- Autobooks is launching Autobooks Capital, a short-term working capital tool embedded directly into its platform and powered by Fundbox.

- The embedded lending experience helps financial institutions retain small business clients by offering fast, flexible funding without requiring third-party apps or extra accounts.

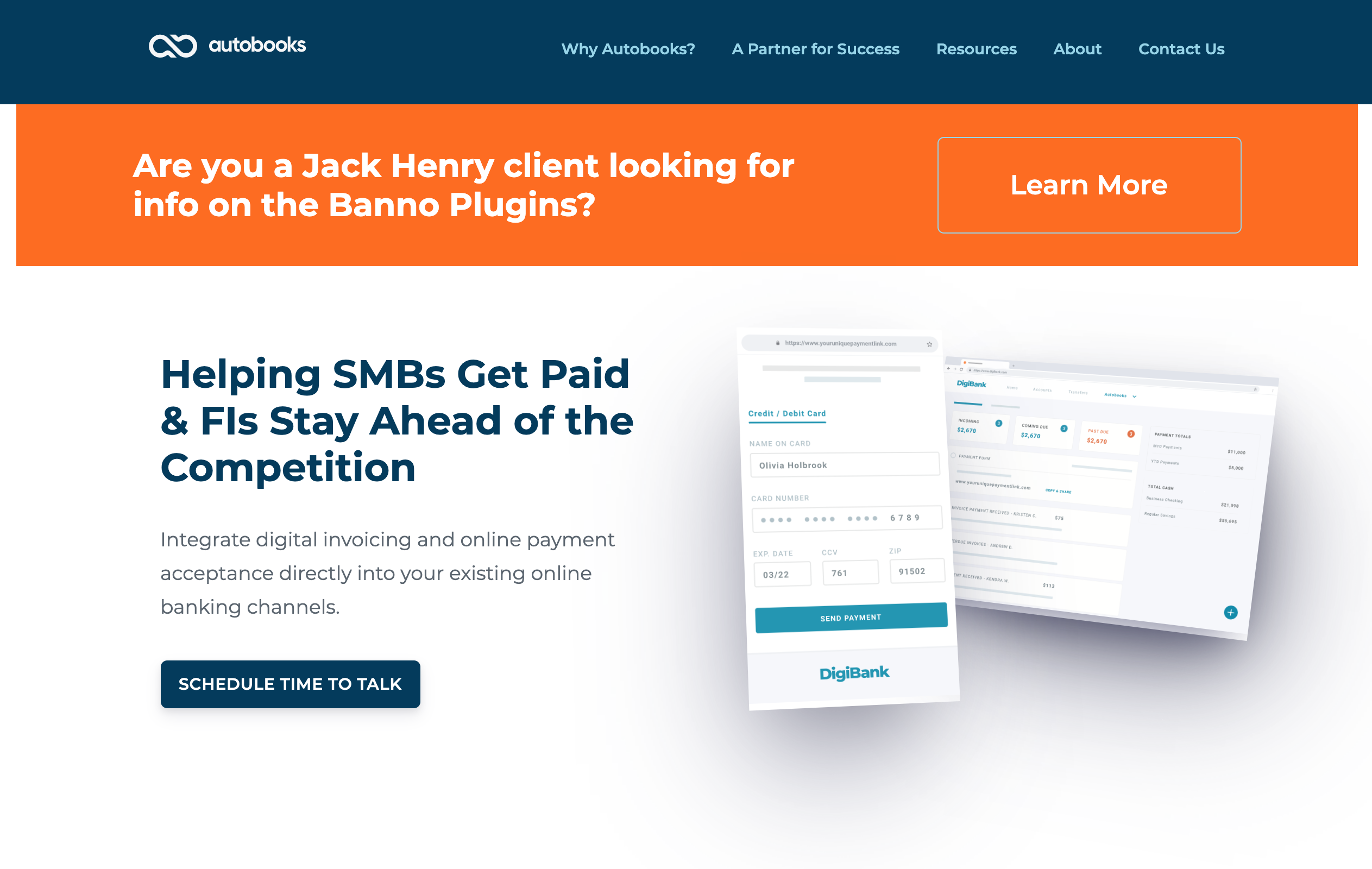

- By partnering with Fundbox, Autobooks is enabling over 2,000 financial institutions to deliver capital access seamlessly inside their digital banking platforms.

Small businesses often face a frustrating gap between sending an invoice and getting paid. Payment and accounting platform Autobooks is seeking to change that with the launch of Autobooks Capital, a funding product embedded within the Autobooks platform. The new short-term working capital tool is powered by embedded capital infrastructure provider Fundbox.

With fast underwriting, competitive rates, and flexible repayment options, Autobooks Capital is designed to complement traditional lending programs by helping small businesses access working capital. By embedding Fundbox’s funding tools directly into its platform, Autobooks enables financial institutions to retain customers, compete with alternative lenders, and serve as the primary operating hub for small business clients.

“While Fintech 1.0 tried to sidestep financial institutions, we believe that working with banks where small businesses already manage their finances is critical to addressing the trillion-dollar SMB capital opportunity,” said Fundbox CEO Prashant Fuloria.

Teaming up with Fundbox will allow Autobooks to offer flexible funding directly within its platform without redirecting the borrower or requiring extra accounts. By placing Autobooks Capital within the Autobooks product suite, the company is able to offer small business owners working capital right when and where they need it. Autobooks’ product suite also includes digital invoicing, payment acceptance, automated bookkeeping, and financial reporting.

The embedded aspect of Autobooks Capital is key. Embedding lending tools directly into digital banking platforms helps turn lending products into seamless, context-aware experiences. Instead of sending small businesses to third-party lenders or apps, Autobooks Capital meets business owners where they already manage cash flow tasks such as invoicing, payments, and bookkeeping.

“The launch of Autobooks Capital gives financial institutions a powerful new way to support small business growth with fast, flexible funding, delivered right inside digital banking,” said Autobooks CEO Steve Robert. “By partnering with Fundbox and leveraging our distribution network of over 2,000 financial institutions, we’re embedding capital access directly into the banking experience—in a way that complements and does not compete with financial institutions. It’s seamless, intuitive, and built to help bridge short-term cash flow gaps for small businesses.”

Founded in 2013, Fundbox is a digital-first provider of capital infrastructure for small businesses. Its platform enables customers to seamlessly embed financial tools into their own user experiences. To date, Fundbox has helped over 150,000 small businesses access more than $6 billion in capital.

With more than 2,000 financial institutions in its distribution network, Autobooks is well-positioned to scale this offering rapidly. As embedded finance continues to mature, embedded products like Autobooks Capital will be a successful way for small businesses to access capital from inside their banking app.

Autobooks was founded in 2015 and now serves more than 60,000 small businesses with a range of tools including digital payment acceptance, online invoicing, online enrollment, accounting, bookkeeping, financial reporting, billpay, and now lending. The company white labels its technology to firms including TD Bank, Alkami, Bottomline, CSI, FIS, Jack Henry, NCR, and Q2.