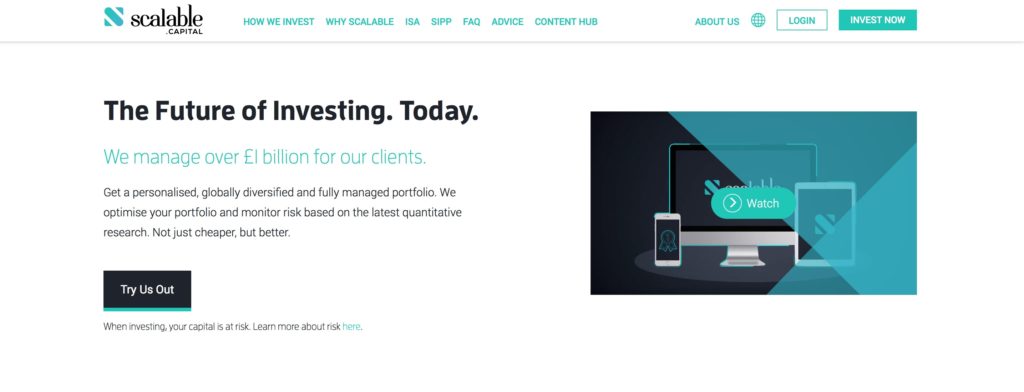

Munich-based robo-advisor platform, Scalable Capital, has raised a further €25 million in growth capital, two years after BlackRock invested €30 million, writes Jane Connolly of Fintech Futures (Finovate’s sister publication).

Handelsblatt reports that HV Holtzbrinck Ventures and Tengelmann Ventures also took part in this round.

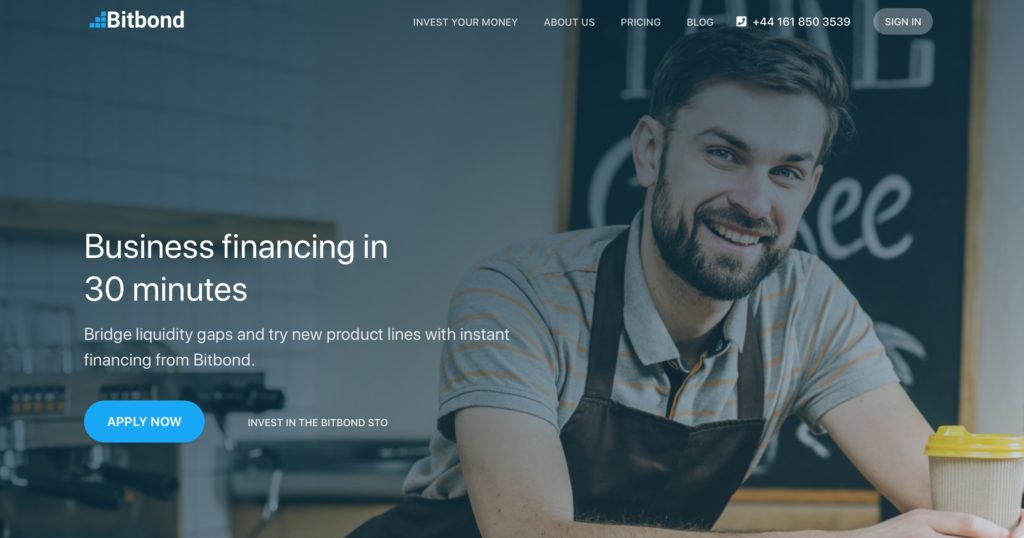

Founded in 2016, Scalable aims to target high-earning young professionals, who invest an average of €35,000. Customers can answer a list of questions about their experiences and objectives, to receive a recommendation for a portfolio of listed index funds (ETFs).

Although the amount raised is relatively low for the industry, Scalable Capital founder Erik Podzuweit said, in the Handelsblatt Disrupt podcast: “Actually, we did not need the money, because unlike some other business models, each customer pays for the offer.”

He added: “So we took the money and can now grow a little faster and at the same time still keep something in reserve.”

BlackRock acquired just under a third of the company two years ago. Despite the capital increase, the founders still have ownership of more than a quarter of the business.

Scalable Capital demonstrated its technology at FinovateEurope 2016. Last month, the company teamed up with Futurae to add multi-factor authentication to its investment platform. This spring, the company was named to the Wealthtech 100.