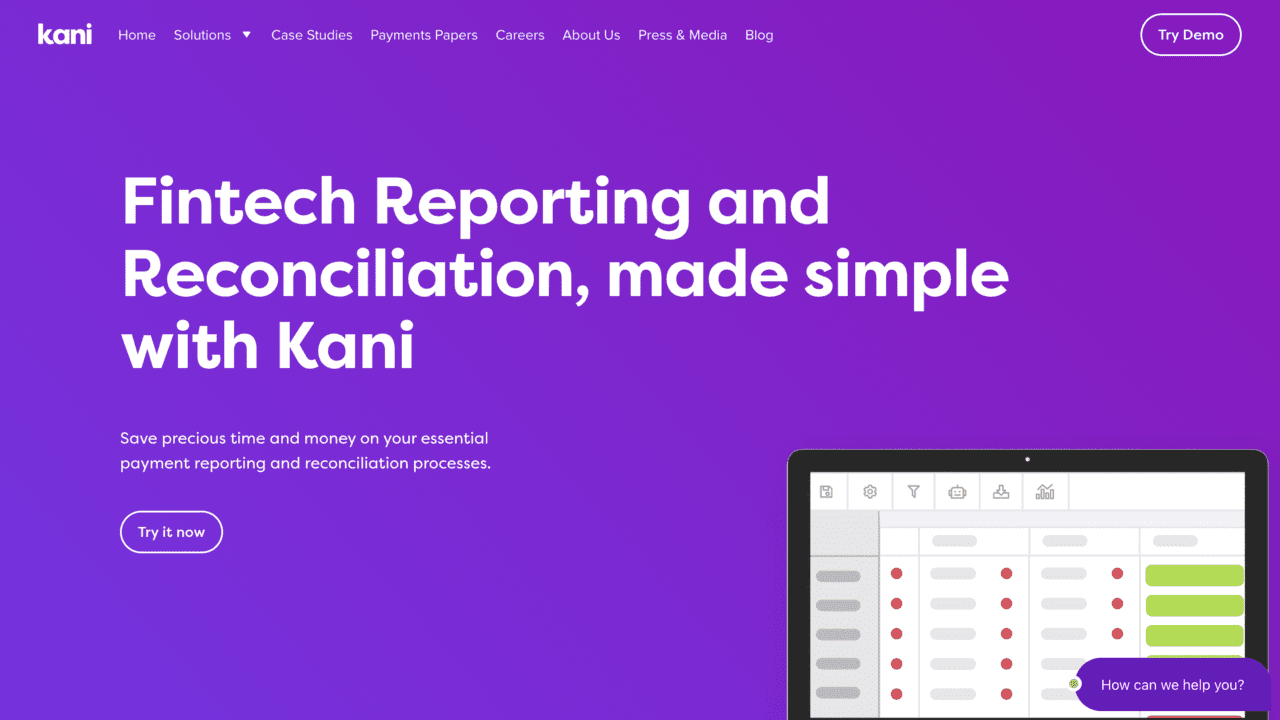

- Reconciliation and reporting services provider Kani Payments has partnered with issuer processor CLOWD9.

- CLOWD9 will leverage Kani Payments’ platform to power its data reporting and reconciliation capabilities.

- Kani Payments made its Finovate debut at FinovateSpring 2023.

Reconciliation and reporting services provider Kani Payments has inked a partnership with CLOWD9. The cloud-native issuer processor selected Kani Payments to power its data reporting and reconciliation capabilities and help the company manage the unique data standardization requirements faced by banks and fintechs alike.

CLOWD9 will use Kani Payments’ SaaS platform to collect and standardize transaction data, including both authorization and settlement data from payment schemes. The platform will enable CLOWD9 to report to clients across the payment value chain faster, as well as provide enhanced and easy-to-understand data customization and visualization via the Kani Payments’ portal dashboard. This will empower clients with the flexibility to configure data as they choose.

“The sweet spot is taking standard data, formatting it for the individual needs of our mutual clients, and accelerating reconciliations with it,” CLOWD9 Chief Product Officer Richard Wray explained. “Kani Payments are the experts in that area and their understanding of the depth, detail, and specializations within the payment data value chain is unsurpassed.”

Headquartered in Newcastle upon Tyne, U.K., Kani Payments made its Finovate debut last year at FinovateSpring in San Francisco. At the conference, the company demoed how its automated reconciliation and reporting platform provides fully automated reconciliations, as well as automated legal, regulatory, and scheme reporting. Kani CCO Marc McCarthy used the example of a simple transaction at a coffee shop to explain the myriad actors – issuing bank, network, processor – that play a role in managing the data of even an everyday purchase. “Each one of those organizations has a different version of that event,” McCarthy said. “We here at Kani Payments provide a reconciliation and reporting platform that helps each one of those actors to have compliance, to have validation of their data, and to have insightful reports of what they can see with their information.”

Earlier this year, Kani Payments announced a partnership with core banking platform Pismo. The collaboration makes Kani’s platform available to Pismo’s bank, marketplace, and fintech clients. Vishal Dalal, Pismo CEO for North America, EMEA, and APAC said that the partnership “will unlock useful insights to help (financial institutions) make better, more informed decisions, shaping a new era for banking and payments.”

Kani Payments was founded in 2018. Aaron Holmes is CEO. Holmes co-founded the company following tenures at Flex-e-card, Global Processing Services, and NBS Card Solutions (now Wirecard).