The summer heat usually comes with a slowing of news activity, and while this is generally still holding true this summer, there have been some notable merger and acquisition activity throughout the past few months.

This season, the fintech landscape has had its fair share of strategic moves, as companies look to expand their capabilities, enter new markets, and expand on their offerings. These acquisitions are not just reshaping individual companies but they are also working to build out what the future of financial technology will look like.

As venture capital funding has dwindled over the past few years, the fintech sector has had to get creative in staying afloat. That may be one reason why we are seeing a growth in deal numbers. Let’s dive into the top 10 fintech acquisitions so far this summer.

Pluto acquired by Robinhood

Robinhood, a commission-free trading platform that aims to democratize finance acquired Pluto, a fintech startup focused on personalized financial planning and investment tools.

Deal Details: Financial terms were not disclosed. The deal is expected to close in Q3 2024.

Strategic Rationale: Pluto’s AI-driven tools will enhance Robinhood’s financial advisory capabilities.

Impact on Industry: The deal may encourage other trading platforms to improve their advisory services, increasing competition.

Future Outlook: Integrating Pluto’s technology will help Robinhood offer personalized financial advice, boosting user engagement and retention.

Theorem acquired by Pagaya

Pagaya, an AI-driven asset management firm that focuses on portfolio optimization through machine learning and big data acquired Theorem, a provider of financial analytics and modeling tools.

Deal Details: The specific financial terms of the deal remain confidential.

Strategic Rationale: Theorem will strengthen Pagaya’s AI and data analytics capabilities, resulting in robust investment strategies.

Impact on Industry: Pagaya’s purchase highlights the importance of AI in asset management, pushing competitors to innovate.

Future Outlook: Pagaya’s platform will demonstrate enhanced analytical power, offering more value to institutional clients.

Aion Bank acquired by UniCredit

UniCredit, a leading European commercial bank that offers a wide range of banking services, acquired Aion Bank, which is known for its digital banking services and innovative financial products.

Deal Details: Financial details of the deal were not disclosed.

Strategic Rationale: Aion Bank will help UniCredit expand its digital banking capabilities and customer base.

Impact on Industry: The deal will help to increase competition in digital banking, driving more customer-centric services.

Future Outlook: Integrating Aion Bank’s technology will enhance UniCredit’s digital offerings and expand its market reach.

Envestnet acquired by Bain Capital

Bain Capital, a private investment firm that focuses on private equity, venture capital, and credit, acquired Envestnet, a provider of integrated portfolio, practice management, and reporting solutions.

Deal Details: The deal is valued at approximately $4 billion.

Strategic Rationale: Envestnet’s long-standing expertise will help Bain Capital enhance its capabilities in financial technology and wealth management solutions.

Impact on Industry: The move will bring Envestnet into the private sector.

Future Outlook: Bain Capital’s acquisition may fuel demand for other private equity firms to buy out wealth management fintechs.

Salt Labs acquired by Chime

Chime, a digital bank known for providing fee-free banking services, acquired Salt Labs, an employee savings and rewards program.

Deal Details: Financial terms were not disclosed, but some sources report that the deal could close for as much as $173 million after Chime provides an up-front payment of $14 million.

Strategic Rationale: Salt Labs will enhance Chime’s offerings by integrating employee savings and rewards programs.

Impact on Industry: Integrating Salt Labs will help Chime promote financial wellness and engagement among employees, setting a new standard for digital banking services.

Future Outlook: The combination of Salt Labs with Chime Enterprise will expand Chime’s client base through employer channels.

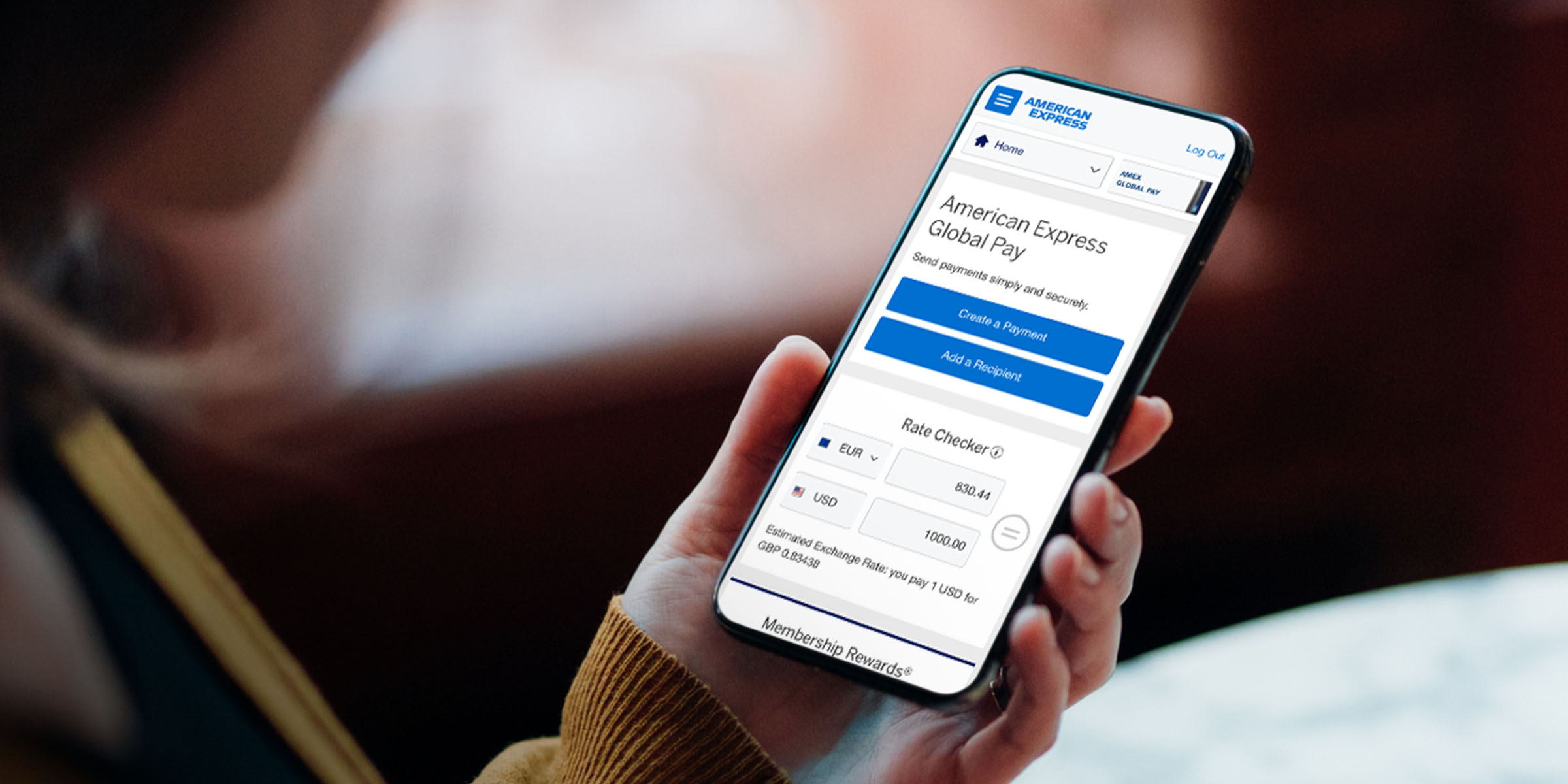

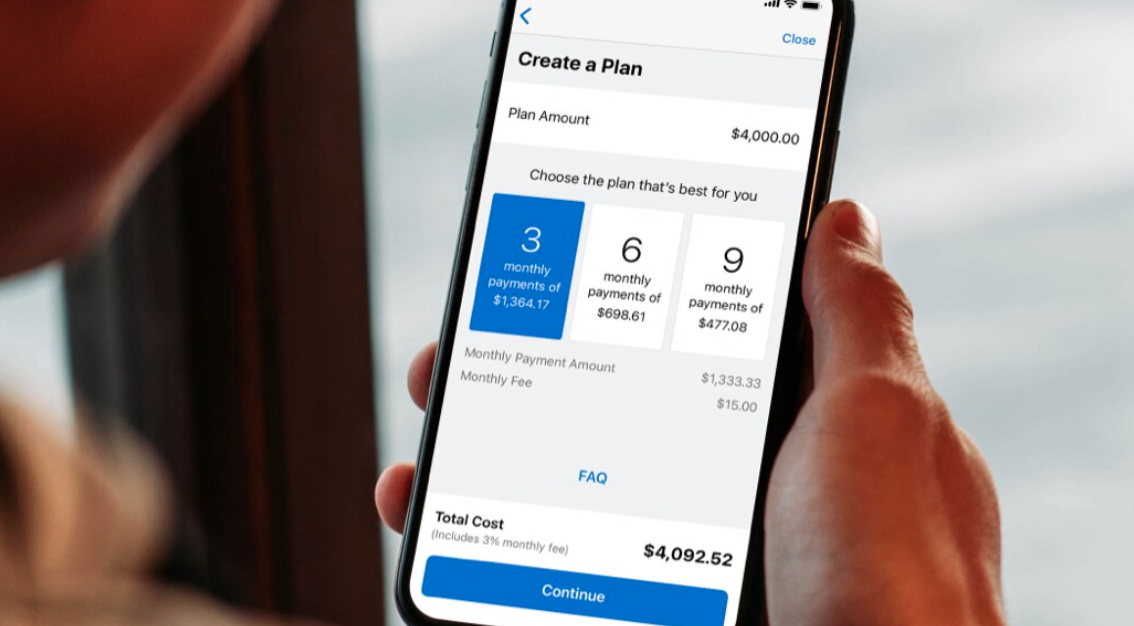

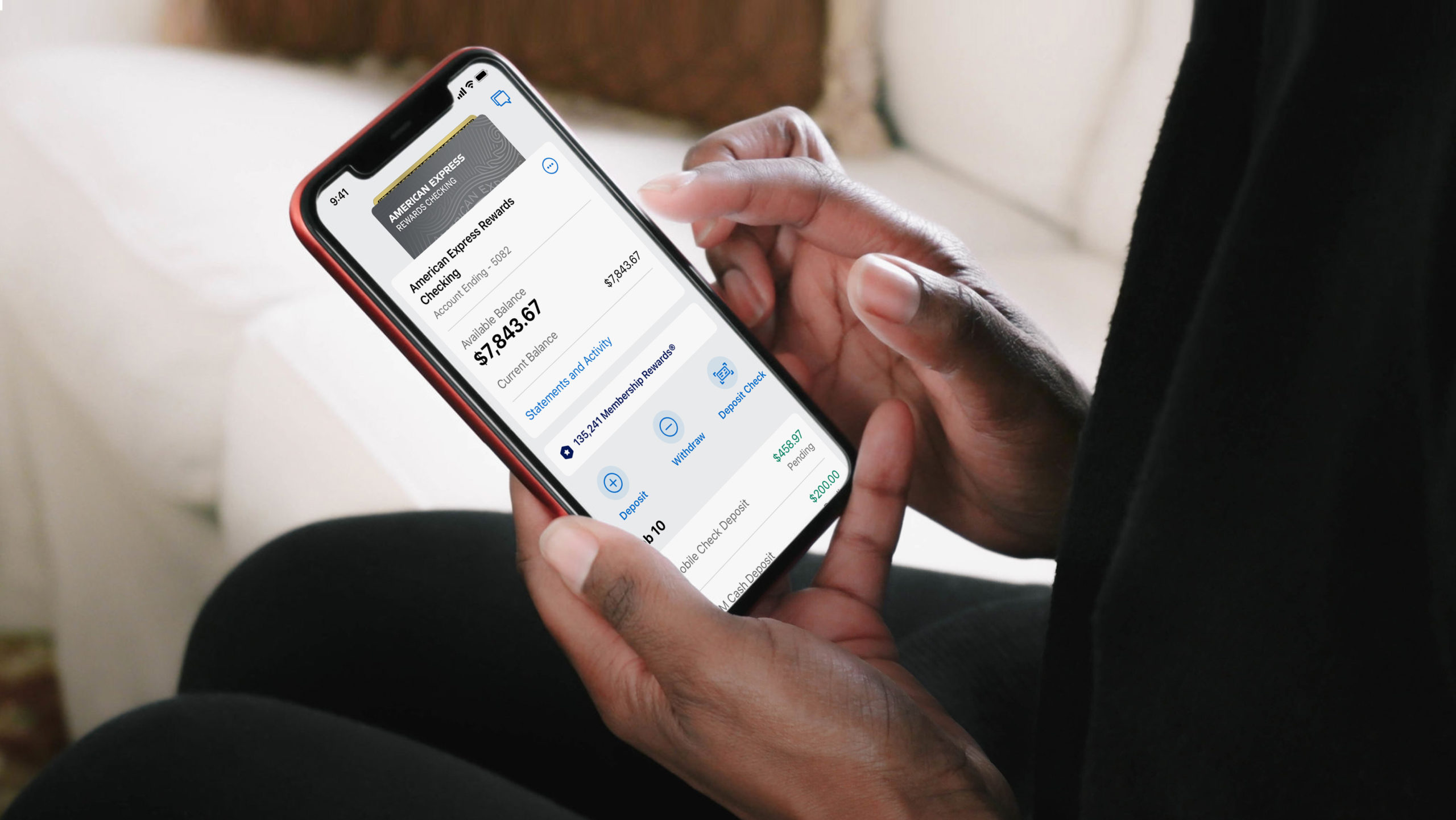

Rooam acquired by American Express

Financial services giant American Express has acquired Rooam, a mobile payment and digital tipping platform for the hospitality industry.

Deal Details: Financial specifics were not disclosed.

Strategic Rationale: American Express is expected to expand its mobile payment capabilities in the hospitality sector.

Impact on Industry: The purchase will fuel demand for more innovation in mobile payment solutions that increase convenience for users and businesses.

Future Outlook: Integrating Rooam’s technology will improve American Express’s digital payment offerings and customer experience.

Funding Circle acquired by iBusiness Funding

Small business funding solutions provider iBusiness Funding acquired Funding Circle, a peer-to-peer lending marketplace focused on small business loans.

Deal Details: Financial terms were not disclosed.

Strategic Rationale: Funding Circle will expand iBusiness Funding’s lending capabilities and customer reach.

Impact on Industry: The move will help strengthen small business lending options, ultimately supporting economic growth and entrepreneurship.

Future Outlook: Integrating Funding Circle’s platform into iBusiness Funding will enhance iBusiness Funding’s lending solutions and expand its market reach.

Invoiced acquired by Flywire

Flywire, a global payments enablement and software company, acquired Invoiced, an accounts receivable automation platform.

Deal Details: Financial specifics were not disclosed.

Strategic Rationale: Invoiced is expected to enhance Flywire’s payment solutions by adding advanced accounts receivable automation.

Impact on Industry: The deal promotes efficiency in payment processing and receivables management solutions.

Future Outlook: Flywire will benefit from integrating Invoiced’s technology, which will offer comprehensive payment and receivables solutions and improving cash flow management.

Screena acquired by ThetaRay

ThetaRay, a provider of AI-powered transaction monitoring technology, has acquired Screena, a cybersecurity firm specializing in fraud detection and prevention.

Deal Details: Financial terms were not disclosed.

Strategic Rationale: The deal will strengthen ThetaRay’s fraud detection capabilities with Screena’s advanced cybersecurity technology.

Impact on Industry: The move enhances current fraud prevention measures, which will increase security in financial transactions.

Future Outlook: Integrating Screena’s technology will improve ThetaRay’s AI-driven fraud detection and prevention solutions.

LemonSqueezy acquired by Stripe

Financial infrastructure platform Stripe acquired LemonSqueezy, a platform for managing digital product sales and subscriptions.

Deal Details: Financial terms were not disclosed.

Strategic Rationale: LemonSqueezy will expand Stripe’s capabilities in digital product sales and subscription management.

Impact on Industry: The deal will promote innovation in digital commerce, providing businesses with more comprehensive tools.

Future Outlook: Stripe will enhance its existing offerings with LemonSqueezy’s capabilities, further supporting digital entrepreneurs.