How does technology help financial advisors do their jobs better? What does it mean to be “customer-focused” when it comes to financial health? And how does an organization successfully pursue a commitment to financial inclusion as a company, while simultaneously supporting and reinforcing a commitment to diversity, equality, and inclusion within a company?

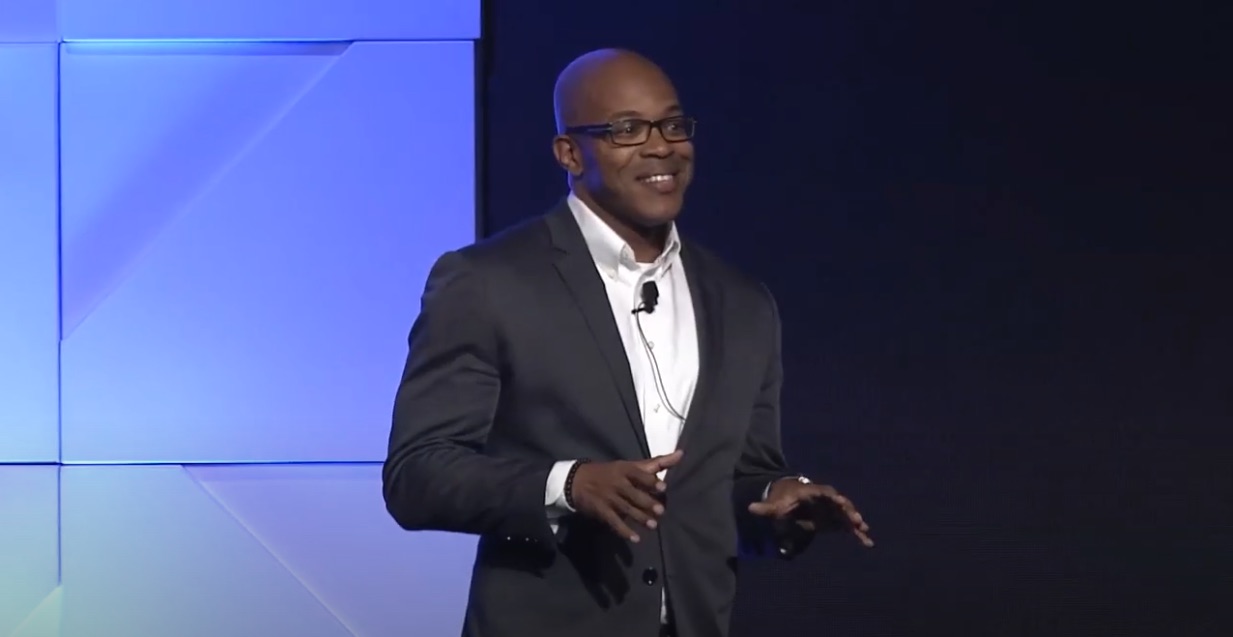

We talked with Christina Walls, Chief Marketing Officer of intelliflo, about intelliflo’s evolution into a comprehensive digital investment platform. We also discussed the firm’s determination to help its clients leverage technology to reach more customers from more diverse backgrounds and investment sophistication levels. Toward the end of our conversation, we talked about the key role of equality in the diversity and inclusion conversation, and what can be done to bring more women into leadership roles within fintech and financial services.

Why was intelliflo formed a year ago? What is the strategy behind the combined company brand?

Christina Walls: What makes what we’re doing at intelliflo so exciting is how we’re addressing the challenges that financial advisors around the world have using technology to expand access to advice. That’s why our parent company, Invesco, combined five digital wealth companies into a single, API-driven platform – intelliflo – so we can offer financial advisors a holistic digital platform designed to serve investors throughout the entire advisory lifecycle. Our technology delivers the digital tools financial advisors need to better serve modern investors and widen access to financial advice.

What was your role in bringing together the five previously separate companies and modernizing the marketing function?

Walls: Validating the opportunity for five companies to come together as one new global brand, culture, and market proposition in the U.S., U.K., and Australia was the first step. Next, the marketing team built a modern, omni-channel marketing function that delivers against global and local business needs. We focused on training colleagues for new jobs and recruiting talent We also embedded new processes and a MarTech stack including sales enablement and CX/EX listening platforms that align with our modern, 360, digital CX/EX experience mindset versus traditional marketing funnel acquisition methodology.

Our new global brand is bold, personable, and challenges the status-quo. The experiences we deliver for all consumers of our brand – colleagues, clients, or partners – need to “feel” different. Every decision we made underpins our business purpose and strategy. The new marketing function was repositioned from previously reactive and tactical to a strategic, commercial, and customer-focused partner for the business.

What were some of your biggest challenges and successes during this project?

Walls: The biggest success is seeing our efforts help advisors grow and improve their clients’ financial health. Advisors are increasingly challenged to accomplish more with less resources; they need open, digital, and cloud-based technology to serve clients of all ages and sophistication levels. With intelliflo, advisors can meet clients where they are, including across digital channels, providing a personalized experience with greater collaboration and communication.

Since March 2021, we have seen increases across all marketing metrics. For example, one omni-channel solution campaign led to a 73% rise in sales YOY in January 2022.

The biggest challenge was planning and executing a new global brand launch during the pandemic and virtually building a new marketing function, business culture, and relationships. I’m so appreciative of the hard work of all my colleagues at intelliflo, who are passionate, proud, and dedicated to our business purpose; without them we wouldn’t be where we are now.

Why did you help intelliflo evolve from D&I to DEI?

Walls: In today’s world, diversity and inclusion can’t work without equality. Companies with D&I policies do a great job of recruiting people from diverse backgrounds, welcoming and celebrating those differences, and making them feel included in the organization, but with all evolution comes revolution.

At intelliflo, our culture relies on ensuring every colleague, regardless of their background, race, gender, etc. is included, has an equal share of voice, and is confident to challenge any level of seniority of the business for the greater good of delivering our business purpose – widening access to financial advice. We must all focus on equality; it is the critical bridge between diversity and inclusion.

As part of our newly created employee value proposition and DEI focus, we’ve recently formed a DEI ally network. We are dedicated to educating colleagues and building greater awareness for all colleagues, customers, clients, partners, industries, and communities, from the inside out.

What more do you think can be done to support women in fintech?

Walls: Progress has been made, but there’s still much work to be done. This isn’t just about delivering a gender metric. For the industry to change we need to highlight the value women bring, especially when it comes to diversity of thought. We should increase access to funding for women-led fintechs, hire more women at all levels of the business, widen access to professional networks in the industry, implement more policies, and continue reporting gender equality metrics, like the pay gap.

Male allies are also important. I’m fortunate to have many male allies at both intelliflo and Invesco and am personally dedicated to continuing the great work all genders have pushed forward in advocating women and removing biases for future generations to forge a gender equal world.

Gender is only one example of equality. Many other traditionally underrepresented groups also need a voice. We must hold ourselves and each other accountable to eradicate these biases and promote greater DEI for everyone.