is built exclusively for iPhone and iPod touch users.

Seriously Chase, this is the best you could come up for the tens of thousands, if not hundreds of thousands, of iPhone users waiting for your updated app? At least the bank gets points for brevity.

Screenshot 4 Screenshot 5

Note:

1. For more info on the importance of a native iPhone app see Online Banking Report: Mobile Banking via iPhone.

2. The same advice holds true for communicating online banking improvements as well, although the communication methods are different (email, newsletter, statement insert, blog, interstitials, log-off messages, etc.).